Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

It’s crucial to draw attention to the prices offered at VAT exclusive rates when determining the amount of VAT charged. To help you, we have created this page on the Vat Exclusive Calculator. A “VAT included” price includes VAT at the current rate.

A VAT-registered company must charge the right VAT rate when sending an invoice to a client. While the basic VAT rate in the US is 20%, there are a variety of other VAT rates and exclusions to take into account. This also applies to the 5% lower VAT rate.

The cost of products or services before VAT is charged is known as VAT exclusive pricing. Only when prices are intended for customers who may recoup any VAT levied, such as “trade pricing” for companies, can VAT-exclusive prices be used.

It is crucial to ensure a clear declaration stating the amount or rate of VAT that will apply, even when VAT-exclusive prices are mentioned. You will benefit greatly from the Vat Exclusive Calculator at this time. Follow along as we elaborate on this.

What is Vat Exclusive Calculation?

Vat Exclusive Calculation comprises determining the cost of products or services before adding VAT. Only when prices are intended for customers who may recoup any VAT levied, such as “trade pricing” for companies, can VAT exclusive calculations be used.

It is crucial to ensure a clear declaration stating the amount or rate of VAT that will apply, even when VAT-exclusive prices are mentioned.

You must divide the VAT price by 1 plus the applicable VAT rate to determine how much VAT should be included in a VAT-exclusive price. For instance, divide the price along with VAT by 1.2 to calculate the price except for the standard VAT rate (20%). Additionally, if VAT was applied at a rate of 5%, the total is divided by 1.

Similar to how you would multiply the valuation excluding VAT by 1.2 to calculate a VAT-exclusive price for a transaction with a standard rate of 20%. Additionally, you would increase the price by 1.05 for a discounted price of 5%.

Vat Exclusive Calculator

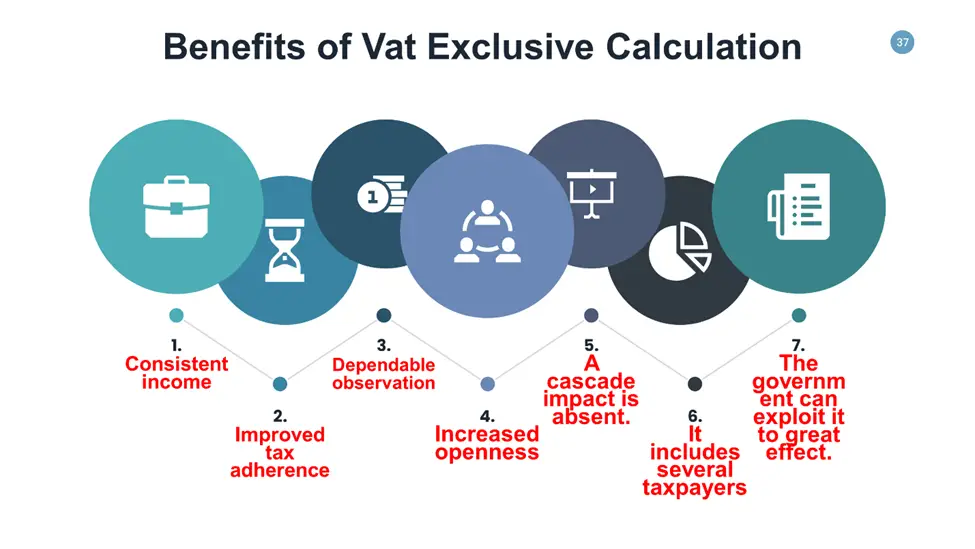

Benefits of Vat Exclusive Calculation

The VAT is gradually evaluated at each point where value is added throughout the manufacturing process. But eventually, it is transferred to the retail customer. For instance, if a product costs $10 and the VAT is 20%, the final amount the buyer would pay is $12.

Vat Exclusive Calculation has a variety of benefits overall. A few of them are:

Consistent income

As a consumption-based tax, the government will always get the same amount of money under the VAT system. The Vat Exclusive Calculation hence substantially aids in this.

Improved tax adherence

Better tax compliance is ensured via VAT Exclusive Calculation. Additionally, tax evasion is decreased as much as feasible because of its catch-up impact.

Dependable observation

Compared to other taxes already in place, Vat Exclusive Calculation means that the VAT can be monitored and handled more effectively.

