Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Many of us are pretty busy. There can be dishes to wash, kids to feed, and errands to do in addition to our active occupations. We often ponder how long something will take if we have to accomplish it outside of our typical routine. For instance, you could be curious about how long it takes to open a bank account if you require a new checking or savings account.

The answer will vary depending on your bank and how you opened your account. But it might take anything from a few seconds to a few days. If you want to save money for a particular reason, you may want to first speak with a financial expert. Moreover, the highlight we provide below will be very helpful to you. Come with me!

How Long It Takes to Open a Bank Account?

What is the time frame for opening a bank account? Sadly, the answer is “it depends.” If you’re starting an account online and have everything ready, you may be able to finish the application in 10 to 15 minutes (or less). It can take a day or two to process your application and provide your account number. Although opening a bank account online might be simple, it is unlikely to be quick.

It can take much longer if you establish an account in person (i.e., 30 minutes to an hour or more). If you don’t make an appointment in advance, you may have to wait a long. This is the recommended way to do it if you have money that must be deposited into a bank account. Your report will be fully active in minutes if everything is in order.

Things to do Before Opening a Bank Account

Two crucial choices must get made before you can create a new bank account: These comprises;

A. The location of account opening.

Typical options for where to store your money include the following:

Banks: When individuals use the word “bank,” they refer to physical banks. The major international and smaller, more regional chains fall under this category. They have locations you may visit, usually via a lobby or drive-through, and they provide various lending and savings options.

Credit Unions: However, credit unions are a distinct financial entity (usually brick and mortar). Members in this structure are account holders. There are several national credit unions.

In terms of their branches and reach, others are more local. Members must fulfill specific requirements to join, sometimes relating to their occupation or location. Additionally, they often profit from reduced loan interest rates and more excellent savings.

Financial Institutions Online: Online banks likely provide services that are comparable to those of traditional banks. Account holders will, however, bank online or through the mobile app. Online banks often offer excellent interest rates and charge lower fees than conventional banks since they don’t have to maintain the costs of physical facilities.

B. The kind of account that you like

You are prepared to go on to the next stage after deciding whether conventional, internet, or credit union banking seems the best match for you. What kind of account to start is the second important choice. One possibility is;

Checking account: A checking account is created by the account holder putting funds into the account. This might get done in person, via the internet, or with direct deposit. They may then use a debit card, an online payment method, or a cheque to make a payment. They may use this to pay bills, buy things, and do other things. The funds in the account might sometimes yield interest.

Savings account: Once funds get placed into a savings account, the intention is often for them to grow. This may serve as an emergency fund or a way to set aside money for a more significant purchase. The interest rates that different financial institutions will charge will vary. As a result, you may wish to compare shops to get the most excellent prices. This is in addition to mentioning if there are any additional limitations, such as minimum balance requirements.

Money market accounts: Another popular choice is money market accounts. These often get used to saving funds the account user has no immediate plans to spend. Additionally, many money market accounts provide practical check-writing and debit card functions. If you do want to use the money you deposited, this works. This kind of account also generates interest.

You will have the most remarkable account if you consider these aspects.

Requirements to Open a Bank Account

Before creating a bank account, you must meet specific prerequisites. They consist of:

- A legitimate, government-issued picture ID, such as a passport or driver’s license. Non-drivers may obtain a state ID card at the Department of Motor Vehicles office.

- Additional fundamental data include your phone number, Social Security number, or Taxpayer Identification Number.

- A $25 initial deposit is required to start an account. Credit, debit, or prepaid cards get accepted for payment of this. It is also permissible to transfer money from another US Bank account or financial institution.

How to Choose the Right Bank?

Choosing the best bank to create an account with might be challenging since most people think banks don’t matter when creating an account. Here, we’ll discuss some crucial factors to consider while choosing a bank before opening a respectable account;

- Choose the appropriate account: Seek banks with little or no costs. This includes credit card fees, overdraft fees, ATM withdrawal, and maintenance fees.

- Take into account the ease of a bank branch.

- Research credit unions

- Look for a bank that accommodates your way of life.

- Check out the digital features. This might include offering an internet service or a smartphone app. This would enable you to do banking whenever you need to and from any location.

- Recognize the rules and regulations.

- Review the banks you’re thinking of using.

