Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Surveys indicate that most families do not have enough money to cover a $1,000 emergency; thus, it is more important than ever to make and stick to a budget. To help you, we have created this article on a free monthly budget calculator. This is also true since many Americans are battling debt. The free monthly budget calculator to create a family budget may serve various needs.

This includes accumulating money for long-term objectives like a home or retirement and paying off credit card debt more quickly. This goes beyond just making sure you have enough money to handle any financial setbacks life may throw your way.

The Free Monthly Budget Calculator is proven by unambiguous proof. According to surveys, those who follow their budgets are less likely to express financial concerns. Additionally, it prevents you from living a paycheck-to-paycheck existence and increases the likelihood that you will succeed financially.

Come along as we highlight more on the Free Monthly Budget Calculator below.

What is a Monthly Budget?

A monthly budget provides a summary of your monthly revenue and expenses. It’s simple to balance the money you have coming in (your revenue) with the money you have spending (your outgoing costs) (your expenses).

A monthly budget will show where your funds are going if it is carefully thought out and utilized. It will demonstrate if you are making ends meet. Additionally, it will show you where you may cut costs or where you’re overspending.

To do this, you must carefully plan your budget and reassess it when circumstances change. The greatest challenge with creating a monthly budget is that life seldom fits neatly into a calendar month. You must plan for expenses such as Christmas, vacations, auto maintenance, and long-term savings objectives in each month by thinking beyond the current month.

How to Calculate with this Free Monthly Budget Calculator

You can calculate this Free Monthly Budget Calculator through the following steps:

- Enter your desired amount for food

- Enter your desired amount for rent

- Put your desired amount for other bills

- Enter your desired amount for Miscellaneous (It’s sort of the catch-all budget category and can include monthly periodic, or yearly expenses. Miscellaneous expenses in my budget include birthdays, other gifts, Christmas gifts and decorations, household, toiletry, diapers/baby supplies, dry cleaning, magazine subscriptions and many more)

- Select your desired month. (12, 24, 36, 48 0r 60)

- At this point, the free monthly budget calculator will process and give you the budget output.

Free Monthly Budget Calculator

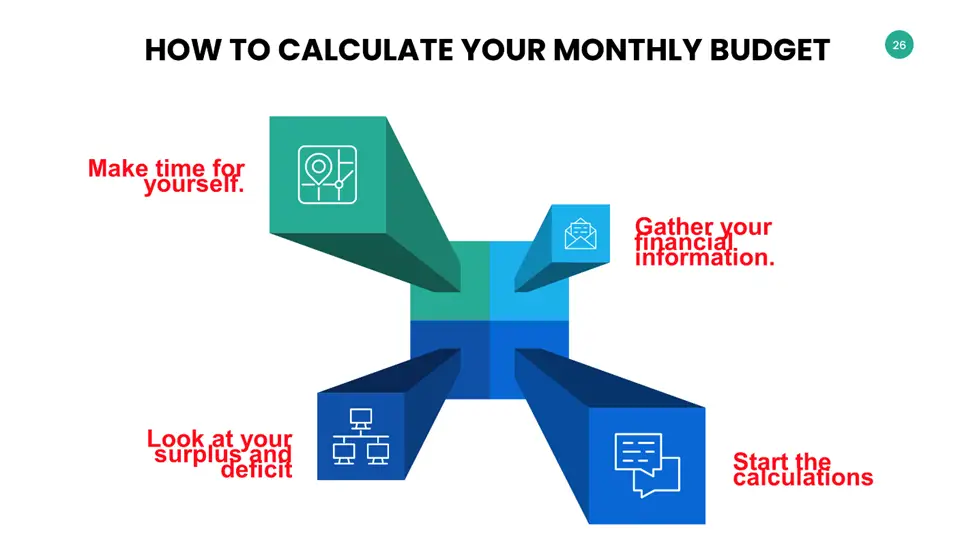

How to Calculate your Monthly Budget

You can calculate your monthly budget through the following steps:

Make time for yourself.

To determine your monthly budget, you must first set aside a sufficient amount of time. The first time you create a budget, it may take several hours. But don’t be discouraged; making it more precise now is worth the effort.

Gather your financial information.

