Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

The rate of return on investment is a crucial financial statistic that assesses an investment’s profit or loss in proportion to the original investment. One of the most popular profitability indicators is ROI because of its adaptability and simplicity. Analyzing the effectiveness and return of investments is quite helpful. It is often used for investment analysis, profitability comparison, and financial decision-making. Furthermore, the rate of return on investment calculator will be indispensable for you at this point.

ROI calculators are easy to use and aid in deciding whether to pursue a certain investment option. The calculator may also provide information on the historical performance of an investment. An essential clue regarding the worth of an investment to the investor is whether an investment has a positive or negative ROI.

An investor may distinguish between low-performing investments and high-performing ventures using the rate of return on Investment calculator. Investors and asset managers might try to maximize their investments using this strategy. Come along as we highlight more of this below.

What is the Rate of Return on Investment?

The rate of return on investment is the speed at which a business earns a profit from an investment over time. Typically, this is contrasted with the company’s investment cost. It is computed by dividing the investment cost by the return on investment for the time.

Also, it is also revenue from asset investments and is often expressed as a percentage. It could be detrimental or beneficial. Additionally, it is evaluated quarterly, monthly, or annual.

The most important factor to consider before making an investment choice is the Rate of Return on Investment. It is only the additional income received more than the original investment or the gradual reduction in investment expense.

The return on investment is crucial from the investor’s perspective for companies whose debt or equity stock is traded on an accredited securities exchange.

How to use this Rate of Return on Investment Calculator

To use this rate of return on investment calculator, use the following steps:

- Enter the amount invested ($)

- Enter the amount Returned ($)

- The rate of return on investment calculator will process your input and produce the right output.

Rate of Return on Investment Calculator

ROI Formula

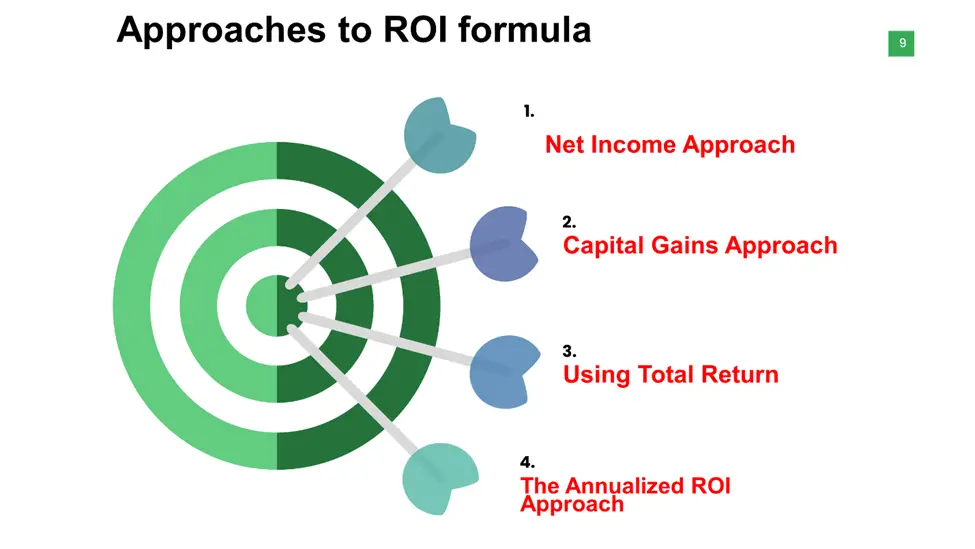

The easiest method to understand the ROI formula is to divide any kind of “benefit” by the “expense.” Asking someone to specify precisely how they assess something’s ROI is vital when they claim it is excellent or terrible. The ROI formula comes in a variety of iterations as well. The most popular ones are shown below:

Net Income Approach

ROI formula: 100 multiplied by (Net Income / Investment Value).

Capital Gains Approach

ROI Formula: 100 times the original share price divided by the current share price.

Using Total Return

ROI Calculation: (Current Share Price – Cumulative Dividends Paid – Basic Share Price) x 100 / Basic Share Price

The Annualized ROI Approach

ROI Formula is equal to [(Adjourning Value / Starting Value) (1 / Years)] – 1

Examples of ROI calculation

Some Return on Investment calculation Examples comprise:

Your return on investment would be 50% if you invested $10,000 and earned $15,000.

[($15,000 – $10,000) / $10,000] x 100% = 50%]

You will make a profit of $100,000 if you sell the home for $350,000. (gain from investment minus the cost of investment). Divide that net return ($100,000) by the entire cost of your investment ($250,000) to get your ROI. To calculate your ROI, multiply your result by 100. This is equivalent to 40%.

ROI and Financial Decisions

Knowing whether an investment will generate a profit enables you to make spending decisions that will eventually aid in the successful expansion of your company.

Particularly when it comes to company funding, ROI is crucial. You should ensure that the development potential will bring in enough money to cover the loan’s costs if you borrow money. If not, you can end yourself submerged in debt.

