Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Can I close my Chase account and open a new one? Many people usually ask this question today. Thus, we have made this post to help you. Closing a Chase bank account and starting a new one is simple. If you don’t prepare, though, it might take an unexpectedly long period.

The procedure may require a day, a week, or even a few months, depending on various conditions. Closing a bank account and starting a new one may usually be completed in one or two days.

The quantity of cash in your account and how soon you deactivate or redirect automatic deposits and online bank transactions to the new account might be factors in the delay.

Furthermore, canceling a Chase bank account and creating a new one is a terrific way to obtain a different perspective on your finances. You can find more details about canceling your bank account and starting a new one in the sections below.

Can I Close my Chase Account and Open a New One?

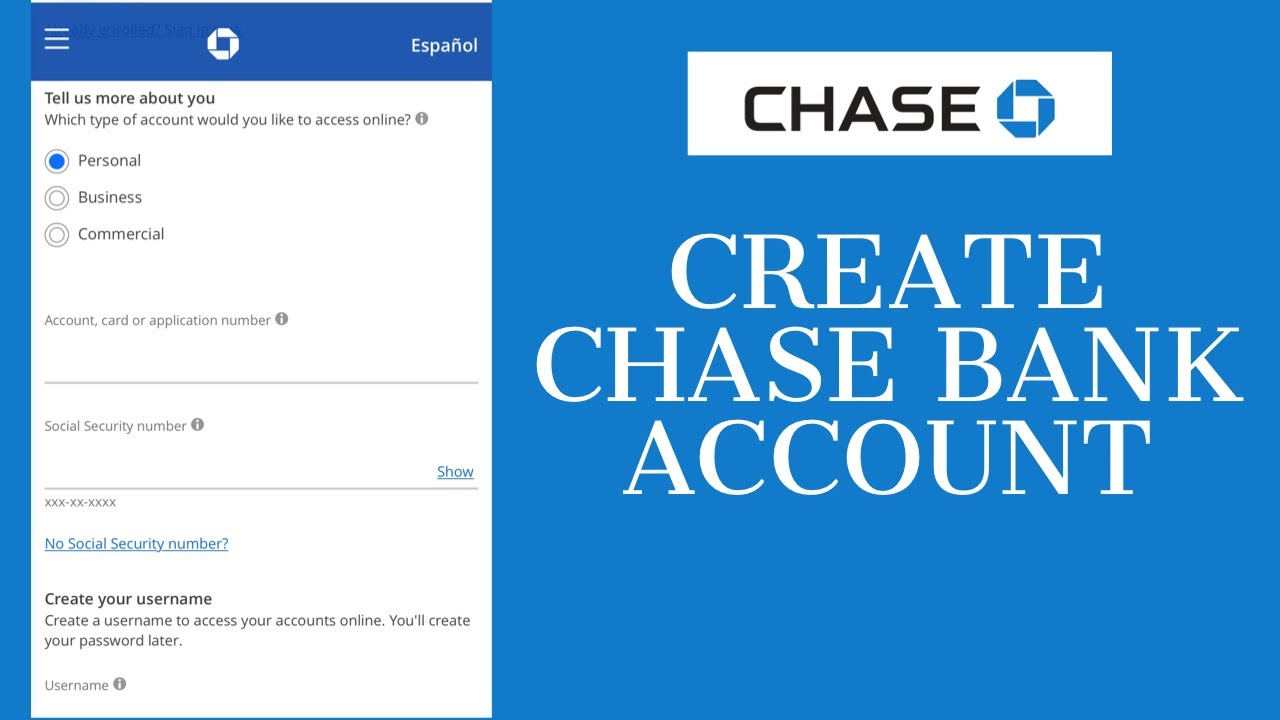

It’s preferable to create a new Chase account before closing your old one. One of the most apparent stages is this one. Ensure you have another account to fall back on before closing your Chase account. You may open one on the bank’s website or in a local branch in a matter of minutes. Here’s how to do it:

How to Register for a Chase Account

Gather all of the necessary materials and information. This includes the following:

- The number assigned by the Social Security Administration

- A driver’s license or a state-issued identification card

- Information about yourself, including your name and phone number

Note: If you’re creating a joint account, both you and the co-account holder must provide this information.

Select a type of account

Chase provides a variety of account choices. Go to the Chase website and click the “Open Now” option for the account you wish to open to get a preview. Examine the details of each Chase checking account and make a note of the key differences to help you decide which one is good for you.

Chase Total Checking: The Chase Total Checking account provides customers with access to 16,000 ATMs and over 4, 00 business units, as well as debit-card chip safeguards and 24-hour customer service. Online bill pay and mobile banking are also available. This account is subject to a $12 monthly service fee. Chase will waive the monthly service cost if you fulfill the conditions for direct deposit, recommended minimum amount, and starting day balance.

