Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

A consumption tax known as sales tax is often levied on goods purchased from shops by individual customers. This may be sometimes tricky to compute; thus, we have included this post on Sales tax in the price calculator to aid you.

Americans think of the Internal Revenue Service when they hear the word tax. The inclusion of sales tax in the price has nothing to do with the IRS. States in the United States are in charge of managing sales taxes. All 45 states, as well as Washington, D.C., impose a sales tax.

Each state determines its own sales tax rates as well as its regulations. As a result, you can incur sales tax at various rates or on various goods, such as food and clothing. Depending on the state you are in, this.

Additionally, the state and municipal governments utilize sales tax to fund expenditures like schools, roads, and fire services. Since many local governments depend on sales tax to maintain their budgets, they take the collection of all unpaid sales tax extremely seriously. The sales tax included in the pricing calculator will also be crucial at this stage.

It’s crucial to understand a product’s price before buying it. It’s more difficult than simply reading the price tag. Calculating sales tax is necessary to arrive at the final price. As a result of rising sales tax rates, the importance of the sales tax incorporated in the price calculator is growing. Come along as we highlight more on this below.

What are Sales Taxes included in the Price Calculator?

Sales tax included in the price calculator is an essential tool that simplifies the task of its users. It pays to utilize this calculator since it significantly impacts the final cost of an item. Use our Sales tax included in the price calculator before making a significant purchase. Knowing what to anticipate can benefit you when you use your credit card.

Sales Tax Included in Price Calculator

How much does Sales Tax Cost?

The price of sales tax varies a little depending on where you live. But overall, the following is a rough outline of the procedures required to compute the cost:

Here’s how to calculate the original price of an item before the sales tax was applied:

- Determine your state’s and local area’s sales tax rates. You may use reference websites to obtain the prices particular to your location.

- Add 100 to the tax rate.

- To convert the entire percentage to a decimal, divide it by 100.

- To finish, divide the cost by the decimal from the preceding step and the cost after taxes.

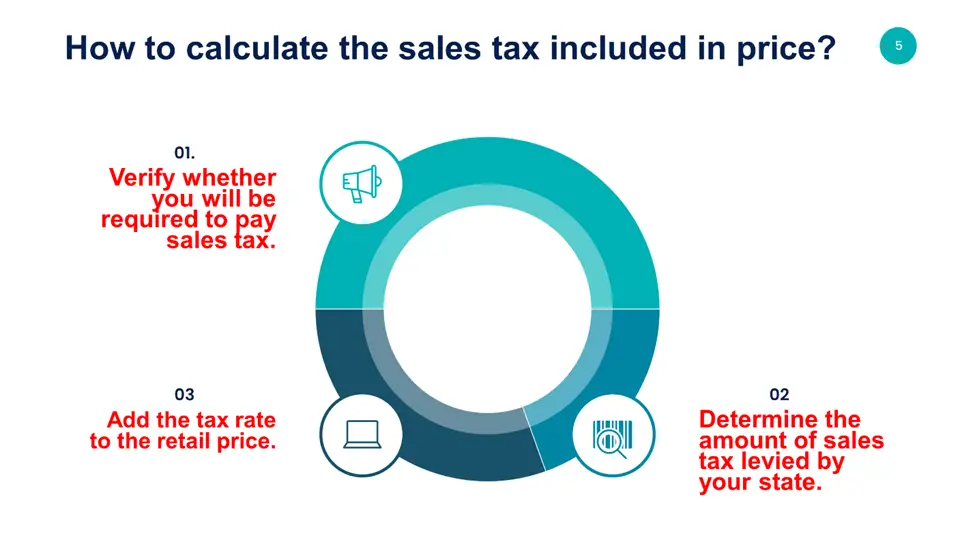

How to Calculate the Sales Tax included in the price?

Calculating the sales tax that is included in the pricing is simple. Knowing the precise tax rate, which varies by state and purchase amount, is significantly more difficult.

In the U.S., you nearly never pay the sticker price for anything you purchase. Sales tax, which might differ by state or city, is to blame for this. However, it often ranges from 4% to 8% of the item’s retail cost. This is often required when you check out eateries, brick-and-mortar establishments, and online merchants.

Each state decides the amount of U.S. sales tax included in the private. And here are the steps you may take to determine the sales tax included in pricing if you’re shopping in most U.S. states and want to know how much you’ll be paying overall before you check out:

Verify whether you will be required to pay sales tax.

First, the sticker price will be the final cost whether you’re buying in New Hampshire, Oregon, Wyoming, Alaska, or Delaware. No sales tax is required.

Shopping on a tax holiday, which many governments regularly proclaim to stimulate consumer spending, is another method to avoid paying sales tax fully. Additionally, some states permit specific products to be excused from paying sales tax.

Usually, this consists of food, medication, or other necessities of life. But in certain circumstances, this also applies to things like clothes.

The list of states announcing tax holidays and exclusions is updated on a calendar maintained by the Federation of Tax Administrators. This is true so that you may prepare in advance.