When attempting to make financial choices, calculating ROI might be helpful. This involves figuring out which investment will benefit your bottom line the most.

Your investing strategy relies on a variety of variables. It depends on the current state and potential of your company. The market and future trends will determine this. It also depends on how much expansion you desire for your company. It also relies on your team, strengths, and collective deficiencies.

After keeping all of these things in mind, you will have to decide which of the approaches above is most likely to result in a good ROI.

ROE vs. ROI

Return on investment (ROI) and equity return are essential indicators frequently used to determine success when generating money from stock investments (ROE). Although they assess distinct things, ROI and ROE are both significant.

While ROE calculates the percentage return on invested equity, ROI calculates the percentage return on investment. In other words, ROE assesses an investment’s “efficiency,” but ROI measures its “cash flow.”

Here’s a more detailed look at the difference between ROI and ROE:

| ROE | ROI |

| A statistic called ROE calculates the percentage return on invested equity. | ROI is a basic idea. It gauges the investment’s percentage return. |

| To determine the return on equity (ROE), divide the net revenue from an investment by its average equity. | Simply split the investment’s profit by its cost to get a return on investment (ROI). |

| ROE is an absolute number, not a relative one like ROI. As a result, it may be used to evaluate assets without having to consider their size or cost. | ROI is a comparative indicator. In other words, it merely provides you with information about an investment’s performance relative to other investments. |

| ROE is the investment that remains after removing any obligations or debts. | Financial strategy inside a corporation is its main emphasis. |

| Return on equity (ROE) gauges how well a business manages the capital that shareholders and investors provide. | The profitability of an investment for the business is measured by return on investment. |

| The ROE formula is as follows: Net income divided by shareholder equity is known as return on equity (company assets – debt) | ROI is calculated as follows: Return on investment is calculated as Net Income / Investment Cost. |

| Professionals may measure a company’s performance by looking at its ROE ratios, which show where it stands in comparison to its rivals. | ROI ratios let experts know how effectively a firm is managing its assets by communicating how successful it is with a certain investment. |

Advantages and Disadvantages of ROI

The advantages and disadvantages that ROI can bring have been highlighted in the table below:

| Advantages | Disadvantages |

| ROI links divisional investments to net income, giving a more precise indication of divisional profitability. | Profits are arbitrary |

| Reduce conflicts of interest and establish coherence in your goals | Maybe incomparable to competing businesses |

| A more accurate metric for profitability | Dissuade administration from making further investments |

| Reduce conflicts of interest and establish coherence in your goals | The timing component is missing |

| Productivity breakdown by division or section | Accounting profit may be quite arbitrary. |

| Aids performing a comparison analysis | |

| Additionally, it ensures that only assets that are guaranteed to generate profits in line with the organization’s policy are purchased. | |

| This kind of cost-benefit analysis aids managers in figuring out the potential rate of return from different investment possibilities. |

Investing Recommendations for Better ROI

Here are our top suggestions for taking the appropriate actions right now if you want to enhance your ROI at every stage of your marketing:

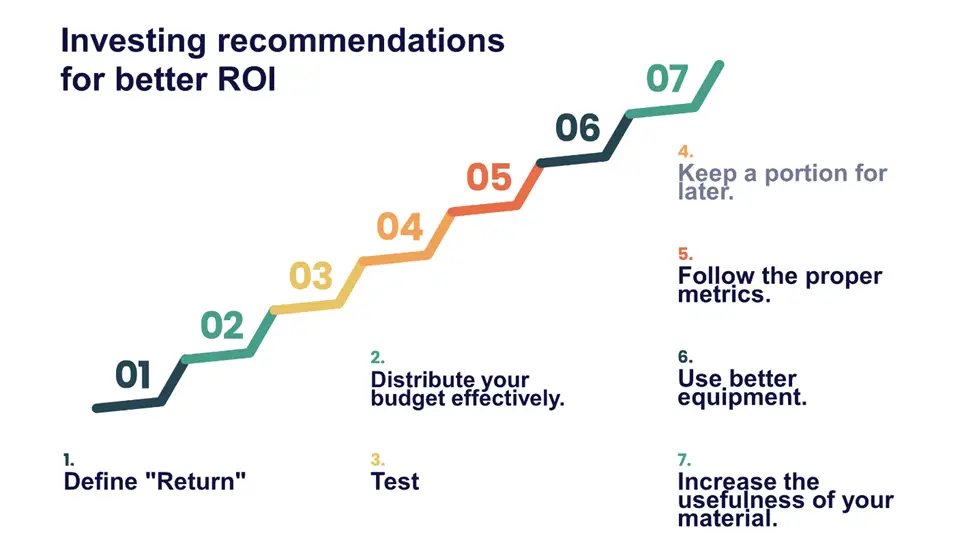

Define “Return”

Clearly defining the possible benefits, you could get from your investment is the first step in increasing your return on investment. Examples are higher sales, improved revenues, more profits, lower production or overhead expenses, and higher staff retention. Set various standards for your return objectives, if you can.

