Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Various uses for monthly loans exist, ranging from debt consolidation to covering wedding costs. Monthly loans may be unsecured, meaning you won’t have to pledge assets as security, like your house or vehicle, if you can’t make your loan payments. Calculating this all together may be difficult. To help you, we have created this page on the monthly loan payment calculator.

A monthly loan payment calculator may also assist you in paying off high-interest credit card debt faster. You would apply for a loan equal to the amount of your credit card debt to condense your debt with a monthly payment. You will utilize the money to pay off your credit cards if granted the whole loan amount.

A monthly loan can have a cheaper interest rate than a credit card, depending on your credit. A reduced loan rate might result in significant savings as well. Understanding the typical debt consolidation rate may be helpful. The monthly loan payment calculator can also be viable if you finance a significant purchase.

You can have a home renovation project or other significant fees, including relocation costs or medical bills. Come along as we highlight more about this below.

What is a Monthly loan payment calculator?

The monthly loan payment calculator is crucial when attempting to pay off your obligations. The lending regulations include a few exceptions. You may also use the Monthly Loan Payment Calculator to see whether the loan you’re thinking about is reasonably priced and suitable for you.

This calculator may be used to evaluate any loan you are thinking about taking out. You may estimate the potential cost by adjusting the loan amount, loan period, and interest rate. You’ll see that your monthly payments decrease as the loan’s duration lengthens. However, the total cost of the loan increases. When using the Monthly Loan Payment Calculator, consider any costs you could pay for mortgages and other particular kinds of loans.

How to Use this Monthly Loan Payment Calculator

You can use this Monthly loan payment calculator through the following steps:

- Enter the Loan Amount ($).

- Enter the Interest Rate (%).

- Put the Loan Term (In Years)

- The monthly loan payment calculator will process your input and produce the right output.

Monthly Loan Payment Calculator

How to Calculate your Monthly Loan Payment

You must pay back more than the amount you borrowed from the lender when you take out a personal loan. The interest on the loan, which represents the cost of borrowing the money, is also paid each month.

Finding out the precise cost of your monthly payments once interest is applied is difficult. You often won’t know the exact amount until you have received the loan. However, getting a broad sense of the monthly payments is still crucial before entering an agreement. By doing this, you can ensure you don’t borrow more money than you can afford. Here’s how to figure up your recurring loan payment:

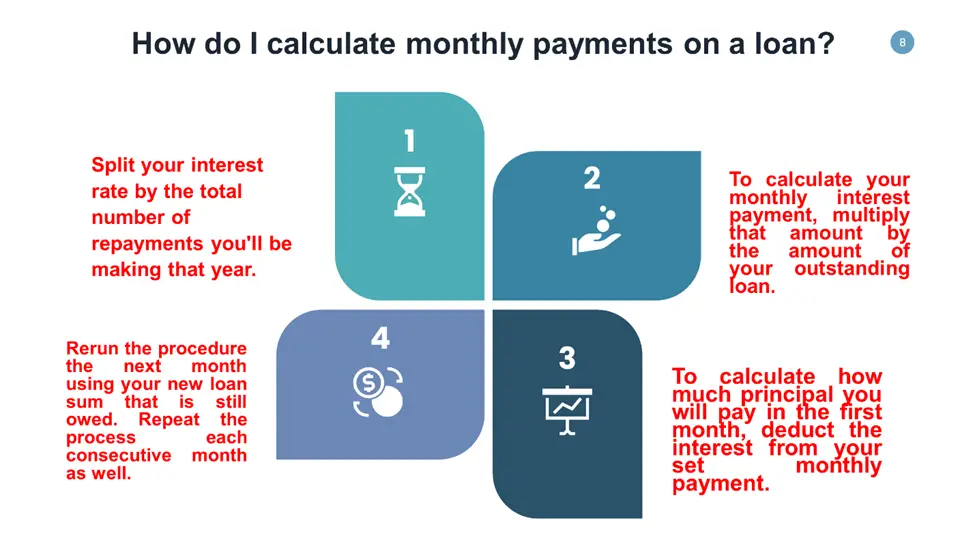

- Start dividing your interest rate by the total number of repayments you’ll be making that year in. You would split 0.06 by 12 to obtain 0.005 if you had a monthly payment schedule and an interest rate of 6%.

