Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

If you heed your monthly credit card monthly statement, you’ll notice that the repayments amount you should pay to avoid getting penalized—can vary monthly. It’s easy to understand since it’s usually computed as a proportion of your existing debt plus any fees, as a result, the larger your debt, the greater your minimum repayment. This minimum credit card payment calculator will help you find out your payment easily and fast.

While paying more than the essential minimum is preferable, you should know how the lower limit is determined and what occurs if you don’t. Although different credit card companies use various approaches, certain fundamental concepts apply. As a result, we’ve prepared this page on credit card minimum payments.

How to Use this Minimum Credit Card Payment Calculator

It’s OK if you can barely pay the balance on your credit card debt at times. Making the minimum payment is preferable to delaying or abandoning a payment, which could hurt your credit score. However, owing to rising interest rates, it will cost you further in the long term.

Use our Minimum credit card payment calculator to figure out how long it takes you to repay your credit card if you raise the minimum payouts:

Step 1: Enter the value of your credit limit into the columns provided

Step 2: Enter the value of your interest rate of the credit (in %)

3 No Step: Enter the commission (in %).

Step 4: Click on “calculate.” And the calculator will process and display the minimum payment in the designated section. This is in addition to the monthly and annual difference.

Step 5: Click on “reset” if you desire to recalculate, and all the values you earlier entered will get cleared.

Minimum Credit Card Payment Calculator

What is the Procedure for Making Minimum Payments?

The lowest number your credit card provider will take toward your monthly credit card debt is a minimum repayment. To mitigate potential fines and other penalties, you must pay approximately this sum for your payment to be deemed “on time.” Certain lenders may raise your interest rate if you submit a late payment late.

Your minimal payment is usually determined as a proportion of your outstanding debt or a fixed monetary amount (such as $30). It usually amounts to 1% to 3% of the amount owed on your credit card. It also includes any accumulated interest and fees. You must pay the full amount of your total debt is less than the required minimum.

How to Calculate Minimum Credit Card Payment

The following formula may get used to determine your minimum credit card payment:

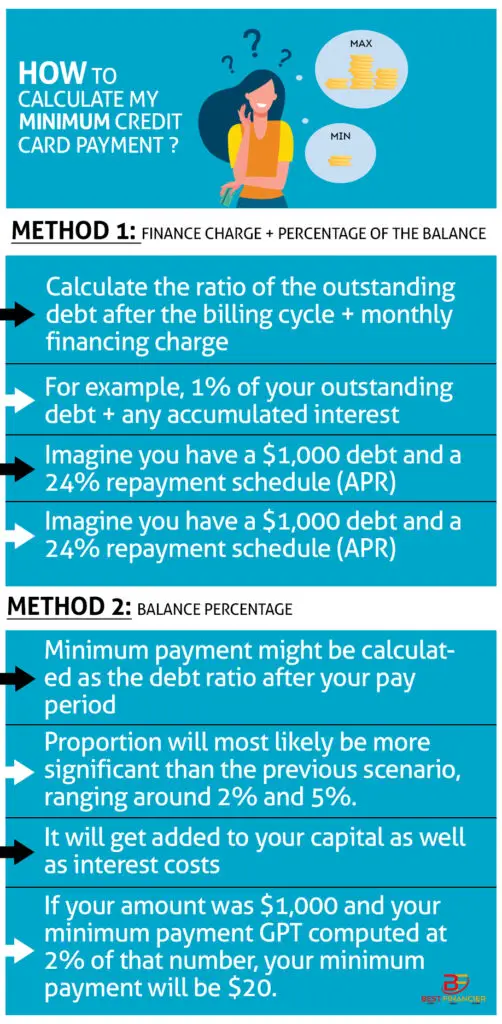

Method 1: Finance Charge + Percentage of the Balance

The monthly payment may be calculated as the ratio of the outstanding debt after the billing cycle plus a monthly financing charge—for example, 1% of your outstanding debt plus any accumulated interest. Imagine having a $1,000 debt and a 24 percent repayment schedule (APR).

Your repayments would be 10% of your loan balance ($10) plus your quarterly finance charge ($20), for an absolute minimum repayment of $30.

Method 2: Balance Percentage

The minimum payment might be calculated as the debt ratio after your pay period. This proportion will likely be more significant than the previous scenario, ranging between 2% and 5%. It will get added to your capital as well as interest costs. So, if your amount was $1,000 and your minimum payment GPT computed at 2% of that number, your minimum payment will be $20.

Why does my Credit Card Say no Minimum Payment due?

Because the outstanding amount was paid in whole by the most current due date, your bank card probably displays “no minimum deposit required.” This is also possible if there was no user activity throughout the pay period. No repayment will get needed until the following billing month ends if the reported amount is paid before the due date.

How to Calculate Interest on a Credit Card?

Computing credit card interest is complex, so it’s better left to the machines. You should know how it works since the rate of return (APR), and the amount on your credit card impact your budget.

