Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

People often ask how to deposit check online at Wells Fargo. Thanks to online banking, banking and transactions have become simpler, quicker, and less stressful. Instead of making excursions to the bank, you may do numerous transactions from the convenience of your own home.

Wells Fargo Online Banking allows you to do business anytime and from any place as long as account holders have access to the internet. Customers may now use the mobile app or online banking to pay invoices, make transfers, and check their balances. This also enables them to pay their bills using their mobile phone or computer.

This is a fantastic approach to regaining control of your money. It will also ensure that you’re on top of your obligations. We have made this article on depositing checks online at wells Fargo to enlighten you more on this.

Account users may now transfer funds via Wells Fargo’s online banking and mobile app via email or a cell phone. Customers may check recurring payments and subscriptions and turn cards on and off.

What is Wells Fargo?

An American global financial services firm, Wells Fargo & Company, has its functional offices in Manhattan, its main offices in San Francisco, Ca, and several management offices both domestically and abroad, with activities in 35 countries and more than 70 million consumers worldwide. The Financial Accounting Standards board regards it as a systemically significant financial organization.

Wells Fargo Institution, N.A., a federal bank with its main headquarters in Sioux Falls, South Dakota, and a charter issued in Wilmington, Delaware, is the company’s major affiliate. According to asset value, it is the 4th bank in the U.S. It also ranks among the top banks regarding cash deposits and enterprise value.

JPMorgan Chase, Citibank, and HSBC are also included. One of the “Big Four Financial institutions” in the U.S. is Wells Fargo. There are 13,000 ATMs and 8,050 outlets.

In 1998, the old Wells Fargo & Corporation and the Minneapolis-based Norwest Corporate entity merged to establish the current Wells Fargo. Even while Norwest was technically still in business, the amalgamated firm used the more recognizable Wells Fargo moniker and relocated to Wells Fargo’s headquarters in San Francisco.

During the same period, its banking division amalgamated with the Sioux Falls-based banking division of Wells Fargo. With the purchase of Charlotte-based Wachovia in 2008, Wells Fargo established itself as a coast-to-coast institution.

Wells Fargo Online Banking and Mobile App Features

Some of the app’s features include:

- It establishes or terminates direct debits and authorizations.

- You can verify your bank balance at any moment.

- You can pay invoices and move funds across accounts.

- Examine your bank records

- Check any connected mortgages, loans, savings accounts, or ISAs.

- Keep an eye on any investments you may have connected to your account.

How to Deposit Check Online Wells Fargo

You may deposit checks online using the Wells Fargo Mobile app after downloading it to your Smartphone or tablet:

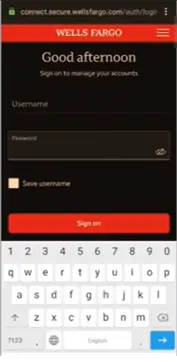

Step 1: Sign on to your account.

Using your login details, you may access your account.

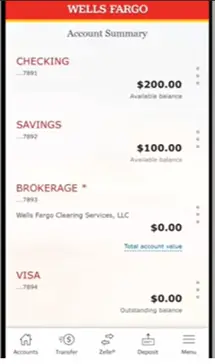

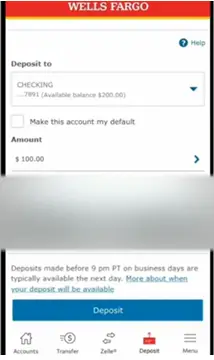

Step 2: In the bottom bar, choose deposit.

This step is crucial when working on how to deposit a check online at Wells Fargo. You may deposit by clicking the ‘deposit’ button on the bottom bar.

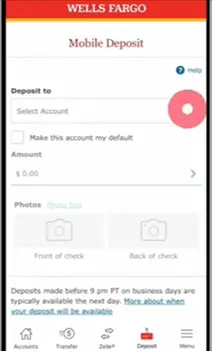

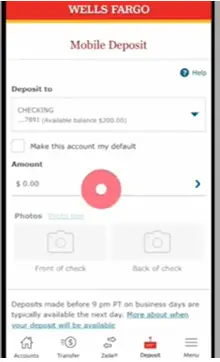

Step 3: Choose an Account

From the deposit to the menu, select an account. You must establish a new account if this is your first time using the mobile app.

After selecting your default account, you may start depositing checks. Your default account will be picked if you make a subsequent Wells Fargo check deposit. This is something you can constantly adjust before making a new deposit.

Step 4: Fill in the amount of the check.

Your account’s outstanding annual and weekly mobile contribution limitations will be displayed at this point. Kindly double-check that the sum provided corresponds to the balance on your check to guarantee a seamless check depositing.

After that, choose Proceed. After double-checking for errors, you can go on to the next step.

Step 5: Click continues at the bottom of the page.

Step 6: Endorse your check

Please pay attention to the following minor elements before uploading images of your Wells Fargo check depositing, as they may assist expedite up the computation. They may also ensure that your money comes on time.

Sign the check on the backside and put “For mobile Deposit at Wells Fargo Bank” underneath your initials.

Step 7: Snap both sides of your check.

You may capture a picture of the back and front of the check by clicking the appropriate buttons. It is highly recommended that you use the following image choices for optimal outcomes:

- Place the checks on a black, basic area that is well-lit.

