Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Because there are no required minimum distributions and tax-free withdrawals, a Roth IRA might be an excellent method to save for retirement. Compound interest is a crucial aspect of this. Interestingly, manual calculation of this may be rather difficult. Thus, we have made this post on the compound interest calculator Roth IRA to aid you.

Additionally, every taxpayer dreams of having tax-free money. And it’s a fact if you save in a Roth account. Roth’s are the newcomers to the world of retirement savings. The Roth IRA, established in 1998 and named after the late Delaware senator William Roth, was followed in 2006 by the Roth 401(k).

One effective retirement option is to establish a tax-free source of income. These accounts have substantial advantages, but complicated Roth rules may apply. Learning all about the Roth IRA, in addition to its calculations, will also aid you greatly. Come along!

What is a Roth IRA?

A Roth IRA is a private retirement account that you may establish with money that has already been taxed or after-tax income.

As a result, even if your tax bracket changes in the future, you won’t have to pay taxes when you remove money from your account. As a result, Roth IRAs may be favourable for folks just starting their professions since they provide their assets more time to develop. Additionally, you can have a lower tax rate if you’re just starting.

A retirement savings account is sometimes an individual retirement account (IRA). The main advantage of a Roth IRA is that after age 5912, deposits and the gains on those contributions may be withdrawn tax-free. This is true as long as the account has been active for at least five years. In other terms, you pay taxes on the funds you deposit into a Roth IRA, and any withdrawals you make after that are tax-free.

How to Calculate Compounded Interest in a Roth IRA

You can easily perform this calculation using our Compound Interest Calculator Roth IRA. The steps include:

- Enter the Initial Investment Amount

- Enter the Annual Interest Rate (%)

- Put the number of months the money is invested

- At this point, the Compound Interest Calculator Roth IRA will process and give you the output.

Compound Interest Calculator Roth IRA

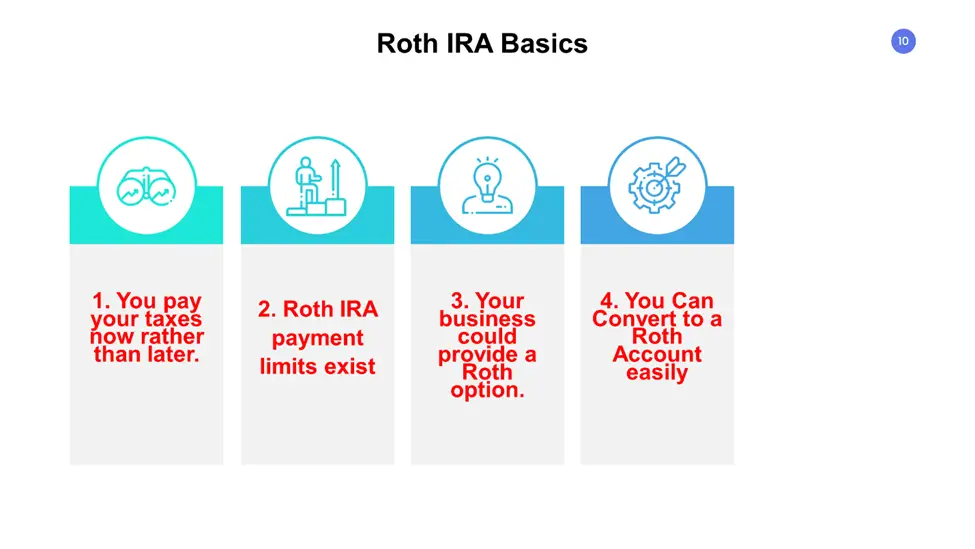

Roth IRA Basics

Here are some fundamentals about using a Roth IRA as part of your retirement income that you need to be aware of.

You pay your taxes now rather than later.

Roth’s completely invalidates traditional IRA and 401(k) regulations. With a Roth, you may save after-tax money and take tax-free withdrawals in retiring rather than receiving a tax advantage when money is put into the account and paying tax on all releases.

If you’re in a higher tax bracket, the Roth method of paying taxes instead of later will benefit you. This is also true if you remove the funds rather than take advantage of the standard account’s tax benefit. However, the Roth benefit would be reduced if your tax bracket is lower.

