Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Did you know that your bank account number is much more than just a random set of numbers? Instead, it’s an access code that can access different services and features from your financial institution. In other words, if someone knows your bank account number, they can access other things like your internet banking, mobile banking, or even credit card services. While this seems like something out of a movie plot, it’s true. The bad thing is that many criminals know this too. Let’s find out, “can someone hack your bank account with account number and routing number?

Therefore, they are always looking for people with open bank accounts who might be ripe for the picking. Luckily, there are ways that you can keep your personal information safe from hackers. Read on to learn more about how someone can hack your bank account with just an access code and routing number.

Can Someone Hack your Bank Account with Account Number and Routing Number?

“No,” is the straightforward answer to this question. The best way to protect your bank account from fraud is to prevent anyone from accessing it. If you’re worried about someone accessing your account from a computer you don’t control, you can create a password you only know. Suppose you’re worried about someone accessing your account outside your home/office. In that case, you can set up remote monitoring to monitor your activity from a phone or another computer in another location.

What are Account Numbers and Routing Numbers?

A bank account’s account number, which may be found on checking or money market accounts, comprises a series of numbers. The bank gives each account you have an account number. For instance, you would have two separate account numbers if you opened a checking and savings account at the same bank. On the other hand, a routing number is a nine-digit number written in the left-hand bottom corner of every check.

When will you be asked for your Bank Account Number and Routing Number?

You may be questioned about your bank account details and a unique ID in various situations. These are two distinct numbers that are commonly used in various monetary operations. Since many individuals are bewildered by the difference between the two figures, it’s important to know how to tell them apart.

An id number is a series of numbers that identify the bank where you set up your account, while your details are the number given to you when you register a checking account. A financial company’s id number is similar for all clients, contrasting your bank account details, which are personal to you.

If you and your colleagues all established accounts with similar banks and regions, you’d have the same SSN.

So, which transactions will require you to reveal your bank account details and account numbers?

When someone needs to pay you.

Your checking account number and unique id are required if anybody owes you cash and wishes to wire or digitally transfer money to your checking account. Without the forwarding number, that individual cannot transfer cash checking accounts.

This is also genuine if you want to participate in a straight posting scheme. Let’s say you desire your boss to deposit your wage straight into your account rather than mailing you a physical check. In that particular instance, you must offer this data to your finance office so your annual paycheck can be transferred.

When You want to use your bank account to pay online purchases or bills.

You could use your financial institution account to make buying process or pay your regular bills if you don’t have a credit card, checking account, or payment processing app. The most common name for these transactions is Automated Clearing Site transition or ACH transactions. For instance, you’ll need your bank account and routing information to make an ACH transaction.

When a financial app needs to link to your bank account

You must provide your checking account and routing figures once you link your checking account to payment processing apps such as Pioneer and Venmo. Numerous financial planning apps and techniques, such as Mint, need your banking details to supervise your accts and pay your debts.

When you send a check or place an order for a new set

Many people in the United States still tend to write paychecks on paper. One of the strongest justifications is that it offers a tangible record of all fees paid. Many people are unaware that sending a physical check entails disclosing personal data such as your names, residential address, mobile details, approval, checking account details, and a unique id. Your route id and bank details usually appear on the lower end of all cashier’s checks you write.

When Use your bank account and routing number to send you money.

If one has your checking account details and unique id, they may send money into the account. In case the person has these two items, they will have the ability to carry out the transfer of funds successfully.

Accepting funds should be a problem if you expect cash from anyone or are on a bank transfer plan. Even so, you can find enormous sums in your checking account. Once this occurs, you must call your lender to find where the money came from.

Someone is likely trying to set you up for illicit behavior such as financial fraud if you find huge sums of money in your checking account.

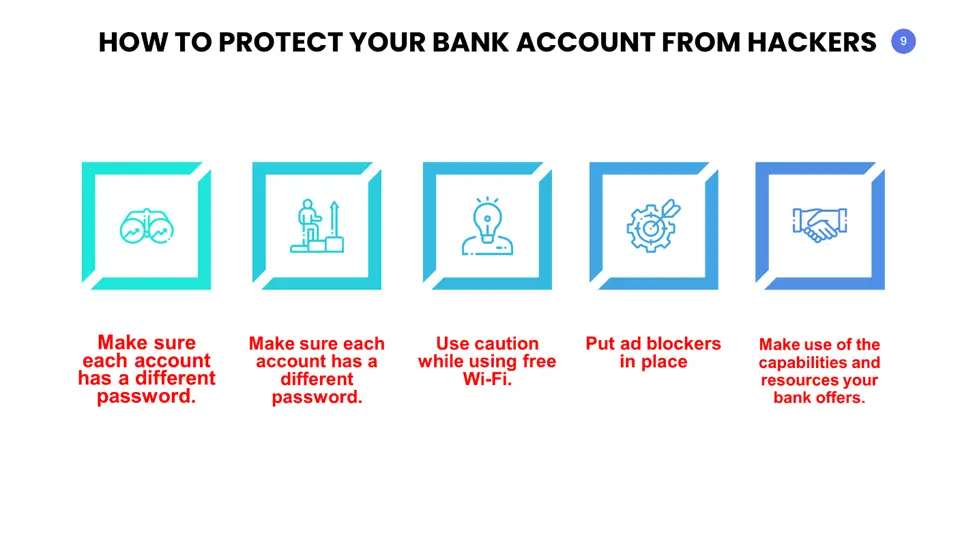

How to Protect your Bank Accounts from Hackers?

