Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

You may have known of the developing industry of Real Estate Investment Trusts if you work in finance (REITs). As it creates income-oriented real estate, it represents a steadily expanding component of the American financial industry. But is real estate investment trusts a good career path?

Due to their rapid expansion since 1960, REITs have been an excellent career option. Your portfolio diversification will be improved by picking it, irrespective of your original career. There are several work prospects in this real estate industry. Additionally, the market capitalization of REITs in the United States was $1.25 trillion, making it a viable career option.

Did you know that management positions will provide the majority of REIT prospects? You may eventually have a big effect on the commercial real estate market.

Read this article to the end if you want more information on real estate investment trusts.

Key Points

- The internet was used by 51% of purchasers to find their houses.

- In 2021, six million pre-existing houses were sold.

- Of all house purchasers, 37 percent are millennials.

- In 2021, the average home price will increase by over 5%.

- Existing house sales will decline 1.7% in 2022.

- Rent prices have increased by roughly 18 percent.

What is a Real Estate Investment Trust?

Upwards of 225 REITs with a total market value of more than $1 trillion operate in the US. A public investment fund listed on a stock exchange is a real estate investment trust (REIT). Investors may also purchase REIT ETFs to diversify their holdings across various real estate asset types.

A REIT owns and manages income-producing real estate and associated assets. The REIT may own office buildings, hotels, resorts, and other structures. The REIT does not intend to resell the property it purchases, however. The REIT’s property is really for development. The property is then utilized to produce revenue as a component of the investment portfolio.

These assets are simple and inexpensive for investors to purchase and sell. Additionally, REITs have far more liquidity than conventional real estate holdings. The NASDAQ, American Stock Exchange, and New York Stock Exchange all list REITs. Additionally, via mutual funds, investors might have indirect access to REITs.

Advantages and Disadvantages of REITs

The following table highlights the advantages and disadvantages of REITs:

| Pros | Cons |

| You may diversify your portfolio of investments. | Interest rate sensitivity |

| High Dividend Yields | Reward taxes |

| High Potential for Return | Trends Affect REITs |

| Continuity | Possibly exorbitant fees and risks |

| Obtaining commercial property easily | Only function best as long-term investments |

