Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Your work compensation may dramatically impact your personal and work lives. Understanding how much your labor is worth to your employer can help you make smart decisions about your job and personal finances. Making an hourly rate calculation might also provide important data for these choices. Thus, we have made this post on the hourly wage calculator to aid you.

You’ll probably come across both opportunities that provide salary earnings and recruit hourly-based staff while applying for new employment or browsing available vacancies. And if you’re working right now, your payment is either hourly or based on an annual income.

The first stage in the job-search process is understanding the distinctions between these two compensation systems. This might also assist you in deciding which compensation structure best suits your requirements and preferences.

Your biggest ally at this stage will be the hourly wage calculator. Follow along as we go into more detail about this below.

What is the Hourly Wage?

The sum of money you are paid every hour you work is known as hourly pay. You may need to evaluate your earnings for other applications or change your budget after comparing the hourly and salaried pay rates.

The gross compensation, or the entire amount the employer believes your job is worth, is what is meant when a corporation offers an hourly rate. Your paycheck is typically your net pay, less than your gross pay since your employer withholds money for taxes and benefits when you get it.

Your hourly gross average pay may be used to compare job ads and estimate your income, among other things. You can think about creating a personal budget utilizing your hourly net salary.

Before figuring out your hourly rate, consider why you’re doing it and carefully examine your pay stub or other documents to determine what kind of pay data you have.

Hourly Wage Calculator

How to Calculate the Hourly Wage?

Many people discover that examining a recent pay stub is all that is necessary to determine their hourly wage. However, figuring out your hourly income requires a few steps, whether you’re a salaried worker or a self-employed person.

Your hourly rate may be determined using a single project, a certain amount of time, or a salary. You may also consider factors to get a more precise rate while utilizing a salary. The many approaches to determining hourly pay include:

Method 1: How to Calculate Your Hourly Wage if You’re Self-Employed

If you’re self-employed, you may calculate your hourly rate by following these steps:

Step 1: Keep a record of your working hours.

You must choose your payment period for this to be useful. Also, you may calculate your hourly rate using your yearly revenue for a more precise estimate. You may also determine your hourly fee for a certain task or time.

For instance, if you are paid for the work or project, you might need to keep track of the time spent on it to calculate your hourly wage. Alternatively, you might decide on your hourly fee for a shorter time frame, like a month or a few weeks.

Step 2: Calculate your income

Keep a record of your salary. Use the same pay period that you choose for calculating hours, please. Once again, this may apply to a single project or some paychecks.

You may decide whether to include taxes in your calculations or not. Remember that your hourly rate will seem greater if you exclude taxes.

Step 3: Ratio your hours worked to your income.

This will provide you with your hourly rate based on the project or time frame you choose. Utilize the following formula: Hourly Rate Equals Hourly Income

Method 2: Calculating Your Hourly Rate if You’re Salaried

If you are salaried, you may calculate your hourly rate by following these steps:

Step 1: Determine your annual income.

As many individuals do, check your most current pay stub if you don’t already know your annual wage. Use the number of pay periods in a year multiplied by your gross (not net) salary, which is your pay before taxes.

To account for employees who work biweekly, increase the number by 26.

You need to double the number by 24 for individuals whose employers give two planned paydays each month, such as the 15th and 30th/31st.

Step 2: Determine how many hours you will work in a year.

You may use a common formula: as a simple rule of thumb.

- 1,950 hours are worked in a year if you work 7.5 hours per day, five days per week, and 52 weeks.

- 2,080 hours are worked annually if you work 8.0 hours each day, five days per week, and 52 weeks.

Step 3: Determine your hourly rate of pay.

Once you have these two figures, you can approximate your hourly salary by dividing your annual gross revenue by the number of hours worked in a given year.

