Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

When a return is made for less than one year or greater than one year, the annual rate of return is the rate each year. This is often annualized to make it easier to compare the annual growth of the same or various asset classes. In other words, a yearly rate of return is assessed as the corresponding yearly return that an investor would be entitled to over a certain time. Investors may compare the return on assets over a certain time since it is calculated based on time weight and scales down to 12 months. Calculating this could be challenging at times. To help you, we have created this page on the annual rate of return calculator.

The amount gained on a fund over a full year is the annual percentage rate in the yearly rate of return technique. The annual rate of return is determined by dividing the total gain or loss at the end of the year by the initial investment made at the beginning of the year. The annual rate of return or nominal annual rate are other names for this approach.

You should have a solid understanding of the annual rate of return if you wish to invest your cash in a financial market or business.

Additionally, over 12 months, this is the return on investment and is often given as a percentage. That percentage may be positive or negative depending on how much was made or lost relative to the principal. This is extra to the original investment or starting sum throughout the scrutinized holding term. Come along as we highlight the relevance of the Annual Rate of Return Calculator in this context.

What is an Annual Rate of Return Calculator?

A metric that measures the rate of return on investments over any time is the annual rate of return. Additionally, it works by averaging the results for a full year. The method equalizes all investments over time and considers all losses and earnings with time.

Because the annual rate of return is an average that considers the accumulation of investment profits over time, it varies from the annual return. The annual rate of return calculator makes it simple for investors with varied portfolios to compare the performance of various assets. Returns on assets, like stocks, might alter at any time, and a 15% gain from the previous year can be followed by a 25% loss this year.

It might be difficult to correctly determine an investment’s performance if it has unpredictable returns or changeable interest rates. For investments, when the returns are recognized in respect of a dollar amount, but the precise percentage rate is unknown, the annual rate of return calculator is extremely helpful. Identifying failing investments and those that provide the highest long-term returns is simple by computing a single yearly percentage for all assets.

How to use the Annual Rate of Return Calculator?

You can use the Annual Rate of Return Calculator through the following steps:

- Enter the amount Invested ($).

- Enter the Amount Returned ($).

- At this point, the Annual Rate of Return Calculator will process your input and produce the % of Return on Investment.

Annual Rate of Return Calculator

Formula to Calculate Annual Rate of Return

The formula below is used to get the Annual Rate of Return when the holding time is more than a year:

(Ending Value / Beginning Value) = (Annualized Rate of Return Ratio) 1/n – 1

Where:

Ending Value = Investment value after the period

Starting value is the investment’s value at the start of the term.

n is the number of years.

For a more accurate computation, 1/n maybe be replaced in the following formula by 365/days. The term “days” in this case refers to the duration of the investment.

The return on an investment kept for less than a year may be determined using the following formula:

(Ending Value / Starting Value) = ARR Formula

365/n – 1

where: n = Days the individual held the investment

Significantly, Worldwide Investment Performance Standards, a global organization that develops standards for results reporting, advises against annualizing performance for periods less than one year.