| REITs are thoroughly screened. | The value of the real estate may change. |

| Greater security is ensured. | |

| Greater adaptability |

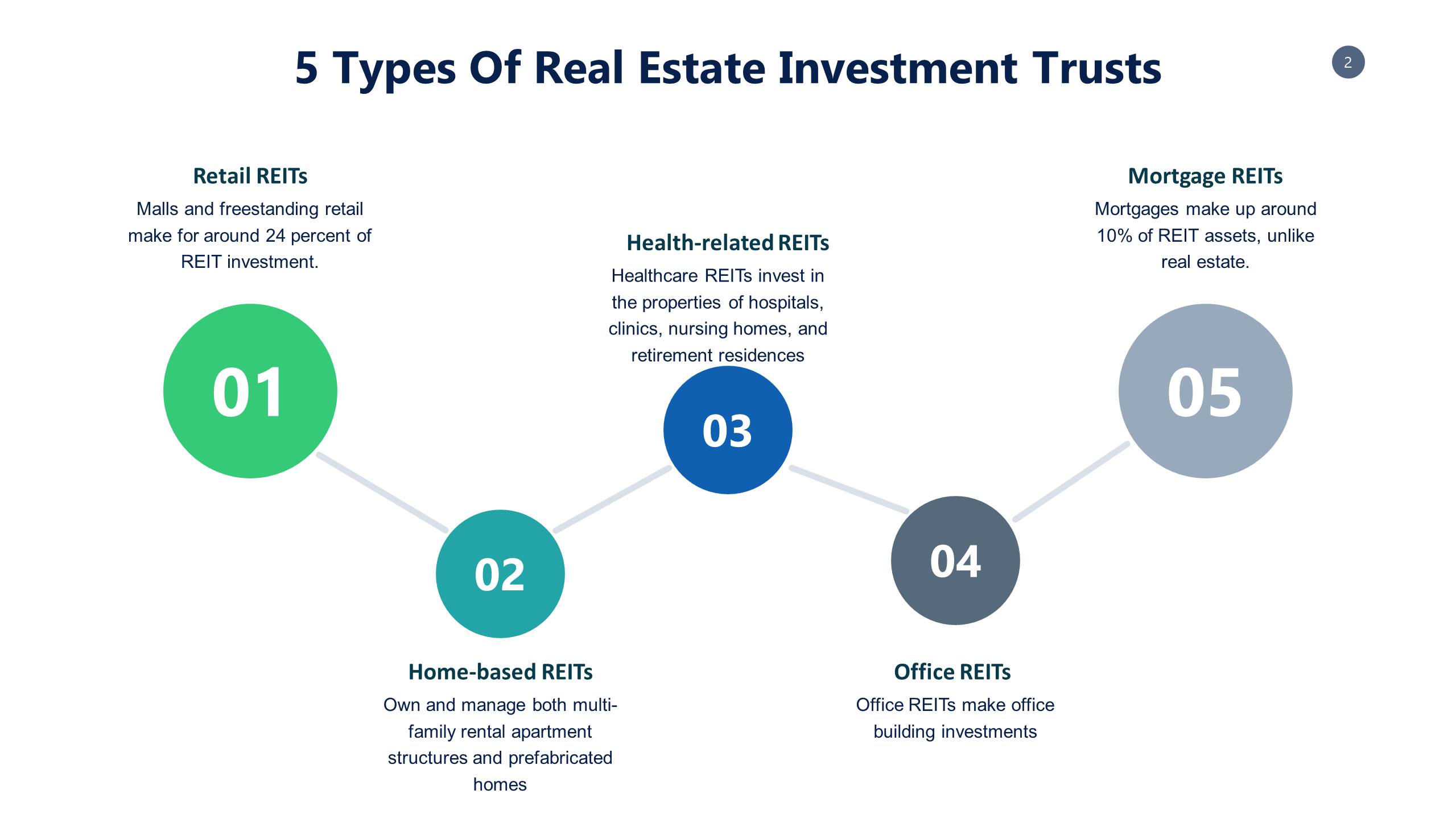

Variety of Real Estate Investment Trusts

Any equities or fixed-income portfolio should consider real estate investment trusts (REITs). Greater diversity, perhaps better total returns, and/or reduced overall risk are all things they provide. In brief, they are a great counterpoint to stocks, bonds, and cash since they may provide dividend income in addition to capital growth.

Whether the actual properties or the mortgages securing them, real estate investment trusts hold and/or manage a commercial real estate that generates revenue.

A mutual fund, an exchange-traded fund, or an individual investor may invest in the firms. There are several varieties of REITs. A few of them are:

1. Retail REITs

Malls and freestanding retail make for around 24 percent of REIT investment.

This is America’s single largest investment of its kind. Any retail establishment you often visit is probably owned by a REIT. One must first look at the retail business before contemplating an investment in retail real estate. What is the current state of its finances, and what does the future hold?

It’s critical to remember that retail REITs profit from the rent they collect from tenants. Retailers could postpone or skip such repayments due to weak sales if they have cash flow issues. They will ultimately go bankrupt as a result of this. Then comes the difficult task of finding a new renter. Because of this, you must invest in REITs with the best anchor tenants. Grocery and home improvement shops are examples of them.

After evaluating the industry, you should concentrate on the REITs themselves. Like any investment, they should have healthy profitability, solid balance sheets, and as little debt as possible, particularly in the near term.

2. Home-based REITs

These REITs own and manage both multi-family rental apartment structures and prefabricated homes. Before deciding to invest in this kind of REIT, one should take into account several variables. For instance, areas with poor house affordability compared to the rest of the nation often have the greatest apartment markets.

More individuals are forced to rent in cities like New York and Los Angeles due to the high cost of single-family houses. The price that landlords may charge each month rises as a result. As a consequence, the largest residential REITs often concentrate on major cities.

3. Health-related REITs

With the aging of the population and rising healthcare expenditures, healthcare REITs will be a fascinating subsector to monitor. Healthcare REITs invest in the properties of hospitals, clinics, nursing homes, and retirement residences. The healthcare system has a direct impact on this real estate’s performance.

Most of these institutions’ owners depend on occupancy fees, payments from Medicare and Medicaid, and private funding. Healthcare REITs are uncertain as long as healthcare financing is.

A healthcare REIT should include interests in a variety of various property types as well as a diverse client base.

