Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

While it’s true that money doesn’t sprout on trees, focusing on interest is one strategy to maximize your earnings. There are two types of interest as well: simple and compound. The original balance of an investment or loan—the amount you initially contributed to or borrowed—is used to determine simple interest. To determine if simple interest would benefit your circumstances, you must first understand how it might impact your savings account or possible investment. Thus, we have made this post on simple interest calculator days.

A simple interest loan has an initial payment that covers the interest for that month, and the remainder is applied to the principle. The interest is paid in full each month, and unlike compound interest, any outstanding interest does not accumulate from month to month.

The current Simple interest calculator may also impact how you invest and increase your money. Only the primary balance or the amount initially deposited, is used to calculate interest. Investors consistently get simple interest, which doesn’t build up over time.

In return for putting your money into savings accounts or deposit certificates with this interesting pattern, you get a monthly interest payment. Come along as we highlight more on the Simple interest calculator days below.

What is Simple Interest?

Simple interest is a method for figuring out how much interest was paid on an amount of money during a certain time at a specific rate. It has a fixed principal amount. Simple interest is a clear-cut and simple method for computing financial interest.

Underneath the simple interest technique, interest is always added to the original principal sum, and the interest rate is constant throughout time. We get interested in our investment when we deposit funds into a bank. One kind of interest that banks impose is simple interest.

After learning what simple interest is, a person would desire to know the simple interest expression. Principal x Rate x Time 100 is the formula used to compute simple interest. Since the interest rate is typically expressed as a percentage, r/100 is assumed to be the value.

How to Use this Simple Interest Calculator Day

You can use this Simple interest calculator day through the following steps:

- Enter the Principal Amount

- Enter the Number of Days

- Put the Rate of Interest per Annum (%)

- The simple interest calculator days will process your input and produce the right output.

Simple Interest Calculator Days

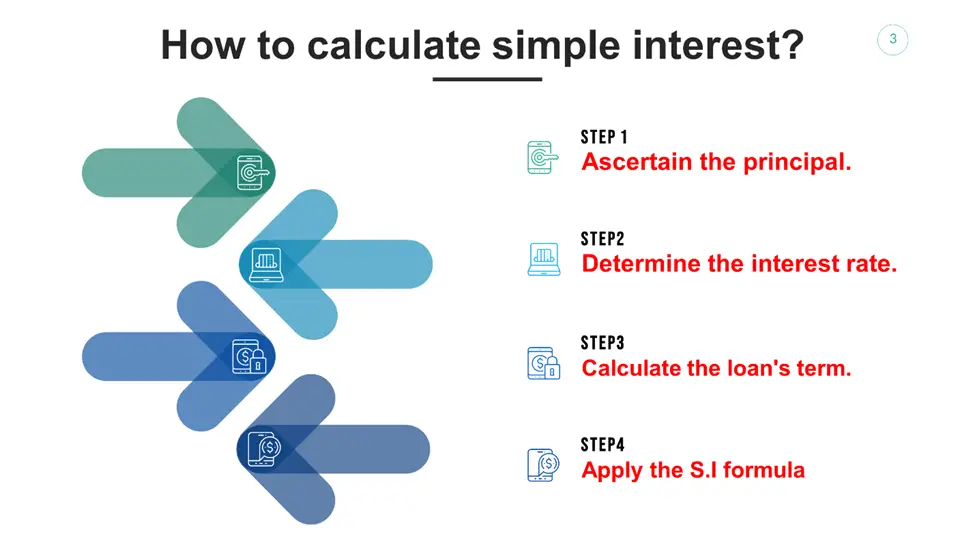

How to Calculate Simple Interest?

Simple interest is a notion that most people are familiar with, but not everyone is aware of how to calculate it. Simple interest is the worth we add to a loan or investment to cover the long-term financial gain of borrowing from someone else. For short-term loans, one of the simplest computations is simple interest. The steps below may be used to compute it:

Step 1: Ascertain the principal.

The sum of money you will use as the principal to compute interest is called the principal. This might be the cash you put into a savings account or a certain kind of bond. In such an instance, you will be paid the calculated interest.

In contrast, if you borrow money—for example, via a house mortgage—the principle is the sum you borrow, and you’ll need to figure out how much interest you owe.

