Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

“Value-Added Tax,” or VAT, refers to a sales tax on the value added to a beginning item or service. It is also a natural condition and is calculated as a percentage of the final cost of the products and services that the consumer pays for. This is made possible through a convoluted system in which the tax is refunded to each individual or business that adds value to a product. This is passed along until the final consumer pays for it. Due to its complexity, we have made this post on the VAT inclusive calculator to aid you.

Why Vat is Important?

In many nations, VAT is one of the budget’s main funding sources. People who believe in equality of result feel it is unjust to people with a worse economic status since it is a consumption tax borne proportionately by everyone who consumes it.

The uniformity of how the tax is applied throughout the many nations that use it is where things become complicated. Although it may go by a different name in certain locations, other nations have embraced VAT, which is most common in Europe.

For instance, the value-added tax (VAT), often charged at rates between 15% and 25%, is administered uniformly in various nations. In other instances, it refers to a sector that is seen, for some, often arbitrary reason, to be essential to the operation of the entire economy, such as tourism in nations where it accounts for a significant portion of GDP.

Several nations have various VAT rates for various categories of goods and services. The official VAT rate, for instance, maybe 20%, while the rate for books could be 5%, and the rate for transportation and lodging services could be 10%.

This is why it might be so helpful to have a VAT-included calculator. Follow along as we go into more detail about this below.

What is VAT Inclusive Calculator?

You may use the VAT inclusive calculator to determine the gross price of the item based on its net worth and the amount of VAT you must pay. Additionally, you may use the calculator to change the net or gross amount by adding or subtracting VAT. The VAT-inclusive calculator may also assist you in quickly determining an item’s or service’s pricing that includes VAT.

How to use this VAT-Inclusive Calculator?

You can use this VAT-inclusive calculator through the following steps:

- Enter the amount ($).

- Enter the VAT (%).

- At this point, the VAT-inclusive calculator will process your input and produce the right output.

VAT-Inclusive Calculator

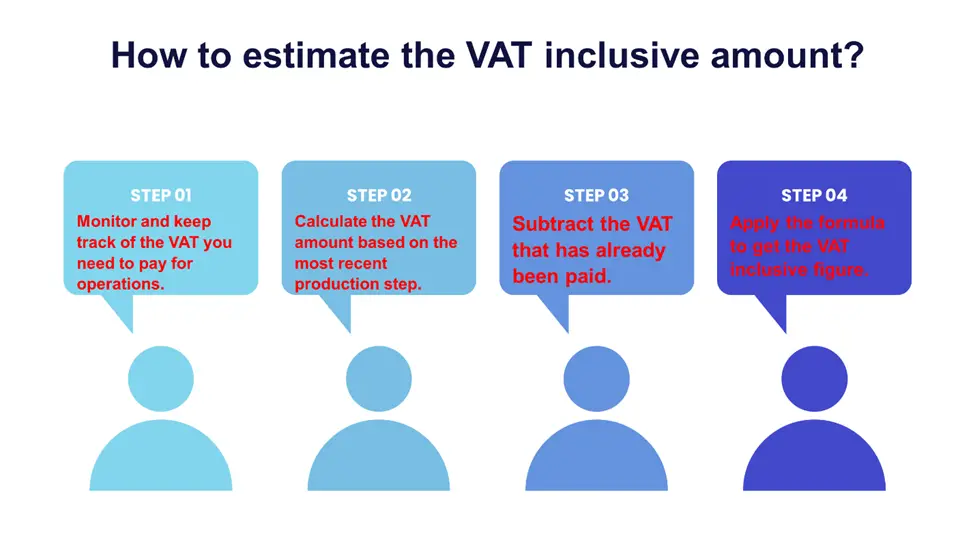

How to Estimate the VAT Inclusive amount?

You must evaluate the VAT inclusive quantity and then add it to the entire amount if a price exempts VAT and you wish to know what the total cost would be if VAT were included. Follow the below steps:

- Monitor and keep track of the VAT you need to pay for operations.

- Instead of merely receiving tax money at the point of sale to the final consumer, tax jurisdictions get it throughout the supply chain under a VAT agreement.

- Calculate the VAT amount based on the most recent production step.

- Subtract the VAT that has already been paid.

- Apply the formula “Output Tax – Input Tax =s VAT” to get the VAT inclusive figure.

You are required to pay that amount if the outcome is affirmative. You’ll receive a refund for that sum if it’s lower than zero.

This can also be seen in the infographics below.

Frequently Asked Questions

How do I calculate VAT backward?

Simply divide the amount you wish to work backward by 1.2 (1. + VAT %) to compute VATS. The VAT is then equaled by subtracting the split amount from the original number.

How do you add 20% VAT on a calculator?

To add 20% VAT on a calculator, simply multiply your initial price by 0.20. Once you press the “=” sign, you’ll get the correct output.

What is VAT inclusive value?

VAT Inclusive value indicates that the price contains the worth of the tax. The inclusion of VAT in the stated price of products or services is required in certain countries.

How do you calculate tax inclusive and exclusive?

Understanding the distinction between exclusive and tax-included rates is useful for company owners. When comparing prices for products and services, distinguishing between flat rates and rates subject to extra tax can help you estimate your overall spending power.

The term “tax included” describes the amount of tax incorporated into the purchase cost. Simply use the usual 18% rate to determine the tax included. For instance, if you sell something for $1,000, the net price is going to be $1,000 Plus 18% of $1,000, which comes out to be $1,000 + 180, or $1180.

Tax Exclusive is the procedure in which tax is computed at the point of final activity. Business owners that do not wish to include tax into the cost of their goods or services may choose Tax Exclusive rates. This technique also offers a more thorough accounting of costs when preparing an invoice.

Remember that customers may desire a clear statement that VAT does not apply, so they know to anticipate a larger total at the purchase.

You can calculate the Tax Exclusive through the following steps:

- Step 1 is to split the total cost by one plus the rate of taxation.

- To calculate the amount of tax due, multiply the first step’s outcome by the tax rate.

- From the final price, deduct the tax dollars from step 2.

In summary, the unit price you see when using the Inclusive tax rates will always include tax. In contrast, the tax applied at the moment of purchase will not be included in tax-exclusive pricing.

Additionally, tax-exclusive rates will constantly be less than the tax-inclusive rate, and the disparity will grow as the quantities rise. Remember that the tax rate will rise along with an increase in the value of a product or service.

Expert Opinion

The Us is the only individual member of the OECD nations without the adoption of a national-level value-added tax, despite the widespread use of VAT and GST around the globe. Instead, municipal and state (sub-state) governments are in charge of collecting and enforcing sales taxes.

Currently, there is no sales tax in 5 of the 50 US states. The development of various tax structures is influenced by historical context, economic models, and country-specific characteristics. Therefore, many individuals often inquire about how to compute VAT.

Some mathematical problems need to be solved to calculate VAT inclusive. To do this manually might be pretty difficult. Thus, the VAT-inclusive calculator is an excellent tool to use here.