4. Office REITs

Office REITs make office building investments. Their long-term lease-bound tenants provide them with rental money. Anyone considering investing in an office REIT has four concerns:

- How is the economy doing now, and how great is the unemployment level?

- How high are vacancy rates?

- How is the economy in the region where the REIT invests doing?

- How much revenue does it have available for purchases?

Look for REITs that make investments in economic powerhouses. Owning many ordinary buildings in Washington, D.C. is preferable to, say, owning great office property in Detroit.

5. Mortgage REITs

Mortgages make up around 10% of REIT assets, unlike real estate.

Fannie Mae and Freddie Mac are the two most well-known investments; however, they aren’t always the best; these companies, supported by the government, purchase mortgages on the secondary market.

However, just because this kind of REIT invests in mortgages rather than stock does not imply risk-free. A rise in interest rates would result in a decline in the book value of mortgage REITs, affecting stock prices. Mortgage REITs also get a significant portion of their funding via secured and unsecured debt issues.

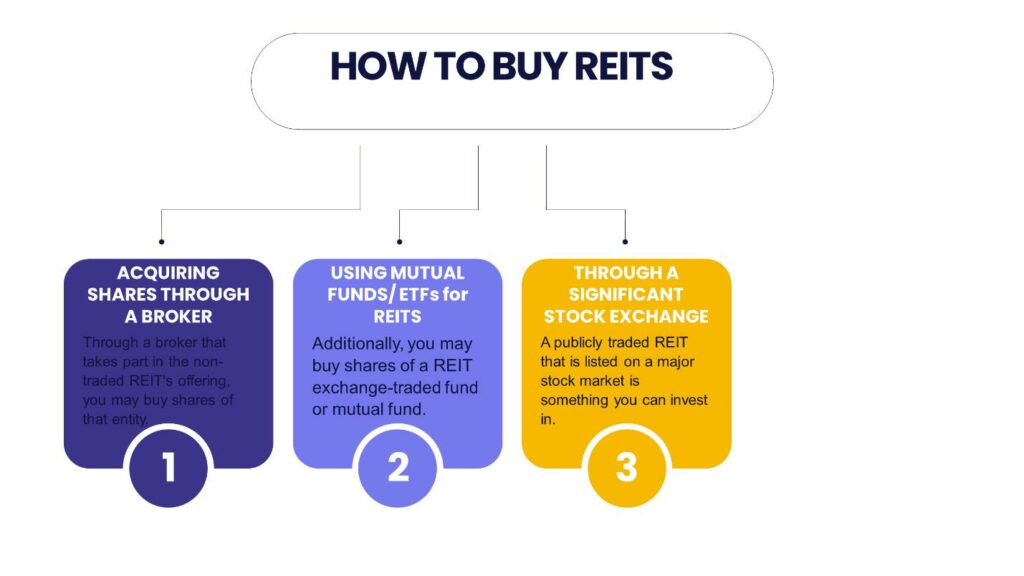

How to Buy Real Estate Investment Trusts

You can Buy Real Estate Investment Trusts in the following ways:

How Do REITs Make Money?

Renting, leasing, or selling the buildings REITs buy generates revenue. The shareholders choose a board of directors, and it is this board that selects the investments and hires staff to oversee them daily.

REIT return amounts

The fact that there is a limited quantity of cash to spend and a virtually endless number of investment possibilities is one of the difficulties that individual investors often encounter when attempting to build a diversified investment portfolio.

As a result, decisions must be made on the amount of money to allocate to each asset type in the portfolio. Equities (stock) and REITs are two examples of these investing choices.

Analyzing their historical returns is the best approach to contrast the performance of a REIT investment with one in equities. Because there are so many REITs and businesses in which stock may be acquired, this process may be challenging. Therefore, it is preferable to use broad indexes as a stand-in for REIT and stock performance in this comparison.

The FTSE Nareit U.S. Real Estate Index, which monitors the performance of US-based REITs, serves as an effective substitute for a REIT. The S&P 500, a collection of the 500 biggest firms, is a reliable substitute for the stock market.

According to historical statistics, the FTSE Nareit index has had an average yearly return of 11.42 percent since 1972. It returned over 49% in its greatest year. It lost 42% of its value in the worst year. Compare this performance to the S&P 500’s historical average annual return for the same time of 9.03 percent.

