Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Realistic retirement calculators appeared online as American employees took on more of the burden of providing for their retirement. There are tens of thousands of results when you search for “online realistic retirement calculator” on Google. People worry about whether they will have sufficient money to support themselves and are nervous about preparing for retirement. To help you, we have created this post.

A realistic retirement calculator is an effective tool to help you find the path to a pleasant retirement. But some of them may quickly divert your attention. The best calculators allow you to simulate various retirement situations.

This also accounts for the factors that may impact how long your funds will last, allowing you to save and invest appropriately. Our Realistic retirement calculator offers this and much more.

The glorious years of retirement may be both simple to envisage and challenging for someone still employed. We can daydream of traveling abroad or taking beach vacations. But we seldom ever build the foundation for achieving our financial retirement objectives. After all, there are more pressing issues.

This includes a job, children, a mortgage, auto payments, etc. It’s easy to put off retirement savings among the daily grind. Many Americans in their 30s, 40s, and even 50s do not have any retirement savings, according to polls that have consistently shown the typical American’s retirement funds to be excessively low.

Therefore, it is important to sufficiently prepare with our Realistic retirement calculator’s assistance. Follow along as we go into more detail about this below.

What is a Realistic Retirement?

A realistic retirement income, as per professionals, is approximately 80% of your pre-tax salary before departing. This is because you won’t be liable for taxation or other expenditures associated with your employment after you stop working. However, this figure may alter depending on a range of variables, including:

- Ideal retirement environment

- Potential medical expenses

- The cost of living in the area you want to go to.

- Projected costs for living

- Duration of life

How to use this Realistic Retirement Calculator

You can use this Realistic retirement calculator through the following steps;

- Enter your Current age

- Enter your Retirement age

- Put your annual income Per year

- Enter the Retirement fund (%)

- Enter the Inflation rate (%)

- The realistic retirement calculator will process your input and produce the right output.

Realistic Retirement Calculator

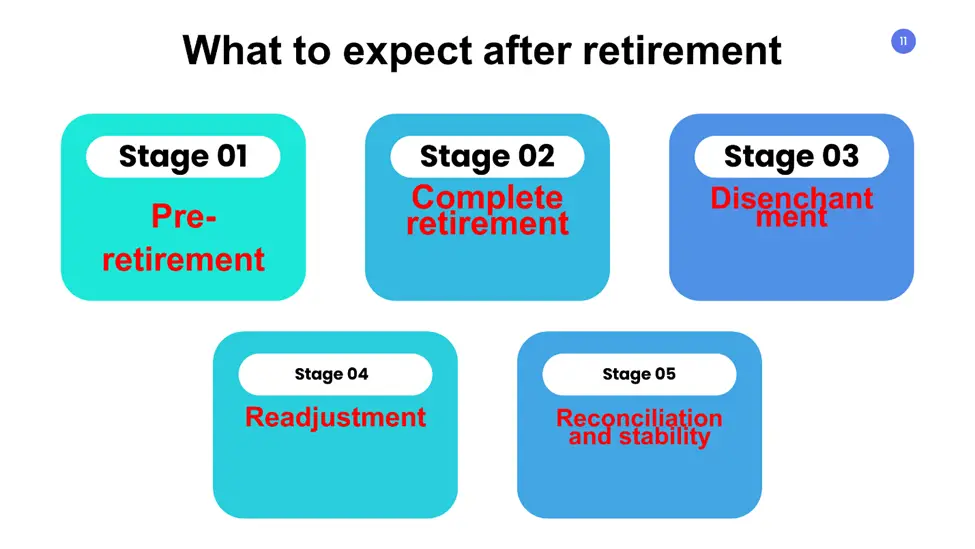

What to Expect after Retirement

The transition from a life of labor to achievement, leisure, and choice occurs during retirement. That transition is not always simple since most individuals believe their work defines them.

It may accompany many feelings and worries, much like other significant life changes. But as you go through the preparation steps for retirement, you may become more informed about what to anticipate and how to properly manage this new phase of your life.

It may be difficult to adapt to different phases of retirement and life after retirement at first, but it’s never too late to be strategic and begin planning a satisfying living.

Here are some typical post-retirement occurrences to aid you with the adjustment.

Stage one: pre-retirement

Before you retire, you go through a planning and fantasizing phase. This phase might run from five to fifteen years until your retirement date.

Most individuals switch their attention from advancing their jobs to the financial preparation component of retirement. But most people seldom devote enough attention to emotional planning, which involves making sure you enjoy yourself and find meaning throughout this period of your life.

You need to think about what will make you content and satisfied throughout the change in addition to your income. You can make your experience considerably smoother by doing this.

