Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Debt occurs, and it may rapidly result in high-interest rates and difficult-to-manage monthly payments on your credit cards or loans, whether it’s to purchase a new vehicle or pay for your school. Although this may sometimes be unavoidable, what matters most is how you choose to approach your debt. One method for simplifying debt management is debt consolidation, which combines all of your debt into a single payment. Often, it has a lower interest rate than your monthly payment. Calculating this could be difficult, so we created our free debt consolidation calculator to help.

Using a debt consolidation calculator, you may quickly determine a lump amount to pay off your higher-interest credit card balances, medical expenses, and other debts. Consolidating your debt is made simple by the ability to have the money delivered straight to your creditors.

You may also streamline and save money with a debt consolidation loan by combining many higher-rate payments into a single fixed payment. Find out more about debt repayment techniques. We will highlight everything you need to know on the Free debt consolidation calculator below.

Additionally, debt consolidation loans enable borrowers to combine the account balances from some installment loans or credit cards into a single loan. Debt consolidation loans must have a shorter payback time than your previous debts without the loan for them to be advantageous.

The rate you pay throughout the payback period should also be lower than what you would pay under your current repayment conditions. Follow along as we go into more detail about this below.

What is a Debt Consolidation Calculator?

Using a debt consolidation calculator may show you the possible financial benefits of taking out a loan to pay off debt with higher interest rates. This calculator totals the debts you enter. It also calculates how it will take to pay off the loan in full using the average interest rate on that debt. This is true as long as you stick to your regular monthly payments. It also calculates how much interest you would pay if you kept making these payments to your loan.

How to use a Debt Consolidation Calculator

You can use a debt consolidation calculator through the following steps:

- Enter your outstanding balance.

- Enter your new Rate of Interest

- Put your remaining number of payments.

- At this point, the free debt consolidation calculator will process and give you the output.

Free Debt Consolidation Calculator

What do you Need to Know before using a Debt Consolidation Calculator?

To use a debt consolidation calculator effectively, you must be aware of the following:

Type of loan

Personal loans, credit cards with promotional 0% APRs, 401(k) loans, and home equity loans are among the most popular.

Loan conditions

The amount, interest rate, and loan period are part of the loan conditions. Your financial situation and the loan you get can play a role in this.

Secured versus unsecured

You are required to put down security for a secured loan. For instance, your house is the security for a home equity loan. The lender may seize that collateral to cover your outstanding sum if you fall behind on payments. Consider keeping your unsecured choices, including personal loans and credit cards, with a 0% APR if you don’t want to put your assets at risk.

How does Consolidation Works?

The idea behind consolidation is straightforward: You apply for a debt consolidation loan and utilize the funds to settle your other obligations, often credit card balances. Contrary to its name, debt consolidation loans don’t include combining debt from many credit accounts.

They might be used to settle only one credit card. The loan profits may be sent directly to your creditors by certain lending partners, or they may be sent to you, and you will be responsible for repaying your creditors.

The loan will be repaid in set monthly payments. If you have debt from numerous sources, consolidation loans make it easier to repay since there is just one interest rate, payment amount, and due date to remember.

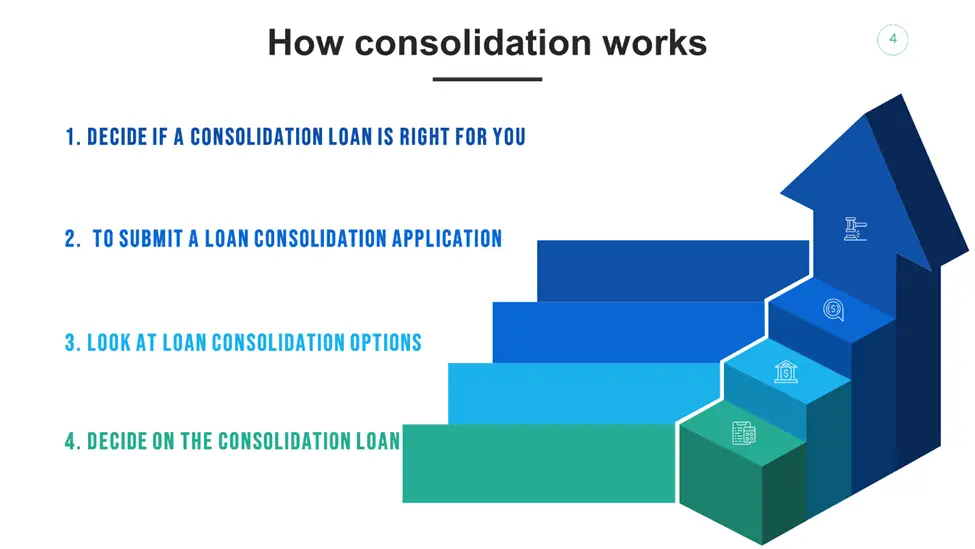

Additionally, you may utilize this detailed checklist:

- Decide if a Consolidation Loan Is Right for You

- Prepare to submit a loan consolidation application

- Look at loan consolidation options

- Decide on the appropriate consolidation loan

This can also be seen in the infographics below.

What to know Before you Consolidate

You may have seen TV commercials for debt consolidation that claim to erase your debt. You may have also encountered success tales of individuals who used debt consolidation to eventually escape debt. Debt consolidation isn’t always the best—or the only—solution you can use to manage what you owe, but it may be a strategy that helps you better manage and take control of your debt. Before you consolidate, consider the following information in more detail:

Consolidating debt involves refinancing a loan with a longer payback period.

The debt consolidation process is to pay down debts with higher interest rates, such as the sums you may have on several different credit cards. This also applies to funds from a bank loan or other low-interest lender you have obtained. To employ this strategy, you must first apply for and get authorized for a new loan big enough to pay off the obligations you wish to settle.

Debt consolidation won’t eliminate your debt or make it smaller.

Debt settlement and debt consolidation are two different processes. According to experts, this entails a third party negotiating with your creditor to lower the amount you owe; often, this leads to the closure of your credit accounts. Additionally, debt settlement could have a long-term negative effect on your score.

As a result, if you are otherwise at risk of completely missing your credit card payments, it should only be used as a last option.

You need to be certain that you can afford the new monthly loan total payment.

Debt consolidation may decrease the interest rate(s) you pay on your monthly debt in addition to the convenience of having just one payment to pay each month rather than many. But the loan you utilize to settle other obligations will probably be an installment loan.

This implies that until the loan is repaid, you agree to make a fixed monthly payment in full, for a certain length of time, at a fixed interest rate. A credit card often offers revolving credit, which is fundamentally different from an installment loan.

Consolidating your debt won’t stop your issue spending.

If debt consolidation enables you to benefit from a loan with a reduced interest rate, it could help you spend less money on your debt. However, it won’t solve the root cause of your credit card debt. Take advantage of debt consolidation to manage your credit card use and spending. This will save you from having to balance new credit card balances and new debt from the loan you acquired to consolidate debt.

Pros & Cons of Debt Consolidation

The Pros & Cons of debt consolidation have been highlighted in the table below:

| Pros | Cons |

| You may combine many payments into one. | Lenders may impose fees for loan origination, balance transfer, or closure. |

| Interest rates are reduced. | The borrower can be required to put up their house as security. |

| You might raise your credit score. | A lengthier payback term may cost more altogether. |

| It guarantees lower stress. | Does not ensure a reduced interest rate, particularly for consumers with weak credit. |

| You can reduce your credit card debt more quickly. | |

| Loans for debt consolidation have longer repayment periods. |

3 Ways to Consolidate Debt and Save Money

The following strategies may help you consolidate debt while saving money:

Balance transfer

By transferring your credit card balances, you may combine them onto one card with an interest rate lower than the one you are now paying. Several balance transfer cards offer introductory rates of 0%. You won’t accrue more interest if you settle your loan before the intro period expires.

You need strong credit to get the finest balance transfer deals. You may transfer a debt if your credit is less than ideal, but your new card’s interest rate may be higher.

Personal borrowing

You can borrow money for any purpose with a personal loan. You may get a personal loan to pay off all of your debts, even if you also have some credit card debt that has to be paid off while paying off a medical cost. Because personal loans are paid back in equal installments, you can count on knowing exactly how much you’ll have to pay each month.

The lower the interest rate you may anticipate, just as with a balance transfer, the higher your credit score is. But there are other personal loans available that are made especially for customers with bad credit.

