Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

A certificate of deposit (CD) is a kind of savings instrument that accrues interest on a single quantity of money for a certain amount of time. Unlike savings accounts, CDs require that the money stay undisturbed over the full term to avoid penalties and missed interest. Savings accounts often provide lower interest rates than CDs as compensation for liquidity loss. Calculating this could sometimes be challenging. Thus, we have posted this on a CD calculator with monthly deposits to aid you.

Although each bank wishes to give parameters vary, almost all consumer banks provide CDs. This is in addition to the rate differential between the product and the bank’s savings and currency market accounts and the early withdrawal fees.

Purchasing around with the aid of the CD calculator with monthly deposits is important for discovering the greatest CD rates. This is true since a surprising variety of financial institutions provide it.

For instance, long-term CDs from your local bank could only yield a pittance. At the same time, a local credit union or internet bank may provide rates three to five times higher than the average.

However, some of the greatest prices are found during special promotions, often for durations as odd as 13 or 21 months. Come along as we highlight more on the CD calculator with monthly deposits below.

What is a CD?

A savings account with a set term and interest rate is known as a CD. Even though CDs often provide greater rates than standard savings accounts, you can’t easily access your money until the term is up.

In general, consider CDs to be a kind of term deposit savings account. You spend a certain amount of money on these items for a set amount of time, commonly referred to as the term. The financial institution provides a set rate of return in exchange for that time, denoted by an annual percentage yield (APY).

Since most CDs impose fees if you withdraw your money before the maturity date, they are intended to be used for savings that you won’t require access to throughout the CD.

How to Use CD Calculator with Monthly Deposits

You can use this CD calculator with monthly deposits through the following steps:

- Enter the Initial deposit Amount ($)

- Enter the Annual Interest Rate (%)

- Put the Compounding periods / Year

- Enter the No of Years

- At this point, the CD Calculator with monthly deposits will process your input and produce the right output.

CD Calculator with Monthly Deposits

How Do CDs Work?

You’ll make a lump-sum deposit to create the account after finding a banking institution with a rate and term for a CD that aligns with your financial objectives. Your first contribution is referred to as your primary.

Your timed investment begins to run from the day your principle is deposited into a CD. For the length of the CD, you will receive the set interest rate on your principal. Your bank or credit union will give you periodic statements that show your principle and the total interest received thus far, just as with any other deposit account.

Make sure the banking institution specifies the early withdrawal penalty on your CD before you acquire it. You will be penalized if you withdraw the funds before the maturity date. Depending on the length of your CD, the precise early withdrawal penalty may range from 60 to 365 days of interest earnings. The penalty may sometimes deplete your initial investment.

How to Calculate your CD’s Interest Rate

You can calculate your CD’s interest rate through the following sections:

More resources: Loan Interest Calculator

Find the deposit required for the desired term

This is the first step necessary to determine the interest rate on your CD. Investments that include putting money into a financial institution account include the deposit necessary for the desired period. Investments in term deposits typically have short-term maturities of one month to a few years. They often have various minimum deposits necessary.

When purchasing a term deposit, the investor must know that they may only withdraw their money after the period has expired. If the investor gives a few days’ notices, the account holder could, in certain situations, permit an early termination—or withdrawal—of their investment. A fee will be charged for early cancellation as well.

Sum up the maturity of all CDs in your portfolio

The next step in calculating how to compute your CD’s interest rate is adding up all of the CDs in your portfolio’s maturities.

Financial planning also includes developing an investment portfolio, which is essential. Diversifying their holdings will help investors create a successful and risk-free portfolio.

Thus, adding up the maturities of all the CDs in your portfolio has many advantages. It also aids in the development of a solid investment portfolio. Among the many market-dependent investment alternatives, the advantages also assist investors in choosing a CD.

Find your weighted average yield for the bank and different terms

Determining your weighted average yield for the bank and various terms is crucial in determining your CD’s interest rate.

A weighted average is often calculated to balance the frequency of the values in a data collection. A survey, for instance, could get sufficient replies from each CD age group to be deemed statistically valid.

However, compared to their proportion of the population, responders in the 18- to 34-year-old age group may be the smallest of all. The survey team may give more weight to responses from 18 to 34 years old so that their opinions are fairly reflected.

In either instance, the specified weight is multiplied by each data point value in a weighted average. After that, it is added and divided by the total data points.

A weighted average is more informative than a simple average because the final average value in a weighted average represents the proportional significance of each observation. When determining the interest rate on your CD, it also has the impact of boosting data quality and flattening it out.

Get an idea about what you can expect from your CD portfolio

When determining your CD’s interest rate, you may anticipate a few things from your CD portfolio. This comprises:

Security:

One of the safest locations to place your cash is in a CD, along with savings and money market accounts. This is so that any money kept in a CD is protected.

You are protected if an FDIC-insured bank closes its doors or ceases operations if you acquire your CD account from one. The current coverage cap is $250,000 per creditor, per banking institution, for each type of account ownership. The NCUA similarly insures your funds at federal credit unions and 95% of state-chartered credit unions.

