Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Loans meant for commercial purposes are known as “business loans,” as the name suggests. The borrower must repay both the principal and interest, just as with other loans, according to the conditions. While certain company loans may need weekly, daily, or interest-only payments, the majority of them ask for monthly repayments. When the loans expire, a chosen number could need to be repaid. These calculations may involve considerable complexity. Thus, we have made this post on the startup business loan calculator to aid you.

Interest rates are just one aspect of the whole picture when looking for a business loan. You should also consider how much you’re lending and how long it will take you to repay it. Our Startup Business Loan Calculator helps you find solutions to all those problems and more.

A business loan may also be necessary for the growth of your company, but you ought to only consider applying for one if you are confident in your ability to repay it. Make sure you have all the required paperwork in order before requesting a business loan.

A private credit report, a company credit history, business financial records, and official business papers are often among them. Along with the Startup Business Loan Calculator, this is also available. Come along as we highlight more on this below.

What is a Startup Business Loan Calculator?

An important tool for estimating your monthly payments and interest depending on the loan duration and APR is a start-up company loan calculator. You can calculate the recurring repayments and overall interest charges of a small company loan using a starting business loan calculator.

How to Use This Business Loan Calculator

You can Use This Business Loan Calculator through the following steps:

- Enter the Loan Taken for Business ($)

- Enter the Loan Period

- Input the Interest Rate (%)

- Enter the Loan Payment Frequency

- The Business Loan Calculator will process your input and produce the right output.

Startup Business Loan Calculator

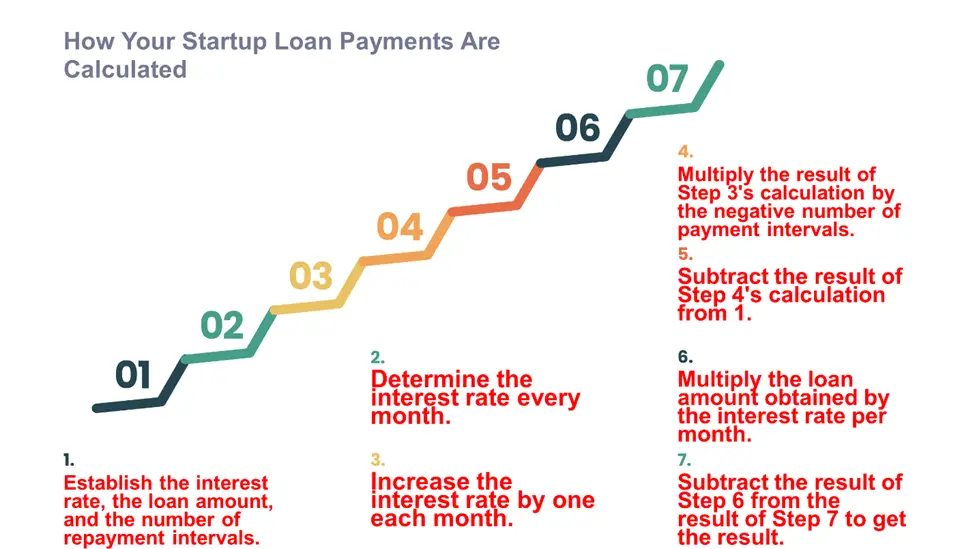

How Your Start-up Loan Payments Are Calculated

Small-company entrepreneurs often depend on business loans when beginning a firm or when more cash is required. It’s crucial when starting a small company that you don’t borrow more money than you can afford to repay. Therefore, a manager or owner of a small company should be able to figure out how much a loan would cost in monthly installments.

The loan’s interest rate, the amount borrowed, and the time remaining for repayment will all affect the total payment. You may learn how to calculate your start-up loan payments by using the steps below:

Establish the interest rate, the loan amount, and the number of repayment intervals.

The frequency and the total number of payment periods will be disclosed by the bank when you meet with them. Usually, this figure is monthly. Therefore, if a lender specifies that a small firm has two years to repay the loan, there will be 24 repayment periods.

Determine the interest rate every month.

Lenders will supply the annual interest rate. Therefore to calculate the amount of interest that will be charged each month, the annual rate must be divided by 12.