The principle amount is often represented by the variable P in any scenario, whether you will be paying or collecting interest.

Step 2: Determine the interest rate.

It would help if you first determined the pace at which your primary will increase to determine how much it will appreciate. Your interest rate is as follows. Before a loan is granted, the parties often announce or agree upon the interest rate.

Step 3: Calculate the loan’s term.

The phrase is another way to refer to the loan’s duration. When you take out a loan, you agree to its term in certain situations. For instance, the majority of mortgages have a set period. The terms of many private loans are negotiable between the lender and the borrower.

It is crucial that the term’s length corresponds to the interest rate or, at the very least, be expressed in the same units. If your interest rate, for instance, is for a year, then your duration should also be expressed in years.

Step 4: Apply the S.I. formula.

After getting all the variables above, you will need to apply them to the S.I. formula.

This goes thus: S.I. = P × R × T,

- P equals the principal.

- R Equals Interest Rate,

- T stands for time.

Why Calculate Simple Interest?

Simple interest is not only a more efficient method to determine how much you owe on a loan but also an easier way to do it. The amount of interest you will make is determined by multiplying the principal by the number of days among payments and the monthly interest rate.

Although some mortgages also employ this kind of interest, it is more often connected with financing alternatives or short-term loans. Furthermore, it’s advisable to calculate simple interest due to the following reasons:

- Calculation is simple

- Usually costs less than a loan with compound interest.

- It helps you to pay a loan off early. You may lower the cost of the loan by doing this as well.

Important things to Remember while Calculating Interest

Some important things to remember while calculating interest include:

Frequently Asked Questions

How do you calculate simple interest in days?

You may use the following calculation to get simple interest in days: Simple Interest equals Pnr/100 X 1/365.

Here, “P” stands for the principal sum, “n” for the number of days, and “r” for the annual interest rate. To get the interest rate for a single day, divide the basic interest formula by 365.

How many days in a year is simple interest?

Simple interest takes 360 days as the equivalency for the number of days in a year.

How do I calculate interest on a date?

Use the number of days for t when computing simple interest on a date, then split the interest rate by 365. Similarly, multiply the interest rate by 12 and use the number of months for t to get simple interest month-by-month.

How do you calculate 90-day interest?

The formula Simple Interest = P n r / 100 X 1/365 may determine interest over 90 days.

Here, “P” stands for the principal sum, “n” for the number of days, and “r” for the annual interest rate.

If the duration is specified in months, convert it to years by dividing the number of months by 12.

How do you calculate 365 days?

To establish uniform daily interest rates based on 30-day months for debt instruments, banks most often employ the 365-day computation technique. Banks multiply the given interest rate by 365, then split the result by 360 to get the interest payment using the 365 days technique.

What is the 360-day method?

The 360-day approach, used in several accounting procedures, gives the number of days between two dates based on a 360-day year (twelve 30-day months). If your accounting system relies on twelve 30-day months, you may use this feature to assist in computing payments.

Why is a year 365 days and not 360?

The partition of a year is essentially a unit of time into 365 days. Now, the split of a circle into 360 degrees in terms of angle is comparable. As a result, both items are distinct from one another and are not interchangeable.

How do you calculate 30 360-day counts?

The 30/360 formula doubles the daily interest by 30 after computing it over a 360-day year. Additionally, this is the recurring month.

Did a year use to be 360 days?

Yes. Of fact, the Babylonian astronomers were aware that no actual year would have precisely 360 days. However, they continued to base their calculations on the 360-day year owing to its advantages as a practical framework. This includes measurements of the duration of the shadow, the moon’s appearance, the day’s duration, etc.

Expert Opinion

Simple interest is a fast and simple formula for determining how much interest will be charged on a loan. Although some loans use this calculating approach, this kind of interest often relates to vehicle or short-term loans. The manual calculation of this might sometimes be challenging. Thus, the Simple interest calculator days will aid you immensely.

In addition, paying interest is a cost of borrowing money. It equates to a fee or additional charge the debtor pays the creditor for the loaned amount and is sometimes stated as a percentage.

Whenever you repay a loan with simple interest, the money first goes towards the interest for that month, and the rest is applied to the principle. Using the Simple interest calculator days will thus help you to avoid hassles.