Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Although innovation has altered how the globe finances, several conventional banking practices and tools still exist. For instance, writing a check is still an acceptable form of payment. Checks are essential to everyday financial life, whether delivering payment for services provided, receiving a salary from your company, or obtaining a birthday check on a card. Additionally, you may need to write a personal check. Various factors may be to blame for this. Thus, we have made this post on how to write a check to yourself.

Additionally, the procedure becomes almost completely automated for those who frequently write checks. It might be hard to write a check to oneself, however. Digital transfers are replacing checks, although they haven’t completely replaced them yet. Thus, below are the steps needed to know how to write a check to yourself. Come along!

What is Check to Cash?

The check on which you usually write the name of payee” has the word “Cash” on the check payable to cash.

- A check receivable to funds is not payable to a specific person or company; anyone with the check may cash or transfer it.

- Most checks can be made payable to somebody who can collect the funds mentioned in the checks.

- The payee is the only one permitted to handle or deposit the check.

- You should write “Cash” instead of the payee’s name for this type of check.

How to Write a Check to Yourself

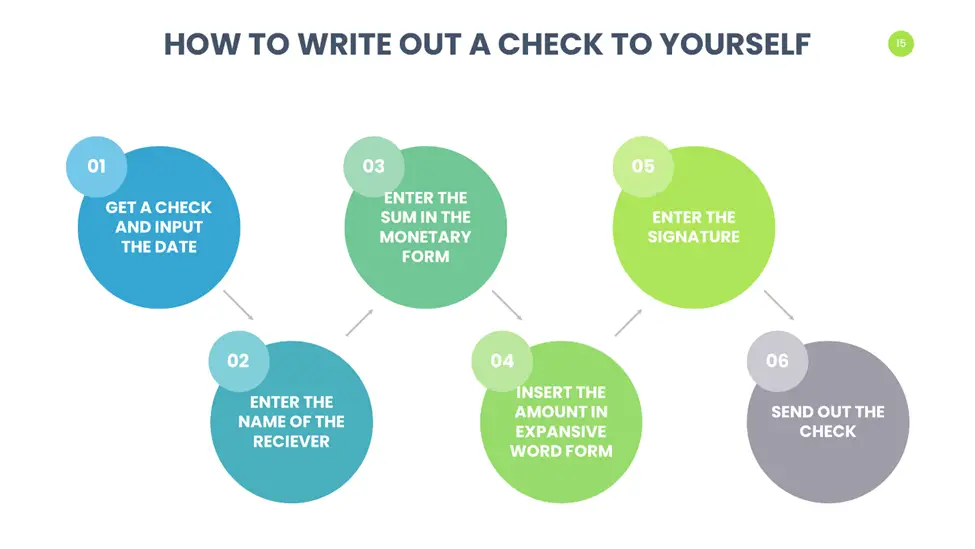

You can Write a Check to Yourself through the following steps:

Step 1: Get a check and input the date.

Write the date on the space at the upper right side of the check. The month/day/year arrangement is the norm in the US. This is crucial because it tells the bank when you wrote the cheque. Additionally, it indicates if the check is postdated, which must be paid on or after the check’s period.

Step 2: Enter the name of the recipient.

After the words “Pay to the Order Of,” fill in the recipient’s name on the empty line. Since you are sending the cheque to yourself, this should be your name. Please remember to include your first and last name for superior results.

Step 3: Enter the amount in numeric data

Add the amount in dollars and cents by using the numbers in the box to the right of the participant’s name. The amount should be written as closely as possible to the left side of the check.

Step 4: Insert the amount in expansive word form

Along with the participant’s name, the dollar amount must be entered in expanded word form in the space below. Nevertheless, cents must be expressed as a fraction. As this is the amount formally defined on the check you write out, write little to guarantee that the complete amount can be written out.

5. Enter the signature.

On the space in the bottom right corner of the cheque, write your name. You must sign this document. Without it, the bank will be unable to process the cheque. Before you give over or send the cheque, double-check to ensure you have typed down your signature.

Step 6: Send out the check

The cheque may be deposited by bringing it in person or sending it to your banking institution. Present your ID to the teller at your bank. The check may also be deposited at an ATM, or you can scan the check’s front and reverse with your smartphone and submit it to your bank’s mobile app.

Reasons to Write a Check to Yourself

Some reasons to write a check to yourself include:

1. Moving money from one bank account to another

A transfer inside a bank is what this is called. You may deposit these monies into your other account by writing a check in the manner described above.

You may also accomplish this digitally by logging into your banking account from a smartphone or computer and moving money across accounts. This may be done over the phone as well.

2. Immediately cashing a cheque

If you need money, writing a check to yourself might be helpful. A check written to be cashed may be deposited or cashed at a check cashing business. On the line that reads “Pay to the order of,” you would put “Cash” to write a check to withdraw cash. As a result, the check practically becomes equivalent to cash since anybody may use it.

3. Using shared bank accounts to cash checks

You and the individual with whom you share a bank account can make checks payable to yourselves if you’re a joint account.

The confirmations of both account holders are not necessary for banking institutions to cash or lodge the cheque. This implies that if you use this account to write a check to yourself, you may deposit it in another account without involving the other person mentioned there.

4. Cashing company checks from accounts

You must be an approved signer to draft a check to yourself from a company account. When an account is created in that name, the banking firm needs the names and signings of all owners, executives, and staff members authorized to sign checks on the company’s behalf. These are the only persons who may make checks from that account unless another person is granted this ability.

You can make a check payable to yourself as an authorized signer and deposit it in your checking account. Follow the same methods previously mentioned above to do this.

Pros & Cons of Write a Check to Yourself

Some pros & cons of writing a check to yourself include:

| Pros | Cons |

| No convenience surcharges. | Checks are expensive. |

| Solid evidence of payment. | It takes longer to process. |

| A secure method of sending money. | You can be levied a service fee by your bank if you write too many checks. |

| No training is required. | You may need to maintain a certain minimum amount in the bank. |

| Nearly every company makes use of them. | |

| They are well-known. |

Other Ways to Move your Money

Transferring money from one bank account to any other bank is not a difficult task. If you have to write a check to yourself, you must wait for the check to get back to your bank.

And to complete the process, you must wait for some business days to transfer funds between banks. There are many electronic tools to make the process of transfer of accounts easier to facilitate the customers.

ACH transfer

The easiest way to move the money is a bank-to-bank transfer, also known as an ACH transfer. It is an electronic way to move money from one account to another. To avail of this option, your existing bank offers you a bank-to-bank transfer service. Online banks permit you to link many accounts, which is the primary reason to use an online bank account.

Nowadays, brick-and-mortar banks offer this feature too. Moving funds through the Automated Clearing House network facilitates the transfer of funds electronically, as it is free of cost.

Other online services and apps

If your bank does not suggest transferring between accounts, you can choose other user-friendly apps and third-party services. These apps help access the funds in your regular bank account. The drawback of this method is that it is time-consuming, and much effort is required to set up charges for these services.

Moreover, small transactions are easy, but large amounts are difficult to transfer and complete in many steps. For example, the PayPal account linked to the checking account, using a different Email address, can make a regular PayPal account.

Joint bank accounts

A joint bank account is an account that two or more persons or entities have opened. The close relatives or business partners commonly open joint bank accounts, but they can be used for other purposes, such as by the club committee.

Writing a check to cash isn’t good; how to write it anyway:

Writing checks to cash isn’t a brilliant idea since you’ll be out of pocket for the cost of writing the check and any check processing costs. If you have insufficient money in your account and have to write checks to yourself to meet the face value, you may have to pay a $25 surcharge, so don’t create a $ 100,000 check with yourself for fun.

For example, if you have to pay a 3% transaction fee on your card and write a check for $1000, you have to pay a $30 fee in addition to any interest rate.

Frequently Asked Questions

Can you write a check to yourself and cash it?

Yes, you can cash a check written to yourself. However, be doubly sure you have the money to cash it. If you wouldn’t, you can face criminal charges.

Can you write a check to yourself?

Yes. Putting your name on the “Pay to the order of” line is the most secure and straightforward method to write a check to yourself. Then, complete the signature line, date, and amount as normal. Endorse the check at your institution in the designated space on the reverse, then provide your ID to the teller.

How much can I write myself a check for?

Personal checks have no monetary amount restriction. You can write a check to yourself for any sum as long as the money is present in your checking account and a personal check is recognized as a valid way of paying.

How can I send money to myself?

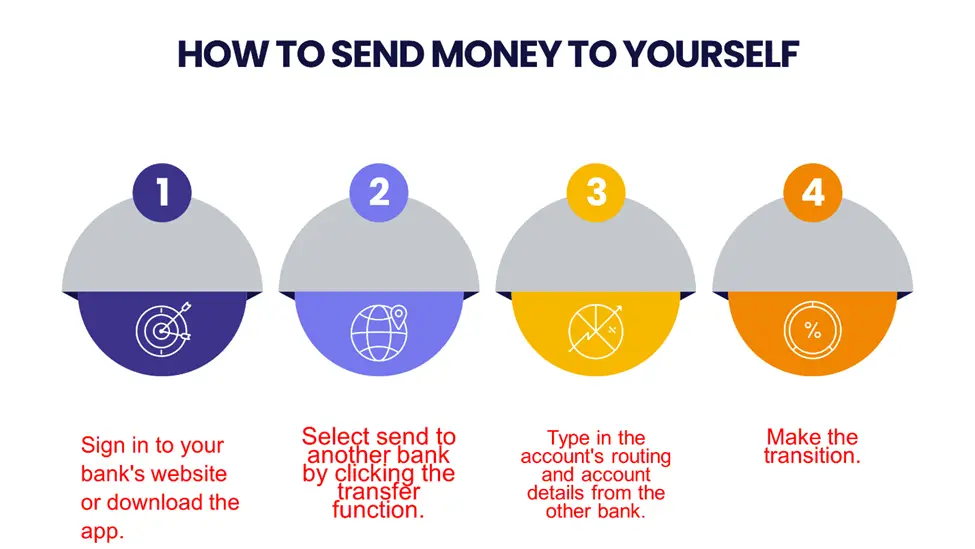

You can send money to yourself through the following steps:

- Sign in to your bank’s website or download the app.

- Select send to another bank by clicking the transfer function.

- Type in the account’s routing and account details from the other bank.

- Make the transition.

This has also been highlighted in the infographics below:

Where can I cash a personal check myself?

You can cash a personal check to yourself through the following places:

- The local credit union or bank.

- The Issuing Bank

- Check processing services at Walmart.

- Travel terminals and service stations.

- Food markets.

- Grocery shop

Conclusion

From the above discussion, it is clear that writing a check to yourself can conveniently transfer money from bank to bank. So it would help if you did not visit any other bank with cash or pay the wire transfer fees to receive the funds from any other bank.

However, it is necessary that when you create a check for yourself, there should be enough funds in your existing account when you deposit the check. Your check will be bounced when the receiving bank accepts the bad check.