Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Personal loans come with set loan amounts, bond yields, and monthly repayment amounts spread over predetermined periods. They have not secured loans, as secured loans often are. Instead, lenders consider a variety of criteria when deciding whether or not to provide a personal loan, including credit score, income, debt load, and interest rate. It is recommended to utilize our personal loan calculator due to its delicate nature.

By entering the appropriate information into the personal loan calculator, you can determine your monthly loan payments. Additionally, you may change the data you provide to see how it impacts your repayments.

The amount of loan you may be able to borrow is also estimated by the personal loan calculator. You may find out how much you might borrow and how much you would have to return, including interest, by entering the amount you can repay each month, the length of your selected loan term, and the APR.

The calculators’ output is based on the assumptions that the interest rate will remain constant for the duration of the loan and that you will make consistent monthly payments. Come along as we highlight more on the personal loan calculator below.

What is Personal Loan Calculator?

A personal loan calculator is an online tool used to determine the monthly payment that a borrower must make on their loan. To calculate the interest due till the loan term and the Balance Loan Amount in a given period, the calculator considers the Loan Amount, Interest Rate, and Loan Tenure.

By analyzing various loan amounts, returns on investment, and loan terms using the personal loan calculator, you may choose the best loan for your financial situation.

To aid in calculating the monthly installments and total costs of a private loan, the personal loan calculator could also include simple examples. Because most personal loans involve fees and/or coverage, the total cost may be greater than expected. The calculator computes the loan’s actual annual percentages, or APR, considering all these criteria. Using this actual APR while comparing loans may be more realistic.

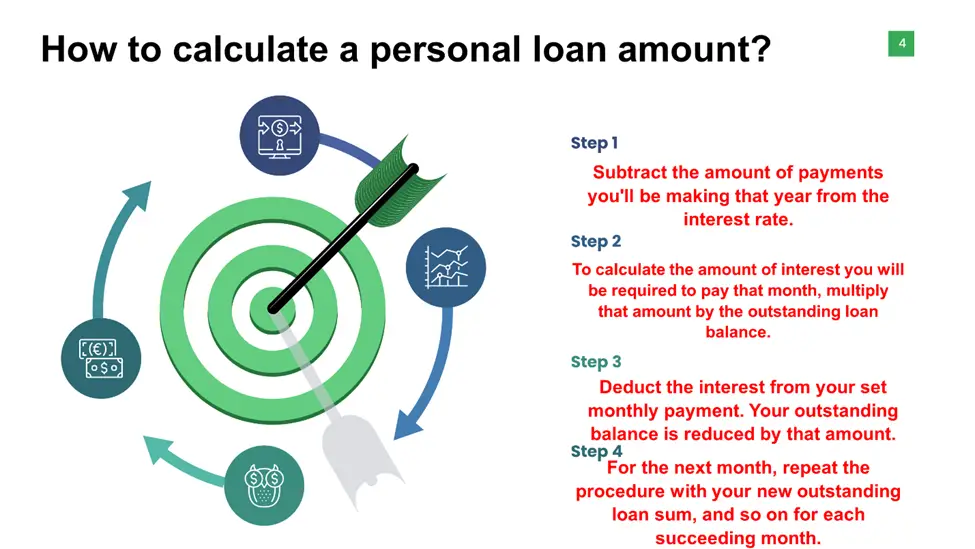

How to Calculate a Personal Loan Amount?

You can calculate a personal loan amount through the following steps:

Personal Loan Calculator

What do you need to know about Personal Loans?

You borrow a certain amount of money for a predetermined length of time when you take out a personal loan from a business. You’ll make a predetermined payment each month.

Since you are not required to put up a significant asset, such as your home, as collateral, personal loans are sometimes referred to as unsecured loans. You risk losing your home if you use your house as security and cannot make your payments.

A personal loan often has a fixed interest rate, which means it won’t vary while you repay it.

How ought I take care of my Personal Loan?

Your credit score may rise if you handle your personal loan correctly, but it may fall if you manage it poorly. Our top four suggestions for handling your loan and maintaining your score are as follows:

- Ad adheres to your payback plan to prevent penalties, late fees, and unfavorable points on your credit record.

- Maintain a regular budget to ensure you always have enough cash to cover your repayments.

- Talk to the business as soon as you can to explore your alternatives if you believe you won’t be able to avoid missing a payment.

- Make sure you can handle the payments on top of any current debts if you require extra credit, and be ready for your credit score to drop after taking on more debt.

