Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

People save money for various things, such as large expenditures like new automobiles and houses. Savings may also be used to save for future expenses like retirement, weddings, holidays, and college tuition. Whatever the motivation for saving, failing to prepare financially for these occurrences may have negative financial effects. To help you, we have created this page on a savings calculator by month.

Saving is reserving a portion of one’s current income for future needs. Income that is not spent, or even postponed costs, is saved. Your savings act as a safety net in case of monetary problems. To build long-term prosperity, you must invest the money you save.

Utilizing the Savings calculator monthly contributes to wealth creation, debt reduction, and financial stability. This also enables you to invest with reasonable risk. You have money saved away for a financial emergency and may invest more flexibility if you want to reach your financial objectives.

You may build an emergency fund with the aid of the Savings calculator by month. Your emergency fund must, at this stage, also have enough money to cover your living expenditures for at least six months.

The money may then be used for a medical crisis or if you lose your work. Depending on your risk tolerance, you may put the funds you save in a savings bank account, a fixed investment, a PPF, or an NSC. These investments have a set rate of return and pay interest on your deposits.

A risk-taking investor could invest the funds in an equities mutual fund. Long-term, this investment may provide a larger return on investment. Stay with us as we go into more detail about the savings calculator by month below.

What is Saving Calculator?

The savings calculator is a tool that demonstrates how much money you need to set aside every month or year to reach your financial objectives. The calculation is based on how much money you have put aside. Additionally, it is influenced by the length of the investment and the anticipated rate of return.

The formulae box on the savings calculator is where you input the amount you need, the length of time to save, and the estimated rate of return. Using the savings calculator, you can find out how much money you need to save each month.

How to use this Saving Calculator by Month

You can use this saving calculator by month through the following steps:

- Enter the Age

- Enter the Retirement age

- Put the Monthly savings

- The monthly saving calculator will process your input and produce the right output.

Savings Calculator by Month

What is the Formula for Calculating Monthly Savings?

You can calculate your monthly savings by using the following formula:

A=P(1+r/n) ^nt,

- Here, A equals the final sum.

- P is the principal sum (the beginning balance).

- r is the Interest rate (as a numeric value).

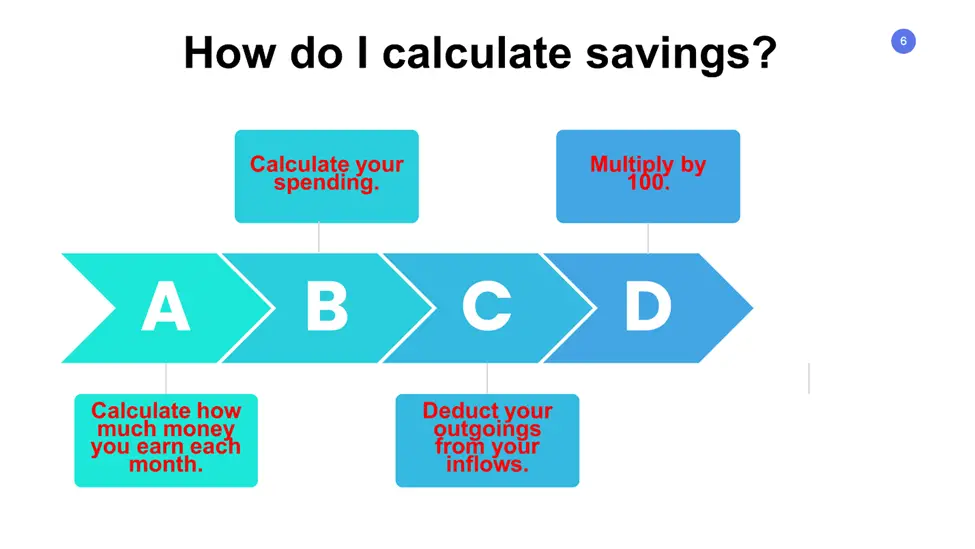

How do I Calculate Savings?

