Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

The Chase bank debit card is considered a trustworthy brand in the American financial segment. Secular, robust, and influential, its financial services have continuously been developed for upper-middle-class clients who demand, above all, differentiated service and the certainty that their money will be well kept and invested. Below, we highlight some of the best cards in this category and their peculiarities.

Furthermore, with the acquisition of Bank One in 2004, CHASE became the largest debit card issuer in the United States. Shortly after that, in 2006, it acquired the Bank of New York Company’s banking network, which gained access to 700,000 new customers and 338 branches in Connecticut, Indiana, New Jersey, and New York.

CHASE continued its strong tradition of offering high-quality and profitable card services to demanding customers in the following years.

Overview of Chase Bank

The consumer banking division of JPMorgan Chase & Co., Chase Bank, is one of the biggest full-service banks in the country. It provides both people and companies with a wide variety of financial products and services.

Chase is widely renowned for its comprehensive credit card products, which include well-liked cash back and travel reward credit cards in addition to checking, savings, and CD accounts. Chase offers accounts for individuals, students, and children that can meet most requirements.

At Chase Bank, you may find anything from checking and savings accounts to credit cards, mortgages, and other loans. Chase is a good option to consider if you want to simplify your money by keeping all of your accounts, loans, and credit cards with the same provider.

You may gain from having all of your financial “things” with a single supplier, even if this isn’t usually the ideal financial approach since it pays to shop around. Making payments is often simpler, and if you frequently visit your local bank for customer care, they may grow to know you and your requirements well.

Chase not only offers all the financial services you may need, but it is also extensively accessible. It now runs more than 4,700 branches and tens of thousands of ATMs in the United States, albeit it doesn’t cover the whole nation. Chase also provides a feature-rich online banking system if you cannot locate a branch or ATM abroad.

What is a Chase Bank Debit Card?

Chase debit cards are instruments that let customers use money from their checking accounts in secure and practical transactions. When you establish an account at a branch or other financial institution of Chase Bank, Chase debit cards are often offered. However, there may be instances in which you must make the request yourself.

Best Chase Bank Debit Cards

As earlier highlighted, Chase bank debit cards come with various merits. To enjoy these, you will have to make use of the card that best suits you. Some of these include:

- Chase Sapphire Reserve card

- Chase Business Debit Card

- Chase Employee Deposit Cards

- Chase Business Associate Debit Cards

Chase Sapphire Reserve card

The Chase Sapphire Reserve card stands as one of the best debit cards available.

Benefits of the Chase Sapphire Reserve card

With the Chase Sapphire Reserve card, customers obtain several benefits.

This includes:

- Access to the loyalty program. This entails a list of attractive shopping offers from Chase bank partners.

- 50,000-point sign-up bonus. (You can get this after spending $4,000 in the first three months). This makes the card ideal for frequent travellers.

- Customer service is available daily.

- Access to several insurance options

Requirements to obtain the Chase Sapphire Reserve card

To apply for the Chase Sapphire Reserve card, you need to go to your closest bank branch. They will ask you to meet some requirements such as the following:

- Proof of current address

- Social security card

- Valid driver’s license

- A bill with your current address and name

- State identification card

- Confirmation of enrollment in an accredited school. ( This is possible when applying for the card as a student).

Chase Business Debit Card

This debit card also comes as an excellent option for many.

Benefits of the Chase Business Debit Card

With the Chase Business Debit Card, customers obtain several benefits. This includes:

- Everyday convenience

- Easy withdrawals and deposits at the ATM

- The added protection of transactions

Requirements to obtain the Chase Business Debit Card

To apply for the Chase Business Debit Card, you need to go to your closest bank branch. They will ask you to meet some requirements such as the following:

- Valid driver’s license

- A bill with your current address and name

- State identification card

- Proof of current address

- Social security card

Chase Employee Deposit Cards

The Chase Employee Deposit Cards serve most people excellently.

Benefits of the Chase Employee Deposit Cards

The Chase Business Debit Card provides various benefits for its customers. This includes:

- Staff accessibility to your account is adequately controlled

- Employees are prohibited from removing funds from your account

- Monthly bills are paid quickly.

- Workers are only allowed to make ATM inputs.

- No purchases or modifications to your card or profiles may be made without your permission.

