Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Most individuals dread when they hear the words “savings” or “budget.” Usually, persistent thoughts of “No Fun Ever” and cutting off any expenses that make them happy are present. Some people also consider living a miserly life essentially. That’s not it at all, however! Simply put, a savings plan directs your money, so you won’t have to worry about where it went. So that you may spend money on the things that are most important to you, your savings can reach their full potential. Your biggest ally at this time will be the monthly savings calculator.

One of the most crucial financial habits is learning how to save. Try our free monthly calculator to see how your savings may increase. With interest compounding, you receive not only interest on your principle but also your interest. As a result, growth will quicken the longer the funds are kept in a savings account.

Calculate your Investment Interest Rate

Use our monthly savings calculator as a wonderful starting point for your savings journey. This is a practical tool for estimating your future earnings. Your original deposit, monthly savings commitment, and APY are often considered. Come along as we highlight more on this below.

What is the Monthly Savings Calculator?

Even though saving cash regularly might be challenging, being aware of the potential worth of your deposits could be beneficial. As a result, the Monthly Savings Calculator may assist you in estimating your future savings account’s worth. This multipurpose tool helps in the development of a precise savings strategy.

This works so you may accumulate enough cash to purchase the vacation or automobile of your dreams. Various mechanisms are the action. You have two options for determining your starting saving amount and how much you’ll save overall. This is in addition to the amount you must deposit over a certain time frame if you wish to meet your savings objective.

Additionally, you may calculate how long it will take to save a certain amount and how much interest you need to get a certain balance.

The ability to precisely simulate any circumstance is this tool’s main power. For instance, adding the average inflation rate in the advanced mode enables you to determine the buying power of your money.

How to Use this Monthly Savings Calculator

You can use this Monthly savings calculator through the following steps:

- Enter the Initial Deposit ($)

- Enter the Interest Rate (%)

- Put the Compounding Periods

- Enter the Periods passed

- The monthly savings calculator will process your input and produce the right output.

Use this Calculator to calculate the credit interest rate.

Monthly Savings Calculator

What is your Monthly Cost Basis?

For tax reasons, the asset’s original value is represented on your monthly cost basis. This is often the purchase price after taking stock splits, rewards, and capital transfers back into the account.

To calculate the capital gain, this number is needed. This is equivalent to the discrepancy between the present value and the asset’s market value. The distinction between a stock’s cash price and futures price may also be described using this phrase.

The initial investment amount plus any royalties or other costs associated with the acquisition constitute the monthly cost basis of investment at its most basic level. The asset’s market price or the effective per-share fee might characterize it.

It’s crucial to use the right cost basis, also called the tax impact, particularly if you retain dividends and capital gains payouts rather than taking them out. Putting more money in dividends improves your asset’s tax base, which you need to consider to declare a lesser capital gain and pay less tax.

You can repeatedly spend on the dividends reinvested if you don’t utilize the higher tax base. Additionally, the first stage in figuring profits and losses once stock is sold is to ascertain the accurate cost basis.

Versions of Monthly Cost Basis

Some Versions of the monthly cost basis include:

Investment funds

Similar to how the cost basis is determined for equities, it is also for shares of investment options. The cost basis is the amount you pay for each share of a mutual fund when you buy them. You may increase the cost base by adding upfront “load costs” for many mutual funds.

Learn the difference between mutual funds and investment funds.

Dividends

You must reevaluate your cost basis for each group if you reinvest dividends from stock or mutual fund shares that you hold to purchase more shares. Additionally, this is crucial for the fresh shares you purchase.

Reinvesting dividends as though you were receiving cash payments from the corporation can be helpful. And you took that money right away and purchased additional shares of the same firm.

Share Splitting

Your cost basis is divided between your new and old firm shares if you possess shares in it and that firm splits. Consider that you purchased 100 shares of ABC for $10 each, giving you a cost model of $1,000. If ABC announces a 2-for-1 stock split, your cost basis remains at $1,000 overall, even if you now own 200 shares of the business. Your cost basis per share decreases to $5 as a result.

Bequests and gifts

The recipients of assets in a taxable account may sometimes benefit from a cost-basis “step-up” when the actual owner dies away. For instance, if you paid $2 a share for 2,000 shares of XYZ 20 years ago, your cost basis would be $4,000. Today, XYZ is going for $200 a share. Therefore your 2,000 stocks are now valued at $400,000 at today’s price.

The net value could reset (or step up) to the worth of those shares on your death date, although if you maintained those shares and left them to your spouse or children when you went away.

Property

Real estate’s cost basis is typically the price you paid at the time of acquisition. If you have added to your house or permanently changed its structure, these are examples of capital upgrades that raise the property’s value. The price of the upgrades may now be included in your cost base.

How much Money do you Need to Save?

You should know your objective before deciding on your monthly savings target. A rainy day fund is the first thing any novice saver needs to handle small financial setbacks and more serious financial catastrophes like a job loss.