Reliable Returns:

Since rates are normally set for the term, CD accounts provide predictability because it is very simple to estimate how much interest you will earn over time. You may enter the amount you’re saving and your APY in the CD calculator with monthly contributions to determine how much your investment will grow.

More Resources: Monthly Savings Calculator

You may customize your choice of CD periods and interest rates to assist you in accomplishing your goal if you’re saving for a long-term objective with a deadline.

Increased Rates:

CDs may be able to provide better deposit interest rates than savings or money market accounts. That’s because you consent to keep your funds in the CD for a certain time. Your interest rate and annual percentage yield (APY) rely on the bank, the length of the CD, and the overall interest rate environment.

The interest rates of high-yield savings accounts and CDs should be compared. Additionally, starting a CD when rates are generally low, you may choose a bump-up or step-up CD that enables you to profit when rates increase.

No Recurring Maintenance Charges:

You could be required to pay a monthly maintenance fee to utilize a savings or money market account, which can significantly reduce your interest returns. On the contrary hand, certificate of deposit accounts normally doesn’t require a monthly maintenance cost.

This implies that you retain all interest income. CDs may be a fee-friendly method to build investments, provided you don’t need to take money out of one before it matures.

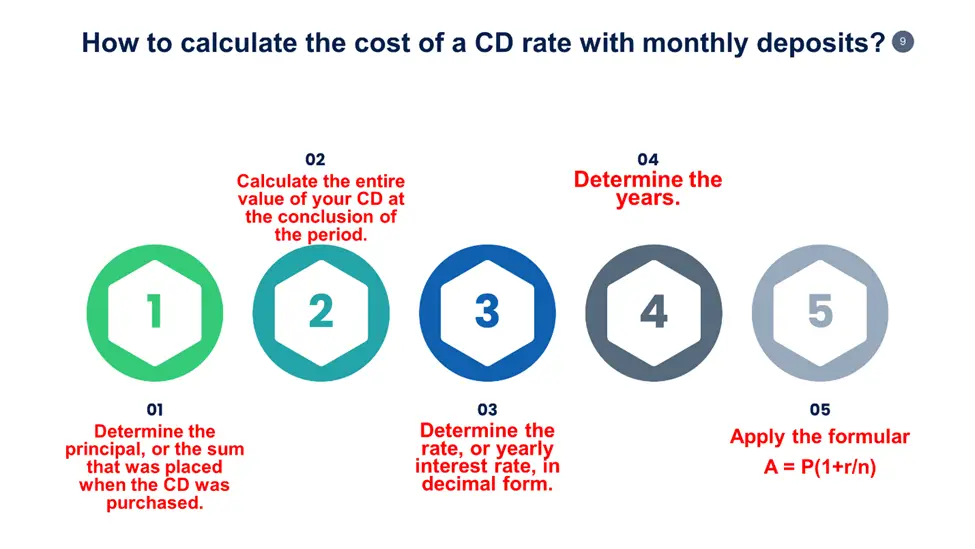

How to Calculate the Cost of a CD rate with Monthly Deposits?

You can calculate the cost of a CD rate with monthly deposits through the following steps:

- Determine the principal, or the sum placed when the CD was purchased. This is usually denoted by “P”.

- Calculate the entire value of your CD after the period, taking your investment into account. This is usually denoted by “A”.

- Determine the rate, or yearly interest rate, in decimal form. This is usually denoted by “R”.

- Determine the years. This is usually denoted by “n”.

- Apply the formula

A = P (1+r/n)

This can also be seen in the infographics below.

How much should you deposit in a CD?

A few crucial criteria determine how much cash you should retain in a certificate of deposit (CD). This comprises:

- You should set aside enough cash to create an account with the minimum deposit required for the CD.

- If you are saving for a shorter-term objective, deposit enough money to accomplish that objective or even to accomplish the objective using CD interest.

- You may want to invest less money in CDs if you save for a longer-term objective, like retirement. Alternatively, you may consider making other investments that might eventually provide substantially bigger profits.

- Your financial objectives and time horizon will influence how much money you invest in a CD.

Most CDs need a minimum opening deposit of $500 to $1,000. However, others do not.

What is the withdrawal penalty on a CD?

It relies on your account’s rules. Early CD withdrawals are subject to a minimum penalty determined by federal law, but there is no ultimate punishment. If you take money out within six days after depositing it, you’ll be penalized with at least 7 days’ worth of simple interest. See your account agreement for rules relevant to your bank and your account.

Frequently Asked Questions

Can you deposit monthly into a CD?

No. However, with an incorporated CD, you may continue to make deposits into your account up to the CD’s maturity date. Depending on how often you are paid, you may be able to set automatic payments on a monthly or bimonthly basis, for instance.

How much does a $10000 CD make in a year?

Your deposit, the CD rate, and the term duration influence this. An investment of $10,000 in a five-year CD with a 1.50% APY, for instance, would yield approximately $770 in interest, but an investment of the same size in a five-year CD with a 0.01% APY would yield just $5 in interest.

