Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

When it pertains to debt, every knowledgeable multiunit investor understands the importance of doing their homework. Understanding how repayments get broken down on a credit card allows a lender to budget and make informed choices about an estate’s future. Evaluating credit repayments often reveals that consumers can handle more than they imagined. This credit repayment calculator will help you.

However, it gets used to keeping lenders from exceeding their financial limits in many circumstances and knowing the recurring expenses of a credit company.

It helps an entrepreneur make better, more knowledgeable selections in both cases. As a result, we’ve created this post on a credit repayment calculator to assist you.

Credit cards might help you pay off massive debt or large payments. Like any other kind of debt, Credits should not get treated lightly. You may start looking for credit after determining how much you need to loan and how much you can justify paying back monthly. Credit repayment calculators will assist you in figuring out how much you’ll have to pay back.

Furthermore, actual feasibility gets determined by the credit interest rate and the total transfer of funds over time. Even a debt with a modest interest rate may result in monthly installments that are too expensive for you to manage.

Some credit cards have changeable interest rates, which may grow over time. These loans have a higher risk than one with a set interest rate. If you’re considering an adjustable interest rate credit, assess it even if the cost of borrowing hits its maximum level. Come along as we highlight all you need to know regarding credit repayment calculators.

How to Use this Credit Repayment Calculator

You can use this credit repayment calculator through the following steps:

Step 1: Enter the credit balance

Step 2: Enter the interest rate (in %)

3 Step: Enter the credit term (in years)

Step 4: Click on “calculate,” and your monthly payments, amount of interest, payment once every two weeks, and the total amount of interest will be displayed upon calculation. If you desire to re-calculate, click “reset,” and all your earlier inputs will get cleared.

Credit Repayment Calculator

How is the Credit Line Calculated?

One of three methods is used to determine your credit limit. You’ll get a credit limit you can’t exceed in certain circumstances. Your credit limit gets determined in certain situations by your payment history and credit rating.

Sometimes, a credit card company will conduct a more thorough investigation of your credit record. This is true when considering any factors why you could be a credit risk and determining the credit lines you presently have on your existing cards.

Here are a few options for dealing with this:

Lending limit

Many card issuers use your credit rating to set the credit limit on your card. This implies that your new card limit will get influenced by repayments, credit use, and duration of credit record, credit mix, and current queries. Your family income, occupation, and monthly spending are likely to be considered by issuers.

The pattern is related to how credit card providers calculate your interest rate. If a credit card proposal has a credit line variation of $1,000 to $5,000, people with more substantial credit ratings will receive the $5,000 available credit. Those with credit scores on the lowest rung of the eligible range, on the other hand, will get $1,000.

The credit limit has gotten set.

Credit cards with fixed credit limitations are available from several credit card companies. For instance, a beginning credit card may have a $500 restriction, but a premium bank card would have a $5,000 restriction.

It’s not a measure of you as a customer whether the limit looks unusually large or little. You subscribed for the incorrect card.

The credit limit that has gotten modified

Many credit card companies utilize a combination of characteristics to produce a unique credit limit for every new customer. This helps credit companies to reduce risk while extending new credit lines.

Some providers use a grid approach to compare ratings from several sources. Determining a credit limit involves a credit rating and an insolvency score.

Others base their debt capacity on your earnings or debt-to-income ratio. Some providers may even consider the credit card limitations on your other accounts. This information is available on your credit file.

How do you calculate how many months it will take to repay a loan?

Since there are 12 months in a year, if you only provide an annual rate of return, divide it by 12 to obtain the monthly charge. Then N represents the total months it will take you to repay the debt. To calculate the years, it will take to pay off the debt, split N by 12.

How do payments work on a line of credit?

A line of credit allows you to borrow money “on request,” which might help you handle costs such as a home renovation or unexpected automobile repair.

Providers such as banks and credit unions generally issue a line of credit. You might depend on it up to the total amount for a specific length of time if you qualified.

You’ll only have to make a payment if you take out a loan from the line of credit. Once you’ve paid back the money you took, you’ll be able to refinance it again. You have complete control over taking the cash out, reimbursing, and repeating. This is true if you follow the requirements, including repaying your debt on schedule and within budget.

How do lines of credit work?

Let’s start with the possibilities you have when you have to take loans. Generally speaking, you may seek either a loan or a credit line. On the other hand, a line of credit offers you access to a specific amount of cash you may borrow as needed. However, you do not have to pay interest unless you take out a loan.

Personal credit lines are usually unprotected, so you don’t have to put up any collateral to get one. Guaranteed lines of credit are debt securities backed by assets such as your home or a retirement fund.

Better credit ratings may make you eligible for a reduced annual yield when applying for a line of credit. Credit cards include fees, such as a yearly charge and limitations on how much you can loan.

Once you pass for the line of credit, you’ll have a specified timescale — the “drawing period”. You may now withdraw funds from the account, and a draw phase might last long.

The institution may provide you with special payments or a card or transfer the funds to your bank account. Once you’re ready to take loans, this method works.

What about the Interest?

Interest will begin to accumulate after you make loans from your line of credit, and you’ll be required to make at least the minimum repayments. This is the quantity credited back to your existing credit line when you make payments.

You will, however, begin the payback period after your draw term ends, and you’ll have a fixed amount of time to settle any outstanding debt. Keep in mind that making merely minimal repayments may cost you more in the long term in terms of interest.

Does a line of credit count as debt?

A line of credit is a kind of debt that functions separately from a loan. When a consumer gets authorized for a line of credit, the lending institution sets a credit limit. In this case, the user may utilize it repeatedly, in whole or in part. It’s an available revolving credit due to this, and it also renders it a far more adaptable borrowing instrument.