Consider establishing a target for higher sales during a certain month rather than overall increasing sales. This should be done in a specific region, with a sales representative, or via a certain distribution platform.

Distribute your budget effectively.

Spend sensibly if you want to increase ROI. This does not imply that you must be familiar with the ideal spending formula. It does imply that you should have a thoughtful plan for everything.

Test

Testing doesn’t always provide quick ROI, but it gives you insights. With this, you may raise both your current and future ROI. Set aside a percentage of your money for testing, whether experimenting with alternative content, channels, or advertising text.

Keep a portion for later.

You don’t want to spend all of your money on testing. It’s crucial to keep some money aside to cover any unforeseen errors or to invest in something your test has shown to be effective.

Follow the proper metrics.

You must clearly understand your objectives and the metrics you’ll use to determine if you were successful before launching any campaign. Therefore, picking the appropriate measurements is essential.

Nevertheless, not all of the items you can monitor will provide you with the information you need. Make sure your statistics are connected to your main objective to ensure you are tracking the appropriate things.

Use better equipment.

You don’t only spend the cash when you engage in content marketing. Additionally, you are expending money, time, and energy. Find methods to operate more efficiently and make the most of your resources to enhance ROI.

A wide variety of free internet tools and resources are available in addition to conventional marketing automation technologies. These may greatly simplify a marketer’s job, particularly if you have a small staff. You can do more with fewer tools since many have many uses.

Increase the usefulness of your material.

Getting your content to do multiple tasks will increase the return on your investment in producing quality content. You may quickly divide a huge piece of material into numerous components using a divisible content approach.

You may also mix many smaller elements to create a bigger piece of high-quality material. Again, if you’re collaborating with a small team, this will be extremely useful.

How to Calculate your ROI

One effective way to calculate ROI is by using this formula:

ROI is calculated by dividing the cost of the investment by 100%.

The steps to use this formula are as follows:

- Determine the investment’s net return.

- The purchase price is subtracted from the home’s selling value in this case. Then you must take away any additional expenses you spend to buy or sell the property. This would cover agent charges, escrow costs, and capital gains tax.

- Calculate the investment’s cost

- To calculate your ROI as a percentage, divide the net investment’s return by the total cost and double by 100%.

How to Calculate the ROI of a Project?

To calculate a project’s ROI, consider the formula below:

ROI is equal to 100 x (Net Profit / Investment Cost).

Subtract the anticipated project costs from the anticipated income to arrive at your net profit:

Net profit = expected revenue – total expenses.

Financial planners often break down projects into manageable jobs to calculate the overall costs and ensure they’ve considered each process phase. After that, they consider the cost of the supplies, the potential number of hours needed to finish the project, the number of employees required, and their hourly salaries. They also consider the expenses of purchasing or leasing premises, software, and infrastructure.

Total costs are calculated as follows: material costs plus (project hours multiplied by the number of workers and their hourly wages) plus equipment, technology, building, and other expenditures.

Even if it might be difficult to estimate the cost and value of a project before you start working on it, you can make your calculations simpler by making a list of the elements you already know and consulting data on the actual ROI of programs with a comparable scope.

Frequently Asked Questions

How do you calculate the rate of return on investment?

A rough indicator of an investment’s effectiveness is the rate of return on investment. This is computed by deducting the investment’s original cost from its end value, dividing the result by the portfolio’s cost, and multiplying the result by 100.

Is an ROI of 30% good?

For instance, a 30% ROI from one retailer seems greater than a 20% ROI from another. In contrast to the 20% from just one year, the 30% could be spread out over three years. Thus, the one-year investment is the preferable alternative.

Is 10% a good ROI?

Yes. For long-term equity investments, most investors would consider an estimated yearly rate of return of 10% or above to be a decent ROI.

Is 80% ROI good?

An ROI of 80% for a five-year investment is outstanding. For a 35-year investment, though, it is less spectacular.

What is a good 5-year return on investment?

As per popular knowledge, a 5-year return on investment in stocks is regarded to be strong, with an annual ROI of around 7% or higher. This also refers to the S&P 500’s average yearly return when inflation is considered. Because this is an average, your return may vary from year to year.

How much money do I need to invest in making $1000 a month?

To consistently produce $1,000 per month in dividend payouts, you would need to make an initial investment of $600,000.

Expert Opinion

Your inputs in business are the time and funds you devote to enhancing your company. The profit you get from your investments is the return. The proportion of the net profit to the entire cost of the venture is how ROI is often defined.

When ROI is used to determine your investment’s benefits and monetary returns, it is most helpful to your company objectives when it pertains to something specific and quantifiable.

The most common technique of analyzing investments is in terms of their monetary cost since it is the simplest to measure. However, it is also feasible to compute ROI considering time as an investment.

The ROI statistic, often known as the ROI figure, is used in a variety of ventures and sectors, including return on equity, return on advertising expenditure, return on assets, return on social investment, etc. And in all, the rate of return on investment calculator will be your best ally.