Stage two: complete retirement

After retirement, a freedom or honeymoon period may last between one and two years.

The sentiments of joy, relaxation, and independence from the pressure and obligations of your regular working life are all part of the liberation period. During this phase, people are often preoccupied with hobbies, travel, new business ventures, and reuniting with their spouses, families, and friends.

Some individuals decide to quickly establish a routine at this time rather than choosing a route that resembles a honeymoon getaway. This involves having a plan in place when they get up in the morning and often continuing with activities that were a regular part of their hectic lives while employed. Others want to unwind and unwind after spending years in stressful professions that sapped all of their vitality.

Stage three: disenchantment

Many individuals feel sadness and disillusion when the emotional high of retirement has worn off and the honeymoon period is ended. Retirement might seem less thrilling than it was made to be once it occurs since they have spent a lot of time looking forward to it. Additionally, individuals could come to believe something is lacking in their lives.

There may be drawbacks, including boredom, loneliness, and a sense of helplessness. It may also be simple to go into despair at this time if the issue is not addressed.

Stage four: readjustment

Readjustment, often seen as the most difficult stage, typically happens when retirees rapidly accomplish their pension to-do list, suffer a sense of purposelessness, and start to assess their pension feel.

Readjustment requires the development of a new identity, which may be time and effort-consuming. But once you’ve created a new persona, you can put your working years behind you and begin to enjoy retiring the way it was supposed to be.

You must later in life discover anything which offers you a feeling of useful priority if you want to avoid being stuck and experiencing sadness. This entails following a passion, giving back to the community, and including new enjoyable things in your routine.

Stage five: reconciliation and stability

This last phase may begin up to 15 years after the formal beginning of retirement. In this stage, retirees are pleased and optimistic about their move and will feel less depressed and anxious.

At this point, retirees have established a fulfilling retirement lifestyle and are engaged in activities that make them feel content. They place a high value on living simple, carefree lives.

Retirees concentrate on preserving their health and independence during this period since health concerns may be more common. They may do this by relocating to retirement communities, where they can continue to live as they age while still having access to neighboring facilities, activities, and friends.

Most retirees will go through this process after they stop working, even if not everyone will go through each stage as fiercely or for the same length of time as others.

How much can you retire on?

To what extent do I need to save to retire? Is it a crucial component of retirement planning? The answer varies from person to person and mostly relies on your current salary and the kind of retirement lifestyle you desire.

It might be easier to remain on track and meet your retirement objectives if you know how much you need to save “by age.” The majority of experts also agree that your yearly income in retirement should be about 80% of your last pre-retirement salary.

Depending on additional sources of income, including Social Security, pensions, and part-time work, as well as aspects like your health and chosen lifestyle, this amount may be increased or decreased. For instance, you could need more if you want to travel substantially in retirement.

Which expenses will be Higher in Retirement?

The Top 5 Expenses that could be higher in retirement include:

Health Care

Many people have health insurance that is at least partly funded by their employers. You are on your own in retirement until Medicare begins at age 65. You’ll undoubtedly buy Medigap coverage and maybe prescription medication insurance.

Our bodies often need more upkeep and repair as we get older. In their fifties and early sixties, early retirees may anticipate making more trips to the doctor than they did in their thirties and forties. Because of this, the actuaries and insurers charge you for your coverage.

Trip

What do many individuals with retirement freedom do with it? Discover the globe! When you may have only had time for one or two short vacations while working, you now have the time to travel if you want.

Even if the travel expense undoubtedly declines someday, maybe in your 80s or 90s, you may have decades to say “Yes” to vacations you had previously declined because of a business commitment. You will see an increase in our travel expenses even if we just work part-time.

Education

There are several ways to pay for education. If you’re an early retiree, you may not have yet paid for your children’s college educations. If they intend to attend college after you quit working, you’d better have prepared by supporting 529 Plans or assisting them in their financial aid applications.

If you have children in elementary or high school, you could reside in an area where private schools are both widespread and practically required. Those were certainly costly years!

Purchases

Retirement might seriously strain your credit card if idle time results in offline or online spending. Even if you don’t perceive yourself as a shopper, retiring won’t stop you from buying more things and spending more money.