You should clearly know where your cash is going, particularly how much you are truly saving, if you have a significant financial objective in mind, such as purchasing a house or retiring early.

Calculating your savings rate is a simple approach to determining how much of your income may be allocated to accumulating wealth. This represents the portion of your monthly revenue you retain instead of how much you spend.

It reveals how much of your revenue is still available after spending, which is money that may be put to work. You can calculate savings through the following steps:

Step 1: Calculate how much money you earn each month.

Start by calculating your monthly income, including full- or part-time employment take-home pay. This will be on top of any extra money you may make from side jobs.

Step 2: Calculate your spending.

The next step is to calculate your spending. Any costs that aren’t deducted from your salary regularly, like your mortgage and student loans, should be included. Include any extra money you spend on streaming subscriptions, vacations, and eating out.

Step 3: Deduct your outgoings from your inflows.

Subtracting your costs from your revenue is the next stage. On the other hand, if you get an employer match, you may include that sum in your gross pay when it is paid to you by your company.

If you want to see the whole amount you’re saving rather than simply the portion of your take-home pay after paying your monthly expenses, you may also include any pretax additions you make to a retirement fund to your income.

Step 4: Multiply by 100.

To calculate your savings rate, double the figure you received in step 3 by 100. Remember that this is only a streamlined version of the computation. You must also take such savings into account if you make pretax contributions to a retirement account, get employer matching funds, or already include other savings in your monthly costs.

Frequently Asked Questions

How much do I need to save each month’s calculator?

Many resources advise saving 20% of your monthly income. You should set aside 50% of your budget for necessities like accommodation and food, 30% for expenses, and at least 20% for savings, according to the widely used 50/30/20 guideline.

A wish is not excessive, by the 50/30/20 guideline; rather, it is a fundamental nicety that enables you to live a good life. It’s better to figure out what of your desires you can cut down on to keep within 30% of your take-home pay since cutting back on your necessities might be difficult and complicated. Your chances of reaching your 20% savings goal increase as you cut down on your wants-related expenditure.

How are monthly deposits calculated?

Multiplying the principle, interest rate, and time yields the monthly deposit amount. The computation is done using the formula (P x R x T/100), which stands for “principal x rate of interest x time divided by 100.”

How long will it take to save 20k?

If You Save $200/month, you will save $20,000 for 100 months. And if You Save $300/month, you will save $20,000 in 67 months.

How do you calculate the future value by month?

This formula may determine future value month by month: Future value equals current value multiplied by (1 + interest rate) n.

How do you calculate future value in Excel by monthly payment?

Using the Excel FV Function, you may compute future value by monthly payment. By assuming regular, consistent payments and a constant interest rate, this method often determines the future worth of an investment.

The equation is as follows: FV = (rate, nper, pmt, [pv], [type])

What is the future value of $1000 in 5 years at 8?

A $1,000 money invested, compounded semi-annually at 8%, will be worth $1,480.24 in five years.

How do you calculate future investments using monthly values?

The future value formula may determine future investments using monthly values.

The formula follows FV=PV(1+i)n, where PV is the current value and grows by a factor of 1 + I for each period into the future.

Expert Opinion

Understanding how much you’re saving offers you a place to start when estimating how long it will take you to attain certain objectives and how close you are to achieving them. By estimating how much you’ll have to depend on your current savings rate, you may determine whether accumulating enough money to retire in the next 20 years is a realistic objective. At this point, the savings calculator will be indispensable.

The ultimate balance and dividend of savings accounts may also be estimated using the savings calculator. In addition, it takes into account a wide range of variables, including tax, inflation, and numerous ongoing payments. You may even utilize negative beginning balances or donation values.

With the savings calculator, you could discover that you’re spending down your income faster than you would like. If so, you may want to seek strategies to reduce your spending.

Bear in mind that your savings rate will change along with changes in your income or spending. When you receive a raise or change your spending plan, it’s important to recalculate to ensure you’re still on pace to meet your objectives.