Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

One of the most crucial choices customers must make when considering the formation of Delaware corporations is how many composition shares of stock the corporation will have. This comes on top of the overall tax value. To help you, we have created this page on the Delaware franchise taxes calculator.

Some customers that register corporations in Delaware can be on a tight budget. Or maybe customers didn’t think about having investors when the company was originally formed since there may have been many other objectives that needed to be accomplished first.

They could want to begin with a stock structure with 1 to 5,000 shares as the absolute least. The Delaware Organization will pay a $225 Delaware Franchise Tax with this stock form, which includes the yearly report cost. Thanks to this, the lowest yearly expenses will be possible, occasionally advantageous for bootstrapped startup businesses.

But what if you want to recruit investors in the future and additional authorized shares are necessary? This happens often. If necessary, a Stock Amendment may be submitted to the state for permission to raise the total number of corporation-authorized shares.

The Delaware Franchise Taxes Calculator will now be necessary here. Come along as we highlight more on this below.

Delaware Franchise Taxes Calculator

What is a Franchise Tax?

The tax that certain businesses must pay to operate in some states is known as a franchise tax. It grants the company the right to be incorporated and/or carry on business inside that state and is also known as a privilege tax.

Even if they are chartered in another state, businesses may still be subject to the tax in several states. A franchise tax, despite its name, is not a tax on franchises and is distinct from the yearly federal and state income taxes that must be reported.

The franchise tax is an additional state tax imposed on certain enterprises in exchange for permission to operate legally and conduct business in a specific area.

A franchise tax is not a tax levied on a franchise, despite what the name would imply. Instead, it is levied on businesses that operate within the state’s borders, such as corporations, partnerships, and limited liability companies (LLCs).

Franchise taxes do not apply to some LLCs, fraternal, and nonprofit organizations. Franchise taxes are often assessed to businesses that operate in more than one state where they are properly registered.

Why Are Delaware Franchise Taxes Important?

Delaware Franchise Taxes are Important for a Variety of Reasons. Among them:

Franchise expenses decrease over time.

Investing in an established brand is advantageous in and of itself since the franchise’s name is well-known and trustworthy. Franchising offers a proven business strategy that gives you ongoing assistance and training in addition to branding. Your franchise fees go toward covering this.

Experts see the first franchise fee as a startup expense that benefits the business throughout tax season. No matter your franchise agreement’s length, the initial price is deducted over 15 years. In other words, it is split into 15 equal portions that will be subtracted each year for 15 years. A tax professional may assist you in recovering these expenditures more rapidly with a shorter-term franchise.

Franchise fees are paid yearly.

Do you realize that franchise fee are considered a business cost each year? Simply put, this lowers your adjusted gross income (AGI), resulting in lower taxes.

Costs related to education or training

The training and business help that come with Delaware Franchise Taxes are one previously highlighted benefit. Any costs associated with education or training directly relevant to the company may be written off as business expenditure.

Travel costs

What about regular travel as part of your regular work activities? These “business miles” are tax deductible as long as you begin at your regular place of business.

Things may get a bit complicated: If you operate your franchise out of a physical location, the distance you travel to get there counts as non-deductible commuter miles. If you operate your franchise from your house, your business miles start as soon as you get in your vehicle and cease when you turn into your driveway.

Keep meticulous daily records of your mileage, including the destination, the time, and the distance traveled. Record the mileage on your odometer at the beginning, the end, and four times a year.

How to Calculate Delaware Franchise Taxes

You can Calculate Delaware Franchise Taxes in the following ways:

Authorized Share Approach

The “Authorized Shares” approach of tax computation will provide cheaper taxes than the “Assumed Par Value Capital Method” if your firm has “no par value” shares. The Authorized Share Approach bases its determination of the tax owed on the total number of authorized shares. Whether or not such shares have been allocated, this is the case.

The Capital Method Using Assumed Par Value

The franchise tax for the business is computed using an assumed par value under the “Assumed Par Value Capital” form of taxation. This is calculated by dividing the total number of issued shares by the total value of the company’s assets.