- To calculate your monthly interest payment, multiply that amount by the amount of your outstanding loan. The first interest payment for a loan with a $5,000 amount would be $25.

- To calculate how much principle you will pay in the first month, deduct the interest from your monthly payment. If your lender informed you that your fixed monthly repayment would be $430.33 the first month, you would pay $405.33 toward the principle. That amount reduces your outstanding balance.

- Rerun the procedure the next month using your new loan sum that is still owed. Repeat the process each consecutive month as well.

What is the Total of your Repayments?

Total Repayment Amount is the total of all planned or anticipated payments of monies that the receiver agrees to make to the supplier.

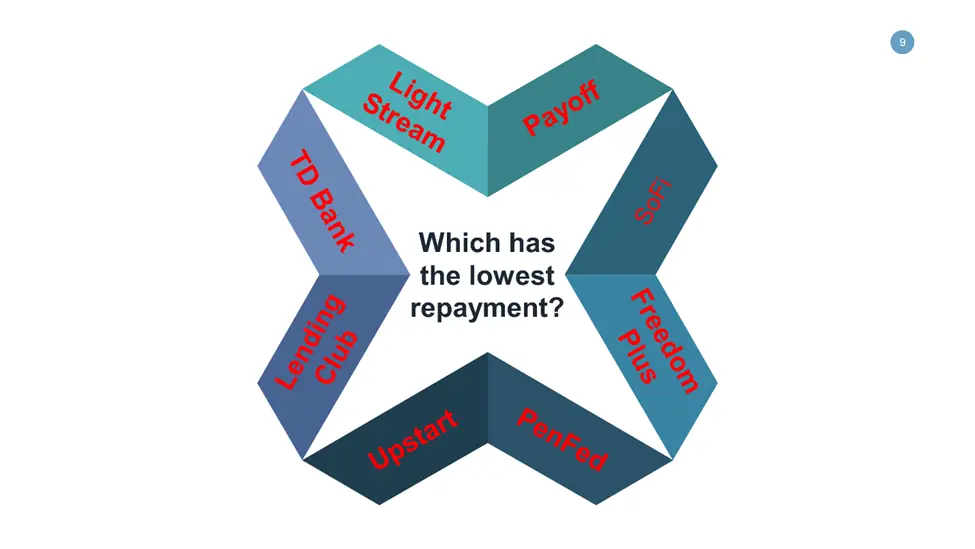

Which has the lowest repayment?

With personal loans, you may take out a lot of money and repay it over time in regular payments. By paying less in interest, low-interest personal loans let you reduce your monthly payments.

You’ll probably need good credit and a high salary to get accepted for the most attractive low-interest loans. However, looking around, you might still locate loans with reasonable interest rates. Additionally, you should consider each lender’s loan amounts and repayment conditions. Some loans with the lowest repayment have been highlighted in the table below.

| Loan Provider | Repayment range |

| LightStream | 5.73% – 19.99% |

| Payoff | 5.99% – 24.99% |

| SoFi | 7.99%–22.73% |

| FreedomPlus | 7.99% – 29.99% |

| PenFed | 5.49%–17.99% |

| Upstart | 5.40% – 35.99% |

| LendingClub | 6.34% – 35.89% |

| TD Bank | 6.99% – 18.99% |

This can also be seen in the infographics below.

Frequently Asked Questions

How do I calculate monthly payments on a loan?

You can calculate monthly payments through the following tips in the chart;

How much is a monthly payment for a $10 000 loan?

Based on the APR and term of the loan, the monthly payment for a $10,000 loan might vary from $137 to $1,005. For instance, your monthly payment would be $1005 for a one-year, $10,000 loan with a 36% APR. However, if you borrow $10,000 for seven years at 4% APR, your recurring payment would be $137.

