Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Thanks to technological advancement, we can all now conduct numerous computations without uncertainty or ambiguity. To calculate various sales tax rates without having to do time-consuming and difficult calculations on your own, utilize a sales tax calculator excluding tax.

It took a lot of time and effort to complete this laborious procedure, and there was still a risk of mistakes. However, you may quickly, and cost-free get precise answers using a sales tax calculator excluding tax. Additionally, you may do all the computations independently without seeking expert assistance. This calculator may be effectively used with only a few clicks on your device.

Additionally, buyers are subject to a tax known as sales tax when they buy goods and services. It is a pass-through tax, which means you must collect it from clients and send the money to your state or local government.

You do not remit sales tax as the vendor. This may be not very easy, as was previously said. As a result, the sales tax calculator without tax will be essential. Follow along as we go into more detail about this below.

What are Sales Tax Calculators Excluding Tax?

A great tool that addresses many issues related to the tax levied on purchasing goods and services is the sales tax calculator, excluding tax. It may also compute the net amount before taxes.

All U.S. states, except Alaska, Delaware, Montana, New Hampshire, and Oregon, charge a state sales tax whenever you purchase goods or pay for services. Like many other states, Alaska permits communities to impose local sales taxes.

Certain product categories are exempt from sales tax in certain states. For instance, Massachusetts does not impose sales tax on most supermarket goods. There are extra tax surcharges in several states as well. It is typical in the hospitality sector for eateries to impose tax rates greater than the applicable state sales tax.

For information on anticipated sales tax rates and prospective tax surcharge rates, contact your state and municipality. Additionally, the sales tax calculator eliminating tax will be of great use to you.

Sales Tax Calculator Excluding Tax

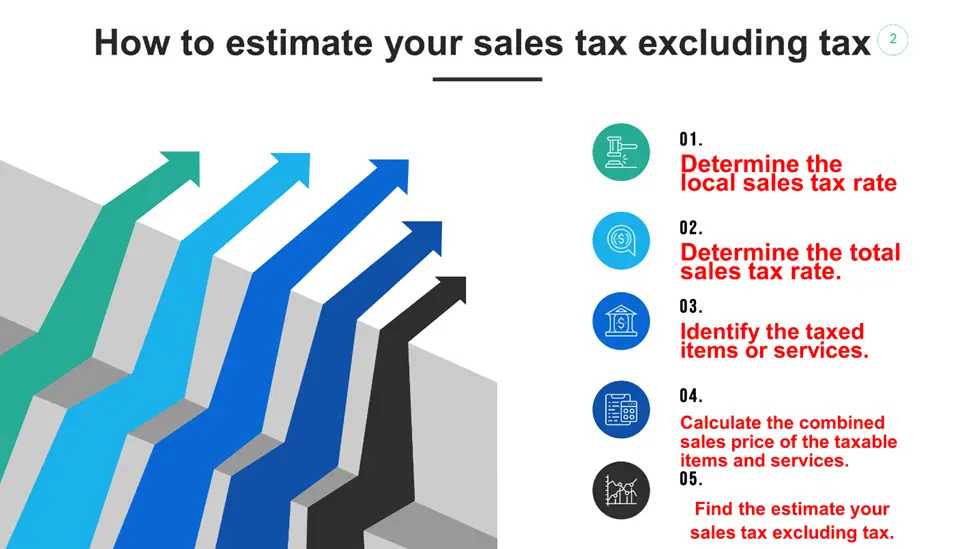

How to Estimate your Sales Tax Excluding Tax

You can estimate your sales tax excluding tax through the following tips:

Determine the local sales tax rate

Due to location-specific variations in sales tax rates, certain localities have a rate that combines municipal, county, and state sales taxes. And other places merely impose the state sales tax. Cities and counties inside the state might not have a sales tax in regions where there isn’t one.

Start by confirming if the state in which your company is located has a state sales tax. If so, find out the state’s current sales tax rate. The basic tax rate is this amount. Next, determine whether the city or county levies a sales tax and the current rate.

Determine the total sales tax rate.

The sum of a region’s local, county, and state sales taxes is represented by the composite sales tax rate, a single number. Businesses determine the total sales tax rate by combining these different sales tax rates.

Firms with two or more sites must figure out the aggregate sales tax rate for every region in which they operate. Thanks to this, the right amount of sales tax will be collected from customers at each site.

Identify the taxed items or services.

Sort the products or services your company offers into groups depending on whether they are subject to taxation. You must be aware of the sales tax laws that are in effect in each city, county, and state where your company has a presence to do this task effectively.

