Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

A balloon payment refers to a loan structure where only a portion of the principal debt is repaid during the loan’s usual relatively short repayment term. In other words, the set monthly payments are insufficient to pay off the loan balance and accumulated interest. As a result, the balloon payment, the last sizable payment due from the borrower after the loan period, is necessary. It may sometimes be difficult to compute this manually. Thus, we have made this post on Balloon Payment Calculator to aid you.

A loan calculator that assists customers with balloon payments is the balloon payment calculator. Estimating the monthly fixed installment and the eventual balloon payment of a certain balloon loan structure typically comes in handy.

The borrower might reduce the monthly interest charge that is payable by the borrower by including a balloon payment with the loan. Only because the whole debt has not yet been amortized is this conceivable. The benefit of balloon payments is that their initial installments are cheaper. They are also perfect for businesses or borrowers experiencing short-term cash flow issues but anticipate improved liquidity in the future.

Customers who have seasonal jobs and anticipate significant cash flows before the loan term finishes find it simple to make a balloon payment. Nevertheless, if they cannot make that repayment, they may have to return the merchandise and skip the previous payment or consider restructuring by taking out a new loan. The Balloon Payment Calculator can help you to minimize any potential problems. Come along as we highlight more on this below.

What is a Balloon Payment?

A balloon payment is a single, disproportionately large payment you make on a debt. After a loan, balloon payments are often made to cover the remaining balance. They may cost tens of thousands of dollars but are often at least twice as expensive. The phrase “balloon payment” denotes a huge final payment.

Typically, balloon payments are at least twice as much as the loan’s prior installments. In contrast to consumer loans, balloon payments are more typical in business credit. This is true because a huge balloon payment after the mortgage is often unaffordable for the ordinary homeowner.

Most homeowners and borrowers want to sell their house before the loan matures or renegotiate their mortgage as the balloon payment approaches. Additionally, firms often use balloon loans to take advantage of lower initial payments to pay for urgent debts before the balloon payment is due.

Two-step mortgages often include balloon payments. In this kind of financing, a borrower begins their loan with an introductory interest rate that is often lower; once the first borrowing time is over, the loan’s interest rate increases.

Balloon Payment Calculator

How to Calculate a Balloon Payment

Balloon mortgages have a set duration and a distinct amortization period. Calculating a balloon payment is simple if you have this knowledge, coupled with the interest rate and loan balance. Next, you must understand the formula.

The following formula is used to determine a balloon payment:

FV = PV*(1+r) n–P*[(1+r) n–1/r]

The variables are briefly explained as follows:

The balloon payment’s ultimate value is known as FV.

The originating loan balance, or PV, is the present value.

The interest rate is r.

The overall number of payments is n.

The monthly payment is denoted by P.

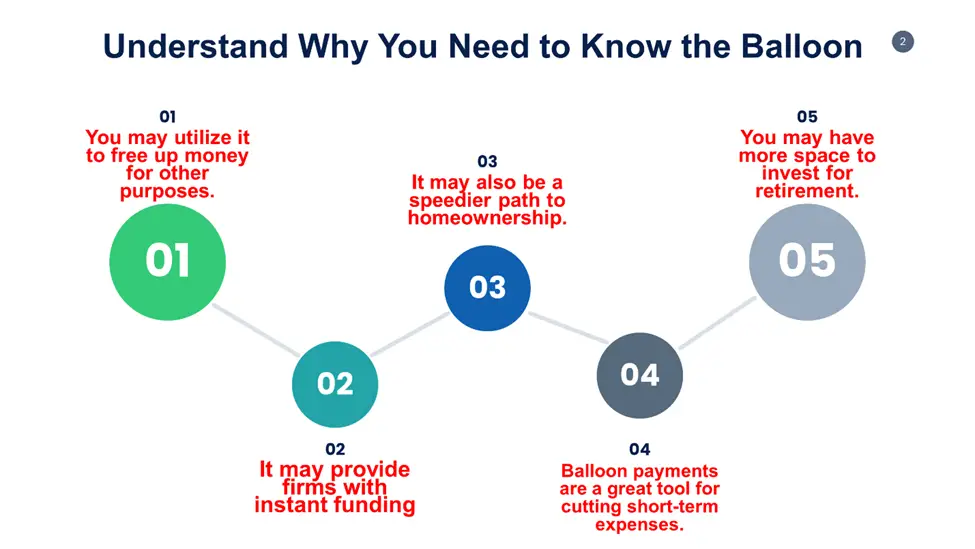

Why You Need to Know the Balloon

Knowing the Balloon comes with diverse merits. This comprises:

- You may utilize it to free up money for other purposes.

- It may provide firms with instant funding.

- It may also be a speedier path to homeownership. This is valid since the lower monthly payment may make it more feasible, given your financial circumstances.

- Balloon payments are a great tool for investors who want to cut short-term expenses. This is valid so that they may free up funds for other purposes. Additionally, some companies want to fund today but are certain they can easily pay the balloon payment in the future.

- You may have more space to invest for retirement or other objectives if you pay less for your monthly mortgage.

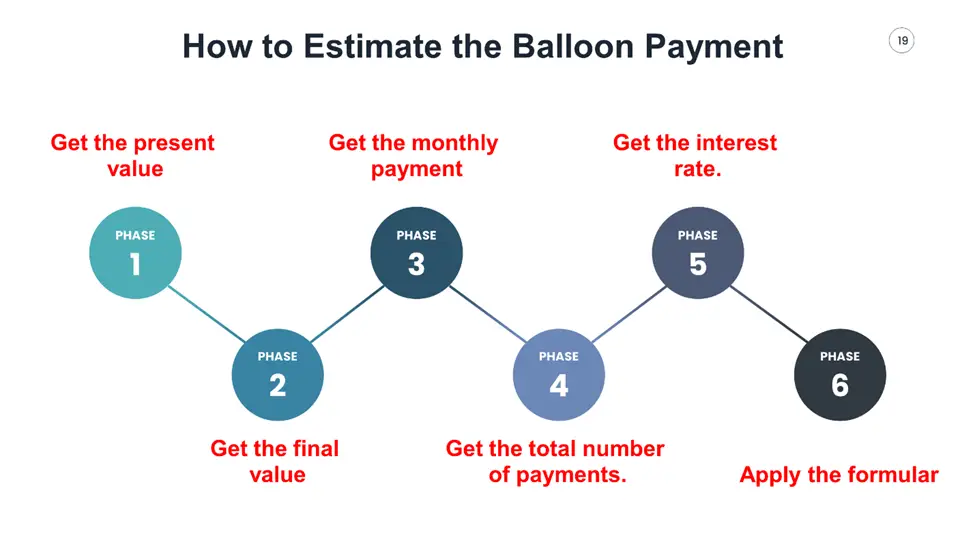

How to Estimate the Balloon Payment

The procedures below may be used to estimate the balloon payment:

Get the present value.

The PV symbol stands for the present value. It is as widely known as the principal amount of the loan.

Get the final value

FV is also used to indicate the balloon payment’s ultimate amount.

Get the monthly payment.

This involves making a principal and interest payment each month (P). The duration of up to 15 years determines the monthly payment.

Get the total number of payments.

This includes all monthly payments made throughout the balloon loan’s duration. This overall payment amount is based on the assumption that no principal will be paid in advance. “n” is often used to indicate it.

Get the interest rate.

The total interest paid throughout the balloon loan’s duration is included. Also, supposing no principal prepayments is the total amount of interest. “r” stands for it.

Apply the formula

Finally, apply the appropriate formula for Balloon Payment.

FV = PV*(1+r) n–P*[(1+r) n–1/r]

This can also be seen in the infographics below.

Should I Calculate My Balloon Payment?

Yes. The process of determining your balloon payment has various benefits. Borrowers may often acquire cheap interest rates with these loans. Since the interest rates are often lower, your monthly mortgage payments are reduced. A balloon mortgage may also allow you to qualify for a bigger loan amount than you could with a fixed-rate or expandable mortgage.

This form of mortgage may also be advantageous if you anticipate making a profit on the sale of your house and want to sell it before the balloon payment is due. Or maybe you’re not generating as much money right now, but you anticipate making more money when the balloon payment is due.

Frequently Asked Questions

How much are balloon payments usually?

A balloon payment often exceeds the loan’s average monthly payment twice and frequently exceeds $10,000. Most Balloon loans call for a single payment to cover the outstanding debt after the loan term.

How does a 5-year balloon payment work?

In a 30/5 arrangement, the lender estimates your monthly payments as though you’ll pay back the loan over 30 years, even if you only have five years to do so. You will pay back the outstanding principal after the five-year (60-month) term.

What is a 3-year balloon payment?

It is possible to compute a 3-year balloon payment as though the loan would be repaid over 10 years. However, there is a balloon payment attached that is due in three years. The purchaser should have a simpler way of receiving clearance from a bank after three years of on-time repayments.

Are balloon payments a good idea?

There may be benefits to taking out a balloon loan with an impending balloon payment. Some borrowers may benefit from having the balloon payment come due five to seven years into what would otherwise be a 30-year loan. With a balloon loan, customers are not obligated to repay the loan for an extended time at a high-interest rate.

If those rates are high at the time, they take out the loan. As the balloon payment date approaches, the borrower may refinance to make the payment and maybe get credit at a cheaper interest rate.

Additionally, balloon loans offer substantially cheaper monthly payments than conventional amortized loans. This is so because only a small portion of the overall amount borrowed is paid back in installments; instead, it is returned in one large lump sum. Therefore, borrowers can get loans that they normally wouldn’t be able to because of lower monthly payments.

Is balloon financing a good idea?

Borrowers may lower their fixed payment amount using balloon financing to make a higher payment after the loan’s term. Generally, these loans are advantageous for applicants with great credit and a sizable salary.

Expert Opinion

A balloon loan may meet your finance requirements, which is a practical option. There are calculations to consider to evaluate if they would suit your case. Consider speaking with a Balloon payment calculator since they might be complicated.

The ballooning debt will be owed after the loan’s term is determined using the balloon payment calculator. A balloon balance is calculated similarly to how a mortgage loan’s outstanding amount is determined.

Access to quick cash is a balloon payment loan’s main advantage. This is advantageous for company startups or entrepreneurs who have secured long-term finance. While the firm is just starting, fixed repayments are less; after the financing has been concluded, they may be repaid with a larger amount.

Choosing the appropriate funding is crucial, regardless of whether you’re a person or a company owner. Utilize the Balloon payment calculator to assist you in identifying the best financial strategy for your requirements.