How to Open a Bank Account Online in the USA

Opening a bank account online may be fast and straightforward in the USA. You may avoid going to a bank branch by doing it in a matter of minutes. It can also be your only choice if you create an online bank account. Use the following procedures:

- Select the kind of account you want.

- Gather your papers and data in advance. Your Social Security number or another form of identity might get used here.

- Provide your details on the application.

- Add money to your internet banking account

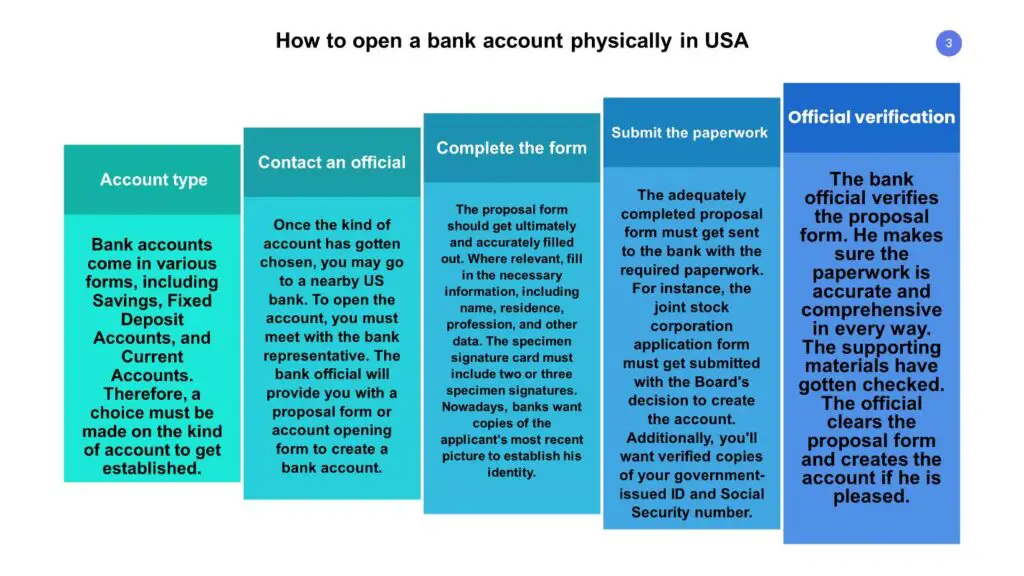

How to Open a Bank Account Physically in the USA?

The methods listed in the infographic below may get used to open a bank account in the USA physically:

Pros & Cons of Opening a Bank Account

| Pros | Cons |

| Possibility of setting up a routine savings program. | Rates may change. |

| Simple access to your funds | The desire to spend. |

| Your funds will earn interest. | Limit of six withdrawals. |

| Most bank accounts may get opened without cost. | Potential government withdrawal restrictions from banks. |

| You do not get locked out for any length of time. | |

| Your cash is secure. |

What to Do Before Opening a Bank Account?

Before Opening a Bank Account, you should do the following:

- Pose the appropriate queries: Not every bank is the same. Request recommendations from your friends and family! Finding a bank you can trust is vital; sometimes, relatives or friends may assist depending on where they bank.