- Increase the interest rate by one each month. Multiply the result of Step 3’s calculation by the negative number of payment intervals.

- Subtract the result of Step 4’s calculation from 1.

- Multiply the loan amount obtained by the interest rate per month.

- Subtract the result of Step 6 from the result of Step 7 to get the result.

Why use a Loan Calculator for your Business?

A business loan calculator will be necessary if you need to take out a loan to fund the expansion of your company, purchase new equipment, or recruit additional staff. You may use it to calculate the credit fees and monthly repayments for various loan kinds.

Here are some more advantages of using business loan calculators.

Make repayment easier

Do you have any issues while figuring out interest rates and loan costs? The calculator has a straightforward layout. With its assistance, you may quickly and easily determine your monthly payments as well as the total amount of interest charged. Using the loan calculator, you may complete the specifics of your loan in under a minute.

Suitable for mobile

At least 50% of individuals use their mobile phones to access the Internet. Using an online loan calculator, you may compare various loan offers without using a computer. Bookmark the website if you come across a deal you like.

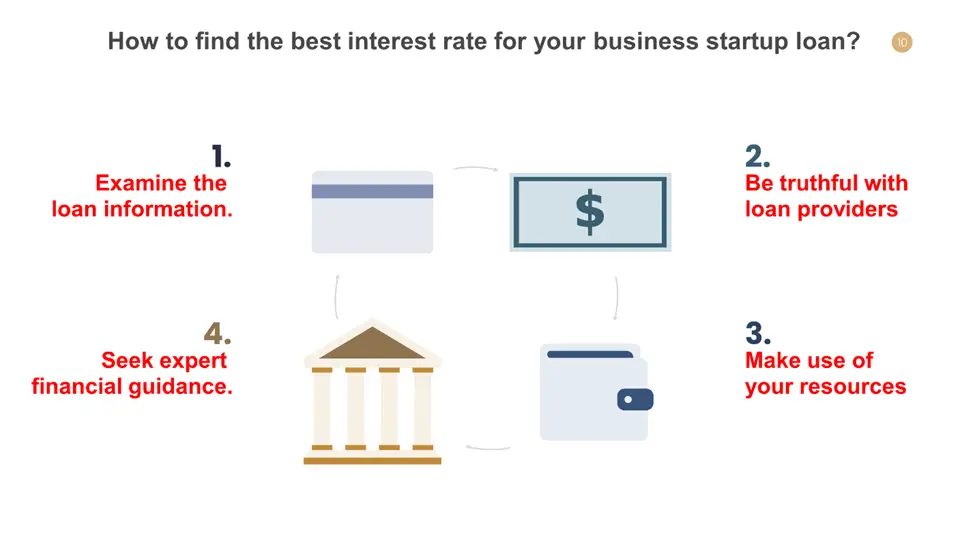

How to find the Best Interest Rate for your Business Start-up loan?

A small business loan can be your solution if you need to obtain money for your new company. Here is our information on increasing your likelihood of receiving the greatest small business loan offer.

Examine the loan information.

Avoid being seduced by small business loan rates that make news. Free payment periods or repayments with lower-than-anticipated interest rates may not be the complete picture. Make sure you research all the terms and conditions of the loan, including the APR, which covers all fees and additional expenditures.

Ensure you understand any loan terms and determine what might cause the lender to call in the loan. Ask the lender to break down all of the fees associated with lending and loan servicing if you are unsure.

Be truthful with loan providers.

Some small business owners may have an unduly optimistic view of their company’s financial situation. When applying for a loan, it is vital to be entirely open and honest about your company. Its cash flow, trading position, other liens and obligations, credit history, and predictions are all accurate.

Make use of your resources.

Ensure you are sweating your company’s assets before searching for a small business loan. You may sell assets such as the bills you’ve sent clients in the past and the future bills you’ll be sending to invoice factoring companies.

For the bills, these companies will pay you in advance. They will then obtain funds from the consumer on your behalf, with a portion of the money being kept back as a charge and interest.

Seek expert financial guidance.

It is wise to stop and get advice from a financial expert before raising money or applying for a loan. Consult with a company finance specialist and attend events or online assistance resources to learn how to get a loan.

