Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

In a basic pension plan, businesses agree to provide workers with a specified benefit for the rest of their lives when they retire. It differs from defined contribution plans, like 401(k)s, in which workers invest their funds in an employer-sponsored investment vehicle. During World War II, pensions gained popularity and became a staple of benefit plans for government employees and union employees. Although they are still widespread in the public sector, defined benefit plans have mostly taken their place in the private sector. To calculate effectively, we have made this post on the basic pension calculator to aid you.

In a perfect world, a firm that provides a pension plan should put away money for each employee, and that money should increase over time. The revenues will subsequently cover the income that will be paid to the employee upon retirement. The employee often has the option of choosing either a lump payment or a pension.

An annuity might also be used to provide consistent payments for life. Depending on the arrangement, those pension benefits can be inherited by a remaining spouse or children.

Additionally, you often provide a portion of your pension income from your working years. The proportion is determined by your employer’s rules and the time you have worked for them. An employee with decades of employment with a corporation or the government may retire with 85% of their income.

One with less experience or working for a less generous business could only get 50%. The Basic Pension Calculator will be of great use to you at this stage. Follow along as we go into more detail about this below.

What is Basic Pension?

The National Insurance System guarantees a minimum retirement benefits payout at the basic pension level. The minimal pension level superseded the notion of the basic pension for old-age pensioners as of January 1, 2011.

Those who collected a retirement benefit before 2011 are likewise affected by this. The term assurance pension will eventually replace the basic pension rate for those born between 1954 and 1962.

Basic Pension Benefit also refers to the standard pension benefit granted under the Basic Pension Plan at the Executive’s Normal Date Of termination. The government normally provides the funding. Additionally, it includes the sum of any allotted portions of the Executive’s earned pension benefits. Additionally, it could be necessary for this to be kept for the Executive’s current or previous spouse.

The Basic Pension Benefit that would have been due at age 65 under the Salaried Plan is typically the amount of the Early Retirement Plans payable hereunder until age 65.

How to use this Basic Pension Calculator?

You can use this basic pension calculator through the following steps;

- Enter the Average Salary

- Enter the Years of Service

- Put the Applicable percentage (%)

- At this point, the basic pension Calculator will process your input and produce the Basic Pension.

Basic Pension Calculator

How does the Basic Pension Work?

The basic pension works in the following phases:

Eligibility

- You will be eligible to claim your full Basic Pension if:

- You attained basic pension age by April 5, 2016, or earlier.

- You have made National Insurance payments for 30 years. This covers your working-related contributions and any contributions attributed to you if you were unable to work. For instance, if you were collecting specific benefits or taking care of a kid or handicapped person.

- Suppose your donation history spans less than 30 years. With this, you will get a third of the total basic Pension amount for each year of contributions.

Potential compensation

The current full Basic Pension rate for those with 30 years of National Insurance payments is $137.60 per week.

You will get 1/30 of the entire basic Pension amount for each year of contributions if you have less than 30 years of contributions.

You may receive an Additional Pension in addition to the Basic Pension. Your National Insurance contributions are also taken into account. Your income and whether you request certain benefits will determine how much you get.

Potential for growth

If your basic pension isn’t fully paid, you may be able to increase it in one of the following ways:

A. By sending in more money

You might choose to make voluntary donations to fill up any gaps during the time that you weren’t working or earning credits.

B. Using the N.I. Record of your spouse

Based on the earnings of your present or past husband or civil partner, you could be eligible to receive a pension.

C. By postponing your regular pension

Deferring your basic pension claim allows you to get a greater pension or a lump payment when you finally do so. If you delay, it can impact the benefits you’re seeking.

Steps to claim

You won’t start receiving your basic pension immediately when you attain pension age. You must assert a claim. What you must do is as follows:

About four months ahead, you attain the basic Pension age, and you should get a letter and pamphlet from the Pension Service.

Pension claims can be made by phone, mail, or online. When filing a claim, you will need to supply your National Insurance number and maybe documentation of your date of birth.

What is a Full Basic Pension?

An employee benefit, known as a complete basic pension plan, binds the company to monthly payments to a fund. This is often put aside to cover payments provided to qualified workers upon retirement.