- Consider Your Account Options

- Be Ready to Put Down a Deposit

- Present current documentation

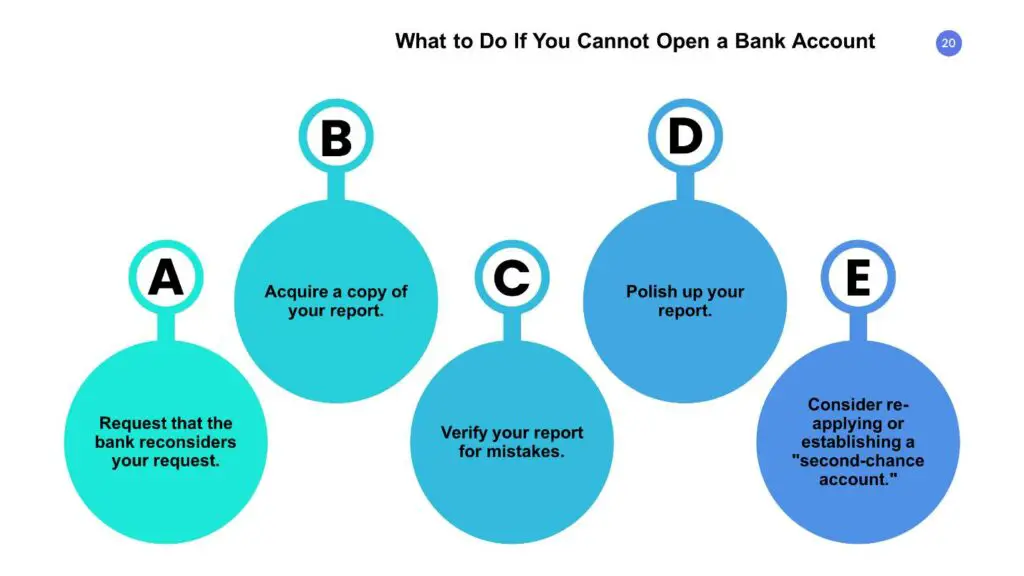

What to Do If You Cannot Open a Bank Account

What you should do if you are unable to create a new bank account is as follows:

Frequently Asked Questions

How long does it take for a deposit to show up in your bank account?

In most cases, the financial institutions immediately show the deposits; however, in some cases, it can take 24 hours to reveal in the bank account, depending on the time the deposit is made.

How long does it take to open a basic bank account?

If you have arranged all your material and want to open an online account, then it is possible that you can fill out your application within 15-20 minutes. Processing the application and issuing the account number can take a day or two.

It can take seven to ten business days to receive the debit card and the additional account information in the mail. If you want to open a personal account, the process can take some time. Make sure to book an appointment unless you will have to wait.

Why isn’t my direct deposit showing up?

The direct deposits do not show up. The reason behind this is simply that it is going to take extra days to process. The delay can be due to holidays or the deposit request going out of business.

Is cash available immediately after deposit?

The cash deposit mostly depends upon the bank policy. In most cases, cash will be available immediately or the next business day. The money will be available immediately if you deposit cash using your ATM.

Which bank opens an account instantly?

The IDFC bank opens the account instantly.

What’s the easiest bank to open an account with?

The people bank is the easiest bank to open an account with easy and understanding policies.

What is the most accessible bank account to open online?

Barclays Easiest Bank is the most reliable online bank and has easy requirements to open an account online. Other than that, Chime, Discover Online, Credit Union, Wells Fargo opportunity, and radius bank are the most accessible banks to open an account online.

Does Direct Deposit happen at midnight?

Most employees can expect the deposit to arrive at midnight. However, the direct deposit is not subject to the bank for use. You can use the deposit as soon as it arrives in the bank.

What time of day do direct deposits Post?

Most employees expect the deposit to arrive at midnight and the next day. However, the direct deposit is not subject to the bank for use. You can use the deposit as soon as it arrives in the bank.

Conclusion

We have many things to cover with our busy routine. When we have something to do out of the way, we usually think of how long it can take to finish. One of such out-of-routine tasks is to open a bank account. Now you will question how long it takes to open a bank account?

There are certain things you need to know before opening a bank account. For example, what kind of account do you acquire? If you want to open a personal account, the process can take some time. Make sure to book an appointment unless you will have to wait. The best thing that can happen is that you can receive your ATM card and debit card on the spot.

If you have arranged all your material and want to open an online account, then it is possible that you can fill out your application within 15-20 minutes. Processing the application and issuing the account number can take a day or two.

Author’s Personal Opinion

Several alternatives are available if you wish to create a bank account in the US. Establishing a bank account is often a simple process. Most banks and credit unions adhere to a simple procedure like the one previously mentioned.

Choosing a bank, giving the necessary information, and financing your account are often all required to start an account. You may begin using your account as soon as the formalities are finished, thus saving time and resources.

In all, knowing how long this will take is quite essential. Thus, the above tips on how long it takes to open a bank account will aid you immensely.

References

- https://www.monito.com/en/wiki/open-bank-account-us-even-without-proof-residency

- https://www.lifehack.org/articles/money/7-things-every-teen-needs-know-when-opening-bank-account.html

- https://www.bossrevolution.com/en-us/blog/us-bank-account-for-non-resident

- https://wise.com/gb/blog/how-to-open-a-bank-account-in-usa