Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Can Bank Take Money from your Account without Permission?

The simple answer is No, until a financial institution exercises its right of offset, it may withdraw funds from your accounts with them or one of their affiliates to settle any unpaid obligation you may owe them. It might do so without first informing you and obtaining your consent.

The bank may debit your account based on the terms and circumstances in the contract you signed or by accepted banking rules and practices. Thus, a good justification should be given when the bank debits your account.

For instance, you are a guarantor for the defaulted debt. Or there may be charges owing from a bank transaction. The debt may occasionally occur incorrectly due to either human or system mistakes. In these situations, the bank must reverse the debit with the right value date following a thorough inquiry.

However, most banks’ terms and conditions allow withdrawals from your account to pay fees and debts owed to the bank or other accounts and to freeze your account in response to legal mandates or enforcement of legal mandates as well as suspicious activity.

When you open an account, you are granting the bank authority to withdraw funds from your account to pay fees or debt and to freeze it as needed. However, the bank cannot deduct funds from your account for services you have yet to opt in to, requested, or been informed about before opening the account.

What can happen if your bank takes money without permission?

The rules stipulate that you must receive a return immediately if money was withdrawn from your account without your consent. Any illegal transaction or the loss of your debit card must be reported right away.

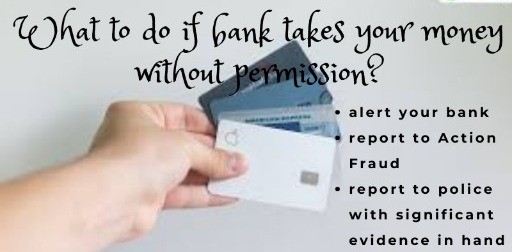

If money has been fraudulently removed from your bank account, there are some actions you should take. Whether your identity has been stolen, your card copied, an unauthorized financial transfer has occurred, or you have been scammed, this situation affects you.

What to Do If Bank Takes Your Money Without Permission

What does it mean for your bank to “take” your money?

In extraordinary circumstances, a bank or building society may withdraw funds from your current account to make up for missing payments on other accounts you hold with them if you have debts. This is referred to as the “right to set off.”

Your loan agreement or deposit account agreement should specify when the bank may use its authority.

Federal law has some restrictions on what a bank may do, though. Federal law, for instance, prohibits banks from using your deposit account as collateral to settle a consumer credit card account.

How do banks take your money?

Deposit of cash and valuables

Money deposited into a bank account is known as a bank deposit. The depositor gives the bank permission to hold their money in a safe place in exchange for interest payments from the bank. The bank invests or lends this money to its customers, who then pay interest to the bank in exchange.

Valuation of cash and valuables

A bank valuation is an estimation of a property’s value for your bank. The property’s condition and similar neighborhood sales are two aspects considered during the valuation.

The bank uses the appraisal to assess the risk of extending credit to you. You could need to come up with more cash or purchase a lender’s mortgage insurance if the bank has valued your home much below the purchase price.

Recording of the transaction

Your bank keeps track of every transaction you complete. A bank statement is then produced by compiling these documents. Statements typically include:

- Your incoming salaries or payments.

- Transfers or deposits.

- Cash withdrawals for a given month.

They also provide a starting and ending balance so you can see exactly where your money is at the end of the month compared to the beginning.

Record maintenance and updating

As long as the account is active, all covered persons’ customer identification records must be kept up-to-date and securely secured. For five (5) years following the transaction date, all transaction records and documentation belonging to covered persons must be kept up to date and securely secured.

Declaration by bank employees and staff

In today’s world, banking plays a significant role in society. Banks can be seen as impartial, ethical, and independent by upholding high standards of service and ethics.

All Bank employees must protect and enhance the bank’s reputation and image by behaving and acting in a certain way. Nothing a Bank employee does or says should embarrass the bank or bring it to shame in the public eye, especially regarding the bank’s objectivity and fairness.

All employees must adhere to the Bank’s Code of Ethics and Business Conduct, which sets out expectations for behavior.

Calculation of cash balance and reconciliation with ledger

General Ledger contains all of the specifics of your accounting transactions throughout a certain time. It displays the balances of your accounts as of the date you select. Making sure the account balances are accurate includes reconciling the accounts.

Depending on the account, each reconciliation could be different. Many accounts are compared to a third-party source, such as your bank statement for cash accounts or a credit card statement for account balances. Generally, it is assumed to be accurate if a third party, such as a bank, has the same balance as your general ledger.

You must identify discrepancies between your balance and theirs, validate their accuracy, and make a note of them.

Transfer to operational accounts of customers or operational expenses

Most businesses consider standard bank service fees an operating expense (G&A). Usually included in the operating subtotal but shown as a separate account on financial statements.

Finance fees, interest costs, or loan processing fees are typically held in a separate account. Because they may not be tax deductible and may or may not be included in operations.

Cash withdrawal for operational expenses through ATM or over-the-counter (OTC) transactions

Cash withdrawals frequently include fees from the bank where the account is held, the company running the ATM, or both. The network determines the cost, which is the same for all participating banks.

Generally, banks give away five free ATM withdrawals each month. Every month, each institution offers a set number of free ATM transactions. Banks charge fees and taxes for additional transactions, including financial and non-financial services, once the limit has been reached.

Repayment of loans or deposits by customers through cheques, drafts, etc., and change in the cash balance

Cheques and drafts are convenient methods of easy payment and withdrawal for consumers, and banks also circulate bank funds. These funds are presented as checks, drafts, etc.

The loan’s repayment conditions outline how it will be paid back. Most loans are typically self-canceling, which means that after a set number of fixed payments, the loan is paid off. Interest and principal are both included in the payments.

The closing process for Cash Departments.

At the end of each month, month-end close is the process of gathering and organizing all financial and accounting data for review, reconciliation, and reporting. To maintain a healthy cash flow, facilitate financial planning, aid in making strategic business decisions, and track advancement toward long-term objectives, businesses care about reporting their financial statements every month.

Conclusion

Bank can debit your account on the strength of terms & conditions specified in the agreement you have signed or in terms of established banking laws and practices. So, when the bank debits your account, there is expected to have a solid reason for it.

When a financial institution exercises its right of offset, it may withdraw funds from your accounts with them or one of their affiliates to settle any unpaid obligation you may owe them.

Expert Opinion

It is rather typical to apply for credit cards or loans from the same bank or credit union where you have a savings or checking account. Most of us feel confident applying for loans or credit cards through our bank or credit union because we have grown to trust them.

Your financial institution may use its right of setoff to collect payment for your credit card or loan if you fail to make payments on time. Based on the idea that they owe you money (kept in your bank accounts) and you owe them money (on a credit card or loan), they have the right to take money out of your account to pay what you owe.