Roth IRA payment limits exist.

You must have earned money to be able to make contributions to a Roth. Additionally, you may only put a maximum of $6,000 in a Roth IRA for 2022, plus an additional $1,000 if you’re 50 years old or older. For 2023, those sums remain the same. The sum of your contributions to both regular and Roth IRAs cannot go beyond this yearly cap.

Your business could provide a Roth option.

Many businesses have expanded their 401(k) plans to include a Roth option. Since the Roth only accepts after-tax money, you won’t get the instant tax benefits of making a pre-tax contribution to a regular plan. However, your money will increase tax-free. Any company matching will also be deposited into a conventional 401(k) account.

You Can Convert to a Roth Account Easily

Converting conventional IRA funds to a Roth is another fundamental aspect of a Roth. You must pay tax on the whole amount transferred into the Roth in the conversion year. You pay that amount to get future tax-free gains. A part of your conversion will be tax-free if you make nondeductible donations to your conventional IRA.

This has also been highlighted in the infographic below.

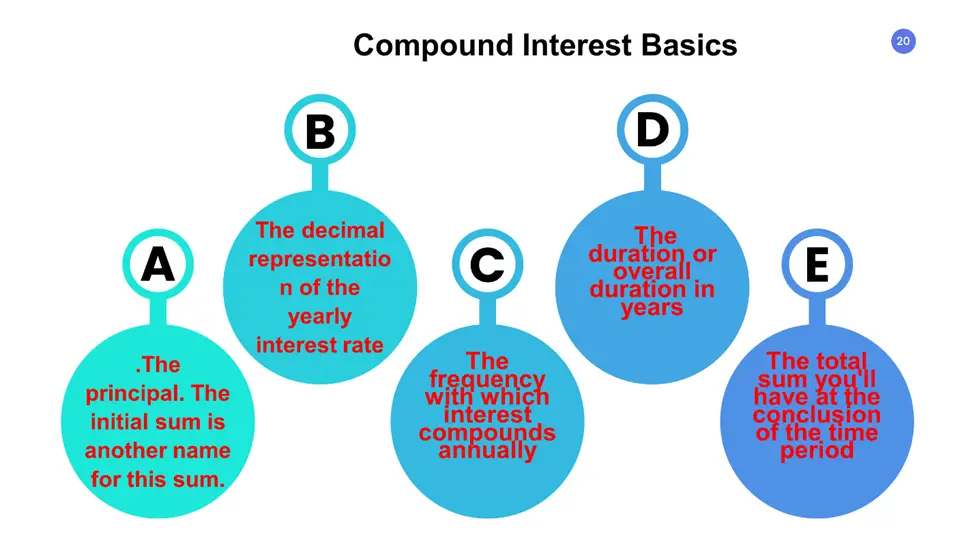

Compound Interest Basics

Compound interest is a factor that can’t be ignored. In other words, depending on the size of your original investment, the appreciation effect may provide steadily rising returns. Therefore, you will earn more interest the more often you save and the more you save overall. The “magic of compound interest” is another name for this.

The compound interest basics include:

- Principal: The initial sum is another name for this sum.

- The decimal representation of the yearly interest rate

- The frequency with which interest compounds annually

- duration or overall duration in years

- total sum you’ll have after the time

How an IRA Works

All IRAs function in much the same manner. Contributed money may be used to purchase a range of stocks, bonds, ETFs, unit trusts, and other financial assets. These assets are tax-deferred, which implies that any capital gains are postponed from taxation and that dividends and interest income earned inside an IRA are not included in the owner’s earnings each year.

Simply said, as long as assets are kept inside an IRA, the account owner won’t owe any taxes on them.

Some types of IRA and how they work include:

Conventional IRA

A conventional IRA is a “pre-tax” account, which means that you may be able to exclude your donations from your taxable income each year up to the IRS’s yearly limit.

You won’t have to continually pay capital gains and dividend taxes since your assets are permitted to grow and accumulate on a tax-deferred basis. Once you remove the funds, they are considered income and may be subject to taxation.

