Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

It’s best practice for a high-growth firm to have a thorough knowledge of the Assumed Par Value if it plans to allocate ownership to co-founders, employees, and investors. This will assist you in dividing ownership precisely across many funding rounds. Therefore, we have made this post on the Assumed Par Value Calculator.

A bond’s face value is referred to as the assumed Par value. A bond’s or fixed-income instrument’s par value is crucial since it establishes the maturity price and the number of coupon payments. Depending on elements, including the level of interest rates and the bond’s credit standing, the market value of a bond may be higher or lower than par.

Due to the common denominations in which bonds are produced, the par value for a bond is often $1,000 or $100. The Assumed Par Value Calculator may also be used to determine this number.

The stock value specified in the company charter is sometimes referred to as the par value for a share. Typically, shares have a volatile or very low par value, such as one penny per share. Regarding equity, the par value and share price are seldom ever related.

The setting of a par value below which shares cannot be traded is mandated by several jurisdictions for businesses. The Assumed Par Value Calculator should be used to adhere to state requirements. Come along as we highlight more on this below.

What is an Assumed Par Value?

The face worth of a bond or the stock value mentioned in the company charter is an assumed Par value, sometimes referred to as nominal value. A bond’s assumed par value is typical $1,000 or, to a lesser extent, $100. This is accurate since they are often issued in these denominations.

A bond’s or a rectified instrument’s assumed par value is crucial since it establishes the bond’s maturity value and the number of coupon payments.

The stock value specified in the company charter is sometimes referred to as the presumed Par value for a share. Typically, shares have a very low par value, such as one penny per share or no set par value. Regarding equity, the par value and share price are seldom ever related.

Assumed Par Value Calculator

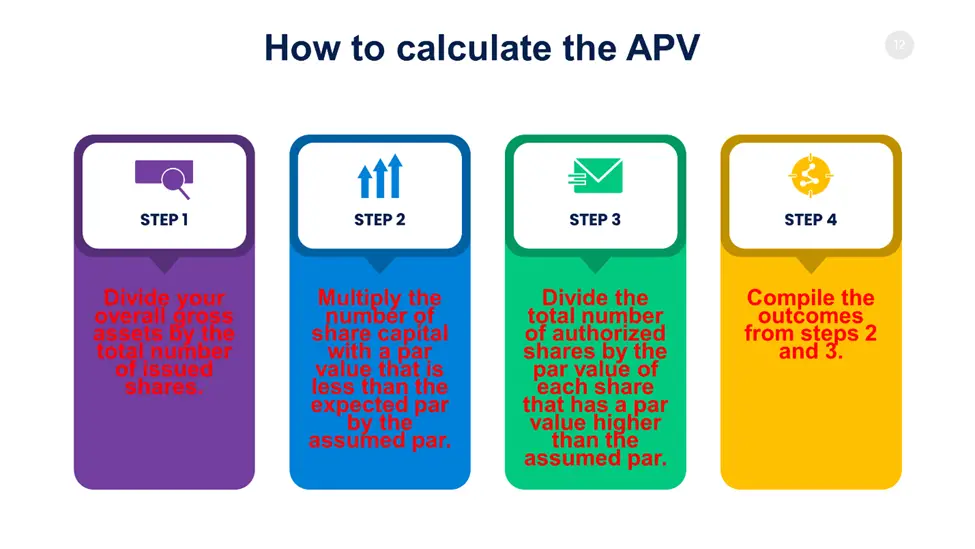

How to Calculate the APV

You can calculate the APV through the following steps:

- Divide your gross assets by the number of issued shares.

- Multiply the share capital with a par value that is less than the expected par by the assumed par.

- Divide the total number of authorized shares by the par value of each share with a par value higher than the assumed par.

- Compile the outcomes from steps 2 and 3. Your capital with assumed par value is the outcome.

Why Assumed Par Value Calculator is Important

A bond’s par value is one of its most significant features. You may use the assumed par calculator to determine how much bond issuers commit to paying bondholders when the bond matures. A bond is simply an assurance that the issuer will get the borrowed money back.

The par value of bonds is not always used when they are issued. Depending on the level of interest rates in the economy, they could also be offered at a premium or a discount. A bond sells at a premium if its price is higher than its par value. A bond that is trading below par is being offered at a discount.