Full basic pension plans are becoming harder to find in the U.S. private sector. Pension payments less expensive to employers, such as the 401(k)-retirement savings plan, have essentially supplanted them.

Nevertheless, nearly 6,000 public sector retirement systems manage $4.5 trillion in asset classes for 14.7 million working members, based on the 2021 U.S. Census. Additionally, the Bureau of Labor Statistics estimates that a defined-benefit plan now covers 15% of private workers in the U.S.

A comprehensive basic pension plan also calls for company payments and could permit extra employees’ commitment. From wages, the employee contributions are subtracted. A part of the employee’s yearly contributions may also be matched by the company, subject to a certain percentage or value limit.

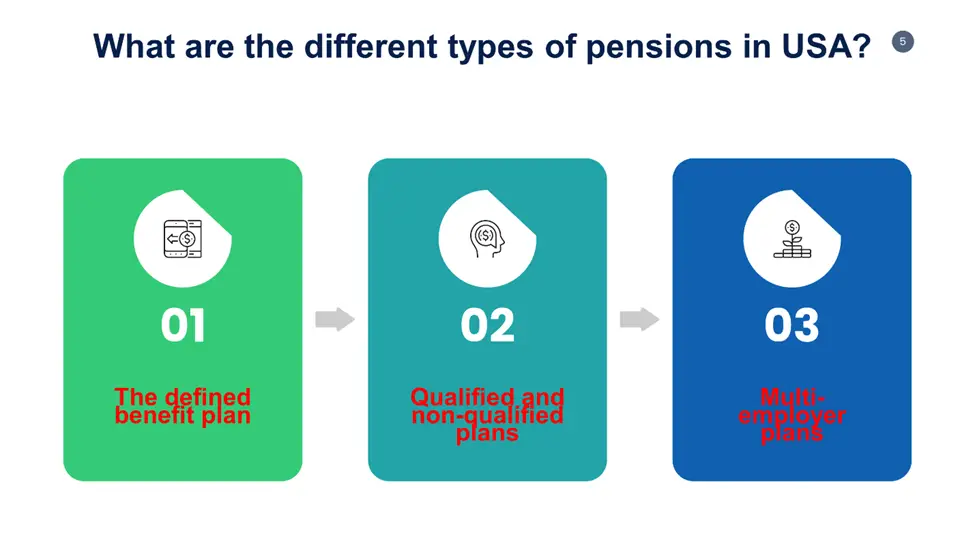

What are the different Types of Pensions in the USA?

The many pension programs available in the USA include:

The defined benefit plan

In the United States, a defined benefit plan is often acknowledged as a specific kind of pension. These programs’ design ensures that retirees will get a payment beyond their official retirement date. On the contrary, a defined contribution plan establishes a trust based on the sum an employee contributes to their employment.

Examples of the latter include IRAs, 401(k) plans, 403(b) plans, and 457 plans, which are not commonly regarded as pensions in everyday speech.

Qualified and non-qualified plans

Under American law, pensions might either be qualified or non-qualified. The Employees Income in Retirement Security Act provides security for qualifying benefit plans’ benefits. Additionally, they provide tax breaks for payments made to the plans by corporations.

Workers at higher levels of organizations are often provided with non-qualified plans since they are exempt from pension income limits. Executive bonus systems and life insurance agreements are typical versions of these arrangements. Deferred compensation plans are more common than defined benefit ones.

Multi-employer plans

An agreement on collective bargaining between many firms and a labor union is required for multi-employer pensions. This system allows workers to move between multiple businesses without affecting retirement and medical benefits.

The Teamsters Unions throughout the country are a prime example of how these programs have helped them since their work requirements require them to relocate across many different locations while preserving benefits in each one.

In recent years, multi-employer plans have drawn criticism for corruption relating to gang participation and general pension fund theft.

The U.S. Congress passed the Multi-employer Pension Privacy Act of 1980 to tighten funding standards and allay insolvency worries in response to escalating funded ratio concerns.

However, the Multiemployer Pension Reform Act of 2014, passed by Congress in 2014, obliged it to impose additional guidelines and limitations on a particular kind of plan (MPRA).