Roth IRA

Because a Roth IRA is an “after-tax” account, your tax deduction for Roth deposits is unavailable. However, until retirement, your Roth IRA assets will grow tax-free, and any qualifying withdrawals from the fund will be completely tax-free.

Simple IRA

Small firms may provide retirement plans to their workers via SIMPLE IRAs. Employers may also make contributions to SIMPLE IRAs on behalf of their workers in addition to individual contributions. A SIMPLE IRA has the same tax structure as a regular IRA. This indicates that although donations are tax-deductible, transfers are taxable income.

Why Should You Invest in a Roth IRA?

Retirement savings accounts are called Roth IRAs to grow on after-tax contributions. So, before you put money in your retirement account, you must pay taxes. This has a lot of positive effects. A few of them are:

Tax-free Retirement withdrawals

The main benefit of a Roth account is that, unlike standard IRAs and other retirement plans, disbursements are not taxed. These requirements are simple to satisfy, particularly if you start saving early, even if you must be 5912 or older and have owned the account for at least 5 years to take those tax-free withdrawals.

Tax-exempt income

Either via interest on a term deposit or investment gains on an investment account, your account will accrue more funds. Additionally, no taxes will be levied on this extra cash. Thus, if you make a $20 contribution to a Roth IRA and it increases to $30, the $10 growth is yours to spend any way you choose tax-free.

Quick access to your funds should you need them.

Since you have paid taxes before donating to the Roth IRA, you are not subject to a tax penalty when you remove the money. In case of an emergency, it’s a wonderful benefit. Until you reach age 59.5, your profits will be subject to taxation.

It’s important to keep in mind, though, that some account types might charge a fee for withdrawals. So, before making a withdrawal, make careful to review the conditions.

As long as you have a source of income, you can donate.

You may keep contributing to a Roth IRA if you’re producing money. Therefore, if you want to continue working, you may benefit from the flexibility of seeing your account grow.

There is no mandate to start withdrawing.

You must start withdrawing from conventional IRAs and other retirement funds at 72. However, there are no lifetime minimum distributions for your Roth IRA. Thus, you can use all or a portion of the cash for retirement or let it grow for your heirs.

Example of Compound Interest Calculations

Compound interest is interest that builds up over a certain length of time on both principal and interest. An example of compound interest calculation includes:

For two years, Noah loans Emma $4000 at a 10% annual interest rate compounded every six months. Can you assist him in determining how much money he will get from Emma after two years?

Solution:

$4000 is the primary amount, or “P.” 10% a year is the interest rate, or “r.” Conversion time is half a year, and the interest rate is 10/2% each half year, or 5%. The duration’s’ is two years. The number n for compounding is 2.

Let’s replace the provided information in the compound interest formula: A = P (1+{r / 2}/100) 2n= 4000(1+ {10 / 2}/100) 2(2) = $4862.03

As a result, the total sum is $4862.03; the compound interest formula simplifies the calculation.

How do you earn compound interest in a Roth IRA?

Investments that, hopefully, will appreciate over time are the focus of a Roth IRA. You don’t instantly start investing when you create a Roth IRA. Simply put, you’re creating a container for the funds you want to set up for retirement.

Over time, your assets may generate interest or dividends. A company pays its shareholders a dividend, a portion of its profits. To constantly earn interest on your account balance, compound interest in a Roth IRA works by adding repeated interest or reinvested dividends to your principle.

The value of certain assets, including mutual funds, equities, and exchange-traded funds, may increase yearly over time.

The compounding growth of your assets might thus be impacted. Your returns may fluctuate more and be less predictable if you invest your money in higher-risk assets. You could even incur a loss some years.

What determines the Rate of Return?

The following factors usually determine the rate of return:

Expected Inflation Rate

Every economy will likely experience inflation, which is OK up to a certain percentage, but inflation that is more than that is bad for the economy. We must take inflation into account when calculating predicted rates of return. The needed rates of return rise in direct proportion to inflation.

Adopting a successful economic strategy that will allow an economy to have an acceptable inflation rate is the central bank’s duty and the government’s. The needed rate of inflation has an impact on the decision-making process for investments.

The connection between risk and investment

You know, nothing exists when danger is not present. Additionally, money is more susceptible to danger. The risk may differ from sector to sector, firm to organization, and individual to individual.