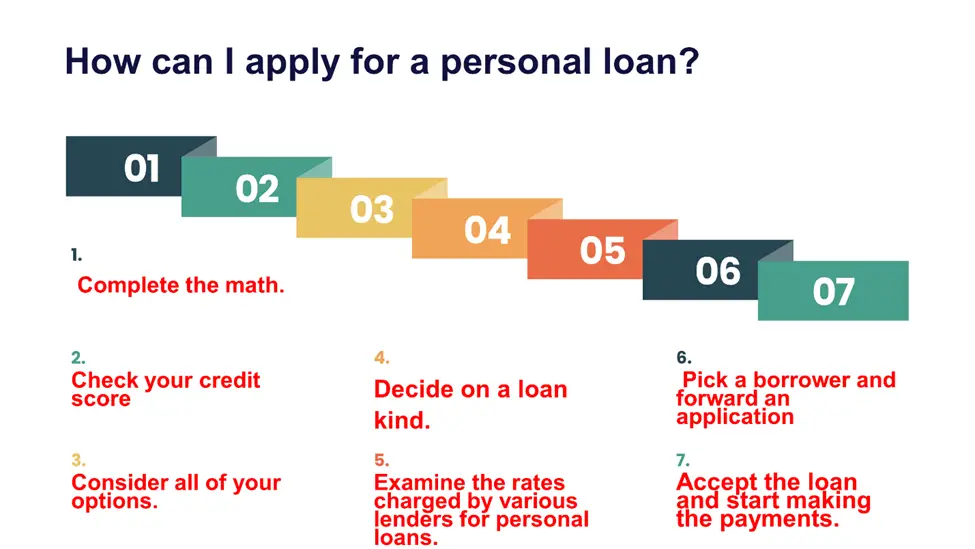

How can I Apply for a Personal Loan?

Personal loans may take many different forms, such as loans for debt settlement, loans for home upgrades, loans for weddings, and loans for medical costs. Before submitting your application, you should be conscious that there are many stages in the hiring process. It’s good to get familiar with those processes so you’ll recognize what to expect and avoid any surprises. They include:

Complete the math.

Creditors and you both hope you won’t get a personal loan just to discover that you cannot pay it back. While lenders often do their assignment to verify you can repay the loan, it’s a good idea to make your calculations to guarantee it will work out.

Considering that some borrowers charge origination costs deducted from your loan earnings, think about how much cash you’ll require upfront. Be cautious to just borrow money that will fulfill your requirements after costs.

Check your credit score.

Most creditors will do a credit check on you to determine your probability of repaying the loan. While some online lenders have started taking external credit details into account, they usually still take your credit score into account.

You must possess at least fair credit for the best personal loans, often around 580 and 669. However, if your credit rating is strong or outstanding and is higher than 670, you’ll have the best odds of getting approved with a fair interest rate.

Consider all of your options.

Depending on your score, you may need a co-signer to get approved for a private loan with a fair interest rate. Suppose you cannot find a co-signer or the providers you are contemplating do not allow co-signers. In that case, you may be able to receive a protected personal loan instead of an unsecured one.

Decide on a loan kind.

Once you are aware of your credit situation and have considered your options, choose the kind of loan that is best suitable for your situation. While some lending companies let you use the cash in any way you choose, others could only approve lending if the money will be utilized for certain purposes.

Examine the rates charged by various lenders for personal loans.

Never take the first deal that is presented to you. Instead, take your time comparing interest rates to get the best deal. To determine your eligibility, consider a variety of lenders and loan types.

Banks, credit unions, and online lenders often offer deals on personal loans. If you’ve held an account with that bank or credit union for a time, think about asking them first.

Pick a borrower and forward an application.

After performing your research, choose the lender with the best offer, and start the application process.

Based on the lender, you might be able to finish the whole application process online. Alternatively, some lenders need you to submit a request in person at a local bank or credit union business unit.

Each borrower has different requirements for the data in an application. However, it’s customary to be asked for your name, location, and phone number in addition to information about your employment, source of income, and the purpose you need the loan.

Accept the loan and start making the payments.

Once the lender notifies you that your application has been approved, you must finish the loan paperwork and accept the terms. You should then get the loan funds in a week or so. However, you may acquire it in only one or two working days from some internet lenders.

After approval, keep track of your final payment dates and consider setting up automatic bank account withdrawals. In certain cases, if you set up automated payments on your accounts, your borrower may even reduce your interest rate.

Why do you need a Personal loan?

There are several justifications for getting a personal loan. Almost everything may be paid for with a personal loan, which you can get from a bank, credit union, or online peer-to-peer borrower without security. They are more appealing because of their flexibility and how quickly they are approved most of the time.

In many cases, the loan money may be placed into your account within one week or even less if your credit is strong and the lender is happy with the income information you supply.

