Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

With various financial products to choose from, determining which account to establish may be as difficult as deciding where to start. Share certificates are one of the choices available to customers wishing to make money on their savings at credit unions. Here’s an overview of the advantages and disadvantages of a share certificate.

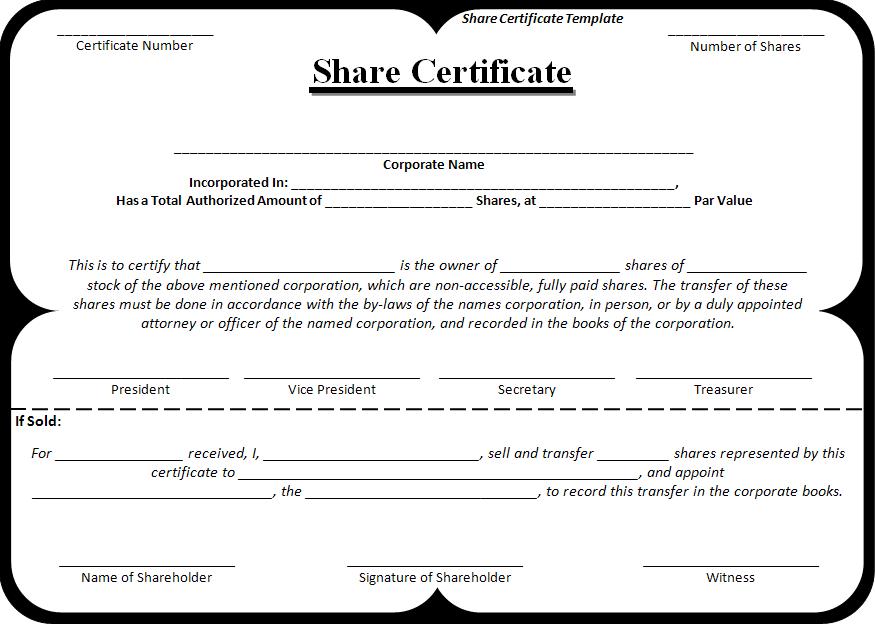

What is a Share Certificate?

A credit union issues a share certificate, which is a deposit certificate. It refers to a deposit made for a certain length of time and earning predetermined dividends throughout that time. A share certificate is comparable to a deposit certificate (CD).

The only variation is that it’s a credit union issuing it. Many credit unions refer to their share certificates as CDs. Share certificates are given for a specific time, usually three to five years. Interest rates and dividends are somewhat more significant than those offered by other types of savings.

The bigger the dividend, the longer the period of the share certificate. Share certificates are a safe and wise investment since they get insured by the National Credit Union Share Insurance Fund (NCUSIF).

Kinds of Share Certificates

Some credit unions provide different product options. The following are some of the most prevalent certificate types:

Certificates with variable rates

These accounts, also known as bump-rate certificates, allow you to upgrade to a greater yield than you began with. You have the option of earning a rate increase if the credit union increases its certificate rates throughout your account. The specific percentage change and the frequency with which you may increase the rate get determined by the institution.

Certificates for young people

These accounts are for those under the age of eighteen. Credit unions often offer youth certificates with lower minimum balance criteria and shorter-term periods than ordinary certificates.

Certificates in jumbo size

A sizeable minimum amount, generally in the tens of thousands of dollars, is required for these accounts. However, they get frequently offered at a lower price than other certificates.

Advantages of Share Certificate

You may wish to consider a share certificate if you have some additional cash and want to earn more enormous dividends (an amount of money given monthly by a corporation to its shareholders out of its earnings).

A certificate of deposit account is comparable to a share certificate account (CD). However, instead of being issued by a bank, it is issued by a credit union. Share certificates are an excellent way to collect dividends while growing your savings.

While you won’t be able to withdraw your savings without penalty throughout the term, you’ll almost certainly receive a greater rate than any other alternatives. Here are a few additional reasons to consider purchasing a share certificate:

Rates for certificates

The yearly percentage yield describes the dividends or profits you may receive on a share certificate. The compounding period, or the frequency with which returns get added to the account, is included in this rate. Credit unions have the option of compounding rates annually, quarterly, monthly, or even daily.

Return on investment that is guaranteed or fixed

When you purchase a Share Certificate, there are no surprises. You choose the deposit amount, period, and interest rate. You’ll be able to compute your dividends upon maturation at the start of your investment as long as you don’t remove the money.

