Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Establishing an investing strategy is essential to safeguarding your financial future. When choosing investments, you should consider your objectives and the timeframe in which you want to achieve them. Do you have any retirement funds? Will you be purchasing a second home? Do you want to leave your family with a lasting legacy? You may choose how to develop your portfolio by having a broad estimate of how much money you’ll need and a goal date for spending those assets. Thus, we have made this post on the Future value of investment calculator to aid you.

You could be more inclined to take chances if you have more time to save. If your aim is more immediate, you could also be more cautious. To calculate the future worth of an account based on regular investments, utilize our future value of investment calculator.

In addition, a hypothetical time range for investment and rate of return are included. Come along as we highlight more on this below.

What is the Future Value of the Investment?

The worth of a present asset in the future based on an estimated growth rate is known as future value (FV). For investors and financial planners, the future value is crucial because they use it to predict how much an investment made now will be worth.

Investors may make wise investment choices based on their projected demands by knowing the future worth. However, external economic forces that depreciate an asset’s value, such as inflation, might harm the asset’s future worth.

Estimating its future worth might be challenging depending on the kind of asset. Additionally, a constant growth rate is assumed to estimate future value. When money is deposited in a savings account with a fixed interest rate, it is simple to accurately calculate the future value. However, investing in stocks or other assets with a more unpredictable rate of return might be more challenging.

What is a Future Value Calculator?

The future value calculator simulates the future worth of an investment. It determines the value of your money in the future. Calculating the worth of any investment at a later time is made easier with the aid of a future value compound interest calculator.

The investment, periodic financing, interest rate, and period number are entered in the formula input box of the future value calculator. The future value calculator on the internet will demonstrate the value of your investment at the specified future date.

How to Use the Calculator?

You can use the calculator through the following steps;

- Enter the Initial Investment Amount ($)

- Enter the Annual Interest Rate (%)

- Put the number of months the money is invested

- The future value of the investment calculator will process your input and display the appropriate results.

Future Value of Investment Calculator

How can a Future Value Calculator help you?

A sophisticated tool called a future value calculator may help you rapidly determine the worth of any investment at a certain point in the future. How FV calculations are done is also influenced by the kind of future value. This comprises:

Simple interest:

This is the future’s worth of a lump amount of money. In the case of simple interest, interest is credited to the original investment but not to the rising amount as interest is accumulated.

Compound interest:

With compound interest, interest is paid on the principal investment and the already accrued interest. The same original investment will provide a bigger account balance when compound interest is used instead of simple interest.

Annuity:

Rather than a single, initial lump sum payment with interest collecting, this future value increases over time via several installments. An ordinary annuity is a payment made after a recurrent period. An annuity due is a payment paid at the start of a recurrent period.

How to Calculate the Future Value of the Investment?

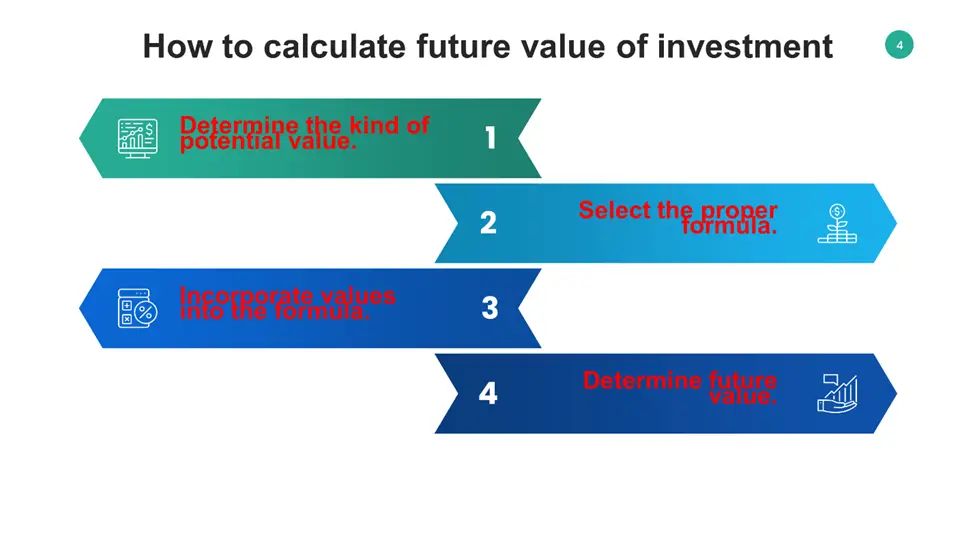

You can calculate the future value of an investment through the following steps:

1. Determine the kind of potential value.

Determine the future value that will apply to your specific investment before calculating future value. This might be an annuity, simple interest, or compound interest.

2. Select the proper formula.

Select the appropriate formula after the kind of future value has been determined. The equation for simple interest is FV = PV [1 + I x t)].

The formula for compound interest is FV = PV [1 + (i/n)] (n x t). The formula for annuities is FV = PMT [(1 + i) n – 1] / i.