It had a return of 34% in its best year and a loss of 39% in its worst. The 2.4 percent yearly difference between REITs and stocks may not seem like much, but it may add up to a lot when compounded over several years.

This can also be seen in the table below:

| Period | S&P 500 (total annual return) | S&P 500 (total annual return) |

| 1972-2022 | 12.1% | 13.3% |

| In the last 25 years | 11.9% | 12.6% |

| In the last 20 years | 7.7% | 13.3% |

| In the last 10 years | 14.2% | 13.2% |

| The last 5 years | 12.5% | 9% |

| The first quarter (2022) | 14.2% | 13.2% |

Additionally, the following graphic shows the outcomes for US stocks. average returns:

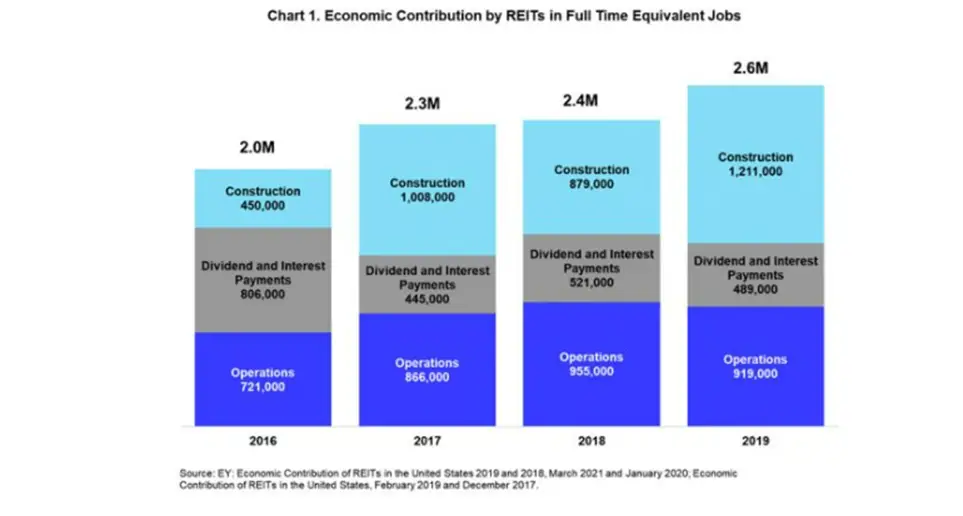

Employment Opportunities in REITs

There are a few job opportunities in REITs. Include:

1. Principal Director

A chief executive officer holds the position with the highest authority in a REIT. A CEO normally controls all business operations, including capital markets, strategy, and operations.

CEOs may make between $7 million and $25 million annually, depending on how well diversified their possessions are. As per statistics from the industry trade organization National Association of Real Estate Investment Trusts, there were 1,430 REIT CEOs in 2021. (NAREIT).

The average yearly salary for these specialists was close to $7 million.

Even the highest paid executives at major corporations earned, on average, little under $3 million per year, less than half what CEOs did.

2. Chief Financial Officer

At REITs, CFOs are paid the highest salary, $193,456 per year, with potential earnings of $500,000 or more.

The responsibilities include managing investments, performing accounting tasks, and raising money.

Because there aren’t many well-paying jobs available, competition for them is fierce.

To acquire one of these jobs, you normally require a master’s degree in business and at least five years of expertise as an accountant or financial analyst.

3. Asset Manager

Asset managers are in charge of overseeing a portfolio of properties in real estate investment trusts. Asset managers have no experience and get average yearly compensation of $139,000, according to PayScale.

Experience is not necessarily essential since REITs are still relatively new, especially on Wall Street. However, those who want to become asset managers must complete some formal schooling.

4. Architects

You could be a good match for a job as an architect if you have a creative streak or are interested in architecture.

Don’t be discouraged by the four years required to complete a bachelor’s degree in architecture from a recognized university.

One of the highest-paying professions accessible through real estate investment trusts is architecture. As of 2015, this comes with annual mean wages of close to $100,000.

5. Senior Analyst, Vice President

Vice President and Senior Analyst are among the highest-paying positions at a REIT.

As of 2013, the average salary for a vice president and senior analyst was $84,510 per year, according to Simply Hired.

Although VP and analyst positions won’t be available at every REIT, you may discover more about their usual duties there.