- Position the cameras at the front of the check (not angled).

- Ensure all four edges of your mobile phone’s screen are included within the boundaries.

- After you have a highly detailed picture of your signed check, you may continue with your check depositing. The remainder of the method is as simple as it gets.

Step 8: Click on deposit.

Hit deposit once you’ve double-checked your payment information.

Step 9: Wait for an on-screen confirmation.

You’ll receive an on-screen confirmation and a mail from Wells Fargo verifying the reception of your check payment. If the on-screen verification does not show, try again after repeating the previous procedures.

Congratulations if you got the confirmation email. Your check deposit from Wells Fargo has been received and is being processed.

Keep the check for a few days.

Don’t trash the check shortly after you make the deposit. It’s critical to hold the check for many days. The bank may need to examine the paper check to see if there is an issue with the transaction. Blurred pictures and excessive deposits are two potential difficulties. There’s always the chance that you’ll type in the incorrect number.

Eliminate the check once it’s cleared

You may dispose of the check after the funds are available and the check has cleared. You don’t want your check to fall into the wrong hands and be cashed or deposited.

How to Get Started with Wells Fargo Mobile Banking

Apple and Android smartphones can use the Wells Fargo Mobile app. On the App Store, get the Wells Fargo Mobile app.

- To enroll, connect to the Wells Fargo bank web portal on your device or download the Wells Fargo bank mobile app.

- Enter your social security or tax identification number.

- Enter the information for any Wells Fargo card (such as ATM, debit, or credit cards) or account number.

- Fill in your details in the designated area.

- Using the directions supplied, create a username and password.

Maintaining a functional email address is recommended to get accurate information about your Wells Fargo account.

Benefits of Depositing a Check Online Wells Fargo

Some Benefits of depositing a check online at Wells Fargo include:

Frequently Asked Questions

Can I deposit a check online through wells Fargo?

Yes. You can deposit a check online through wells Fargo with the abovementioned steps.

What is the online check deposit limit at Wells Fargo?

All Wells Fargo mobile check deposit clients have a daily limit of $2,500 and a 30-day maximum of $5,000. When you pick a Deposit to account and go to the Enter Amount page, your mobile deposit restrictions are shown for each qualifying account.

How does Wells Fargo’s online check deposit work?

The following are some of the ways that Wells Fargo’s online check deposit works:

- In the bottom bar, choose deposit.

- Pick the account into which you wish to make your deposit.

- Enter the amount of your check-in in the third box.

- Put “For Smartphone Deposit at Wells Fargo Bank Exclusively” under your name on the reverse of your paycheck (or tick the box that reads “Check here for smartphone depositing” if that alternative exists).

Take a photo on both the front and reverse of your authorized check using your smartphone. For the best photographs, follow these guidelines:

- Put your checks on a well-lit, black, flat plane, and put your cameras in front of it immediately (not angled).

- Now, align all outer edges of the camera lens on your smartphone with the recommendations.

Make payments: You’ll get a notification email on your smartphone after each completed payment. A deposit notification will also be sent to your main email ID and the secure mailboxes in your Wells Fargo Internet® Messaging Center. Please just keep your checks secure for 5 days following depositing them before destroying them. This allows you ample time to get the actual check if needed.

What kind of checks can I deposit online with the Wells Fargo app?

Using the Wells Fargo phone app, you can post checks denominated in US dollars issued by every US-based bank. This group includes personal, business, and most government handouts. Please remember that you must write cheques to the correct person and authorize them as the payee.

Who is eligible to make a Wells Fargo online deposit?

Clients with a qualified bank savings account may use remote deposit via Wells Fargo Internet and Wells Fargo Enterprise Web.

Is it possible for your Wells Fargo online deposit to be rejected?

Yes. Your Wells Fargo online deposit may encounter rejection. Other causes that might result in a check rejection are:

Duplicate payment: You will not be able to deposit a check if you have previously done so.

The payee isn’t listed: Before depositing a check, double-check that all pertinent details, such as the payee, check amount, and payer’s signature, is written down.

Amounts don’t mix and match: Before you snap a check photo, double-check that you’ve entered the correct deposit amount into the app.

Your signature is missing: Ensure your signature is endorsed on the reverse of the check. Put your account number and “For Mobile Deposit Only” on the reverse of the check beneath your signature.

The images are hazy: Make sure both sides of the check are visible. If the photos of your check aren’t captured clearly, the check may be delayed in being deposited.

Errors in endorsing: If two persons sign the check, you must include both autographs to support the check correctly. So make sure both signatures are included.

My Personal Opinion

You may use the camera on your smartphone or another personal device to add money to your deposit accounts quickly and securely with Wells Fargo’s online deposit. In most circumstances, you may access the money you’ve placed the day after they’ve been credited. There are restrictions on how much funds may be deposited via mobile devices, and not all accounts are qualified for them.

Overall, Wells Fargo’s online check deposit offers a quick, cost-free, and safe method of check deposit. You’re likely to discover that mobile banking makes perfect sense not only for deposits but also for general account management, given the app’s abundance of other beneficial functions. The above tips on How to Deposit Check Online at Wells Fargo will also be beneficial.

Conclusion

In conclusion, wells Fargo’s online banking offers various merits to its users. And if you need more help in this regard, the above highlight on depositing checks online at wells Fargo will aid you immensely.

References