Investing in the short and long term

You have a broad selection of investment options with durations as little as six months and as long as 70 months. If you feel the interest rates will increase, invest for a limited period.

You can invest in a long-term share certificate if you believe rates will fall or stay the same. Keep in mind that the greater the rate, the longer the duration—similarly, the shorter the period, the lower the dividends.

The initial beginning deposit is low.

A share certificate may be open with as little as $100, but a money market account usually needs more significant investment and doesn’t pay as well. Jumbo accounts are offered for more extensive deposits and often receive more substantial interest.

Federally backed insurance

The National Credit Union Administration usually insures share certificates. Each account gets federal insurance up to $250,000, so you can be confident that your money is secure.

Higher yield

Share certificates are a higher-yielding but still secure option to invest money for a specified period among the numerous savings products offered by credit unions. Consider if the additional profits outweigh the time commitment, and choose the best one for you.

Adaptable terms

You can be confident of a precise return at a given moment as an investment. You’ll be able to calculate the pace at which your account balance will increase, making financial planning even more straightforward.

Better rate of return than savings accounts

A certificate is sometimes more valuable to the financial institution than a standard savings account since the certificate holder cannot withdraw money as freely as ordinary savings account customers. As a result, a certificate’s interest rate is often more significant than a standard savings account. This allows you to get a better return on your investment.

Disadvantages of Share Certificate

The following are some of the drawbacks of a share certificate:

Penalties for early withdrawal

You’ll usually get a penalty if you take money out of a share certificate before the stated maturity date. Depending on the account agreement, the amount might be a part of the profits, such as 90 days of dividends.

In other words, share certificates are comparable to bonds and CDs in that the money gets restricted for the duration of the certificate. Early redemption of the certificate is usually problematic. There are steep early withdrawal penalties that wipe out any profits when it is permitted.

Liquidity is limited

A CD holder does not have the same access to their funds as a regular savings account holder. You must pay the penalty if you remove money from a CD before the end of the term. This penalty might shape lost interest or a penalty on the principal.

An investor may establish a CD ladder to maximize flexibility, which entails CDs with multiple maturity dates and durations. You have additional opportunities to retrieve your CD funds at various periods if you use a laddering technique.

Risk of Inflation

The rate of interest on CDs may be lower than the inflation rate. This implies that if interest rates outpace inflation, your money may lose buying power over time.

Frequently Asked Questions

Are share certificates worth it?

Yes. Share certificates are valuable since they allow you to diversify your portfolio.

What are share certificates?

Share certificates are a kind of financial institution deposit account that functions in the same way as bank CFDs (CDs) do. They normally pay a higher rate of interest than regular savings accounts.

In return, you consider leaving your money in the account for a set amount of time. It’s possible that this will endure anything between 4 to 5 years. Greater durations are more probable than small distances to have greater rates. If you hold your money out too soon, you could face a penalty.

Money put into such accounts by government-guaranteed credit unionized workers is likewise safe. Share certifications and other holdings are normally insured by the Financial Services Authority Administration for upwards of $250,000.

What are certificate ladders?

You can use a certificate pyramid to benefit from the greater rates of a five-year capital contribution without committing your funds for that long. This is a strategy of investing in many term certificates and afterwards rolling the money out into a fresh one or removing them when they age. For instance, if you spend $10,000, you could achieve the following:

- Put $2,000 into each of the 5 certificates, which have together around from one through five years.

- Whenever the one-year certificate expires, roll over the money into a new five-year certification.

- The following year, the funds from the aged two-year certification in a current 5 certificate.

- If you slide across each certificate as it ages at the close of every year, you’ll have such a five-year certification at the end of the tenure. You can take the money and earnings at a five-year pace if one of these finishes.

What are the options to share certificates?

While share certificates are excellent investment vehicles, they do have certain disadvantages. If you’re looking for another investment vehicle, consider the following:

High-yield account: Depending on the length of the term, these accounts provide similar interest rates to CDs and share certificates. In contrast to the set rate offered by a share certificate, interest rates on a high-yield savings account might grow and decrease.

Money market account: Money market accounts pay interest and are presented by banks and credit unions. Unlike savings accounts, CDs, and share certificates, money market accounts generally come with checks and a debit card, comparable to a conventional checking account.

Stock market investing: This strategy offers the most significant potential for profits, but it also has the greatest danger of losing money. The government does not guarantee stock market investments.

Conclusion

In conclusion, share certificates provide a good investment alternative for many today. And if you desire more help in this regard, the tips on the advantages and disadvantages of share certificates above will aid you immensely.