6. Officer in Charge of Compliance

Senior compliance officer positions at REITs are among the highest-paid positions.

Senior compliance officers often earn $150,000 per year.

They get a significant portion of their salary as bonuses and annual incentive pay. Bonuses are often given out at 100% of the target, with incentives beginning at 25%.

One of the highest-paid roles at a REIT is senior compliance officer, thanks to this remuneration structure.

7. Project Manager, Development & Operations

Project Manager, Operations & Production, with an average annual compensation of $174,579, is among the best-paying positions in real estate investment trusts.

A degree and three to five decades of expertise are requirements for this post. For this position, legal and commercial real estate knowledge is required.

8. Accounting Supervisor

PayScale’s average annual salary for accountants and auditors is $81,480.

While not as senior as a CFO, an accounting manager is more experienced than an accountant. Both occupations typically need a four-year degree for entrance.

According to the U.S. Bureau of Labor Statistics, the employment of accountants and auditors is expected to grow by 6% between 2016 and 2026.

9. Executive; Leasing Agent

To help their customers get wealthier, investment firms are in charge of investing their client’s money in a variety of stocks, bonds, and other assets.

They use leasing brokers to attract new occupants to the shops and offices that have emerged in recently built structures.

Payscale estimates that the entry-level salary for a director at an investment business will be between $108,000 and $110,000 annually.

10. Computer specialists

Computer specialists have had some of the quickest pay rises, with salaries rising 6.9 percent in the last five years.

In 2021, the yearly median pay for these professionals was $70,310. The BLS reports that as recently as 2020, their average annual income was less than $42,440.

In all, REITS usually come with good payment. And the graph below can confirm this as well.

REITs vs. Real Realty Operating Companies vs. Real Realty Private Equity

The distinctions between these can be seen in the table below:

| Mode for comparison | REITs | Real Realty Operating Companies | Real Realty Private Equity |

| Net Profit Distribution | While some REITs may opt to distribute all their earnings as dividends, the law compels them to pay at least 90% of their net income. | For REOCs, the administration can decide how the net revenue is allocated to shareholders or reinvested in new initiatives. | Real Realty Private Equity may decide to split the earnings fifty percent. |

| Investment Plan | Less than 10% of the net profits are available for reinvestment by REITs since they must distribute the bulk (at least 90 percent) of their net income as dividends. | By employing internal money to invest in new constructions, purchases, and redevelopments of existing properties, then selling them at a profit, REOCs may swiftly fill up their portfolios. | At least half of Real Realty Private Equity’s net profits must be paid out in dividends. |

| Main goal | A REIT is a real estate organization that owns and oversees real estate assets in a certain industry. | Real estate properties in many industries are owned and managed by a Real Realty Operating Company. | Investment finance uses the phrase “Real Realty Private Equity” to describe a particular subgroup of the real estate investment asset class. |

| Possibility of entry | Lowered obstacles to entrance | Medium entrance barriers | Higher entry obstacles |

Requirements for REITs in the United States

The Securities and Exchange Commission (SEC) states that for a company to be categorized as a REIT, it must comply with many regulatory standards, including:

Frequently Asked Questions

Are real estate investment trusts a good investment?

REITs are investments that provide a total return. They usually offer significant dividends and the potential for moderate long-term capital growth. REITs are also a helpful portfolio diversifier due to the low correlation of listed REIT stock returns with other equities and fixed-income assets.

Is a real estate investor a good career?

Real estate investment is a fantastic way to take control of your financial destiny. Buying, rehabbing, and selling properties for a living comes with its dangers. As you learn, it’s practically unavoidable that you’ll make some mistakes and report abuse sometimes. You can spend too much on a home, reducing your profit margin.

To be a full-time real estate investor, you’ll need a lot of money or connections to money (private money, hard money, bank financing, self-directed IRA, etc.). Also, to have the ability to work 16-hour days until you can scale in addition, the ability to appraise a deal correctly. I’ve seen many beginner investors buy a house that had major issues or that they overpaid for. They either lost money or had the house seized by the lender.

Why are REITs a bad investment?

REITs are likely to be particularly vulnerable to interest rate movements in 2021. The most important aspect is that rising interest rates are detrimental to REIT stock values. When a general rule yields on risk-free assets like Treasury securities grow, so do the yields on other income-based investments.

Can you get rich investing in REITs?

With REIT investment, there is a proven method to grow rich slowly. Realty Income (NYSE: O), Digital Realty Trust (NYSE: DLR), and Vanguard Real Estate ETF (NYSEMKT: VNQ) are three REIT stocks in particular that are about the closest things you’ll find to guaranteed methods to grow wealthy over time.

The amount you receive is determined by the REIT’s management and market circumstances. A REIT may generally generate a 5–10% or higher return on investment. You get dividends and share price movements like any other stock, and your return is proportional to your risk.

What is the average return on a REIT?

Residential and diversified real estate investments do somewhat better, with an average return of 10.5 percent. Meanwhile, real estate investment trusts (REITs) had a 10.5 percent average yearly return.

So it’s not the answer you were searching for because even with those high-yield investments, you’ll need at least $100,000 to earn $1,000 a month. It takes more than twice that for most solid equities to provide a thousand dollars monthly income.

Is real estate a better investment than stocks?

While stocks are a well-known investment choice, many people are unaware that purchasing real estate is also viable. Under the appropriate conditions, real estate may be a viable alternative to stocks, giving lower risk, higher returns, and more diversity.

Real estate investments might be more time-consuming than stock ones. Property ownership takes much more sweat equity than buying stock or assets like mutual funds. Real estate is both costly and illiquid. Even when borrowing funds, investing in real estate necessitates a significant initial outlay.

What are the highest yielding REITs?

Rank Company Market Cap Forward Dividend Yield Projected 5-Year Annualized EPS Growth** 2020 Return (as of 12/17) 3-Year Return

- Innovative Industrial Properties (NYSE: IIPR) $4.2 billion 2.6% N/A (Current year: 72%; next year: 67%) 157% 746%

- Hannon Armstrong Sustainable Infrastructure Capital (NYSE: HASI) $4.5 billion 2.3% 5.4% 91.6% 192%

- Safehold (NYSE: SAFE) $3.9 billion 0.9% 37% 89% 341%

- Uniti Group (NASDAQ: UNIT) $2.7 billion 5.1% 8.6% 53.3% (11.3%)

- Taubman Centers (NYSE:TCO) $2.7 billion 0%* 5.8% 40.1% (23.1%)

Does Warren Buffett invest in REITs?

The billionaire investor Warren Buffett does not own any real estate investment trusts or REITs. His preferred businesses include banking, commodities, and wealth management, all of which are ok in Berkshire Hathaway’s massive stock holdings.

REITs, on either hand, have numerous characteristics that Buffett idolizes, including recurring income, a large number of tangible assets, and the ability to develop without experiencing significant volatility. While Buffett is not a REIT expert, he does own two REITs, one by Berkshire and the other by his holdings.

What is the best REIT to invest in?

Shutdowns and work-from-home regulations hit retail and office REITs particularly hard, leaving premises unoccupied and rents uncollected. Even the year’s top REITs — those in the industrial and self-storage industries – were hit hard, with total returns of 9% and 10% in 2020, respectively, still behind the S&P 500. So, let’s talk about some REIT investments you can make:

American Tower

By increasing the number of tenants per tower, American Tower may increase earnings. With 8 percent annual growth in mobile device penetration, 28 percent yearly growth in data use, and 5G technology rollouts. The REIT well-position to exploit its existing tower contracts and acquire new tenants.

Equity LifeStyle Properties

Equity LifeStyle Properties (ELS, $59.62) is a real estate company that holds land where renters can put up prefabricated homes, vacation cottages, and recreational vehicles (RVs). Its 415 assets are spread across 33 states and cover around 158.000 house sites in the prominent resort and holiday areas. Many of its villages have lakes, rivers, and ocean frontage, and 120 are within 10 miles of a US coast.

Digital Realty

Digital Realty (DLR, $133.45) is a prominent worldwide data center REIT that serves clients in the information technology, communications, social networking, financial services, manufacturing, healthcare, and consumer products industries.

It is one of the significant REITs in the United States because of its 15-year dividend increase run, it’s well on its way to becoming a Dividend Aristocrat. And, given its industry, it may be one of the best REITs for 2021 and beyond.

What are the top 10 REITs?

