Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Investors can make significant returns on their investments in the stock market. Understanding stock market terminology is crucial when investing in the markets. The face value of the share is the first concept to grasp. It is chosen when the stock is offered and referred to as the stock par value. The fact that the face value is set and unchanging is crucial. We have created this Stock Par Value Calculation guide to help you further.

The accounting value of a company’s stock for a company’s balance sheet is also determined using stock par value. Therefore, it’s crucial to remember that the face value has nothing to do with the current stock price.

For legal and accounting purposes, stock par value is significant in the stock market. Come along as we highlight more on the Stock Par Value Calculation below.

What is Stock Par Calue?

The stock price specified in a corporation’s charter is known as par value. The idea behind the par value concept was to provide potential investors peace of mind by guaranteeing that the issuing corporation wouldn’t sell its shares for less than the par value. Par value is today, however, often fixed at a low price, such as $0.01 per share.

This is true because certain state laws still prohibit companies from selling their stock below par value. A corporation may prevent any issues with future stock sales if its units start to trade in the range of penny stocks by fixing the par value at the lowest feasible unit of currency.

There is no theoretically minimal price at which a firm may sell its stock since certain jurisdictions permit companies to issue shares with no par value. As a result, even if the rationale for par value is no longer relevant, the word is still in use.

Additionally, businesses that issue stock with a par value are still required to keep track of the par value of their outstanding shares in a separate account.

A stock certificate’s face has the par value of each share of stock written on it. The certificate will read “no par value if the stock has no par value.”

Stock Par Value Calculator

Includes $9.00 per page plus other filing fees – a certified copy is an additional $50.00.

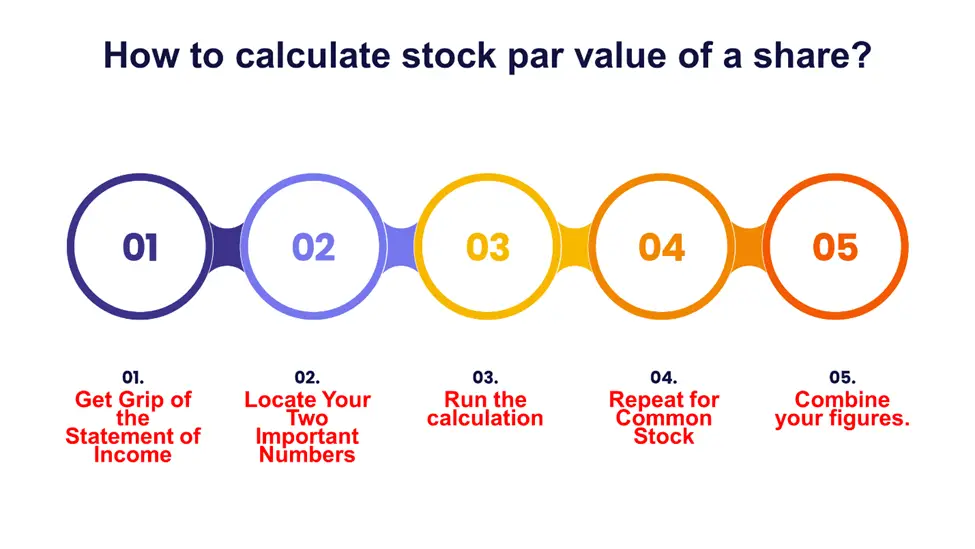

How to Calculate the Stock Par Value of a Share?

You may compute the par value in financial accounting using the number of shares that have previously been issued and the current par value per share. The following steps may be used to accomplish this:

Get a grip on the Statement of Income.

Get the most current balance sheet for the firm by consulting either its 10-Q quarterly filings or its 10-K financial reports. You may get these reports through the company’s website’s investor relations section or the online database maintained by the U.S. Securities and Exchange Commission. You may discover these reports with the aid of your broker as well.

Locate Your Two Important Numbers

You need two figures to determine the par value of a company’s issued shares. The total number of shares issued and the par value for each share are listed below. Find these figures in the balance sheet’s “Stockholders’ Equity” section under the “Preferred Stock” line item.

For instance, a business may have issued 1,000 preference shares with a $1 par value. It’s not unusual for the par value to be quite low. Because it cannot sell shares to holders for less than par value, a firm often sets the value as low as feasible.

Run the calculation

Now all you have to do is a quick calculation: Preferred stock par value equals (number of shares issued) x (Par value per share). To get the par value of the preferred stock, multiply the number of shares issued by the par value per share. In this example, multiply 1,000 by $1 to acquire preferred stock with a par value of $1,000.

Repeat for Common Stock

Next, locate the line item for “Common Stock,” shown after the preferred stock line item. Count the number of common shares issued and note their par value. For the sake of this illustration, assume that the corporation has 10,000 issued common shares with a $1 par value.

