Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

You may make deposits, transfer funds, write a check, make withdrawals, pay bills, and handle other banking operations in person, at an ATM, or digitally with a checking account. There are several benefits of having a checking account too. Thus, we have made this article to educate you on them.

There are several sorts of checking accounts to suit your requirements, and the majority of them enable you to create limitless transactions. On the other hand, some provide additional bonuses, rewards, and convenience. Come along as we explore all these!

What is a Checking Account?

A checking account is a kind of bank account that helps you create necessary banking transactions. A check is frequently placed here, as the title indicates. These are, nevertheless, most often associated with ATMs and banking debit cards.

Essentially, your local bank is the account that is used for activities. When you use your debit card, the amount is deducted from your deposit account. Instead of a savings account, and that’s where the account holder puts money that they don’t care about using.

Benefits of Having a Checking Account

Bank checking accounts provide several advantages to financial customers, mainly ease and security. The following benefits are at the top of the list:

Accessibility

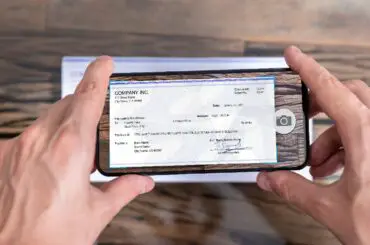

To begin, using your debit card to withdraw dollars in person or at an ATM is simple. You may also use your debit card or checks to access your money for purchases. Online or using a mobile app, you may move dollars in and out of your account.

You may also use your account to set up automated payments to pay your bills each month. With a checking account, you may access your money in several ways, and, in most situations, there are no restrictions on how frequently you can withdraw cash.

Peace of mind

There’s no need to carry all your cash or put it in a shoebox in your closet when you have a bank account. Keeping money at home comes with several dangers, including theft, fires, and other natural calamities. Furthermore, it’s simple to lose track of your expenditures.

You can keep track of monies moving in and out of your checking account with a checking account. In addition, the Federal Deposit Insurance Corporation (FDIC) ensures most banks (FDIC). This implies that each insured bank covers up to $250,000 in deposits by the FDIC per account owner/ownership type.

Direct deposit is more convenient.

You may set up a direct deposit of your salary with your company if you have a bank account. You may have your paycheck immediately deposited into your account each pay cycle instead of waiting for a physical check. Plus, instead of needing to travel to the bank to deposit a regular check, direct deposit allows you to access your cash right away.

Possibility of interest

Certain checking accounts pay interest, meaning your money might increase just by staying in the account. It’s vital to remember that the account may or may not yield interest depending on the amount.

Improve your credit score

A checking account may aid in establishing and improving your credit score. You may make payments on a plan to guarantee that they are paid on time, which will help your credit score. Establishing and sustaining credit requires a well-maintained checking account.

If you’re thinking about buying a home, this is crucial. You may also utilize your bank account information to create a budget and better grip your costs and revenue.

It is easier to pay debts.

Online banking is often available with today’s checking accounts. One of these features is a bill-paying interface. This approach allows you to pay credit card bills, utility bills, and other obligations directly from your outstanding balance.

If you have a fee that is the same each quarter, you can even establish your account for automatic bill payment. In any case, bill payment online is more efficient than paying bills with cash or a fixed amount.

There is a paper trail.

Another drawback of making payments or other expenses in cash is that the transaction may not be properly recorded or filed. What will you do if you paid a $500 electricity payment in cash but the power company does not update your account?

What evidence will you have that you paid the charge in the first position? Either you pay by cash, direct debit, or internet bill pay, it’s all documented in statements and activity general ledger. There is a paper trail for every transaction you make.

They have more functionality than digital wallets.

Individuals may transfer cash to one other via the internet using firms such as Venmo and PayPal. These solutions, as well as other mobile wallet apps, are perhaps one of the factors why so many millennials and people of other ages are ditching traditional banking.

On the other hand, a bank account offers considerably more functionality than any mobile wallet software. Anything from direct payment to payment processing is covered.

Types of Checking Accounts

Banking checking accounts come in a variety of shapes and sizes, giving users a variety of options for investing in their operations. Conduct studies before choosing a checking account to see which sorts of bank accounts most fit your needs. The most prevalent checking account categories are as follows:

Fee-free checking accounts

Such accounts are exactly what they claim to be. They don’t charge subscription fees, however, account direct debits and certain bank operations, such as printing published financial records, may be charged.

It’s no wonder that unrestricted checking accounts are popular, given that the average actual charge of a checking account is roughly $160.

Online account checking

Individuals with online accounts are increasing each year as a result of the expansion of e-commerce. Many online checking accounts don’t charge extra charges and give customers access to their money 24/7.

Checking accounts that are shared

Partners often maintain their cash in multiple-user joint checking accounts. Possessing all of their income in one location could make household finances much easier to manage.

Accounts for students

Banks are increasingly offering younger financial customers customized checking accounts. These accounts often have minimal fees, low or no minimum balance requirements, and special offers for younger customers.

Checking accounts for businesses

Money is kept in business banking accounts by both large and small businesses. This company specializes in dealing with vast sums of money and a high volume of financial transactions. Business checking accounts are often linked to business lines of credit by banks.

High-yield checking accounts and money market accounts

Traditional checking accounts provide lower interest rates than high-yield checking and money market accounts. They do, however, result in higher initial account asset restrictions.

This may limit the number of transactions a client may do each month. It’s also worth mentioning that bank savings and bank checking accounts have significant distinctions. The main difference is that it is based on a calendar. A checking account, also known as a transactional account, allows consumers to transfer money frequently, often even daily.

A financial savings account, on the contrary, is designed for the long term. This will enable you to save money in one place and keep it safe from being utilized for everyday purchases.

Frequently Asked Questions

What is a checking account?

A checking account is a bank account that enables you to make essential withdrawals and deposits. As the name implies, this is often where a check is deposited. However, they are most commonly connected with ATMs and bank debit cards.

What are the benefits of having a checking account?

The following are some of the advantages of having a checking account:

- Accessibility

- Peace of mind

- Direct deposit is more convenient.

- Possibility of interest

- Improve your credit score

- It is easier to pay debts.

- A paper trail exists.

- They have more functionality than digital wallets.

What is the difference between a checking account and a savings account?

For regular transactions, a checking account is utilized. The savings account stores money for the long term and earns interest.

Does interest accrue on checking accounts?

Checking accounts, in general, does not earn interest since they are used for short-term deposits and spending. On the other hand, some checking accounts offer an interest rate, allowing you to earn money on your checking account balance.

An interest checking account may be perfect for you if you intend on retaining a large sum in your checking account.

Are checking accounts worth it?

Yes. As highlighted above, setting up a checking account is worth it because of its diverse merits. Furthermore, these merits usually outweigh any possible issues you encounter while using checking accounts.

Conclusion

In conclusion, there are numerous benefits of having a checking account. And for more help in this regard, the highlight above will be indispensable for you.