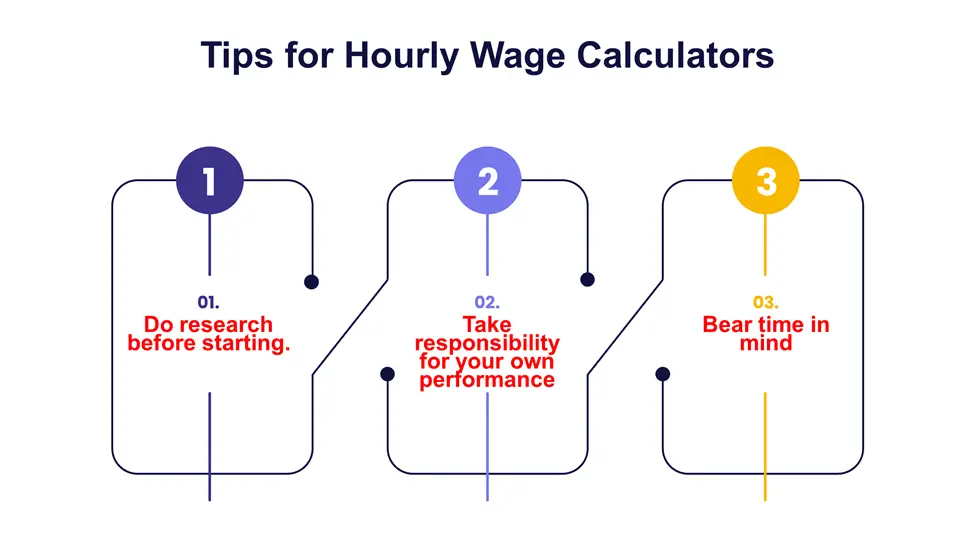

Tips for Hourly Wage Calculators

The hourly pay calculator lets you see your earnings across several time frames. It is a versatile tool that enables you to change your annual salary into an hourly payout, compute your monthly salary into an hourly rate, change your weekly rate into an annual salary, etc.

You may save time and effort by using our salary calculator, which completes everything fast and effortlessly. Following are some pointers for using this calculator:

Do research before starting.

You may use research to learn the typical pay rates for workers with your experience who accomplish work of a comparable kind. Also, you may look at salaries offered for equivalent roles at competing firms or salaries listed by relevant specialists on job search websites.

You may talk to regional experts to find out how your local markets stack up against the national averages. Also, you may use the hourly pay calculator with this information to determine how much your labor is worth.

Take responsibility for your performance.

If you can demonstrate your worth as an employee, you may be a stronger contender for a raise. Think about things that have a quantitative or external effect since it might be useful to have quantifiable facts to support your successes. The hourly pay calculator may be used effectively to do this.

Bear time in mind

Use the hourly pay calculator with caution and attempt to plan. You may learn from this what the job’s estimated salary range is. As a good applicant, you may be able to negotiate a better salary using your advantages and skills. You may provide a range if the application or interviewer requests a certain amount rather than committing to a specific compensation estimate.

Why use an Hourly Wage Calculator

You can use an Hourly Wage Calculator due to the following reasons:

- Quickly calculating hourly pay

- Convert the hourly pay you get to the corresponding yearly income.

- Maintain a balance between your annual income and living expenses.

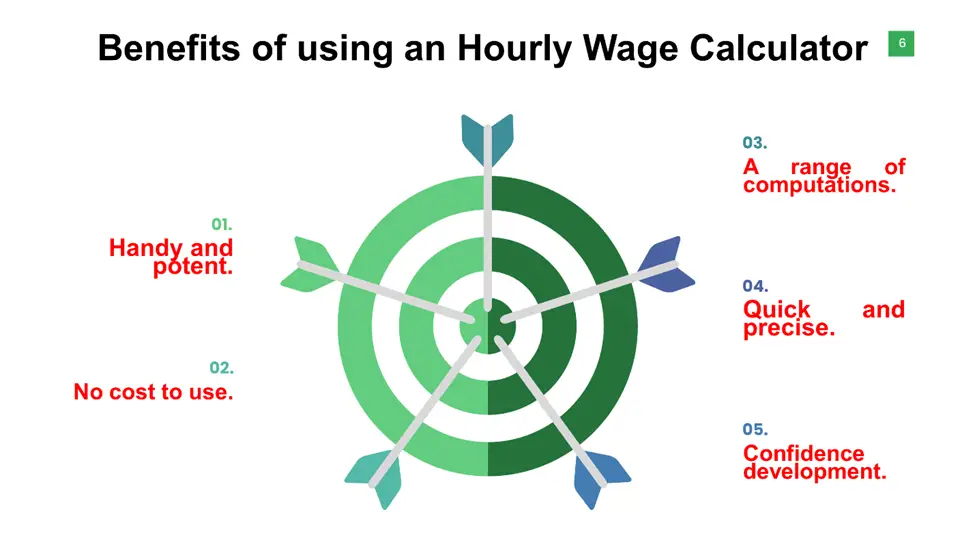

Benefits of using an Hourly Wage Calculator

Some Benefits of using an Hourly Wage Calculator include:

Expert Opinion

It might be exhilarating to interview for a new job. There is the expectation of change, including a new workplace, a new set of duties, and a new team. You may feel motivated to advance in your field and get experience that will help you advance in your profession. For individuals looking for contract or freelance work, there is one tough component of the interview process.

To do this, you must determine how much money to request. While you don’t want to make a lowball offer, asking for too much money may make it impossible for you to get the position. In certain financial situations in your life, a reasonable estimate may be sufficient.

But being exact and smart pays you when it relates to your income. Thus, the hourly wage calculator will be your best ally. You may change your financial impressions using this calculator, which will help you know what to demand in a hiring process.