Chase Secure Banking: Chase Secure Banking offers all of the features you’d expect from a checking account. This account includes a charge exemption for counter checks and money orders and access to over 16,000 ATMs and online banking services. This account has a monthly charge of $4.95 that you cannot cancel.

Chase Premier Plus Checking: Customers with this interest-bearing account receive priority service and have full rights to all Chase Total Checking perks. Account-holders also accept free checks and no fees when using non-Chase ATMs (up to four times per statement period).

Other benefits include a Chase First Banking account for children, a gratis or reduced safe deposit box, and no costs for paper checks for Premier Plus account users. You may avoid paying the $25 monthly charge if you satisfy specific criteria.

Apply online

You can sign in to your profile and use a pre-filled request to open a new account if you are a current Chase customer.

Put money into the account

To open an account with Chase, you do not need to make a deposit. You must, however, fund the account within 60 days of creating it.

How to Close Old Chase Account

It’s time to close your old Chase account now that you’ve opened a new one. You can do so by following these guidelines:

Move your funds to your new bank account.

To prevent any mistakes, be sure to follow the proper process while moving cash to your new Chase account. Transferring funds between two accounts is usually free, but check the bank’s regulations beforehand. There may be a restriction on the amount of money you may move at one time or the number of payments you can make each month, so plan.

Transfer all future billing to the new account.

Changing your payments to a new account is typically a simple process. Review your past six months of spending to ensure you haven’t forgotten to transmit any regular payments. To avoid mistakenly charging the incorrect account, be sure to update or erase your stored banking information on all of your favourite websites.

Remember to update your deposit information with your company’s payroll department and prepare ahead for any mistakes. Also, verify if you have any regular payments set up that usually get deducted from your checking account. Credit cards, car loans, subscriptions, and other accounts you’ve established to draft from your account every month fall into this category.

Verify that you have received all outstanding payments.

Before closing your account, double-check that you have stopped any automated transactions, such as checks and electronic debits. Ensure that you transfer your direct deposit to the new or another account of your choosing.

Fill out the account closing form, sign it, and send it in.

Keep in mind that your closing paperwork may need to be notarized. Banks and credit union branch sites usually provide notaries.

Dispose of any old checks or debit cards

Ensure that you dispose of outdated chequebooks and debit cards associated with your prior bank account. This will not only avoid any misunderstandings but will also secure your personal information.

Create a document that contains information on each step of the process.

This includes the dates and times you talked with bank employees. You never know when you’ll need this knowledge in the future. Make careful to acquire written confirmation of the account’s termination.

Chase Bank Account: Tips for a Seamless Transition

It doesn’t have to be stressful to close your Chase bank account and start a new one. Follow these guidelines in addition to the ones listed above to make the procedure go more smoothly:

Request a “Switch Kit”

If you’re worried about the procedure of cancelling your bank account and starting a new one, a “switch kit” might help. This can help you write letters instructing your depositors and billers to amend their records. They’re often accessible online, by mail, or at a bank location.

Bringing everyone and everything

Chase bank requires both owners of a joint account to be present while closing it if it is a joint account. So make sure you’re both free on that particular day. For account verification, each account owner may need to present identification and their Social Security number.

Make a reservation

If you want to move your account in person, find out what hours your bank is open and if a staff member can help you. Certain banks handle account opening and closing at a specified time range and a specialized department. The procedure can encounter delays if you are not present or talk with the proper person at the appropriate time.

Don’t anticipate what you think you’re getting

If you have an equity account, some banks may refuse to pay the money accumulated on your account that month when your account is closed. Update Your Contact Information: Make sure your bank has your current postal address and phone number.

You’ll want your reimbursement to go to the appropriate location if it owes you money after you close your account. And you’ll want to know if it reopens your account because of auto payments that you shut off but went through before paying hefty penalties and being reported to the authorities.

Don’t forget to close your account

To avoid the inconvenience of losing their bank account, some individuals keep it open, but there is a penalty. Aside from the costs mentioned before, your bank may charge you a “dormant account” fee if your account is inactive for an extended time (e.g., one year).

Some companies may charge you this monthly fee until you terminate or reuse your account. If you no longer require your account and have already moved automated payments to your new bank account, it’s wise to close it.

Frequently Asked Questions

Can I close my Chase account and open a new one?

Yes. You can close your Chase account and open a new one through the tips highlighted above.

Is there a charge to close a Chase account?

No. There is no charge to terminate your account. Regardless, the client should double-check that their account has not been emptied and their balance is not zero.

How long does it take to terminate a Chase bank account?

It might take one to two business days to terminate a Chase bank account. This is only applicable if you are sure that your Chase account is in good standing.

Is it possible to terminate a Chase bank account through the internet?

Yes. The simplest method is to close your Chase Bank account online. All you have to do is visit the bank’s website and send an email.

Conclusion

In conclusion, Chase bank comes with various merits. And if you desire more help on closing your Chase account and opening a new one, the tips highlighted above will aid you immensely.