You can protect your Bank Accounts from Hackers through the following ways:

Make sure each account has a different password.

You are surely aware of the need to use a secure password. But no matter how secure your password is, it may not be enough to keep hackers out of your bank account.

Using the same password across several accounts puts them all at risk of being compromised. A hacker may find it simpler to access your other accounts if they figure out the one password. This can include bank accounts that contain your private financial or payment information.

Leverage two-factor authentication

It is preferable to have two levels of security than one when trying to prevent fraud from happening to your bank account. Two-factor authentication is useful in this situation. You’ll need your password and an additional form of identification for this approach.

This may be a one-time code for logging into an account sent to your phone. It would be difficult for hackers to get in without your second verification if they had your bank account login information.

Use caution while using free WiFi.

Public WiFi is accessible everywhere, from your favorite coffee shop to your neighborhood library. It’s generally okay to read blog articles or to peruse the news. It’s advisable to avoid activities that need login credentials, such as logging into your online bank account. When you utilize public WiFi, the open link may make it possible for thieves to seize your login and password as they go between you and the website for your bank.

Put ad blockers in place.

The advertisements on your screen might be fake if they look too wonderful to be true. Another fraud that puts your bank account at risk is malvertising, in which thieves produce advertisements laced with dangerous code.

Maybe you come on a commercial for free software. When you click on the malicious ad, your device can download malware. Your identity might be stolen in this way. In certain circumstances, just opening the website with the infected advertisement is sufficient to start an assault.

Make use of the capabilities and resources your bank offers.

Spend some time learning about the security precautions your bank has implemented as you attempt to safeguard your bank account against fraud. Maintaining the security of your sensitive information is simpler when you make the most of the security tools offered by your bank. For instance, Discover provides encrypted online and mobile banking that is both safe and secure.

Customers may use a fingerprint login with several banks, including Discover, to access their accounts on their smartphones safely and securely. This is a kind of biometric identification that makes use of your bodily attributes. Because your fingerprint cannot be lost or stolen like a character password, biometrics may help you safeguard your bank account from hackers.

Can your bank account be hacked if you give out personal information?

Yes. A hacker may sometimes attempt to get your information by intercepting communications between you and the bank’s website. Man-in-the-Middle (MITM) assaults are the name of these attacks. It happens when a hacker intercepts conversations between you and a reliable service, as the name implies.

Frequently Asked Questions

Is it common for bank accounts to get hacked?

Yes. Scammers have gained access to the information of around half of the American people. Checking your bank and credit card statements is more crucial than ever since fraud may happen anywhere. In addition, check your credit report every three months.

Can someone hack your bank account with your number?

Usually, accessing your checking account requires more than just your bank account number. But if someone has both your routing number and account number, they could be able to take money from your account. Additionally, someone else might commit fraud by using your debit card information.

Which bank is most secure?

The most secure banks include:

- Wells Fargo.

- JPMorgan Chase.

- U.S. Bank.

- PNC Bank.

- Citibank

- Capital One.

Is it safe to bank on your phone?

Yes. Most individuals who experience mobile banking breaches don’t take their safety seriously. Mobile banking is a handy, safe method to manage your money as long as you exercise common sense.

Are online banks safe?

Online banks are secure. An online bank will provide the same protection as a nearby FDIC-insured bank as long as the Federal Deposit Insurance Corp covers it. The FDIC insures each unique customer’s accounts up to a maximum of $250,000.

Is it reasonable to give out your bank account information?

Giving up your financial data to anybody, whether an individual, an online merchant, or a company, poses hazards. It depends on who you’re sending the data to and how you’re providing it to them, whether it’s reasonable to give out your bank account details to anyone.

Can someone use my account number and routing number to make a withdrawal?

Perhaps you’re thinking about how someone with my account number and routing number could steal money from my bank account. As mentioned previously, there are ways for a person to steal funds in your account: ACH deals and scam checks.

Thus, the response is YES – scammers can use these methods to withdraw your money. These are significant crimes, so most criminals target business bank accounts that carry more cash. Since they often have lesser security safeguards, fraudsters are increasingly targeting little and moderate enterprises and individual account users.

Is it worthwhile to have a bank account?

Yes. Despite incidents of hacking and fraud, keeping your money at the bank is generally safer than storing it at home.

Conclusion

In conclusion, banks come with various merits. And if you are among those who usually ask if anyone can hack your bank account with the account number and routing number, the tips above will aid you immensely.

Personal Opinion

Given the prevalence of bank hacks, it makes sense that consumers are worried about having their bank accounts compromised. However, we occasionally neglect to safeguard the physical copies of our bank accounts because we are so used to protecting our private information online. While we may no longer use paper checks, account information is frequently used in online purchases. In all, it’s best to protect your account through the tips highlighted above.

References