Under the anticipated par value capital approach, a $400.00 minimum tax must be paid. Although it is a little more difficult, it nearly always leads to a substantially smaller tax obligation for a starting firm.

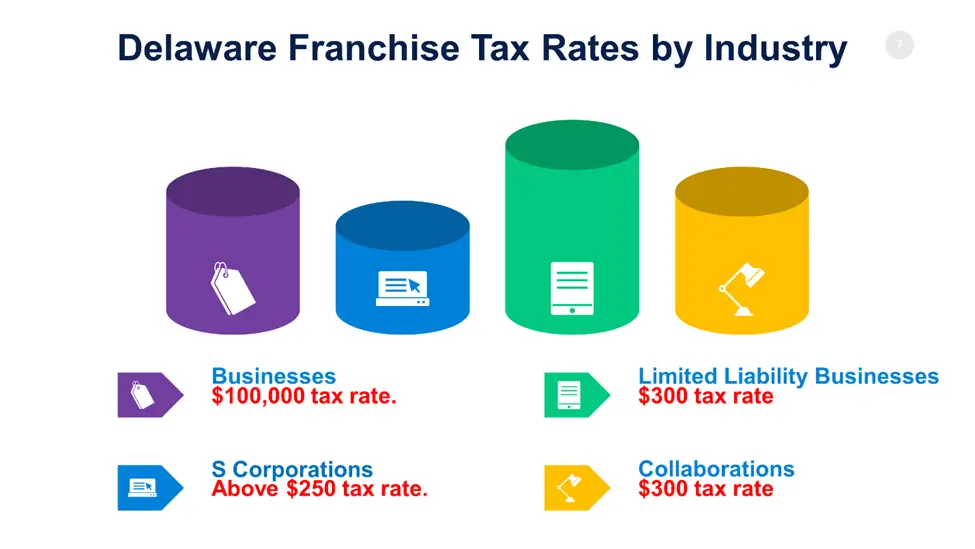

Delaware Franchise Tax Rates by Industry

Delaware Franchise Tax Rates by Industry entails the following:

Businesses

Delaware companies are liable for the state’s corporate and franchise income tax.

Your Delaware company has 10,000 authorized shares, $100,000 in approved no-par capital, and a $100,000 tax rate.

S Corporations

A typical company must first be established before electing “S” status by submitting a particular form to the IRS. Unlike a standard corporation, an S company often isn’t liable to a separate federal income tax.

Instead, an S company passes taxable income to the individual owners. Each shareholder must pay federal taxes on their respective portions of the income. The rate is above $250 here.

Limited Liability Businesses (LLCs)

Standard Delaware LLCs are pass-through businesses, like S corporations, and are exempt from paying federal or state income taxes. However, LLCs must pay the state a $300 fixed yearly tax rate. Aside from this yearly tax, revenue earned by the company is dispersed to specific LLC members, who subsequently pay federal and state taxes on the money received.

Collaborations

Limited and general partnerships must pay the state a $300 yearly flat tax. The partnership revenue is allocated to the individual partners, who then report the amount given to them on their federal and state tax returns and pay tax on it, leaving aside the yearly tax.