The law advocated reducing pension payouts for plans about to go bankrupt due to the enormous unfunded pension obligations. Additionally, premium penalties were imposed by the legislation for plans that required PBGC involvement.

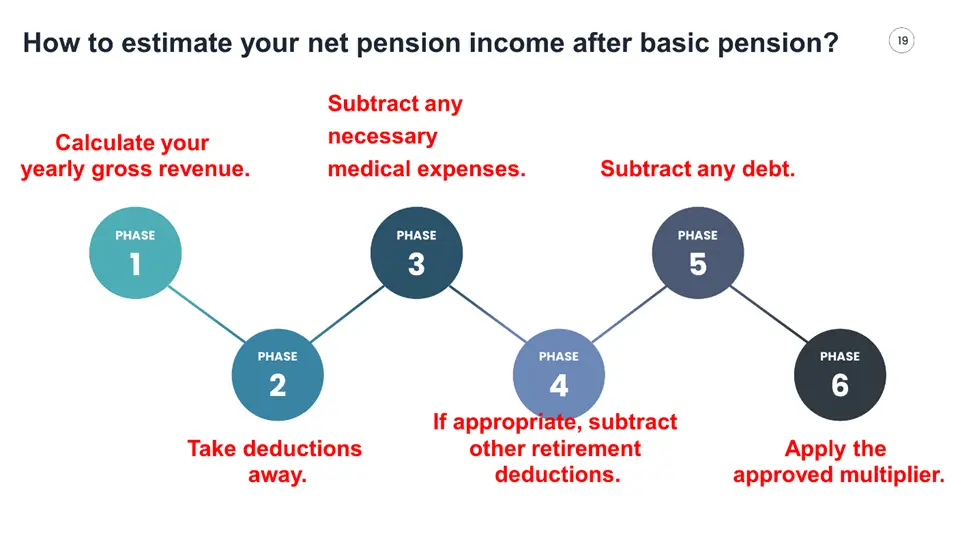

How to Estimate your Net Pension Income after Basic Pension?

You can estimate your net pension income after basic pension through the following steps:

2% is a common multiplier. Therefore, after 30 years of labor, your ultimate output will equal 30 x 2% of your final average wage.

Frequently Asked Questions

How much is a typical pension per month?

The usual pension for newly eligible retirees (age 65) in January 2022 is $779.32 per month.

How is the monthly pension calculated?

You may use the allowed multiplier to determine your monthly pension.

2% is a common multiplier. Therefore, after 30 years of labor, your ultimate output will equal 30 x 2% of your final average wage.

What is the amount of basic pension payable?

50% of the emoluments, or average emoluments, are basic pension payments.

What is the base U.S. State Pension?

After being raised by 1.3 percent to account for inflation, the standard U.S. State Pension in 2022 will be worth $779.32 per month.

How is pension payout calculated?

Your future guaranteed monthly pension income’s current value determines your pension payment. The Society of Actuaries mortality tables and actuarial variables based on age are often used for this. The minimal present value segment rates of the Internal Revenue Service, which are revised regularly, are in addition to this.

Expert Opinion

In retirement, pension payments are generally a set monthly sum permanently guaranteed. Some pension payments increase in value over time. A spouse or dependent may get further pension advantages. But there are other ways to get a lifetime of guaranteed income after retirement without pensions.

Pensions are distinctive in that the retirement savings benefit is calculated without taking into consideration the amount of money that has been saved. In other words, even if the pension plan isn’t simultaneously maintaining with accumulating money to pay the benefit, the pension amount remains the same. At this point, it will be best to use the basic pension calculator more easily.

References

- https://www.canada.ca/en/treasury-board-secretariat/topics/pension-plan.html

- https://www.oecd.org/els/public-pensions/PAG2019-country-profile-United-States.pdf

- https://www.usa.gov/retirement/

- https://en.wikipedia.org/wiki/Pensions_in_the_United_States

- https://www.annuity.org/retirement/planning/average-retirement-income/

- https://www.indeed.com/career-advice/career-development/how-do-pensions-work