A greater percentage of bonds will trade over par or at a premium when interest rates are low or have been heading downward. Bonds will market at a discount more often when interest rates are high. With the help of the Assumed Par Value Calculator, all of these issues may be resolved quickly.

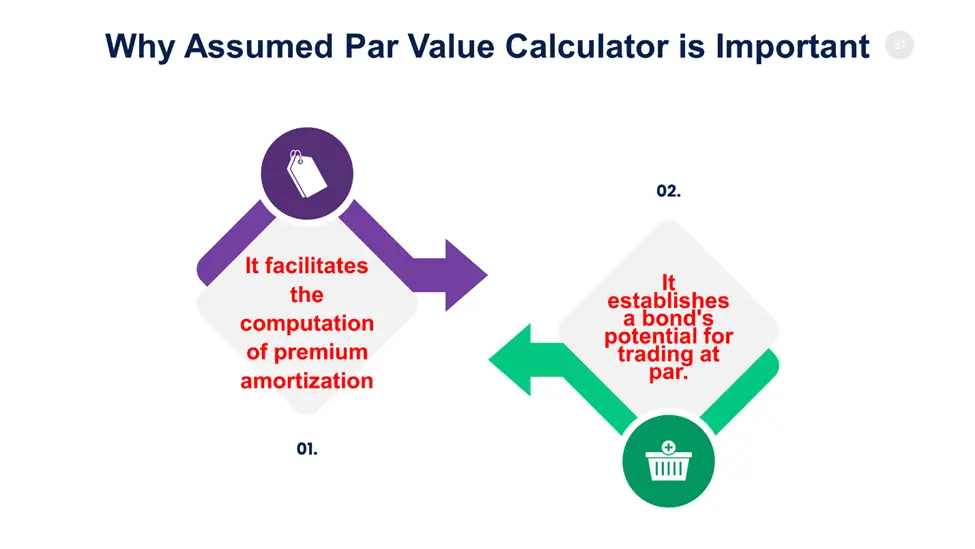

Other factors supporting the significance of the assumed par value calculator include:

It facilitates the computation of premium amortization.

The premium paid by an investor who purchases a taxable bond over par may be repaid during the bond’s remaining life. Here, the Assumed Par Value Calculator will be quite useful. This often cancels out the bond’s interest payment, lowering the investor’s taxable income. However, tax-free bonds bought over par cannot benefit from this premium amortization.

Establishes a bond’s potential for trading at par.

Using the Assumed Par Value Calculator, you may compare the coupon rate of a bond to the current market interest rates. In addition, this will influence whether a bond trades at par, beneath par, or above par.

The interest payments paid to bondholders yearly or semi-annually as remuneration for lending the issuer a certain sum of money are known as the coupon rate.

Pros & Cons of Assumed Par Value Calculator

The Pros & Cons of the Assumed Par Value Calculator have been highlighted in the table below.

| Pros | Cons |

| It can be rapidly and readily located and is often free. | As soon as you gain access to the Internet’s boundless potential, anybody might become sidetracked. |

| It offers efficient technical support | It could be a little difficult for beginners. |

| Whether you’re at your desk or on the road, the Assumed Par Value Calculator is accessible at the touch of a few clicks. | |

| It raises the user’s confidence and spirit. | |

| The Assumed Par Value Calculator quickly and accurately completes laborious computations and returns a precise result. |

Expert Opinion

The face value of a bond or shares indicated in the company charter is the assumed Par value, sometimes called nominal.

One of a bond’s most crucial properties is its par value. The bond’s par value is the sum of money that the issuer commits to pay bondholders at the bond’s maturity date. A bond is simply a written commitment that the cash lent to the issuers will be returned.

The par value establishes the maturity value and the monetary coupon payment amount. Due to the common denominations in which bonds are produced, the par value for a bond is often $1,000 or $100.

Handling assumed par value is a frequent concern for individuals creating businesses. This makes sense since it often has little to do with the real value of the shares. As a result, the Assumed Par Value Calculator will mostly be required.

The Par value, which most states still use to calculate franchise taxes and for attorneys to provide legal opinions, is a holdover from their corporate legislation. And happily, once properly established, it won’t need to be handled again.

References