3. Incorporate values into the formula.

“FV” stands for future value, “PV” for present value, I for yearly interest rate, and “n” for the number of compounding periods in these calculations. Additionally, “t” denotes the duration in years, and “PMT” stands for the dollar amount of each annuity payment. Calculate each variable’s value depending on your particular investment.

4. Determine future value.

To solve for future value:

- Use the formula.

- As you solve the problem, pay close attention to the sequence of the operations.

- Use our financial calculator to determine future worth when solving.

Why does the Investment have a Future Value?

Investors and businesses may evaluate an investment’s worth using future value. The amount of money spent, the rate of return, and the transaction’s length all affect the investment’s future worth. This valuation method performs best when the investment includes a steady interest rate when making financial decisions.

How does Future Value Calculators help you?

Future value calculators help you in the following ways:

- Future value calculators assist you in making wise plans.

- They facilitate comparisons.

- They make navigating through market turbulence simple for you.

- Future value calculators also assist you in comprehending the ambiguity around future investing situations.

Benefits of Future Value Calculator Online

Some benefits of Future Value Calculator Online include:

- If you invest a certain sum at a specific moment, this calculator will show you how much money will be gathered in the future.

- Choosing an investment that provides a long-term return over inflation is beneficial.

- The calculator assists you in determining if you need to raise the deposit amount and the frequency of deposits.

- The Future Value Calculator Online also assists you in selecting the investment that offers the highest return on your money.

Frequently Asked Questions

How do you calculate the future value of an investment?

The future value formula comes in some different forms, but at its most fundamental, the equation is as follows:

Future value equals current value x (1 + interest rate) n.

The formula, when reduced to mathematical terms, is as follows:

FV=PV (1+i) n

The amount of interest-compounding periods that will take place during the period you are calculating is indicated by the superscript n in this calculation.

Consider buying $1,000 worth of shares with a 10% annual interest rate. The calculation you would use to determine the future worth of your investment after five years would look like this:

FV = $1,000 x (1 + 0.1)5

The calculations show that your investment will be worth $1,610 in future value after five years.

What is the future value of $1000 in 5 years at 8?

$1,000 money invested today, compounded semi-annually at 8%, will be worth $1,480.24 in five years.

How do you calculate the future value of an investment compounded monthly?

With future value, an investment only earns interest on the amount initially invested. Only your principal amount, not the interest produced on that principal, is the interest that accumulates over the years.

If you’re attempting to determine the future worth of an investment that grows monthly, your computation will be like this:

Future value equals current value x [1 + (interest rate over time)]

If the FV formula were reduced to math values, it would appear more like this:

FV = PV [1+ (r x t)]

How do you calculate PV and FV interest?

The future value FV is divided by a factor of 1 + I for each interval between the current date and the future date in the current value formula, PV=FV/ (1+i) n. For the PV calculation, enter the data into the present value calculator. The formula’s n represents the number of periods (years) t.

How do you calculate future value in Excel with different payments?

The financial Excel function FV calculates an investment’s future value using a fixed interest rate. A series of regular payments and a single unit price payment may be made using it.

The following is the FV syntax:

FV (rate, NPER, PMT, [PV], [type])

Where:

Rate (mandatory): is the periodic interest rate. Give the yearly interest rate if you only make one payment each year. If you make monthly payments, you need to provide an interest rate for each month, and so on.

Nper: is the overall amount of payment periods during an annuity, is a necessary field.

PMT, optional: is the set payment made each month. You should use a negative integer to represent this.

PV (optional): The investment’s current value. A negative number ought to be used to represent it.

Kind (optional): This field specifies the type of payments paid.

How do you calculate future value compounded monthly?

The principal amount is multiplied by one to determine monthly compounding. Next, multiply the result by the number of periods divided by the sum of the interest rate and increases it to the power of the number of periods. Lastly, deduct that sum from the principal sum. You’ll get the interest amount from this.

How do you calculate future value compounded semi-annually?

Compound interest is calculated using a formula that considers the principal, P, the lending rate, I and the quantity of compounding periods. P [(1+i) n-1] is the formula you would apply to determine the future value compounded semi-annually.

Expert Opinion

One must estimate the future worth of the amount invested while making financial investments. This is true for him to calculate the value of the invested sum using the chosen interest rate.

This is the foundation of finance and is the focus of this article. You must be aware that you could lose money if you don’t estimate the money’s future value before investing it. As a result, we have dedicated this post to explaining the importance of future value calculation and guiding you through the entire process.

References

- https://www.icicidirect.com/calculators/future-value-calculator

- https://www.business.org/finance/investing/how-to-calculate-future-value-of-an-investment/

- https://www.investopedia.com/terms/f/futurevalue.asp

- https://www.investopedia.com/articles/fundamental-analysis/09/net-present-value.asp

- https://finance.yahoo.com/news/edited-transcript-dxs-ax-earnings-233000025.html