They often suggest other financing sources or strategies to improve your P&L statements. By minimizing taxes and maximizing earnings, you can potentially borrow less money.

How to get a Business Loan when you’re just Starting Out?

If you do your research, obtaining a business loan doesn’t have to be a difficult procedure. Understanding the requirements for your company and then locating the small-business loan that best suits your requirements can boost your chances of being approved. Here are some quick instructions on how to get a business loan.

Select the loan type you’ll need to finance your firm.

Depending on what you want to achieve, you should consider which sort of business loan is best for you. All in all:

Conventional term loans are lump amounts that you repay back over time with interest and sometimes feature high borrowing maximums if you wish to fund a large investment or company development. Many lenders also provide specialized products, including loans for equipment or car purchases, to meet the demands of a developing business.

Establish your financing eligibility for a firm.

Several sources, including banks, internet lenders, and micro-lenders, provide business loans. Most internet small business loans need a minimum of one year of company operation, while most bank loans require a minimum of two years.

Establish your financial capacity.

Pay close attention to your company’s financials, particularly cash flow. Additionally, consider how much you can afford to contribute each month toward loan repayments.

Your overall income must be more than your total costs, including your new payments, by at least 1.25 times. Consider the fact that some internet lenders want daily or weekly repayments. You’ll need sufficient cash flow to complete all required payments on schedule.

Choose if and how to use assets to secure the loan.

Loans for businesses may be secured or unsecured. A secured loan calls for company collateral, such as real estate or machinery, that the lender may confiscate if you don’t pay back the loan. Risky as it is, putting up collateral might improve your borrowing capacity and decrease your interest rate.

Evaluate lenders for small businesses.

Generally speaking, you should choose the company loan with the most favorable conditions. However, other aspects, including financing timeliness, could be important to your company, and certain funding sources might be preferable in some situations than others.

Obtain a business loan.

You succeeded! Finally, the moment has come to submit a small business loan application.

Start by comparing the loan conditions and annual percentage rates, or APR, of two or three alternatives that are comparable to each other. The easiest method to comprehend the whole cost of a business loan is to utilize the annual percentage rate (APR), which includes all loan expenses and the interest rate.

Choose the loan with the lowest APR and the most favorable conditions among those for which you are eligible. This will be true if you can make the loan’s monthly installments.

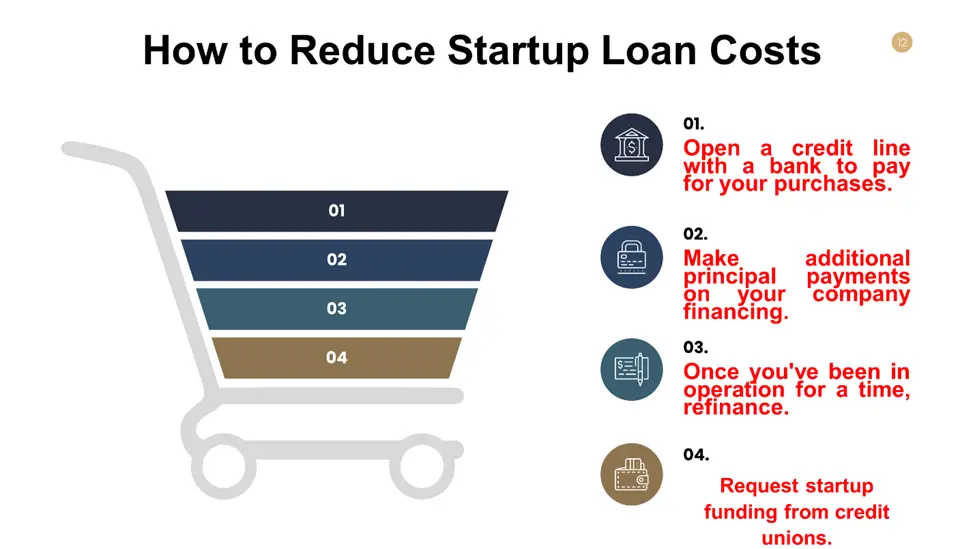

How to Reduce Start-up Loan Costs

Making money requires capital. A bank could have given you a high-interest business loan due to your previous credit issues. Additionally, owing to your excellent credit history, you could be able to carry a loan with the lowest rates possible. All told, interest will be charged on any loans you make. So, the following are some strategies for cutting start-up loan costs:

Open a credit line with a bank to pay for your purchases.