A refinancing with cash-out

When you refinance your mortgage with cash, you borrow more money than the outstanding sum. The extra money may be used for any use. Consolidating and paying off debt is a smart idea with cash-out refinancing. Additionally, compared to what a credit card or personal loan would cost you, refinancing might save you a ton of money at the current low-interest rates.

Here are Credit Card Comparison Calculator

This can also be seen in the infographics below.

Frequently Asked Questions

Should you consolidate your debt?

Yes. Consolidating your debt may be a smart option if you’re having difficulties remembering your payments. Additionally, you may lower the overall interest you’ll pay over time. On the other hand, although controlling your present debt is critical, it’s crucial to avoid taking on any more debt.

o first, sit back and assess how your spending stack up against your earnings. Do you spend excessively? Consider setting new priorities and adjusting your spending plan before combining.

What is the average fee for debt consolidation?

Typically, a creditor will consent to repay around 50% of the outstanding amount. The creditor agrees to settle your debt because it is preferable to get a portion of the money owed than not get anything at all.

How much can debt consolidation Save Me?

Debt consolidation may help you reduce your interest and other costs and put you in a good situation to regularly make your payments on schedule. It can speed up the process of getting out of debt, examine your financial position and determine how much money you may save with a debt consolidation loan. It is good to get free financial counsel.

How is interest calculated on a consolidation loan?

To calculate interest calculated on a consolidation loan, use the following steps:

- Multiply the loan balance of each loan you want to consolidate by its statutory interest rate

- Add together the individual results from Step 1.

- Divide the results of Step 2 by the Direct Consolidation Loan balance.

- Multiply the amount determined in Step 3 by 100.

- Round up the resulting value to the nearest one-eighth of 1%.

Will consolidating debt lower your credit score?

Yes. Consolidating debt lowers your credit score in the following ways:

- The addition of a new account

- Higher credit utilization

- Credit inquiry

Can I still use my credit card after debt consolidation?

Credit cards may be automatically closed as part of certain debt reduction programs. While other alternatives, such as a HELOC or debt transfer credit card, won’t. After consolidating your debt, you may still use your credit cards if the account is active and in good standing. Be cautious about approaching with prudence, especially if your prior debts result from overspending.

What does freedom debt relief do?

Freedom Debt Relief can be a smart choice if you are battling heavy debt and poor credit scores. This organization will pay debts up to $100,000 and demands that you have at least $7,500. Freedom Debt Relief is an excellent firm to work with if your credit is bad and you often pay higher interest rates since they negotiate with your creditors on your behalf to get cheaper rates.

How do I get out of debt with no money?

Nobody finds it simple to get out of debt, but it may be significantly more difficult if you don’t have much extra cash. You can pay off debt only after making certain financial adjustments when you’re poor. Here are several methods for doing it:

- Establish a Budget

- Separate between being broke and being overspent

- Construct a Plan

- Quit accruing debt.

- Find ways to reduce your spending.

- You can earn more money

- Request a lower interest rate from your creditors.

- Pay promptly to avoid fees.

- Take into account consumer credit counselling.

How much is the Freedom Debt Relief fee?

Freedom Debt Relief is an excellent fit for those with debts totalling at least $15,000. Although it may collect up to 25% of the settlement amount in fees, it won’t do so until part of your debt has been paid.

How do you qualify for Freedom Debt Relief?

If you satisfy the following requirements, you may be eligible for freedom debt relief:

- You must have unsecured debt of at least $7,500.

- You need to be able to pay every month

- Your credit must be good

- You must be able to demonstrate financial difficulty.

Conclusion

In conclusion, debt consolidation has several advantages. It may help you manage your debt today but consider the long future carefully. Future debt management is part of this. Along with controlling your debt, keep an eye on your whole financial situation, including your budget, objectives, and strategies for achieving them. Furthermore, our Free debt consolidation calculator will aid you immensely.

Expert Advice

Money may be borrowed rather easily. The challenging thing is repaying it. It is tough to manage several payment amounts and payback periods, certainly. Millions of Americans are impacted by this hidden “cost” of borrowing. So, by consolidating payments and streamlining accounting, debt consolidation may help you manage. That could lessen your worry, but it won’t make your debt disappear.

You are still responsible for paying back the loaned funds. Not that consolidating is a bad idea—far from it. But before you do, it’s best to study the tips highlighted above.