Combining your APR to your current mean amount throughout your billing cycle determines how much interest you owe. Overall, the following procedures may get used to compute credit card interest:

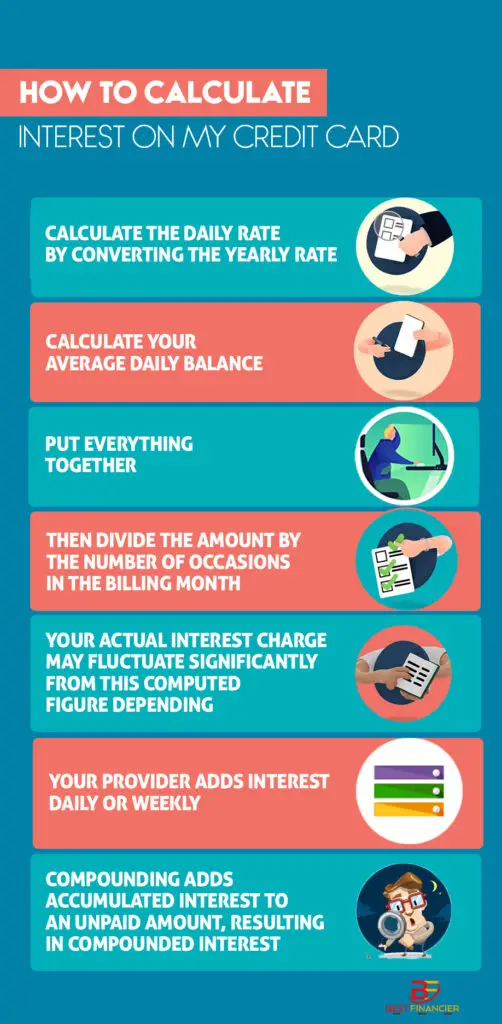

Calculate the daily rate by converting the annual rate.

To get the daily rate, divide your credit card’s annual percentage rate by 365. The daily interest rate is compounded by the amount of money you have on hand that day. Because the average daily amount is accumulated, each day’s computation depends on the previous day.

Determine your average daily balance

This is the most time-consuming stage since you’ll have to know your amount every day of the pay period. If your repayment period is 25 days long, you’ll need to understand your exact amount every 25 days. You’ll also need to compensate for any outstanding amounts from the previous billing cycle and any new money paid this billing cycle.

The calculation is a little less complex if you have no outstanding amount from the previous billing cycle and have not made any repayments during the current month.

Determine Your Interest Rates

The last step is to figure out how much extra you’ll have to pay. Multiply your daily amount by the standard rate, then scale that result by the number of sessions in your pay period. You might not get an unbeatable interest rate for a month, but don’t be fooled. Allowing a debt to accumulate or making minimal payouts might cost you a lot of money.

Finance costs accumulate over time, so cards with 0% APR rates may be enticing to anyone needing more time to settle off their account. If you have a $10,000 amount on cards with a twelve-month 0% APR offer and don’t pay for a year, you’ll owe the same $10,000 without accruing a year’s finance charges.

If you’re considering transferring a debt to a card with a special 0% APR on money transfers, remember that these cards often charge a balance transfer fee. Before shifting a balance, consider the advantages and disadvantages.

How to Calculate a Credit Card Payment?

Many individuals are interested in learning how credit card transactions are computed. Knowing the details may assist you in making informed choices and managing your debt. Understanding how payments are calculated and how each transaction contributes to debt reduction is the first step toward effective credit counseling (or not).

Fortunately, manually computing your payments (and expenditures) is relatively simple. You’ll have all you need if you can recall how to multiply or acquire a computer to do it for you. The steps are as follows:

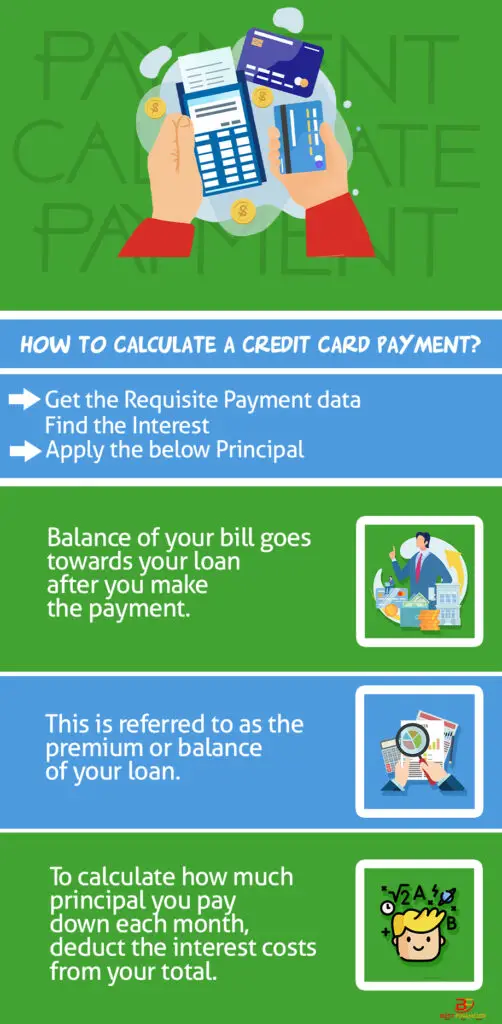

The Requisite Payment

Begin by setting the minimum amount your credit card provider requires. This figure is usually calculated using your financial position. Your card issuer determines your monthly minimum, so you might have to inquire about which amount to use.