Most experts advise keeping three months’ worth of pay in savings. Others contend that it should equal up to six months’ value. You don’t have to save it all at once, so don’t worry. You may gradually get more prepared for it. A specific proportion of your salaries, such as 10% or 20%, is recommended by more experts.

After you’ve organized your buffer, you may begin setting aside money for more targeted objectives. That might be anything from vacation or new clothing to a down payment on a home or retirement.

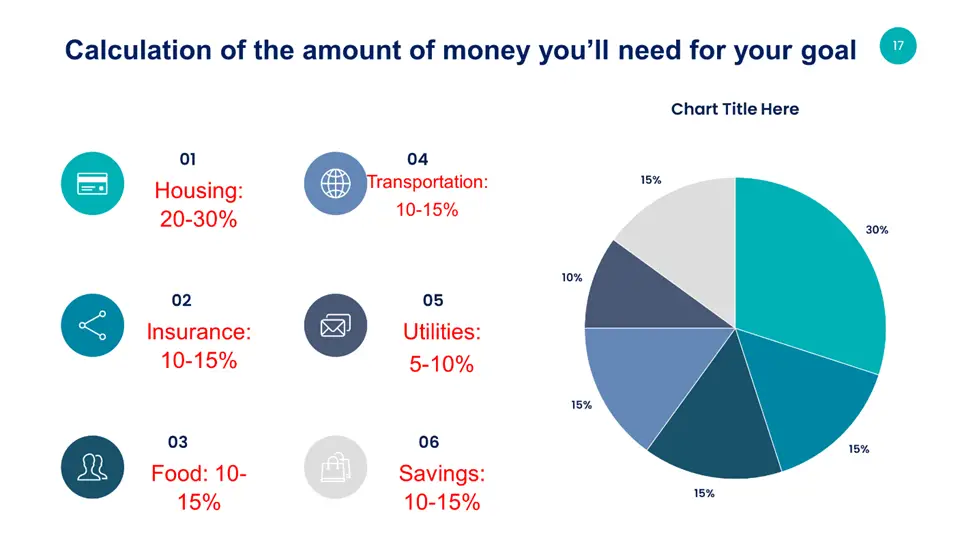

How to Calculate the Amount of Money you’ll need for your Goal

There is more to creating a budget than just totalling your spending and deducting them from your income. Establishing budget percentages for the amount you’ll spend on certain things is crucial. This is true, particularly if you have significant financial objectives, like paying off debt, setting up an emergency fund, or preparing for retirement.

Even if you struggle with math, you can establish budget percentages. Identifying your income and monthly expenses is the first step.

Here’s a quick rundown of how your income may be divided up:

Frequently Asked Questions

What is the formula for calculating monthly savings?

The cash you earn when you deposit it in a savings account is known as interest gained on savings. Knowing how to calculate it can assist you in evaluating savings accounts from various banks. In addition to helping your investment grow, this will assist you in finding the one that will perform for you.

To calculate monthly savings, you can use this formula:

Savings = Principal x Rate x Number of Periods

How do I calculate savings?

Start by deducting the item’s current price from its listed amount to get the efficiency gains percentage. Then, subtract the original price from the price difference. Lastly, to get the percentage of cost reductions, multiply that decimal by 100.

How long will it take to save 20k?

In 100 months, if you saved $200 per month, you would have saved $20,000. Also, if you saved $400 every month for 50 months, you would have saved $20,000.

How can I save 100k in 3 years?

You can save 100k in 3 years through the following ways:

- Use a 401(k)-plan provided by your work to donate to your retirement.

- Keep your costs to a minimum.

- Pay particular attention to saving 40% to 50% of each salary.

- Begin a secondary business.

- Use the credit to make purchases, but do so responsibly.

Is saving 1000 a month good?

Saving $1,000 a month is a smart idea. Saving $1,000 each month for 20 years at an average yield of 7% will result in $500,000 in savings. However, if you are persistent enough, saving only $1000 a month could get you to 1.5 million USD in 20 years.

Expert Opinion

One of the key components of accumulating wealth and having a stable investment portfolio is saving money. You may escape life’s uncertainties by saving money, allowing you to live a decent life. You may avoid many difficulties and barriers by setting away money in a disciplined manner.

It may help you in times of need and ensure your family has resources in case anything unfavourable happens. And to calculate accurately, the monthly savings calculator will aid you immensely.

References

- https://www.investopedia.com/terms/s/savings.asp

- https://en.wikipedia.org/wiki/Saving

- https://www.iciciprulife.com/protection-saving-plans/importance-of-savings.html

- https://www.economicsdiscussion.net/income/saving-function-of-income-meaning-and-relationship-between-saving-and-income/653

- https://www.ndtv.com/business/investment-vs-savings-key-differences-and-which-to-choose-when-3278323

- https://www.forbes.com/advisor/banking/savings/savings-account-rates-today-08-23-22/