Requirements to obtain the Chase Employee Deposit Cards

To get the Chase Employee Deposit Cards, you need to go to your closest bank branch. They will ask you to meet some requirements such as the following:

- Valid driver’s license

- A bill with your current address and name

- State identification card

- Date of birth

- Employee’s legal name, residential address, and date of birth

- Proof of current address

- Social security card

Chase Business Associate Debit Cards

This also stands as an excellent Chase debit card.

Benefits of the Chase Business Associate Debit Cards

With the Chase Business Associate Debit Cards, customers obtain several advantages. This includes:

- Participation in the reward program. This is a collection of enticing shopping deals provided by Chase bank affiliates.

- Allows all workers to make transactions • Helps in saving time and ensures you to establish daily restrictions for Cash withdrawals and point-of-sale transactions • 80,000-point login bonus For regular tourists, this renders the cards perfect.

- Client assistance is accessible 24 hours a day, 7 days a week.

- Accessibility to a variety of covered services

Requirements to obtain the Chase Business Associate Debit Cards

To apply for the Chase Business Associate Debit Cards, you need to go to your closest bank branch. They will ask you to meet some requirements such as the following:

- A bill with your current address and name

- Proof of current address

- Social security card

- Employee’s legal name, residential address, and date of birth

- Valid driver’s license

- State identification card

- Confirmation of enrollment in an accredited school ( when applying for the card as a student).

Advantages & Disadvantages of a Chase Bank Debit Card

The Advantages & Disadvantages of a Chase Bank Debit Card have been highlighted in the table below:

| Advantages | Disadvantages |

| Flexibility | Not accessible in every state. |

| Savings products with low-interest rates. | Hefty out-of-network ATM surcharges |

| Protection | Many banking fees |

| Ability to connect many bank accounts | |

| ATM deposits are simple. | |

| More choices and benefits | |

| Simple withdrawals |

Things to Consider before getting a Chase bank debit card

You need to go to your closest bank branch to apply for the Chase Bank Debit Card. They will ask you to meet some requirements such as the following:

- Valid driver’s license

- A bill with your current address and name

- State identification card

- Proof of current address

- Social security card

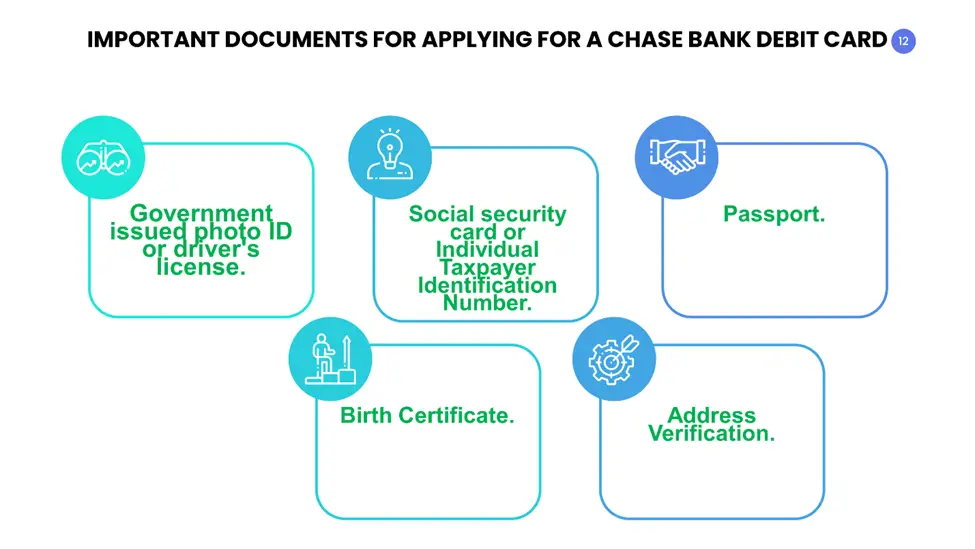

Important Documents for Applying for a Chase Bank Debit Card

Some important documents for applying for a Chase Bank Debit Card include:

- Government-issued photo ID or driver’s license.

- Social security card or Individual Taxpayer Identification Number.

- Passport.

- Birth Certificate.

- 5Address Verification. It must include your name and home address. This may be an accurate and up-to-date: lease agreement. Loan agreement.

This can also be seen in the infographics below:

How to Place an Order for Chase Bank Debit Card

It’s never enjoyable to discover that your Chase bank card has now been misplaced, confiscated, or destroyed, but Chase has made it simple to request a replacement card. To fulfil your demand, you may utilize the application or go to Chase.com. You’ll get your new debit card within 5 working days if you do this.