Find the Interest

Your loan amount is not always reduced by the money you spend when making payments. If you spend $100, your balance is unlikely to decrease by $100. But if you have a 0% cost option with no extra fees or levies, this is true. Each transaction contributes to the credit card firm’s interest rate drop and other lending expenses.

The Principal

The balance of your bill goes towards your loan after you make the payment. This is referred to as the “premium” or “balance” of your loan. To calculate how much principal you pay each month, deduct the interest costs from your total.

Frequently Asked Questions

What happens to your balance and credit score when you pay only the minimum on your credit card?

It may be enticing to pay just the slightest amount owing on your credit card, but doing so may be costly.

Experts advise paying your bill in full each month, although this may not always be achievable. In certain situations, making at least minimal payment is critical to keep your account active and avoid late penalties or punitive APRs.

It’s evident from a financial standpoint that paying the least on credit cards is a terrible idea. You may not realize that paying just the bare minimum each month might negatively influence your credit score. This is due to the components that go into determining your credit score.

Your repayments alert displays the financial repercussions of making just minimum payments with annual fees. Calculating the impact on a credit score, however, is more complex. Because increased usage rates will influence the scores of various clients, it’s more challenging to evaluate the precise credit score effect of minimum payments.

What happens if I miss or skip a monthly payment?

You should receive a fine if you skip a payment. You should pay two months’ worth of bills plus a late charge when your following statement is due. As a result, catching up may be challenging and becomes more complex as your monthly repayments increase. As a result, getting hung up on mortgage and vehicle loan payments is generally the most challenging.

Does my credit limit reset after making the minimum payment?

Yes. Your credit limit will be reset each time you make payments to your credit account, and that transaction is reimbursed. Your credit score will be reset regularly if you pay timely each month.

Does paying a credit card minimum affect credit score?

Since you’re not skipping a payment, a minimum payment will not harm your credit score. Nevertheless, experts highly advise paying more than the least each month to prevent economic difficulties.

What happens if I pay the minimum amount on a credit card?

Paying the Minimum Threshold required ensures that you will only have to make payments when it is due. There will be no late payment fees or penalties. If you pay the Minimum Threshold Due Repayments on schedule, your credit card provider or financial institution will not mention you to the credit agency as erratic.

Will I be charged interest if I pay a minimum payment?

You will not get charged a late fee if you pay the required credit card payment. However, you will still be in charge of paying interest on the unpaid amount.

Is there a minimum payment on a 0 credit card?

Yes. Even if your card has a 0% APR, you’ll have to make minimum monthly payments. This is often a modest portion of your total amount. If you miss a payment by even one day, your card issuer may terminate the 0% offer and return your card’s lending rate to the current APR.

How long does it take to pay off a credit card with minimum payments?

You’ll be debt-free in around six years and 11 months if you merely make minimum payments. If you pay an extra $50 monthly on top of the repayments, the time will be cut in half.

Does a minimum payment count as on time?

Yes. The smallest value your credit card provider will take toward your monthly borrowing is a minimum payment. To avoid late sanctions, you should pay roughly this amount for your transaction to be deemed “on time.”

How long do you have to pay a credit card before interest?

Many credit cards offer a 21-day interest-free time window, beginning when your periodic statement is produced and ending on the day your bill is due.

Why is my minimum payment 0 when I have a balance?

If your statement amount is zero, no minimum payment is required. Suppose no initial payment is required. However, if your account has a current balance, it implies the charges get incurred after the previous pay period ended and will appear on your following report.

Can I pay my credit card the day it’s due?

Every quarter, credit card transactions are attributable on the same day and time, usually 5 p.m. or later. Per the CARD Act, a credit card payment is not deemed late if collected by 5 p.m. on the due date. If you pay your account online, certain card issuers may extend the due date, giving you more time to pay.

Can I use my credit card the same day I pay it off?

Yes. You may use your credit card again if you settle it off early. When you have sufficient credit on your credit card, you may use it to make a transaction. The value of each transaction you make reduces your credit line, while any repayment raises it.

Does paying minimum payment hurt credit?

Since you’re not skipping a payment, a minimum payment will not harm your credit score. However, experts highly advise paying more than the minimum amount each month to prevent financial trouble.