The general rule is that you may anticipate greater rates of return from an investment the higher the risk, even though different people’s risk-taking tendencies may vary. Risks may be roughly divided into two types: systematic risks and unsystematic risks.

The evolution of interest rates over time

The needed rates of return do not necessarily have to be the same for everyone. The rate will change depending on the economy and the individual’s propensity for taking risks. Therefore, it would benefit you more if you first determine the influencing elements before determining the needed rates of return on investment.

How do you open a Roth IRA?

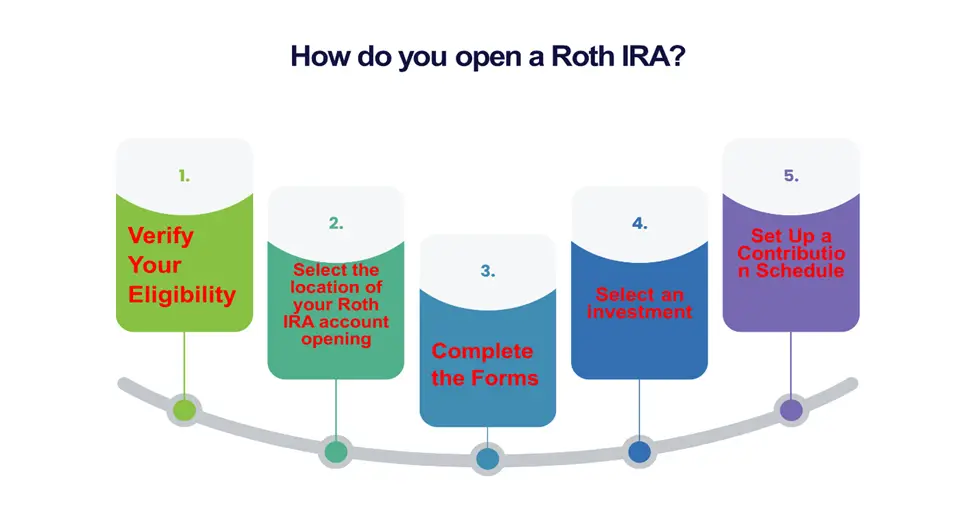

Most investing firms offer Roth IRAs, and opening one is simple. Review your investment options and the financial institution where you’ll establish your account. Additional stages include the ones listed below:

Verify Your Eligibility

As long as they have earned money for the year, most persons are qualified to make contributions to a Roth IRA. Remember that income restrictions depend on your modified total income if you consider contributing to one.

Select the location of your Roth IRA account opening

Nearly all investing firms provide Roth IRA accounts. If you already have a conventional IRA, your current provider may be able to start a Roth IRA for you. Since it takes custody of your money, the bank with whom you establish the account is a custodian.

Complete the Forms

You may start the process by going to the Roth IRA pages on the websites of the majority of banks and brokerages. If you have any issues, you may ask a customer care representative, or you might be able to finish the full application online.

Select an investment

The financial institution will assist you in opening the account, but it is up to you to select how to invest the funds that go into your Roth. The hardest element of opening a Roth IRA may be this. Most financial institutions provide a wide range of possibilities from which you may choose to create your portfolio.

You might also invest in a target-date fund or existence fund. It resembles a pre-made portfolio created by an investment firm for someone your age.

Set Up a Contribution Schedule

You may set up recurring monthly payments from your bank account to your Roth IRA if your bank permits it. As long as you continue to fulfil the income criteria, you may also choose to make an annual payment. Up to the deadline for paying your taxes for the following year, you may contribute to your Roth IRA.

Personal Opinion

The best candidates for Roth IRAs are those who anticipate future tax increases. You have a variety of alternatives when investing for retirement. There are various IRA varieties, as well as 401(k)s, 403(b)s, and thrift savings plans.

Even while all of these options may help you increase your wealth and have a nice retirement, Roth IRAs are the only ones that allow tax-free withdrawals. This can be especially advantageous when you’re closer to retirement, on a low income, and potentially subject to higher income taxes. The Compound Interest Calculator Roth IRA will also aid you greatly with this.

References