The estimates use a minimum and maximum payback duration of one to seven years, which is universal for personal loans. Additionally, these calculations presumptively include any origination fees the lender may charge in the APR. Your repayments may be lower since some lenders demand an origination fee upfront.

What is a monthly payment on a 50000 loan?

Based on the APR and a $50,000 loan term, the monthly payment might vary from $683 to $5,023. For instance, your monthly payment would be $5,023 if you took out a $50,000 loan for a year with a 36% APR. However, if you borrow $50,000 for seven years at 4% APR, your recurring payment would be $683.

What is the minimum monthly loan payment?

To maintain good standing with the credit card business, clients must make at least the minimum monthly payment on their revolving credit account each month. The least a customer should do to avoid late penalties and to maintain a positive payback history on their credit report is to make the minimum payment on time each month.

The minimum monthly payment is determined as a tiny proportion of the overall credit debt owed by the customer.

How are minimum monthly payments calculated?

Different issuers use different methods for calculating minimum payments. Many calculations ultimately rely on the amount and interest rate on your card. Read the terms and conditions to learn the precise formula used to determine a card’s down payment.

There are three primary methods for calculating minimum payments:

- A flat proportion of your balance: This rate might be a small portion of your overall balance. The repayments in this instance will change depending on how much of the debt is owed.

- A percentage of the outstanding debt plus any interest or fees from the previous statement period: In this case, the card issuer may impose a fee equal to 1% of the outstanding amount plus any interest or costs from the previous statement period.

- A flat fee: The card company may impose a straightforward flat payment of as little as $35 each month that is owed. This is true if the balance doesn’t exceed a specific amount. The minimum payment is the whole balance if the balance is less than a particular amount.

Depending on your situation, whether interest has accumulated, and if late payment penalties have been charged, a card issuer may use one or more of these calculating techniques.

Calculate Cash Advance Credit Card

What are the monthly payments?

The amount paid each month to repay the loan throughout the loan is known as the monthly payment. Not only the principle, or the amount that was first lent out, must be returned when a loan is taken out. This is in addition to accumulated interest.

How much would a 30,000-loan cost per month?

Based on the APR and a $30,000 loan term, the monthly payment might vary from $410 to $3,014. For instance, your monthly payment would be $3,014 if you took out a $30,000 loan for a year with a 36% APR. However, if you borrow $30,000 for seven years at 4% APR, your recurring monthly payment will be $410.

What is a good interest rate on a personal loan?

A personal loan interest rate should be less than 12% in March 2022, below the national average. Nevertheless, some variables affect the exact interest rate you’ll be eligible for. Additionally, lenders typically tack on extra fees that may raise the cost of a loan.

Ensure you comprehend a suitable interest rate to keep expenses down. This will make it simpler for you to look around for comparable terms and guarantee that you obtain the finest offer.

How much loan can I get on 60000 salaries?

Generally speaking, you should be able to afford a loan that is two to 2.5 times your annual salary. That’s a $120000 to $150000 loan at $60,000.

Expert Opinion

Lenders make money by collecting interest when you take out a loan, whether a college loan, personal loan, vehicle loan or mortgage. The cost of borrowing funds from a creditor interest.

That implies that you won’t just return the borrowed funds. The interest on the loan will be added to the amount you repay. Additionally, the Monthly Loan Payment Calculator will be of great use to you in helping you make the best decisions.

Lenders use different methods for assessing interest. Some charge interest using the so-called simple interest technique, while others could do so using an amortization plan. This raises the interest rate earlier in the loan’s life.

Your credit history, the loan’s size, and the loan’s conditions all influence the interest rate you will eventually pay. The Monthly loan payment calculator will also help you navigate this easily.

References

- https://www.bankrate.com/loans/personal-loans/how-to-calculate-loan-payments/

- https://www.lawinsider.com/dictionary/total-repayment-amount

- https://www.creditkarma.com/personal-loans/i/personal-loans-low-interest-rates

- https://www.accessbank.com/calculator/complex-loan

- https://www.calculatorsoup.com/calculators/financial/loan-calculator.php