This is also true since the government receives significant income from VAT. Additionally, the tax rate levied on the consumption of commodities is rather low.

Increased openness

The Vat Exclusive Calculation laws and regulations are fairly clear. Furthermore, the tax is collected in lesser amounts over several phases. Since it was imposed on all companies, this tax is also considered neutral.

A cascade impact is absent.

Vat Exclusive Calculation refers to tax assessed on each stage’s value-added rather than the whole cost. There is no cascading impact as a result.

It includes several taxpayers.

This system has a multitude of taxpayers since it imposes taxes at different levels. And regardless of their income, all final consumers pay the consumption tax. The Vat Exclusive Calculation is thus quite efficient.

The government can exploit it to great effect.

For the government, the Vat Exclusive Calculation is quite helpful. This is true because the government obtains a portion of the tax even for items still in stock with the distributor or retailer.

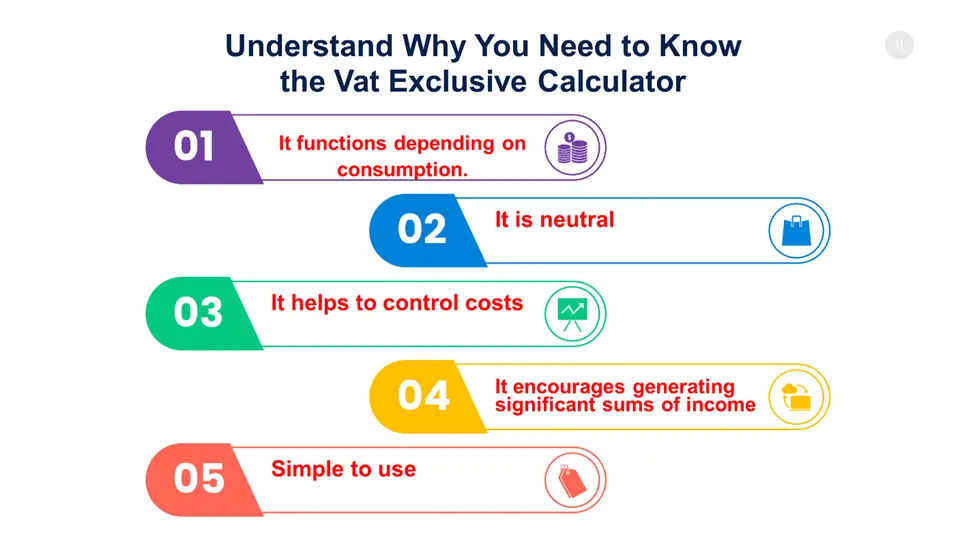

Understand Why You Need to Know the Vat Exclusive Calculator

You need to know the Vat Exclusive Calculator due to the following reasons:

It functions depending on consumption.

Based on usage, the vat Exclusive Calculator operates. Consequently, it gives access to a reliable income source;

It is neutral

The vat Exclusive Calculator is impartial since various enterprises may utilize it.

It helps to control costs.

Businesses are incentivized to reduce expenses because of the vat Exclusive Calculator. When used correctly, this is true.

It encourages generating significant sums of income

The vat Exclusive Calculator may help in generating significant sums of money at a low tax rate;

Simple to use

You may benefit from utilizing the vat Exclusive Calculator without problems since the instruction manual includes all the instructions you need. Many of them don’t need any assistance to utilize. Some individuals may first see it as tough, but it will become simple after they begin using it.

This has also been highlighted in the infographics below.

How to Estimate the Vat Exclusive Calculation

You can estimate the Vat Exclusive Calculation through the following steps:

- Obtain the net price. You must ascertain the VAT price before you can start this computation. Divide everything stated as a percentage by 100.

- Get the VAT amount. Multiply the net amount by the VAT rate to get the VAT amount.

- Determine the gross cost. Add the VAT to the net price to get the gross price.

- Add the amount to the price that excludes VAT. Finally, add the amount to the VAT exclusive price to get the Vat Exclusive value.

Expert Opinion

Utilizing the VAT inclusive calculator is crucial for determining the VAT charged. A VAT-registered company must charge the right VAT rate when sending an invoice to a client. While the basic VAT rate in the US is 20%, there are a variety of other VAT rates and exclusions to take into account. The VAT-included calculator may also be used to compute this.