Frequently Asked Questions

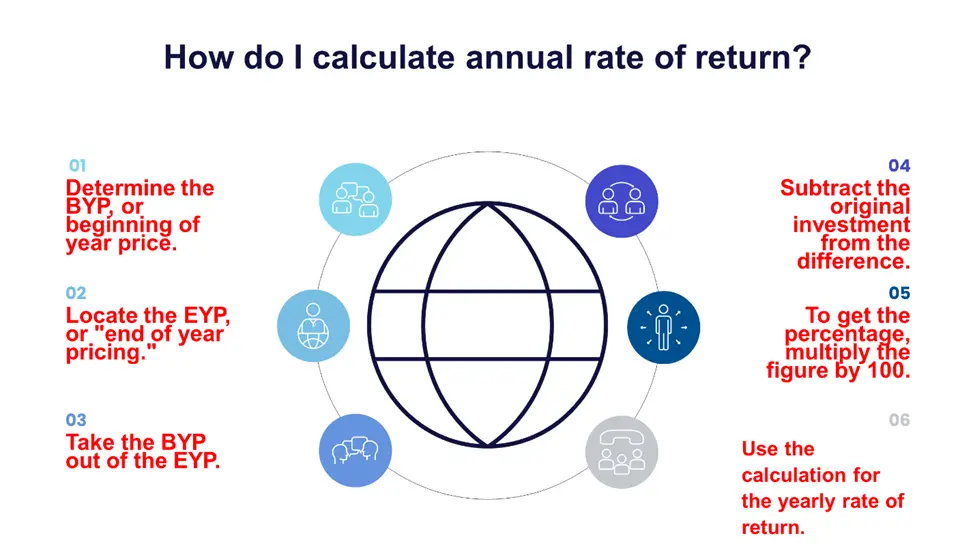

How do I calculate the annual rate of return?

You can calculate the annual rate of return through the following steps:

- Determine the BYP or beginning-of-year price. Get your first investment from the year’s beginning. The “beginning of year price,” or “BYP,” is another name for this.

- Locate the EYP, or “end-of-year pricing.” Additionally, it indicates how much money you made or lost at the end of the year.

- Take the BYP out of the EYP.

- Subtract the original investment from the difference.

- To get the percentage, multiply the figure by 100.

- Use the calculation for the yearly rate of return.

Yearly Rate of Return = [(EYP – BYP) / BYP] x 100 is the formula for calculating the annual rate of return.

Don’t forget to subtract any income or profits you received while owning the investment. Simply increase the investment’s closing value by the dividend to account for profits.

This can also be seen in the infographics below.

How do you calculate the rate of return over multiple years?

To calculate the rate of return over multiple years, you can use the following steps:

- Split the investment’s worth at the end of the term by its value at the beginning of the period as the first step.

- Multiply the result by the number of years and raise it to one exponent.

- Take one away from the outcome.

How do I calculate my 3-year return?

Multiply your original investment value by three to get your 3-year return by dividing the investment’s initial value by its ultimate value.

To calculate the value of your three-year return, multiply the amount by three.

How do you calculate the annual rate of return on 401k?

To calculate the annual rate of return on 401k, take the final amount and subtract any commitments you made over the past year.

Then divide by the beginning balance from the previous year.

Finally, increase the value by 100 after removing 1.

What is a good annual rate of return on 401k?

According to market circumstances, many financial planners estimate that the conventional 401(k) portfolio yields an average annual return of 5% to 8%. However, some variables, including your donations, investment choices, and fees, affect your 401(k) return.

What is a good 3-year rate of return on 401k?

The typical 401(k) rate of return over three years for a portfolio with 60% stock and 40% bond investments varies from 5% to 8% annually. Of fact, the average those financial advisors recommend using to calculate returns is simply that.

What is a good 401K balance at age 50?

To be on pace to retire at age 67, you should attempt to save at least six times your annual wage by age 50. If your annual income is $50,000, you should try to save $300,000 by the time you are 50.

Can you retire 2 million?

Investors generally anticipate this. Three case studies had a significant likelihood of running out of cash, shocking people. In other words, $2 million may not be enough for some people to retire, but it is not enough for others.

How long will a 500k retirement fund last?

The 4% rule states that you should be able to take $20,000 annually for a 30-year pension if you retire with $500k in assets. As a result, if you retire at age 60, your funds should ideally last until age 90. If you think 4% is too low, keep in mind that you’ll accept an income that goes up with inflation.

Expert Opinion

An annual rate is a rate of return estimated as if it were for a full year, even when the supplied time is shorter than a year. It is simply a mathematical extrapolation of a projected rate of annual return. The monthly change in the rate of return is multiplied by 12 to get the annualized rate. This will assist in obtaining the annual rate. A time-weighted formula is used to calculate the annualized rate of return.

Another method of determining investment returns yearly is using the annualized rate. We often want to know how much money we are making from our investments as we make them. The term “rate of return” refers to our formula to determine our investment profits over time. At this point, the Annual Rate of Return Calculator will be indispensable for you.