Gather all of your financial data and supporting documentation next. Include any bills, past-due bank statements, and paystubs. Additionally, get any insurance policies and debt documents.

Moreover, your bank records might provide information on how much you normally spend on living expenses like food and clothes. Additionally, keep track of your expenditures on things like vacation and recreation. Take a month to acclimate these yearly expenses.

Start the calculations

The amount of money you earn each month may then be calculated. This is what you make. Include all household income sources, including salaries, bonuses, investments, inheritances, and pensions.

After that, you must also determine your ongoing expenses. You may complete all the necessary steps with our free monthly budget calculator. Utilizing all your knowledge will make this simple and ensure you don’t miss anything.

You may then finish the total computation using this step. This will demonstrate how much money you have left over each month and if you live over your means.

Look at your surplus and deficit.

Your budget is in deficit if your expenses are more than your income. You’ll now need to reduce part of your spending. Dropping your regular cup of coffee is one option comparing energy companies.

You have a surplus budget when you meet your outgoings and still have money left over. You must now decide whether to start, expand your savings, or make further debt payments. Investing and saving can help you attain even more financial stability if your budget is surplus and you have no debts.

This can also be seen in the infographic below.

How Much Do you Need to Save?

That is a significant question. You may determine your appropriate savings rate depending on your individual, long-term savings goals. This comprises:

Retirement

You should consider setting aside 10 to 15% of your salary for retirement. Sounds difficult? Not to worry, if you have an employer match, it counts. If you save 5% of your salary and your employer matches it with another 5%, your savings rate is 10%.

Emergencies

Additionally, you want to consider setting up an “emergency savings” that can pay for 3–9 months of your living costs.

How do you manage to save so much money? To start, figure out your monthly cost of living. Consider giving up pleasures like pedicures or your premium cable TV package if you lose your work. How much is required of you to survive?

That sum is divided in half. Can you make this a monthly saving? If so, during the next year, you’ll accumulate a six-month emergency fund.

The remainder

Make a list of the high costs you will incur over the next ten years, from fixing your gutters to planning your wedding.

Indicate the aim and timeline for your desired savings goal. To calculate how much you should save, divide by the number of months left. Want to buy a $10,000 automobile in five years with cash? You will need $167 each month.

Which Investments can Fund your Savings goal?

To reach your investment objectives, no one method works for everyone. A plan that works for retirement savings may not be the best choice for your emergency fund or a down payment on a house. Let’s look at some fundamental investment tactics for your objectives.

Savings Accounts

Savings accounts are the ideal storage facility for the money you need but cannot risk losing. They are accessible from credit unions, banks, and internet banks.

You’re dealing at a relatively poor rate of return with physical banks. The average savings account APY is now at 0.05 percent, according to the Federal Deposit Insurance Corp. An online savings account offers a higher interest rate if you’re ready to utilize an online bank and forgo the in-person knowledge of the industry. This typically has an APY of 0.50 percent.

Accounts for Cash Management

Checking and savings account functionalities are combined in cash management accounts. They are often provided by financial entities that are not banks. As a value-added service, this also covers online brokerages or Robo-advisors. However, you don’t need to use these platforms to create a cash management account.

They may be the best option for people wishing to earn a greater rate of return with no restrictions on the number of withdrawals made each month due to the freedom they provide. Some of them provide more FDIC insurance coverage than is available with traditional bank accounts.

Deposit certificates

A certificate of deposit (CD) can be the ideal short-term investment if you often withdraw money from your savings accounts. This still holds if you want further inducements to save money.

Time deposits are CDs. You donate your money here for a certain time. This might be from one month to five years, and when the CD matures, you receive your money back plus interest. CDs are hence less liquid. You often have to pay a penalty equal to a few months worth of interest if you wish to withdraw money early.

Tax-Advantaged Retirement Accounts

A tax-advantaged retirement account is where you should invest for retirement if you’re like most people. Individual retirement accounts provide significant tax advantages over taxable investment accounts. While assets are in your account, you are assured tax-free growth, saving you a lot of money on capital gains taxes.

529 Plans

One of the finest investments you can make is a 529 plan if you’re saving for college costs. One may be started even before the birth of your children, and family members are welcome to contribute.