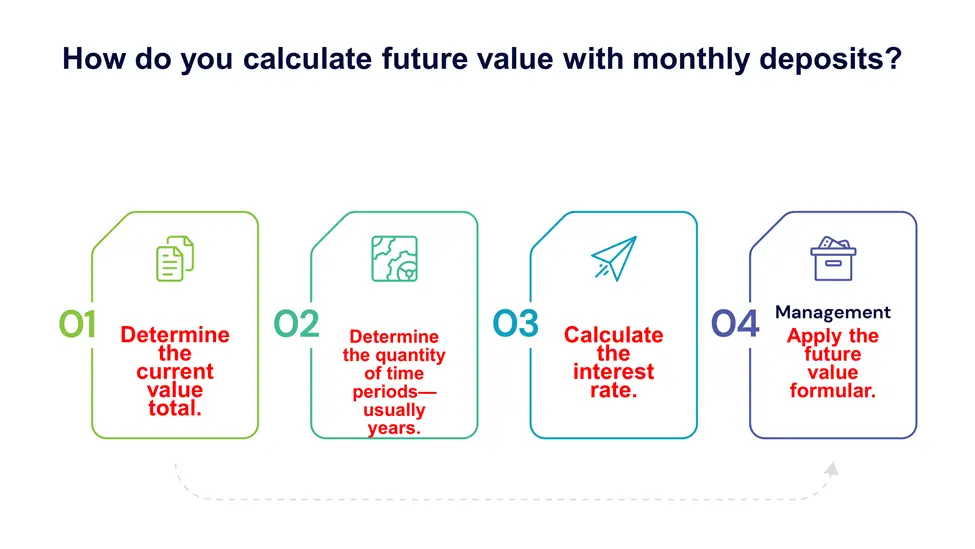

How do you calculate the future value with monthly deposits?

You can calculate the future value with monthly deposits through the following steps:

The future value formula is “=PV*(1+R) ^N.”

What is the formula for compound interest with monthly contributions?

Compound interest with monthly payments is calculated using the formula CI = P (1 + (r/12)).12t – P.

- Where P stands for principal, r for the interest rate expressed in decimal notation, and t for the passage of time

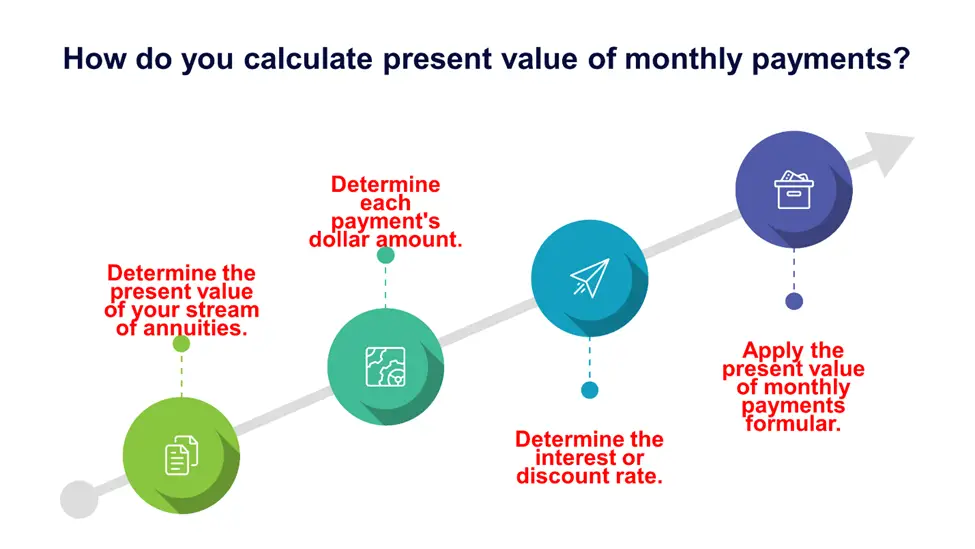

How do you calculate the present value of monthly payments?

You can calculate the present value of monthly payments through the following steps:

How do you calculate monthly annuity payments?

The formula for monthly annuity payments is:

Payment Amount x Present Value of an Annuity (PVOA) component equals Annuity Value.

Expert opinion

A form of savings account is known as a certificate of deposit. It often provides a set interest rate and a greater rate of return than a conventional savings account. There will be a time restriction on how much access you have to the money. The advantages are that your funds are federally protected, and you may make more money through interest.

Given that the money in a certificate of deposit is up to $250,000, protected by the Federal Deposit Insurance Corp., it is also a secure investment that yields interest.

Although CDs may be found in shorter versions, like three months, and longer ones, like 10 years, they typically mature around six months and five years. And if you need more help in this regard, the CD calculator with monthly deposits will aid you immensely.

References

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/certificates-deposit-cds

- https://www.investopedia.com/terms/c/certificateofdeposit.asp

- https://en.wikipedia.org/wiki/Certificate_of_deposit

- https://www.bankrate.com/banking/cds/cd-rates/

- https://www.nerdwallet.com/article/banking/cd-certificate-of-deposit

- https://www.wellsfargo.com/savings-cds/certificate-of-deposit/