Here are some guidelines for when getting a personal loan makes sense. Additionally, there are many possible applications for personal loans, but the following are some of the most important ones:

Adding expensive credit card balances together.

If you have many credit cards with huge balances, you’re paying a lot in fees, which is probably hurting your credit rating. You may combine many debts into one by using a personal loan to pay off your credit cards, a practice known as debt consolidation. Additionally, this will lower your interest rates and raise your credit score.

Covering unexpected costs.

You may be able to use a credit card to pay for expenses if your furnace breaks down or your property requires a new roof right away. However, expensive repairs might result in huge card balances that damage your credit and accrue hefty interest costs.

Medical crises may be the same. Sickness or accident that causes you to pay your whole yearly deductible all at once might put too much strain on your credit cards.

And other costs that aren’t reimbursed by your health insurance may quickly mount up. Getting a personal loan to assist with managing these costs could be less stressful.

Handling private affairs

A personal loan can offer a ready source of money to help with down payments and other payments for caterers, florists, venue rentals, and other vendors when organizing an expensive one-time event like a wedding, golden anniversary gala, or even in some cases, a funeral.

Making a large acquisition

While you may use a personal loan to fund a significant purchase, you shouldn’t take out a loan to buy a new television, patio furniture, or automobile. Some unavoidable expenses include an unexpected need for a new big appliance.

While you may get a vehicle with a personal loan, auto loans are generally the better option since they often offer cheaper interest rates and less stringent qualifying standards.

However, since vehicle loans need collateral, you risk losing your automobile if you don’t keep up with your payments. Comparing prices is smart, particularly if risk aversion is a concern.

Repayment of Personal Loan

A personal loan paid off early might seem like a tremendous burden has been removed. However, there can be interest and penalty penalties to pay. You will be given a certain amount of time to repay a personal loan.

This is determined at the time the loan is first accepted. Assessing your financial objectives is crucial before paying off your loan early. Here are some suggestions to keep in mind if you’re thinking about paying off your personal loan early.

Make a financial strategy.

Do you have a strategy for the additional funds you will need to pay down your debt? You’ll feel great after repaying the full debt. However, insufficient funds to pay off the debt could make you quite anxious.

If you want to use your savings to cover the payback, be sure there will still be money in your account after you are through. We often save aside money for future needs or emergencies. Don’t spend all of your funds since you could need them shortly.

Speak with your lender.

Inform your lender that you want to settle the loan early. The loan’s Terms & Conditions should be carefully read. While some lenders could permit early loan repayment with a fee, others would not. You must comprehend the contract you signed with the lender when you applied for a personal loan if you want to be on the safe side.

Establish a monthly budget.

After making the payments, you have to have enough money to cover your monthly costs. A few necessary expenditures that cannot be prevented at all costs are housing, utilities, and food. Additionally, you must set aside funds for any additional loan repayments (if any).

Making late payments might lower your credit score. You must be ready to avoid putting yourself in greater financial problems by making an early repayment.

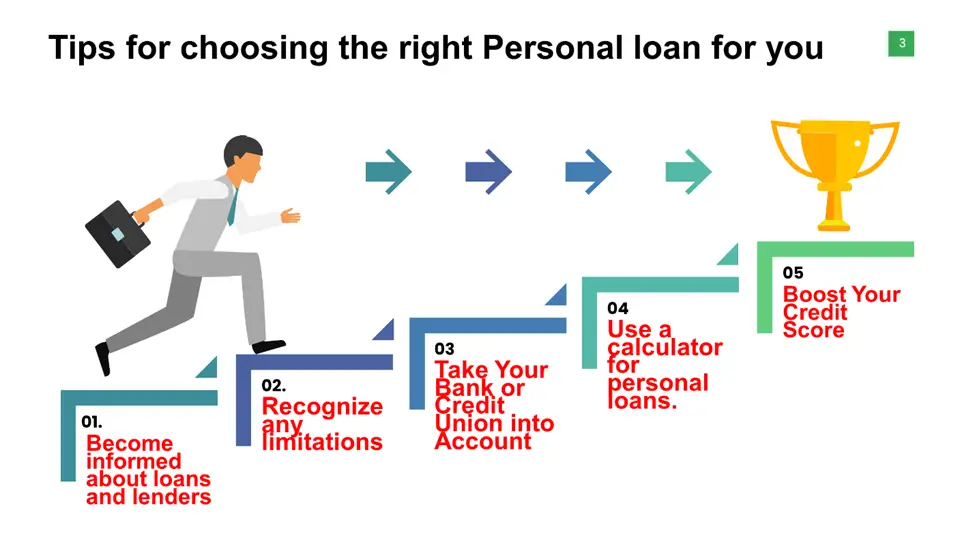

Tips for Choosing the Right Personal Loan

You may have many possibilities if you’re looking for a personal loan. Along with looking at loans through your bank or credit union, some internet lenders cater to a variety of borrowers from whom you may borrow money—often fast. You will benefit greatly from the following advice before you start shopping:

Become informed about loans and lenders

By searching on the internet, you may begin comparing various online lenders. You may also utilize tools that match your data with various lenders to simplify your search.

