Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Can a bank be closed for more than 3 days? According to 2010 Tennessee Code Title 45 – Banks and Financial Institutions, Chapter 2 – Banking Institutions, Part 6 – General Powers of Banks 45-2-604, A bank that is not a member of the Federal Reserve System can’t be closed for more than 2 days.

Banks must set their operating hours, with the caveat that the commissioner must approve closure for more than two consecutive weekdays, except that a bank is free to close on Saturdays, Sundays, and legal holidays, as well as during emergencies, as specified in § 45-2-603.

The only exception is if the institution has a banking charter from another state, subject to limitations imposed by that state. Federal law does not contemplate that the FDIC could close a bank for three days. The FDIC’s procedures for closing banks allow for longer periods, but only with agreement from federal regulators. However, some states may not allow the FDIC to close banks in their state.

Read More: How to Get Money from a Closed Bank Account

Why does the bank need to be closed for more than 3 days?

Bank closure is a fairly common occurrence in the United States. The FDIC (Federal Deposit Insurance Corporation) mandates that banks close for more than three days if they deal with any significant operational or safety issue.

The FDIC has a list of reasons for closing a bank for more than 3 days, and these include:

- A natural disaster that could have an impact on the bank’s employees or property;

- A significant operational or safety issue at the bank;

- An event that could affect the bank’s ability to transact business;

- An event that would disrupt access to the bank’s premises and services.

- Bankruptcy or receivership.

Banks that fail to file a return for 3 consecutive years may have their charter revoked. This includes banks that are closed and not yet reopened. Other reasons for revocation include the following:

- The bank’s board of directors, shareholders, or creditors have not acted in good faith;

- The bank has fallen into unsound financial condition and is unlikely to be able to continue operations;

- Bank has been engaged in fraud or other illegal activity;

- The bank’s assets are not protected from loss or misuse, and there is a danger that the assets will be lost or misused;

- The bank has violated a state usury law, an anti-money laundering statute, or similar law.

What happens after a bank is closed for more than 3 days?

If a bank is closed for more than 3 days in the US, the FDIC (Federal Deposit Insurance Corporation) will take over, and it will reopen as soon as possible. The FDIC is an American government agency that provides deposit insurance to depositors in case of a bank failure.

FDIC was created during the Great Depression by the US Congress to restore the public’s trust in the nation’s banking system and to protect consumers’ deposits from loss due to bank failures.

The FDIC covers deposits at member banks up to $250,000 per account holder per insured bank, including checking and savings accounts, against losses when banks cannot meet their obligations for any reason, up to certain limits.

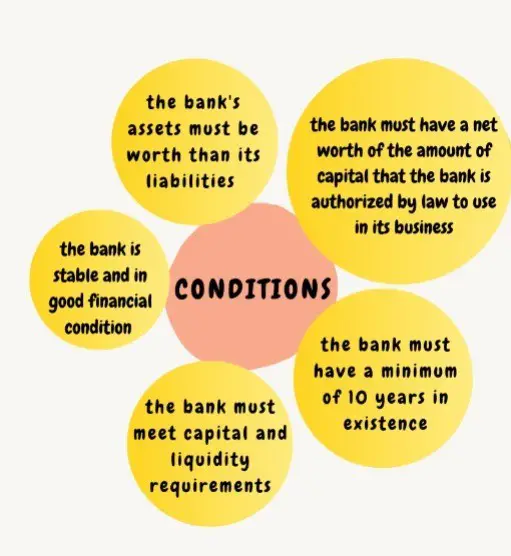

What conditions are required for closing a bank?

What happens to the customers during and after a bank holiday?

Customers are informed about the bank holiday in advance by the banks. The customers can be notified about it through email or a message on the bank’s website. Banks will not open on bank holidays, and customers cannot access their accounts. But they can still use ATMs to withdraw money from their accounts.

Customers can make transactions online, over the phone, or in person during a bank holiday. Banks must be open for at least 10 hours during a bank holiday to allow customers to access their accounts and withdraw money from cash machines.

Read More: How to Withdraw Money from Bank with Debit Card

Frequently Asked Questions

Who can close a bank?

The answer to this question is complex. Banks are in the business of lending and borrowing money. They must ensure that they have enough capital to cover any losses or other problems, keeping the bank afloat. When a bank wants to close a branch, it needs to evaluate how much revenue it will lose, including the revenue generated from commercial lending, individual deposits, and retail loans.

There are a lot of factors that can influence the process of closing a bank. For example, if the bank is FDIC insured, then the FDIC will take over and manage the closing process. If it is not FDIC-insured, other things need to be taken into account, like whether or not it has deposits from foreign entities.

How much time should be given before closing the bank?

The bank should be closed after a certain time to reduce the risk of fraud and to comply with the law. The bank must have a clear timeline for when it closes. This will help to reduce risk and ensure compliance with regulations.

The respective branch of the bank must submit a 90-day notice before a permanent shutdown. This time is mandatory so all affiliated customers can plan and withdraw accordingly.

Can you tell me the dates of the next national holidays in advance?

National holidays are an important part of the culture of many countries. People celebrate them in some ways, such as taking time off work, school, or other activities. It is also common for stores to have promotions on national holidays that can be beneficial.

Many banks offer services to their customers that warn them when national holidays will happen so they can plan accordingly. For example, they may offer to send notifications about upcoming events and special offers in the form of email or text messages.

There are some benefits to knowing the dates of upcoming national holidays in advance:

Customers can plan and avoid any potential issues with work or school so they don’t miss out on anything important.

It also helps customers avoid any unwanted surprises with promotions from stores that might not be available during a customer’s next shopping trip if they didn’t know about it beforehand.

- The bank customers can plan their cash flow, budgeting, and other financial decisions in advance.

Expert Opinion

The two main reasons for closing a bank are:

- The bank is insolvent and going out of business

- Bank has become so large and complex that it can no longer manage effectively.

Due to the rapid modernization of the world, it has become almost impossible for anything to stop or slow down in its business, including banks. They require special permits or orders from authorized organizations before closing on business days. Although closing on national or bank holidays requires no such parameters.

References: