Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

A critical component of building money is investing. By doing so, you may combat inflation, contribute to the achievement of financial goals, and stable your financial situation going forward. Each individual has different financial goals that are not universal. The investor’s risk tolerance should be taken into consideration while making an investment choice. Similarly, the investor is aware of how investment plans are classified according to various risk factors. At this point, the investment plan calculator will be your best ally.

An essential step in the financial planning process is investment planning. Here, one establishes clear financial objectives and creates a plan for reaching them. The many types of investments include cash, bonds, securities, contracts, and even real estate. One may use these financial instruments, depending on the cash available, to achieve their desired goals and objectives.

In other utterance, an investment plan calculator can assist you in devising a strategy. This may also help you accumulate more wealth and safeguard your future as well as the futures of your loved ones. Come along as we highlight more on this below.

What is an Investment Plan?

An investment plan is an approach that takes into account both your financial situation right now and your investing objectives. Your investing strategy should specify how you intend to use the funds. This is about how long you’re prepared to keep it invested and the kind of investments you make to help you reach your objectives.

If you are working toward a long-term objective, you may want to invest more heavily in volatile stocks since they may provide greater dividends. If you’re worried about losing money during market downturns, you could wish to spread your funds out further throughout several industries, marketplaces, or regions to help you better withstand the wave.

When estimating your potential future returns, it might be helpful to consider past investment results. But keep in mind that previous outcomes are not always predictive of future ones. Whatever your objectives, you should constantly keep in mind how your financial situation is now and in the future.

How to Calculate your Investment Plan

You can calculate your investment plan by using our investment plan calculator. This works through the following steps:

- Enter the Value of Investment ($)

- Enter the Interest Rate (%)

- Put the Frequency (Compounds)

- Enter the Number of Periods

The investment plan calculator will process your input and produce the right output.

Investment Plan Calculator

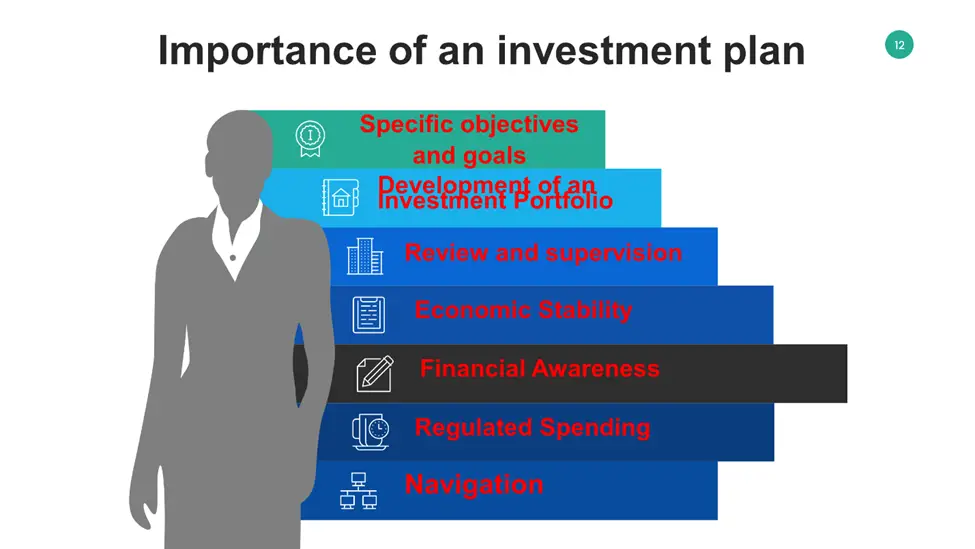

Importance of an Investment Plan

One of the main benefits of having investments is having a safety net in case of emergencies or after retirement. It is seldom a good idea to spend all of your income as it is received. No matter how little you save or invest, it is wise to set aside some of your income. Financial gurus will constantly advise you to invest your money in various portfolios to secure your future and the future of your loved ones.

You need to have a strong investment strategy that will guarantee the accomplishment of your financial and investment objectives if you want to make profitable investments. Planning your investments is crucial for the following reasons:

1. Specific objectives and goals

Your financial plan will benefit when you incorporate an investing strategy since it will force you to consider and pinpoint your long-term financial goals and objectives. The optimal form of an investment portfolio to achieve your financial objectives will depend on the type of lifestyle you wish to lead in the future. You may see the greater image you desire for yourself through this.

2. Navigation

Your financial situation will feel more organized if you have a strategy for your investments. The finest investment will be available to you, and all of your financial decisions will be deliberate and well-intentioned.

3. Development of an Investment Portfolio

You may choose the investing approach that best fits your financial objectives with the use of an investment plan. You would be able to decide how to shift money around to expand your assets and how to match your income with your savings. Taking into account your current needs, it enables you to create an investment strategy that will be confident for you.

4. Review and supervision

You may evaluate your investing tactics and keep track of the performance of your investment portfolios with the aid of an investment plan. If there are signs that your current methods won’t help you achieve your financial objectives, you can always analyze and alter them with a sound investment strategy.

5. Economic Stability

A long-term and short-term investment plan safeguards your future. It teaches you how to invest and save money to safeguard your future and the futures of others you care about.

6. Financial Awareness

The amount of financial knowledge you get through investment planning is one advantage. You must be knowledgeable about a wide range of investment vehicles to pick the best investment strategy for your financial goal, which will increase your financial literacy.

You will be aware of assets that are suitable for both short- and long-term goals. It will open your eyes to whole new ways of thinking about budgeting and enhancing both your financial status and way of life.

7. Regulated Spending

You must evaluate your present financial status before creating an investing strategy. This will make it possible for you to set aside and invest some of your money. Additionally, it limits your spending so that you may adhere to your investment and savings goals.

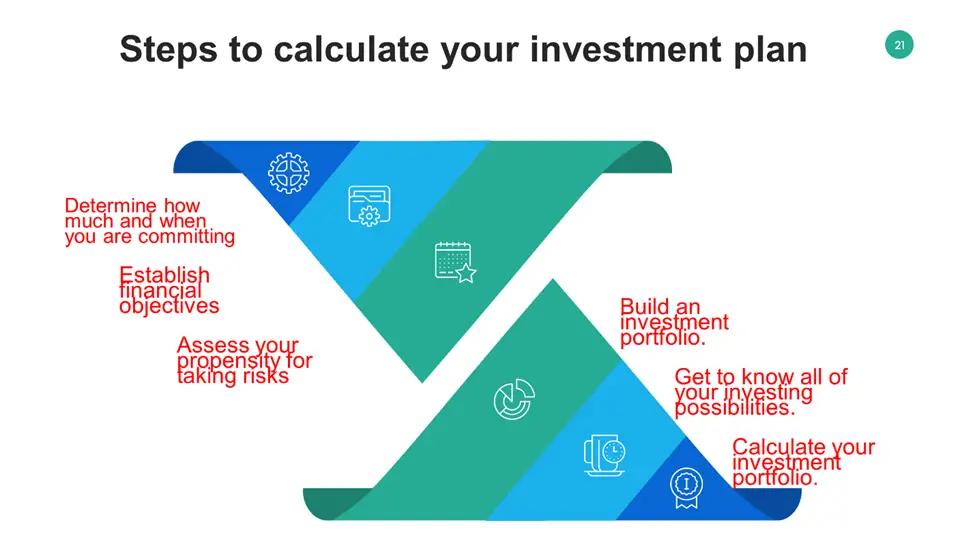

Steps to Calculate your Investment Plan

You can calculate your investment plan through the following steps:

- Determine how much and when you are committing.

- Establish financial objectives

- Assess your propensity for taking risks.

- Build an investment portfolio.

- Get to know all of your investing possibilities.

- Calculate your investment portfolio.

Finally, you may compute your investing strategy by fusing the aforementioned processes with the Rule of 72.

Simply divide 72 by the anticipated annual rate of return to use the Rule of 72. Keep in mind that the methodology assumes a constant rate throughout the investment’s lifetime.

The steps have also been highlighted in the infographics below.

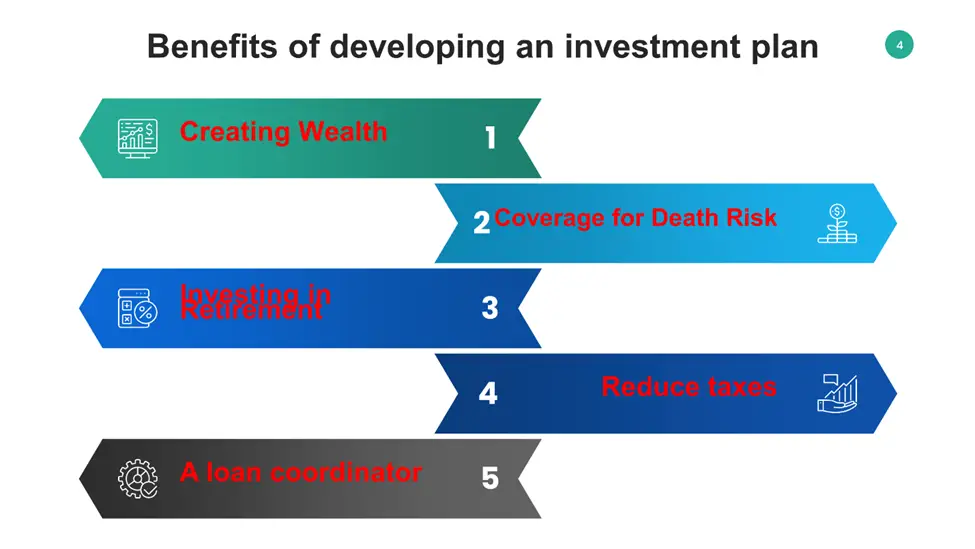

Benefits of Developing an Investment Plan

Some Benefits of developing an investment plan include:

Creating Wealth

Investment strategies are certain methods to build money over time. A plan may be purchased by an investor depending on the risk, rewards, and disposal cost. Investment plans can help you financially in the future when you’ll need money for things like a child’s schooling, child’s wedding, retirement, or pension.

Coverage for Death Risk

Not all investment plans include possibilities for mortality risk insurance. However, life insurance investment programs do. These policies cover the risk of death. In this manner, even if you are not home, your family’s financial requirements will be met. In the case of the policyholder’s death, the nominee receives the amount promised.

Investing in Retirement

These investment programs are available for purchase at any stage of life. Having said that, doing so enables you to build a retirement fund. One may acquire and accumulate resources for use in later life. In this manner, the investor would maintain their financial independence even after retirement.

Reduce taxes

Investment plans assist in tax reduction in addition to risk mitigation and wealth building. The American Tax Act exempts premiums and payments from taxation. a wonderful combination of tax advantages, wealth building, and financial protection.

A loan coordinator

Plans for investing in life insurance also facilitate loans. However, it depends on the insurance coverage selected, the number of payments made, and the loan amount qualifying.

Frequently Asked Questions

How much will I have if I invest 500 a month for 30 years?

Building money is a straightforward and uncomplicated procedure when you invest $500 a month. If you put $500 down each month for 30 years, you’ll have more than $1.2 million.

How do I calculate investment growth?

The following equation may be used to determine investment growth: ROI = Net Profit / Cost of the Investment X 100. If you are an entrepreneur, the growth of your holdings will show you how profitable they are. The return on investment (ROI) reveals the profit from your mutual fund schemes if you put your money in mutual funds.

What is the rule of 72 in investment?

The Rule of 72 is a computation that determines how many years it will take for your money to double at a certain rate of return. Divide 72 by 4 to get the number of years it will require for your income to double, for instance, if your account yields 4%.

How is investment calculated?

You can calculate investment through the following steps:

Step 1: Acquire the Investments Present Value

These days, it’s rather simple to locate investment values. Look for the value of an income investment that you do not now possess online.

The same applies to an income investment that is part of your income portfolio. The holding is also available in your brokerage account if you like.

Step 2: Calculate the Asset Yield

The yield of an investment is a common way to describe the revenue it generates. The yearly revenue a certain investment generates is its yield. Then divide it by the investment’s value. A percentage may also be used to represent yield.

Step 3: Divide the asset’s value by its yield.

The challenging task is finally over. Step 3 is just a multiplication of the return from stages 1 and 2 by the investment’s value. The result of the computation is our investment income.

How much will I have if I invest 500 a month?

In 29 years, $500 invested each month at an average annual return of 7% will have increased to more than $500,000. A reasonable expectation for an S&P 500 index fund is a return of 7%. After accounting for inflation, such a growth rate is consistent with the long-term performance of the stock market.

How much do I need to invest for 10000 per month?

Let’s look at stock market investment if your objective is to earn an additional $10,000 every month. To achieve your objective, you would need to commit around $1.72 million at a return of 7% annually, or 58% monthly.

Which scheme is best for monthly income?

The best scheme for monthly income includes:

- Fixed Deposit

- Monthly Income Plan for Post Office

- Long-term Treasury Bonds.

- Deposits made by businesses.

- SWP is obtained through mutual funds.

- The Senior Citizen Savings Program.

How do I invest my salary?

You can invest your salary in the following ways:

- Equity-Linked Investment Plan

- Employee Pension Plan

- A fixed deposit

- A mutual fund

- Gold

Expert Opinion

Investors have often selected fixed income assets where the returns are predetermined and have made returns a trade-off. Many investors are likewise afraid of taking risks. However, many of them are now taking the risk and investing in equities due to the shifting trend and appeal of stock market returns. In today’s environment, investment preparation is essential.

Without it, you are unable to achieve your objectives in life and sometimes run into financial difficulties. It would make logical sense to have a plan to assist drive our actions if we are making investments now that would directly impact our financial future. The above tips on the investment plan calculator will also aid you immensely.

References

- https://www.elearnmarkets.com/blog/investment-planning/

- https://smartasset.com/investing/how-to-make-an-investment-plan

- https://investor.vanguard.com/investor-resources-education/how-to-invest/turn-your-goals-into-an-investment-plan

- https://www.europeantimes.news/2022/08/investment-plan-for-europe-e22-million-support-to-polish-company-for-new-cancer-treatments/