The growth of your investment is tax-free, which is another advantage. Additionally, your kid will never owe taxes on the money if the funds are utilized for an eligible school cost. If you invest utilizing this plan, your state may even provide a tax benefit on your state income taxes.

You may often create your portfolio with 529s or choose from a target college start date fund.

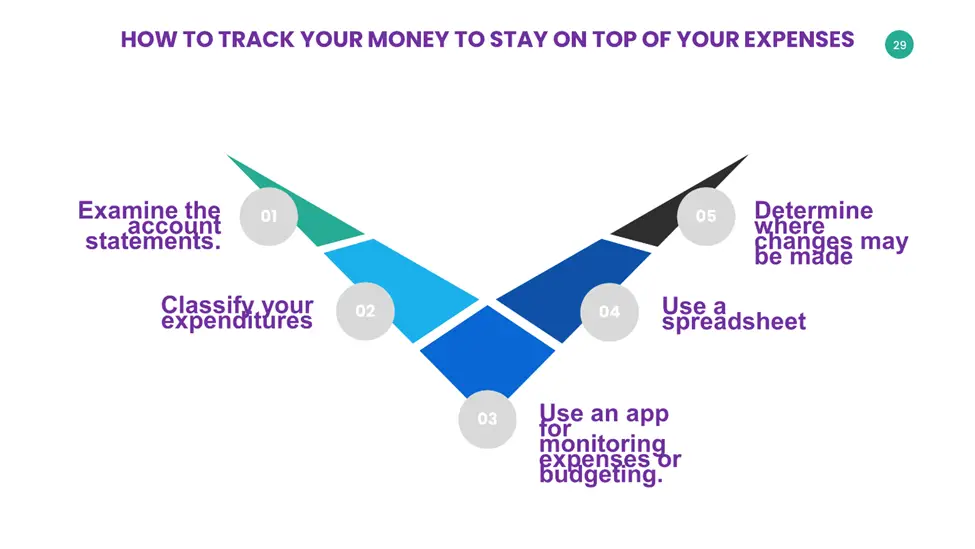

How to Track your Money to Stay on Top of your Expenses

Regularly tracking your expenditures will help you know where your funds are going and where you desire them. The following tips will aid you:

Examine the account statements.

Identify your spending patterns by listing all of your accounts. This should cover all of your credit cards and bank accounts. Finding where your money will go will be easier if you look at your accounts.

Classify your expenditures

Start classifying your expenditures. Some credit cards categorize your purchases for you, such as department stores or automobiles. You could discover that your impulsive purchases are costing you a lot. Perhaps you’ll also discover that you don’t need to be paying for services that need ongoing subscriptions.

Both fixed and variable costs will be included in your expenditure. Less often do fixed costs vary monthly. You’ll have greater flexibility to modify varying costs like clothes, food, and travel.

View your breakdown of expenses to see your main spending patterns and areas where you might make savings.

Use an app for monitoring expenses or budgeting.

Apps for budgeting are made for managing finances while travelling. This enables you to set aside a certain amount of disposable cash each month based on your income and outgoing expenses. These applications may be useful provided you’re prepared to track your buys, put in the effort, and stay under your spending limit.

Use a spreadsheet

A spreadsheet is an additional useful tool for monitoring finances. Numerous free budgeting samples are available online. Additionally, you might choose to pay for software if your financial portfolio is more complicated.

Determine where changes may be made

Be prepared to make modifications as you track because of what you’ll learn; keeping track of your monthly spending is time well spent. Finding out what is truly costing you and what is not as expensive as you first assumed may be done very well by keeping track of your spending.

Reduced “major fixed costs” in your life, such as the price of your home, car, and utilities, may greatly influence your spending plan.

Benefits of Budgeting and the Importance of a Monthly Financial Plan

The Benefits of Budgeting and the Importance of a Monthly Financial Plan include:

Reaching Financial Objectives

Everybody has financial objectives. Some people could want to live independently from their parents, while others would aim to travel the globe. You may set aside monthly money for these objectives without a financial plan. But they won’t be accurate.

Your budget and financial strategy determine how much money you need to make a dream a reality. You may organize your money appropriately when you build a plan to incorporate your objectives and the age at which the goal should be attained. Doing this may avoid using the funds before you reach your objective. It may help you spend less and make wise financial choices.