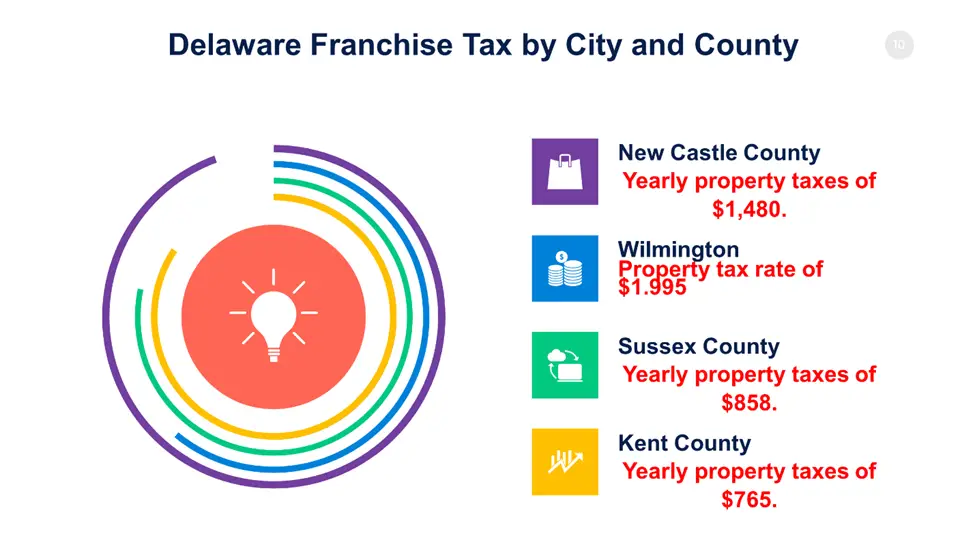

Delaware Franchise Tax by City and County

Unlike most other states, local governments in Delaware don’t routinely appraise property values. Instead, all counties and localities base their property taxes on the sums determined at the most recent reassessment of all property.

A highlight of Delaware Franchise Tax by City and County include:

New Castle County

Despite having the highest property tax rate among the three counties in Delaware, New Castle County’s property taxes are still relatively inexpensive compared to nationally. In

In New Castle County, the average effective tax rate is about 0.74%. The rate in Sussex County is more than twice that. Even so, it implies that a $200,000 house would only have yearly property taxes of $1,480.

Wilmington.

The biggest city in the state, Wilmington, has a property tax rate of $1.995 per $100 of a property’s assessed value. The actual tax rate in the city is substantially lower since the assessed value is so little of what the property is now worth on the market.

Senior persons may also get tax-free property status from the city of Wilmington. Seniors may be eligible for a reduction in their sewage and water rates and an exemption of up to $715.64 per year. Seniors who qualify must earn no more than $19,000 annually for married couples and $15,000 annually for singles, minus Social Security benefits.

Sussex County

Not only in the state of Delaware but also in the whole nation, Sussex County offers some of the lowest property tax rates. The average property tax paid by a Sussex County homeowner is about $858 per year or roughly one-third of the national average, With a typical effective property tax rate in Sussex County of 0.34% and a median house value of roughly $248,900.

Kent County

The effective property tax rate in Kent County is typically about 0.51%. Therefore, a homeowner with a $150,000 house might anticipate paying $765 in property taxes yearly.

Frequently Asked Questions

What is the minimum franchise tax in Delaware?

For companies utilizing the authorized shares method, the minimum franchise tax in Delaware is $175.00, while for those using the presumed par value capital technique, the required franchise tax is $400.00. The maximum tax for all firms employing either strategy is $200,000.00.

What happens if you don’t pay Delaware franchise tax?

A $200 penalty will be assessed if the franchise tax is not paid by the due date. This is in addition to the 1.5% monthly interest charges levied by the State of Delaware.

Is par value required in Delaware?

Yes. Delaware minimum par value is a section of corporate laws often required for determining franchise taxes or providing legal counsel. Par value ought not to be changed once it has been established. Delaware stock is often issued with a minimum or no par value, similar to most states.

How do I avoid franchise tax in Delaware?

There are methods to get around Delaware’s franchise tax in some situations. The Assumed Par Value technique is the most effective approach.

What is the Delaware annual franchise tax?

Despite not submitting an annual report, Delaware-based limited partnerships, LLCs, and general partnerships must pay a $300 tax each year.

How is Delaware state income tax calculated?

With tax rates ranging from 0% to 6.6%, Delaware collects income taxes based on a few tax bands.

Expert Opinion

Startups who choose Delaware as their place of incorporation are probably already aware that they must pay the Delaware franchise tax.

A franchise tax is a state tax levied on incorporated companies. Companies must pay a fee to a state to do business there. Additionally, the methodologies used to determine your tax liability vary across states.

Many startups are incorporated in Delaware, which has an unusual method of figuring out how much franchise tax you owe and telling you how much you owe it. The above tips will aid you in this.