Credit lines, except loans, may be used for any purpose, including everything from ordinary expenditures to unique requirements like vacations, modest improvements, and debt repayment.

A person’s credit line functions similarly to a credit card in certain circumstances, such as with a checking account. People may access this money anytime, just as they can with a credit card. This is true as long as the profile is current and credit is still accessible.

So, if you’ve had a $10,000 credit line, you may spend all or a portion of it for anything you need. You may utilize the leftover $5,000 any time if you have a $5,000 reserve. If you finish off the $5,000, you’ll have access to the whole $10,000.

Credit lines feature a higher rate of interest, lower cash quantities, and more minor minimal repayment terms than mortgages. Payments are usually set monthly and include both principles and interests. Lines of credit can have a far quicker and more substantial influence on consumer credit files and scores. Interest occurs when you make a transaction or withdraw cash against the credit line.

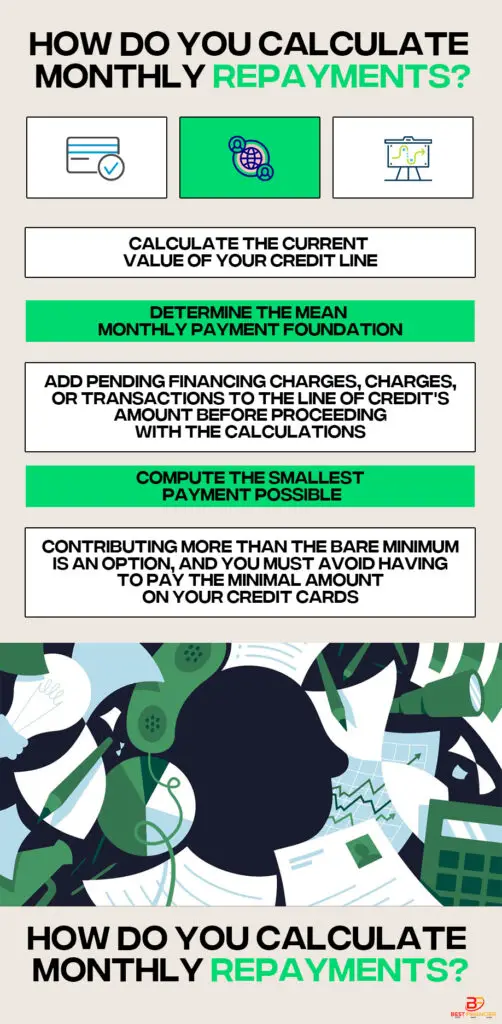

How to Calculate Monthly Repayments?

The processes for calculating monthly repayments are as follows:

1st Step

Calculate the current value of your credit line. This is the sum you’ve drawn on the line so far, not the line’s maximum limit. This information may get found on your most current account report or by contacting the bank that manages your credit line. This data will also get included in your monthly payment statement.

2nd Step

Determine the mean monthly payment foundation. This is often measured as a percentage of the lending line’s outstanding amount. It might, however, be determined only based on exceptional interest. This isn’t something you’ll see on your account balances very often. However, you may get it by contacting customer support or consulting your line of credit’s original documents.

3rd Step

As you make your next repayment, double-check that there are no pending financing charges, charges, or transactions from the account. If any get planned, add them to the line of credit’s amount before proceeding with the calculations. Payments may be subject to fees, so check to see if any are outstanding on your profile before computing your repayment.

4th Step

Compute the smallest payment possible. Calculate the monthly amount by multiplying the amount of your line of credit by the premise. As a consequence, your monthly minimum for that period will get calculated.

For instance, suppose you had a line with a value of $20,000 and a payment base of 2%. Your monthly bill would be ($20,000 multiplied by 2%). This is the equivalent of $400.

Your monthly minimum will get shown on your bank report as well. You can also be obliged to pay off your credit line profile’s amount in total yearly.

5th Step

Contributing more than the bare minimum is an option, and you must avoid paying the minimum amount on your credit cards. Spending more than the least on any credit line monthly might save you a surprising amount.

The additional payment gets allocated to the principal, which indicates that the line of credit will accrue less interest in the months ahead. This might entail paying off a hefty debt, such as a home mortgage, months ahead.

What does monthly payment mean?

Your monthly repayments are the amount you pay to the borrower to repay your debt each month. The conditions of your bank loan determine the monthly payment amount. This comprises the loan’s principal, the total amount owed, and the interest.

How do you calculate monthly principal and interest?

You’ll have to repay both the principal and interest when you lend money, whether it’s a vehicle loan, a house loan, or a credit card balance. But what exactly do we mean when we say that?

Interest is a price you pay for borrowing money from someone else (typically the bank). It’s how borrowers benefit from lending – besides, they’re not in it for the sake of money.

The installments you make on loan get usually split into two portions. This comprises the portion that lowers your amount to pay off your loan and the part that pays the loan’s interest.

An interest calculator will help you figure out how much principal and interest you’ll pay. If you want to do it manually,

Follow these instructions:

- Multiply your annual rate of return by the number of repayments you’ll make. Because interest rates get stated yearly, this is correct. Divide by 12 if you’re making monthly bills, for instance.

- Combine it with the sum of your credit, which will be your entire principal amount for the first repayment. This tells you how much interest you’ll have to repay in the first quarter.

Even though you’ve started paying down your principal, you’ll need to compute your new amount before calculating the interest you’ll pay in the coming months. So:

- Deduct the number you spent from the percentage you just computed. This tells you how much of the loan principal you’ve paid down.

- Subtract this amount from the initial principle to arrive at the new loan sum.

The most straightforward approach to figuring out continuous interest payments is to whittle it down into a table.

It’s also important to remember that conducting the calculations yourself will result in minor inaccuracies due to squaring and human mistakes. Overall, this must give you a fair picture of how much interest you’re spending every quarter.