You can apply for a new card on Chase.com or using the app via the following steps:

On the Chase app:

- Launch the app and double-check that you’re logged in.

- Then, for a replacement debit card, touch the savings account. You may click the credit card you want to update if you have one.

- Browse until you see the chance to Replace a missing or broken card.

- Select your cards and the purpose for replacing them.

- Evaluate your demand thoroughly before submitting it.

On Chase.com:

- Log in to your profile at chase.com.

- Choose the account associated with the debit card you’d want to update.

- In a section titled “Activities you could do,” you’d see a drop-down list.

- Choose “Substitute a stolen or destroyed card” from the drop-down option.

- After that, select the card you want to exchange and send your application for an evaluation.

- Within one business day, you will receive a reply.

- Chase will issue you a new card within 3-5 working days of receiving your application.

Benefits of Chase Bank Debit Cards

Stopping at the bank or checking in at the register can be time-consuming. A debit card is swiped like a credit card, but money is taken straight out of a bank account in the same way it is when you pay with a paper check. Having a Chase Bank debit card will give you this merit, in addition to other options when it comes to paying for items and managing your money.

Some of these benefits include:

Flexibility

You can use a Chase debit bank almost anywhere. You have the option of swiping your debit card at stores, giving it to waiters to pay a restaurant bill, or taking it to an ATM to withdraw cash.

Also, use your Chase Bank Debit Card online to pay for items you’ve ordered over the Internet. All you need to do is punch your name, account number, and security code at checkout, just as you would a credit card.

Protection

You will also have the option to sign up for fraud protection with your Chase bank debit card. Chase bank has a unique system in place to help protect your card number from being stolen online, even when you want to save your debit card number to a store’s website.

You can also get a refund for unauthorized debit card transactions if your card is lost or stolen. There are different levels of protection available for both personal and business debit cards. Talk to a Chase bank representative to make sure you have the protection you are looking for.

Linking of multiple bank accounts

Chase Bank gives debit cardholders the option to link multiple bank accounts. This can provide protection when it comes to overdraft fees. You can also avoid frustration and embarrassment on occasions when your checking account inadvertently goes into a negative balance.

Chase bank will also allow you to link your card to other accounts, such as a savings account or money market. You can also pull money from these accounts to pay for a purchase if you swipe the card. This would be possible when there is not enough money in your primary checking account.

More options and perks

If you upgrade your Chase debit card to a rewards card, you will have the option to earn points each time you make a purchase using your debit card at specific stores and websites. When you earn enough points, you can easily exchange them for goods or travel accommodations.

Your debit card will also give you access to online bill payments, which can save you time each month. You can further set the bills themselves to be paid in a cycle or log in and pay them manually.

Can You Trust a Chase Bank Debit Card?

Clients who need access to several branches can use a Chase Bank Debit Card. This is also true for those who don’t want to pay the most interest rates and can maintain a high enough balance to avoid a monthly charge.

Frequently Asked Questions

Does Chase offer a debit card?

Yes. Chase provides new clients with a debit card. They can use their phone, tablet, or computer to do their banking and make purchases practically anywhere. In addition, you may use more than 16,000 ATMs and 4,700 branches.

Is the Chase debit card free?

Yes. A few Chase debit cards have no monthly service charges. You may use this to manage your accounts in one place.

How long does it take to get Chase’s debit card?

Your card will arrive within 3 to 5 days of creating your new account. You may request a replacement card online if you don’t get it after two weeks.

Can you get a Chase debit card the same day?

No, Chase no longer provides quick-issue debit cards, and delivery takes approximately 3 to 5 business days.

Which debit card is best for me?

You should use the Chase cash back rewards credit card. By applying for this card, you may use the money you get to reduce your credit card debt or just to have more spending cash.

Conclusion

In conclusion, Chase bank debit cards come with various merits. And if you desire to enjoy them, the highlight above would aid you immensely.

Personal Opinion

Chase is JPMorgan Chase & Co.’s consumer and business banking subsidiary. It is one of the biggest banks in the country and expanded after merging with JPMorgan & Co. in 2000. With $2.9 trillion in assets today, the banking firm serves almost half of all American families with its services. The Chase bank debit card is an excellent choice in this situation.

Talking of innovation, all of your accounts with Chase are integrated. You may have immediate access to the balances of your checking and savings accounts and your unpaid credit card amount when you visit your mobile account, for example. Your card may pay bills, send money to friends and family, and move money between accounts. The above tips will also aid you in making the best choice.

Resources