Innovative Industrial Properties (or IIP), the top performance, is the only public cannabis-focus REIT. It acquires properties in places where medicinal marijuana allows and leases them out to cannabis growers and processors. It continues to expand swiftly, with sales nearly doubling in the third quarter.

No. 2 Hannon Armstrong invests in climate change solutions, such as renewable energy. It was established in 1981 and became publicly traded in 2013.

Safehold, the first publicly listed business to acquire, own, and capitalize ground net leases, takes third place (GNLs). It owns the property under commercial real estate development, in other words. It was established in 2016 and went public the following year.

According to the company’s website, Unit (No. 4) “focuses on the acquisition and building of mission-critical communications infrastructures such as fiber, wireless towers, and ground leases.”

Equinix (No. 6) is the next company on the list, a significant worldwide data center operator. The firm was founded in 1998, went public in 2000, and converted to a REIT at the beginning of 2015.

What REITs pay monthly dividends?

Realty Income Corporation

The firm was founded in 1969, and its first commercial property was a Taco Bell restaurant, which it bought shortly after. Realty Income emphasizes low-cost financing solutions such as debt or stock issuance over mortgages and concentrates on assets with significant long-term growth potential. It also requires triple-net leases, placing the renter in charge of taxes, insurance, and upkeep.

Chatham Lodging Trust

Chatham Lodging Trust operates almost 40 premium brand hotels in 15 states, including Hilton Garden Inn, Hyatt Place, and Residence Inn. So, Chatham is looking for properties where demand is currently outpacing supply, focusing on undercapitalized assets.

EPR Properties

EPR Properties specializes in charter schools, movie theaters, water parks, ski resorts, and golf courses, among other educational and entertainment-related facilities. So, EPR looks at value, opportunity, execution, economics, and location as part of its “Five-Star Investment Criteria.

” To recap, EPR seeks assets with a long-term competitive edge, the ability to gain market dominance, and the ability to provide an instant return on investment.

LTC Properties Inc.

LTC Properties is in charge of more than 200 senior-focused healthcare facilities. Skilled nursing institutions, assisted living homes, and memory care institutions are among them.

According to its most recent quarterly report, LTC searches for five qualities in a potential property: robust cash flows with an annual return of 7-9 percent, competent operators, defendable market positions, superior building structures, and a suitable regulatory environment.

Author’s Personal Opinion

Many investors aim to generate a consistent flow of passive income. Why else would it not be? Anyone is likely to find the prospect of relaxing while earning money appealing. However, there are other strategies you may use to create your dynasty of passive income inside the world of real estate investment.

For instance, you may amass many rental houses and profit from monthly rent payments. Alternately, you may stockpile REITs (real estate investment trusts) in your portfolios, sit quietly, and take advantage of regular dividend payouts that are often more substantial than those made by your average stock.

However, choosing the best strategy for generating passive income from real estate is crucial. And the above highlight will be of great use to you in that regard.

Bottom Line

A real estate investment trust (REIT) is a corporation that manages and administers a portfolio of buildings. Apartment buildings, office complexes, commercial properties, hospitals, retail malls, and hotels are examples of these properties, while particular REITs prefer to specialize in one type of property.

REITs are popular because they require to pay out at least 90% of their earnings in dividends to their shareholders, resulting in yields of 10% or more in some cases.

Things become a little difficult for investors trying to create monthly revenue. The majority of them pay dividends every quarter. Only a few companies pay monthly dividends, and even fewer that are worthwhile to invest in.

REITs are lovely for generating greater returns, but they’re also quite susceptible to the economy. REIT values plummeted during the financial crisis as defaults increased, revenues dried up, and facilities sat unused.

Interest rates have an impact on REITs as well. Interest rates and REIT prices usually move in opposite directions, although each industry reacts differently. Given the current low loan rates, this will be highly crucial to watch.

Article References

- https://www.benzinga.com/22/07/28157362/how-to-make-money-investing-in-apartments

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/real-estate-investment-trusts-reits

- https://financialwolves.com/best-paying-jobs-in-real-estate-investment-trusts/

- https://news.morningstar.com/classroom2/course.asp?docId=145579&page=3&CN

- https://www.cnbc.com/select/what-to-know-about-reits/

- https://news.bloomberglaw.com/daily-labor-report/theyve-got-next-the-40-under-40-john-pitts-of-kirkland-ellis

- https://www.entrepreneur.com/article/430482