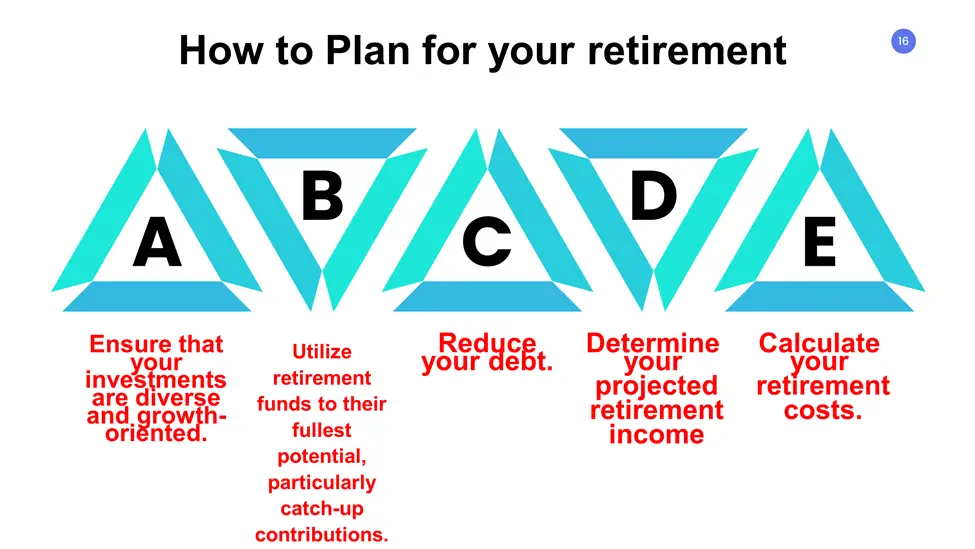

How to Plan for your Retirement

You may prepare for a risk-free, secure, and enjoyable retirement by following these suggestions:

Ensure that your investments are diverse and growth-oriented.

It may be tempting to avoid investing in stocks to lower risk. However, at this point in your life, equities’ potential increase is still significant. Think about keeping a balanced portfolio of stocks, bonds, mutual funds, and other securities that meet your risk appetite, investment time horizon, and liquidity requirements.

Evaluating your income sources long before retirement provides you time to make any required adjustments to your plans.

Utilize retirement funds to their fullest potential, particularly catch-up contributions.

Raise your retirement savings as much as is permitted in your 401(k), IRA, or other retirement plans as much as you can. To be eligible for any full matching contributions your company could make, try to contribute enough to your 401(k). The regulations for catch-up contributions allow you to save more than the typical contribution if you are 50 or older at any point in the calendar year.

Reduce your debt.

If you want to pay off your home loan before you retire, you may choose to accelerate your house payments. Try paying cash for significant purchases to reduce new credit card debt. You may lessen the amount of pension savings used for interest payments by minimizing new debt and paying off current debt.

More Resource: Basic Pension Calculator

Determine your projected retirement income

Calculate the stable income you get from Social Security and employee pensions. The remaining retirement assets will most likely come from your salary, savings, investment accounts, and any retirement income. The conventional wisdom was that you should be able to spend 4% of your portfolio each year in retirement for your assets to survive throughout your lifetime.

Calculate your retirement costs.

Later in age, certain expenditures, like health care, can increase while others, like clothes or transportation, might decrease. How you live throughout retirement will determine how much money you spend. Your predicted expenditures may even be greater than they are now when you are still employed if you anticipate taking many trips.

Frequently Asked Questions

What is the most accurate retirement calculator?

The MaxiFi Planner and the Rowe Price Retirement Income Calculator are two of the greatest tools. Remembering retirement calculators depend on precise data and reasonable assumptions is critical.

What is a realistic amount to retire on?

This question does not have a clear solution. Retirement specialists have provided different general guidelines for how much you should save. Over $1 million, 80% to 90% of your yearly pre-retirement income, or 12 times your pre-retirement wage, should be included in this.

What is a good monthly amount to retire on?

Most experts concur that to maintain your quality of life in retirement, you would need between 70 and 80 percent of your pre-retirement income. Accordingly, you were to make $50,000 per year ($4,167 per month) before retirement. You may need between $35,000 and $40,000 each year.

What is the 70% retirement rule?

The 70% retirement rule estimates how long, at a certain rate of return, it will take for your income or an investment to double. Investors may use this statistic to assess various assets, such as mutual fund returns and a retirement stock’s growth rate.

What is the 80% rule for retirement?

The generalization that you should aim for a retirement income that is 80% of your pre-retirement earnings is outdated. It worked when seniors remained in their purchased house for the duration of their years and had a defined contribution pension plan.

Expert Opinion

Like any significant move in life, retirement is accompanied by a wide range of feelings and concerns. However, suppose you carefully prepare for your shift to take care of yourself emotionally and financially. In that case, you may help lessen the intense feelings of this big life move and devote more time to savoring your new life. At this point, the Realistic retirement calculator will stand as your best ally.