You may arrange your results by predicted APR, payback periods, monthly payments, and more to quickly identify your best alternatives. For instance, borrowers with excellent credit can discover appealing offers from loans with no initiation or prepayment costs and perhaps a low APR.

Recognize any limitations

For practically any legitimate reason, you can certainly locate a personal loan. However, there could be limitations on how personal loans can be utilized. Make sure you can utilize your money for the intended purpose before applying.

For instance, loans from Payoff are specially made to assist consumers in consolidating credit card debt with low-interest rates and little to no initiation costs. You must find a new lender if you want to utilize the funds to repair your automobile.

Take Your Bank or Credit Union into Account

Although recent years have seen a rise in personal lending because of internet businesses, most banks also offer personal loans. If you do not currently have a connection with a bank, rates and fees can be less competitive. However, if you do and your credit is outstanding, it could be worthwhile to look into your bank’s options.

Use a calculator for personal loans.

By “eyeballing” rates, periods, fees, and loan quantities, comparisons may easily spiral out of control. Even worse, it’s difficult for most of us to precisely predict how these numerous elements will affect your monthly rates and total expenses.

Calculating personal loan payments is quick and simple using a personal loan calculator. You may evaluate several possibilities while using one and yet get to a quick selection.

Boost Your Credit Score

Regardless of where your credit score lands on the scale, improving it even little will help you receive a better rate and conditions. However, if your credit score is at the fair level or below (below 670), it could be very beneficial to raise it if you can.

This can also be seen in the infographics below.

Frequently Asked Questions

How much is a 50000 loan monthly?

Based on the APR and a $50,000 loan term, the monthly payment might vary from $683 to $5,023.

Is 8% a good rate for a personal loan?

Yes. An excellent personal loan rate is 8%. Your credit score affects your ability to get a favorable personal loan interest rate.

What is the monthly payment on a 10,000 personal loan?

For a personal loan of $10,000, the monthly payment ranges from $201 to $379.

How do I calculate interest on a personal loan?

Split the interest rate by the total number of payments you will make over the year to determine the interest on a personal loan. Then, multiply that amount by the outstanding loan total to determine how much interest you will be required to pay that month.

How much would a 15000-loan cost per month?

Based on the APR and term of the loan, the monthly payment for a $15,000 loan might vary from $205 to $1,504.

How much loan can I get on 50,000 salaries?

Some institutions can allow you to borrow up to $200,000 if your earnings are $50,000. But the amount of money you borrow will also depend on your job history, debt-to-income proportion, and credit score. Therefore, it’s important to speak with a lender to see how much of a loan you qualify for with a $50,000 income.

How much loan can I get on 35000 salaries?

A person may get a personal loan for more than $130,000 if their monthly earnings exceed $35,000.

How much loan can I get if my salary is 18,000?

Some lenders could allow you to borrow up to $40,000 if your annual income is $18,000.

How much loan can I get if my salary is 15000?

Some lenders can let you borrow up to $30,000 if your income is $15,000 in such cases.

Expert Opinion

A personal loan may assist you in making a large purchase, paying off debt more quickly, covering an unforeseen expenditure, or getting over a financial hurdle. Banks, credit unions, and internet lenders offer most unsecured personal loans.

You may estimate the cost of a personal loan using a personal loan calculator, another great tool. It also lets you determine if it would be a viable financial choice. The information you provide in the various areas determines the outcome.

You may use a personal loan calculator to estimate the loan amounts accessible to you. However, it does not ensure that you will be approved for that amount of credit. The lender’s requirements, including your credit score and affordability, will determine whether you are approved for a loan.

References

- https://www.bankrate.com/loans/personal-loans/rates/

- https://www.wellsfargo.com/personal-loans/

- https://www.lendingclub.com/loans/personal-loans

- https://www.forbes.com/advisor/personal-loans/personal-loan-rates-09-12-22/

- https://money.usnews.com/loans/personal-loans/articles/should-you-take-out-a-personal-loan-to-pay-off-credit-card-debt

- https://www.hdfcbank.com/personal/borrow/popular-loans/personal-loan