Emergency Preparedness

It is impossible to forecast accidents, business losses, or diseases. You must put your health above your cash in these circumstances. However, obtaining the necessary help may be challenging or impossible without a solid financial position. This compels people to borrow money or get further bank loans.

A financial plan that is carried out and followed requires a certain quantity of savings. An emergency fund is one of a financial plan’s most often advised components. And you will have one if you follow your financial strategy. Then, this emergency cash may be used.

Increased Financial Knowledge

Opportunities appear out of nowhere. Whether you’ve discovered an investment opportunity or a chance to launch your firm, these circumstances demand that you come up with money quickly. Knowing where your money is invested implies you have a good financial strategy.

Enhanced Quality of Life

A financial plan is not only a way to increase your savings. It may also aid your financial growth if planned out and implemented appropriately. With careful financial planning, you may put your money in the appropriate investment vehicles.

These may provide your family with a supplementary or even tertiary source of income. Even a tiny amount of this revenue may raise your level of life.

Economic Stability

Every individual in the world strives for financial stability. Self-employed individuals and business entrepreneurs lack the stability of a monthly wage. Instead, their monthly salary is based on how much their firm makes each month. Due to this, it could be challenging for you to support your family financially.

With a financial plan, you may safeguard your family’s money and liberate yourself from these restrictions.

Frequently Asked Questions

How do I determine my monthly budget?

The following methods may help you figure up your monthly spending plan:

- To keep track of your expenditures, use labels on your banking app.

- To keep cash payments orderly, separate your money into envelopes.

- If you need an additional reminder, monitor your expenses using a calendar.

What is the 50 30 20 rule budget?

The 50-20-30 budget guideline is an easy-to-understand strategy that may assist individuals in achieving their financial objectives. The guideline indicates that you should expend up to 50% of your income after taxes on commitments and necessities you must fulfill. With the other half, you should allocate 30% to anything else you may desire, 20% to savings and debt reduction, and 10% to both.

The rule is a framework designed to assist people in managing their finances and setting aside funds for retirement and unexpected expenses.

How do I create a monthly budget spreadsheet?

You can create a monthly budget spreadsheet through the following steps:

- Pick Your ProgramSelect a Template

- Enter Your Numbers

- Check Your Results

Is the 50 30 20 rule weekly or monthly?

The 50/30/20 rule is effective once a month. The simplicity of this rule is also lovely. It might assist you in categorizing your income to make saving simple.

Is paying off debt considered saving?

Since a credit card company may restrict your available credit, paying off debts like credit card balances is not a strategy to save money.

How much should I spend on food a month?

Based on age, one person’s average monthly food cost ranges from $150 to $300. These national statistics, however, change depending on where you reside and the food you buy.

What is a realistic food budget for one person?

Based on age and sex, a single adult should plan to spend between $229 and $419 a month on food.

How much do clothes cost monthly?

The typical 25- to 34-year-old adult spends $161 a month on clothes. However, spending is significantly higher for those aged 35 to 44, at $209 per month. This makes sense given that individuals aged 35 to 44 had a mean income of 26% greater than those aged 25 to 34. Depending on their tastes, those who exclusively use a clothing premium service for new garments may spend more or less.

How do you drastically cut household expenses?

The following strategies can help you significantly reduce home expenses:

- Begin monitoring your spending patterns.

- Establish a budget.

- Reconsider Your Subscriptions.

- Use less electricity.

- Reduce your housing costs.

- Consolidate your debt to save money on interest.

- Cut Your Insurance Costs.

Expert Opinion

An examination revealed that over two-thirds of Americans were limiting their monthly spending, even though the country’s economy was experiencing one of its longest expansions. Given how quickly economic fortunes are shifting, that number will probably just rise.

Many Americans have recently tried to tighten their budgets due to stagnant salaries, increased debt loads, and rising housing and healthcare prices. It also doesn’t matter what the GDP and employment statistics indicate.

But without a budget to reveal where your money is going, it’s as difficult to trim the fat from your expenditures and get your finances in order. Thus, the free monthly budget calculator will aid you immensely.

References