Ask the bank to reduce your credit limit as you make deposits. The interest on a loan is always more than the interest gained in savings, even if your salary may not produce interest on its own when you’re paying down a credit line.

Make additional principal payments on your company financing.

Similar to making additional payments on a personal loan or mortgage, you may shorten the time it takes to pay off the debt while decreasing the overall amount of interest.

Once you’ve been in operation for a time, refinance.

When you originally launched the company, you may have had to make do with a higher interest rate. Request that your bank reviews your accounts and provide you the benefit of a reduced interest rate.

Request start-up funding from credit unions and private investors.

This is a great alternative to visiting a bank initially starting your company. Like bigger businesses that provide stock options to invest in, offer to pay a bonus to the borrower after a predetermined time that represents the number of your earnings.

When to Start Expanding your Small Business

For small company entrepreneurs, starting a business is difficult enough. When a small firm is successful, the rate of client growth may plateau, indicating that it may be time to consider growing it.

Growth can be a fun moment as well as advantageous for businesses. It may result in increased consumer awareness of the brand, a bigger selection of goods and services to cater to a wider geographic market, and cost savings that may make growth simpler to carry out. The following situations indicate when to begin growing your small business:

In response to client demands

It’s time to start thinking about growth when your consumers request information about other locations or goods. Consider creating a second location if clients must drive far to visit your restaurant or retail store. Find out whether you have a market that is feasible so that you may keep expanding your company by doing some research.

When There Is a Limited Room

You need adequate space to function if you work in an office, a cafe, or a manufacturing plant. You may need to expand if your waiters are bumping against one another or if your staff members are crammed desk to desk.

These cramped conditions can necessitate renting a new place, constructing a second facility, or remodeling your current location. Thoughtfully consider whether to buy a new site or lease a bigger facility.

You have an excessive amount of work to do.

Most entrepreneurs don’t fret about having too much business. But it might become a major problem for businesses that are expanding quickly. It could be smart to grow your company if you’re working long hours or turning away clients due to bandwidth issues.

If you have a food truck and the lines continually wrap around the corner, getting an extra vehicle would help you provide for your clients much better.

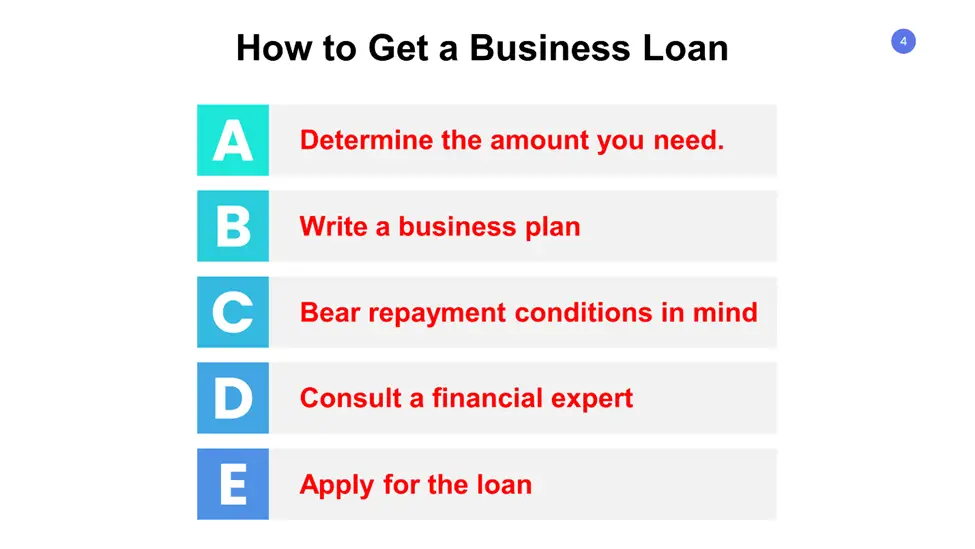

How to Get a Business Loan

One of the most popular sources of funding for entrepreneurs wishing to launch a firm or meet other financial obligations is a business loan. But for any business owner, deciding whether to arrange for a business loan is a significant decision that should not be made hastily. Here are a few instructions on how to get a business loan.

Determine the amount you need.

Use a loan calculator to estimate how much money you’ll need before you apply for a business loan. You must first decide why you need a company loan in order to respond.

Write a business plan.

The majority of private lenders that provide conventional business loans will not consider a loan application unless it is backed by a thorough business plan. The future direction of your firm is mapped out in a strong business plan. It’s quite difficult for a potential lender to determine if your project is financially feasible without one.

Bear repayment conditions in mind

Making a repayment plan for your loan is your next step. Regarding the monthly payment, you can make, be honest with yourself. Take into account external variables like supply chain disruptions, seasonal slowdowns, and even sociological shifts.

Consult a financial expert

Before selecting a loan, consult a financial advisor. They will get knowledge of the different financial organizations’ lending schemes. They can thus provide you with more individualized guidance on the financing solutions that are ideal for your company.

This will also assist you in coming up with a strategy for repaying whatever debt you incur and sustaining long-term success.

Apply for the loan

You can probably utilize a conventional lender if you have a strong credit score and small company resources. If you don’t satisfy those conditions, you may need to go online for less traditional lending choices like a merchant cash advance.

Each lender will have a different application procedure and specific guidelines for submitting an application. The procedure usually includes interviews. It can include visiting a bank location or scheduling a phone interview.

Observe the guidance that your lender has supplied. Please find out how long it typically takes them to process applications during the interview so you’ll know when to anticipate a response. Contact your lender again if necessary.

Difference between Principal and Interest

The principal is the fund you earlier accepted to repay. The cost of lending the principal interests.

Any loan payment will typically be applied first to any outstanding fees. The remainder of your contribution will then be used to pay any interest that is still owed, including any that is past late, if any. The remainder of your payment will then be put into your loan’s principal amount.

Frequently Asked Questions

How much do I need to deposit for a business loan?

Since every company is different, there is no standard deposit sum for business loans. Most issuers need a deposit of 10 to 30 percent of the loan amount. Savings, working capital, unconventional financial instruments, or outside investments are all possible sources of this money. Your required deposit for a business loan may vary depending on a number of factors: These consist of:

- The sum of money lent

- The loan’s objective

- Your credit history personally

- Your history of business credit

How much money can I borrow to buy a business?

Loan amounts for business purchases vary from $250,000 to $5,000,000.

What are additional fees associated with a business loan?

When you apply for a small business loan, lenders may impose one of three major kinds of fees; sometimes, these costs may be used interchangeably. Application fees, origination costs, and processing fees fall under this category. Most lenders charge an application fee when you submit your first loan application.

Should you take out a loan for your start-up?

Depending on the sector in which your company operates, you could need more money than you can loan from savings, loved ones, or credit cards to get started. You could want a new business loan to cover costs if your company needs a sizable initial investment, such as inventory or equipment.

More Resource: Number of Payments on Credit Calculator

What is an SBA 7(a) loan?

The SBA’s most popular lending program, the 7(a) Loan Program, offers financial assistance to small companies with unique needs. When real estate is a component of a company deal, this is the greatest choice. The use of it for both short- and long-term cash flow is also possible. Refinance your present company debt.

Who qualifies for an SBA 7(a) loan?

Obtaining an SBA 7(a) loan Your company must have less than 500 workers and annual revenues that, over the last three years, have averaged less than $7.5 million. Your physical net worth must be lower than $15 million, and your net profit must be less than $5 million.

Expert Opinion

A starting business loan provides funding to cover a fledgling company’s expenses. It might assist you in paying the start-up expenses for your new company, such as cash flow, real estate, furniture, supplies, and inventory.

The SBA lending programs are widely regarded as the benchmark for financing new businesses. They provide large lending sums, lengthy repayment periods, and low rates but often demand a 20% to 30% financial infusion from the borrower in addition to six months to two years of company operation.

The SBA isn’t the only route to success, however. If you don’t match the SBA’s standards, there are other alternatives to getting a beginning company loan. All of these were previously highlighted. And the start-up business loan calculator will aid you immensely at this point.