Determine the amount of sales tax levied by your state.

It might be challenging to estimate the amount you’ll pay for sales tax since it can vary by state and item. The overall notion, though, is not nearly as difficult to grasp.

The spectrum of sales taxes in each U.S. state is kept up to date by the Sales Tax Institute. While you might spend hours online calculating whether you’ll have to pay 3% or 3.5% in sales tax, you may want to go with the higher tax scale. Nobody ever feels let down when the price is lower than they anticipated.

Calculating sales tax may be difficult for national merchants who do business in numerous states. For instance, Amazon openly outlines the criteria used to calculate sales tax. It will be determined by the state and municipal charges that apply to the location where your purchase is being delivered or fulfilled.

However, a long list of exclusions and cautions accompany that assertion. This includes whether the order is delivered to a home or commercial address. Before completing your purchase, Amazon does provide an anticipated tax amount.

And if that’s the case, you might be better off waiting for your approximated tax to be presented rather than attempting to figure it out on your own.

Add the tax rate to the retail price.

The exact arithmetic required to calculate how much sales tax you’ll be paying is only a simple percentage; setting the rates is far more difficult. Finally, increase the retail price by the tax rate to get the sales tax included in the purchase.

Frequently Asked Questions

How do you calculate tax included in the price?

At the moment of the purchase, sales tax is taken into account. Because sales tax is a consumer tax, companies must add the appropriate amount at the time of purchase.

After that, businesses will take this sales tax sum and deliver it to the appropriate government entity. A state, county, or municipal tax will determine this. Overall, the following procedures may be used to determine the tax included in the price:

- Verify whether you will be required to pay sales tax.

- Determine the amount of sales tax levied by your state.

- Add the tax rate to the retail price.

Is sales tax included in the price of the product?

Yes, there are circumstances in which the product’s listed price may include the sales tax. A company may promote and sell meals, drinks, or other goods at pricing that includes sales tax. However, the menu and other pricing details must explicitly state that sales tax is included in the price for this to be true.

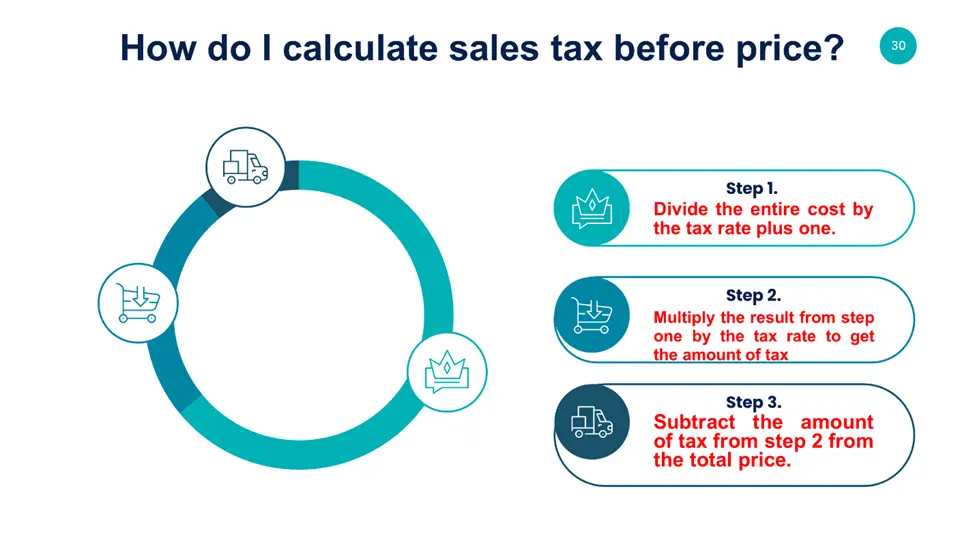

How do I calculate sales tax before price?

The methods listed below may be used to determine sales tax before price:

Do you add or subtract for sales tax?

The IRS permits you to deduct the real sales taxes you paid as long as the tax rate is identical to the area’s standard sales tax rate. Food, clothes, and emergency aid are all exempt.

Why is sales tax not included in the price?

Since the price is considered “what it costs to create the product,” sales tax is not included in the price. Additionally, taxes, outside the business’s authority, often play a role in this. That is the standard defense, and as others have noted, legislation has been passed to segregate taxes from the price.

How do you subtract tax on a purchase?

You can subtract tax on a purchase using the following formula:

- Tax on a purchase = TP – [(TP / (1 + r) x r]

- Where: TP= Tax price

- R= tax rate

Expert Opinion

A consumption tax, known as a sales tax, is levied on purchasing goods and services. Customers pay this tax to the government. There is no federal sales tax in the USA. Instead, the state is in charge of collecting sales tax.

The nationwide sales tax rates in the states that do so vary from 0% to 16%. The way the sales tax is applied varies greatly across several states. For instance, some jurisdictions exclude goods from sales tax, such as alcohol and prescription drugs. At this point, the Sales tax included in the price calculator will be your best ally.

References