Don’t forget to confirm if some goods, such as food, clothes, or prescription prescriptions, are tax-exempt in the regions where your company is located. Be careful to be aware of the dates of sales tax holidays, the things that are free from taxes during those periods, and the criteria that must be met.

Calculate the combined sales price of the taxable items and services.

The price mentioned on the item is used as the total sales price for determining the sales taxable income for a single taxable item. Add the reported pricing of each taxable product to determine the total taxable sales price for determining the amount of sales tax a buyer makes for acquiring several products or services.

Don’t forget to separate the total sales price of non-taxable products from this computation. Making fewer calculations is easier if you complete this step before calculating the sales tax amount.

Use the sales tax formula to find the estimate of your sales tax, excluding tax.

You may estimate your sales tax excluding tax after you know the combined sales tax rate for the region your company is located in and the entire taxable sales price for the user’s transaction. The sales tax equation is:

Sales tax is calculated by multiplying the total taxable sales price by the decimal sales tax rate.

To get the final sales amount, multiply the sales tax amount by the sum of the taxable and non-taxable sales prices. At this stage, be sure to re-incorporate the whole non-taxable sales price. The following is the formula for calculating the ultimate sales amount:

Total sales amount = [total taxable sales price] plus [sales tax amount] plus [total non-taxable sales price].

Your estimated sales tax, excluding tax, is represented by the resultant total.

What is a Sale Tax Excluding Tax?

A sale tax excluding tax is money taxpayers do not need to include when determining their taxable income in their gross income. The money includes wages and income obtained as a benefit, gift, or inheritance for the sake of this definition. Both state and federal tax laws apply to the amount of income excluded.

Additionally, revenue is excluded from your gross income as defined by tax legislation as a sale tax excluding tax. It is distinct from tax deductions, which are sums you may subtract from your earnings, such as costs related to obtaining an income.

The United States taxes foreign income from American citizens and resident aliens overseas. However, a U.S. citizen may be able to exclude up to $101,300 in overseas earned income from their stated income if they reside abroad for the whole tax year or are absent from the U.S. and its regions for at least 330 days out of every 12. Every year, the amount that may be omitted is changed.

Active-duty military members serving in areas designated as conflict zones may additionally remove some revenue from their annual revenue. Whether they are in a conflict zone for all or a portion of a given month, this holds. This still holds if they end up in the hospital due to wounds they received while serving in a conflict zone.

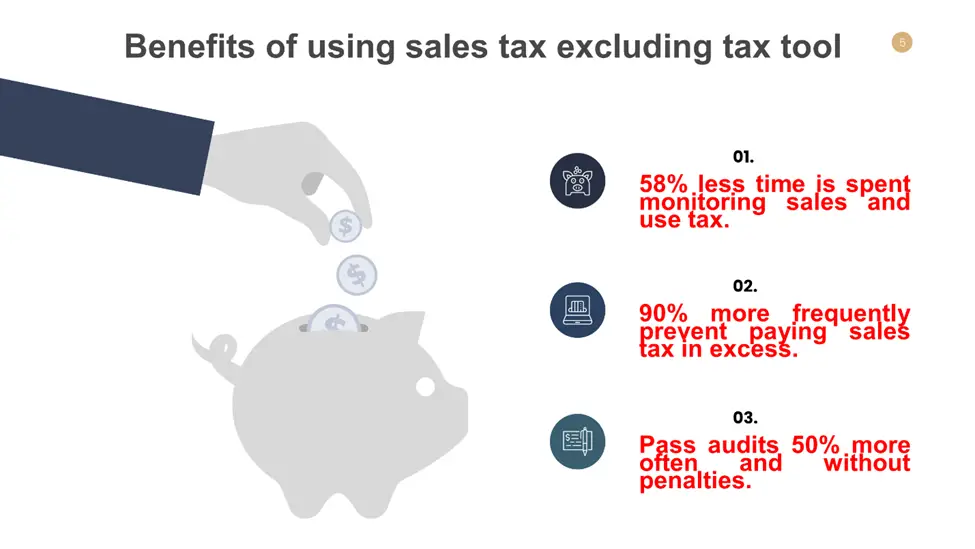

Benefits of using the Sales Tax Excluding Tax Tool

Some benefits of using sales tax excluding tax tool include:

How much does sales tax cost?

A customer’s whole bill is subject to sales tax. What state, region, and city your company has a physical presence in determines the sales tax cost.

Expert Opinion

Many companies that sell products and provide services require sales tax collection. After receiving it from clients, you are responsible for paying the sales tax to your state or city. However, you must first understand how to compute sales tax excluding tax before you can begin to collect.

Due to complex sales tax regulations, doing this step may be challenging. Thus, it’s best to work with the sales tax calculator excluding tax, as highlighted above.