To get the par value of the common stock, use the same procedure as previously by multiplying the quantity of issued common shares by their par value. To obtain $10,000 in this example, multiply 10,000 by $1.

Combine your figures.

To determine the par value of all stock, add the par values of preferred and common stock. Using the same example, multiply $1,000 by $10,000 to get $11,000 as the stock’s par value. It’s that easy.

How Stock Par Value Works

A security’s par value is its initial face value at the time it was issued. Purchasing bonds entails making a fixed-term loan to an issuer, such as a government, municipality, or business. The issuer guarantees that it will return the principal of your original investment. Once the period is finished, this will take place and pay you a fixed interest rate for the bond’s duration.

A bond investment’s principal may or may not match the par value. For instance, certain bonds are offered at a discount and are repaid at par when they mature. The bond’s set interest rate, often known as its coupon, is determined using the fixed par value.

The cost to purchase a bond from a party other than the original issuer on the secondary market is what is known as the bond’s market value. As demand increases and decreases, the market value fluctuates. Your effective rate of return when purchasing a bond on the secondary market differs from the fixed interest rate.

The effective interest rate you would get on a bond if you purchased it in the secondary market for more money than par value would be less than the coupon. The effective interest you would receive on a bond if you paid less than the par value would be more than the coupon.

Pros & Cons of Stock Par Value Calculation

The Pros & Cons of Stock Par Value Calculation have been highlighted in the table below.

| Pros | Cons |

| Before forming a company, it’s crucial for each small business owner to comprehend the concept of stock par value. | Stock par value is a hypothetical figure that has no bearing on the share’s market value. |

| It offers a standard below which stock values are unable to go. | Rarely does it have an impact on stock ownership or share price? |

| A low stock par value reduces the potential liabilities of a corporation. | The par value of the stock is often so low that it has no impact on the equity book value. |

| Bond stock par values are a crucial marketing idea. |

Importance of Calculating Stock Par Value

Stock Par Value Calculation is Important due to the following reasons:

It acts as a standard for pricing.

The par value acts as a standard for pricing for the entity issuing the bond. Depending on variables, including the level of interest rates and the bond’s credit standing, the bond’s market price could be above or below par value when exchanged.

It provides a coupon rate that is greater than the going rate of interest.

A bond that is being sold at a premium is trading over par. This provides a coupon rate that is greater than the going rate of interest. Investors will fork over more money because they anticipate a larger yield or return.

On the other hand, a bond that is below par is on a discount trade, has a lower rate of interest than the present market, and is sold for less money.

It serves as a manual for prospective business owners.

Potential business owners must consider the stock par value to incorporate a company. The capitalization objective may be easily defined if the corporation decides to establish a price for each share issued.

Shares of stock sold over par value would generate extra paid-in capital, which would be recorded in the company’s records. And though the changing market stock value has no impact on the books, the corporation is legally obligated to its investors to sell all of its shares at or over par value.

Frequently Asked Questions

What is the common stock par value on the balance sheet?

The stock par value of shareholdings is shown as common stock on the balance sheet. Additionally, extra paid-in capital is reflected in the excess market price-par value.

What is a par value example?

For instance, Apple (AAPL) shares have a par value of $0.00001. Additionally, Amazon’s (AMZN) stock’s par value is $0.01.1011. At the time of the first public offering, the shares cannot be sold lower than this price. Investors may feel secure knowing that nobody is getting a special deal.

Why do stocks have par value?

The idea behind the par value for the stock is to provide potential investors peace of mind by guaranteeing that the issuing corporation won’t issue shares for less than the par value.

What does the $10 par value mean?

Put another way. A par value is given when incorporation documents are prepared, stating that the firm stock is worth at least this share. While some businesses put their equities’ par value at $1, others set it at $10.

Is par value the same as market value?

An economical instrument’s nominal value is established by the corporation that issued it. Par values were inscribed on the surface of shares of stocks and bonds when they were printed on paper. However, market value is the actual cost at which an investment vehicle is available for trading on the stock marketplace at any particular moment.

How do you record stock without par value?

The sale revenues of no-par-value stocks sold by a corporation will only be credited to the ordinary shares account. As a result, the accounting item will debit the cash account and credit the account for common stock.

Expert Opinion

The face value of a bond or stock is referred to as the par value. The issuer determines the par value of stocks, which is fixed for the security duration. Contrary to market value, which varies when a stock or bond is traded on a secondary market, this is not the case.

Knowing your return on investment in treasuries and preferred stock depends on understanding how interest and dividend payments are affected by a security’s par value. The Stock Par Value Calculation will greatly use you at this stage.

References