Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

A consumption tax called Value Added Tax (VAT), commonly referred to as the Goods and Services Tax, is levied on goods at every step of the manufacturing process. This includes everything from labor and raw supplies to the sale of the finished product. This may become impossible to compute at some time. To help you, we have created this page on the US vat calculator.

Taxes are likely one of your top worries if you own a company in the USA. It’s crucial to understand just how much tax you should charge and how much you should get in return. Value-added tax, or VAT, is one of the levies you need to be aware of. Even though not all firms must pay VAT, many do.

Value-added tax is a levy that impacts supply chain management companies. A consumption tax is imposed on the money spent on goods and services. To put it simply, VAT is a tax applied to a product at every step of manufacture. This covers every production phase, from original manufacturing to the point of sale.

The cost of the goods determines how much VAT a user must pay. It subtracts any material expenses taxed earlier from the product’s cost. Read on to find out all there is to know about VAT and how to figure it out with our USA VAT calculator.

What is USA vat?

A surtax known as the USA VAT is applied on merchandise and services at each stage of the production cycle where value is created, from the position of the original manufacturer to the retail level. The cost of the item, less any prices of elements that were previously taxed at a preceding step, defines how much USA VAT the client must pay.

How to use this Vat Calculator

You can use this vat calculator through the following steps;

- Enter the Price

- Enter the Rate of VAT (%)

- Select the option of your choice to add vat or remove vat

- At this point, the USA VAT Calculator will process your input and produce the right output.

US Vat Calculator

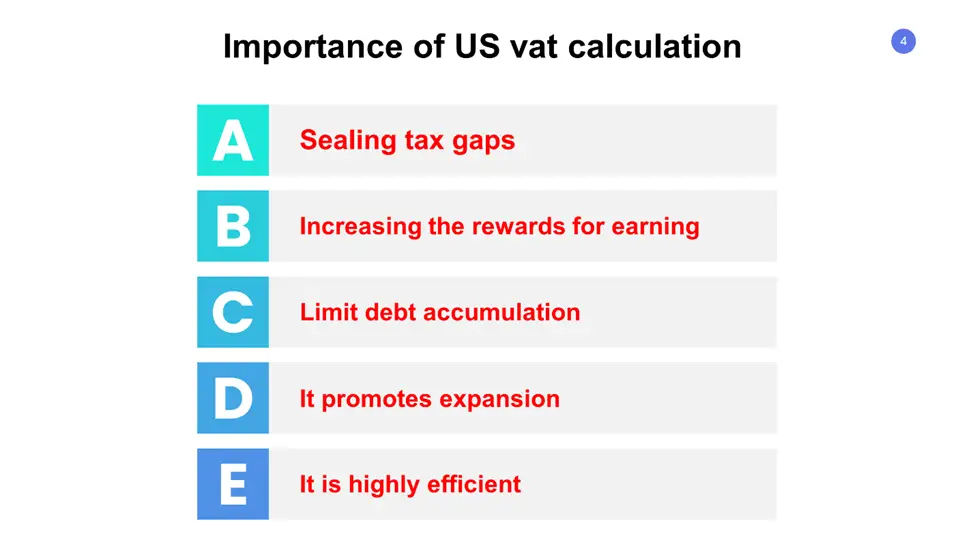

Importance of US Vat Calculation

A kind of indirect tax known as the US Value-Added Tax (VAT) is imposed on products and services for value added at each stage of the manufacturing or distribution cycle. This process begins with the raw ingredients and ends with the retail sale. On April 1, 2005, VAT became effective.

By it, tax is initially assessed on the value added at each level. In the end, the VAT must be paid in full when purchasing products. Taxes paid by buyers at previous stages of manufacturing are reimbursed. VAT is a consumption tax since the customer entirely bears it.

The major purpose of implementing the US VAT computation was to end double taxation and the cascade impact caused by the then-current sales tax system. When a product is taxed at each stage of the sale, it has a cascading impact.

The consumer ultimately pays tax on tax that has already been paid since the tax is assessed on a value that includes tax that the prior purchase had already paid.

Under the VAT system, there are no exclusions possible. Each step of the manufacturing process being taxed provides improved compliance and fewer opportunities for fraud.

More on the Importance of US vat calculation include:

Sealing tax gaps

According to proponents, the Internal Revenue Service (IRS) will be more effective thanks to VAT, who also claim that the levy would make tax dodging harder. Even on online goods sold in the US, US VAT computation has the potential to generate cash.

Increasing the rewards for earning

The progressive tax system’s critics will no longer have valid concerns once VAT calculation takes the role of US income tax. More money belongs to the citizens, who use it to purchase things. This adjustment accomplishes more than merely increasing the motivation to earn. Additionally, it promotes saving and discourages pointless purchasing.

Limit debt accumulation

Calculating US VAT would drastically reduce debt accumulation. Of course, since it raises taxes on the middle class, the VAT may initially seem undesirable. However, the constraints of the top alternatives—tax hikes on high-income families and cutbacks to entitlement benefits—make the necessity for the VAT obvious.

It promotes expansion

Because the US vat calculation does not punish saving and investment and causes fewer economic distortions, it is more growth-friendly than high-income tax rises. A lot less regressive than benefit cutbacks is the VAT computation. If rebate payments are given to low-income families to lessen the tax burden, it may be made somewhat progressive.

It is highly efficient.

The VAT falls somewhere between raising taxes on the wealthy and reducing entitlements. Even if cutting benefits is more economically efficient, high-income tax hikes are less effective.

The VAT also avoids the extreme regressivity of benefit cutbacks, even though it cannot equal the substantial progressivity of tax hikes on high earnings. Due to these factors, the VAT computation creates a compelling foundation for the bipartisan agreement that will be required to close the budget deficit.

The VAT may not be each party’s first option, but if they can discover a way to cooperate, it may become both sides’ second choice.

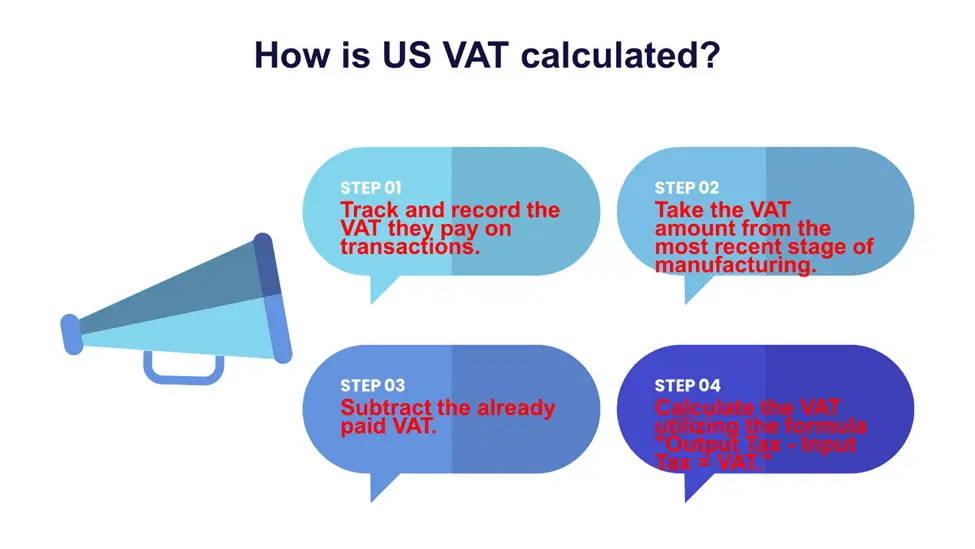

How to Calculate US Vat Amount

You must register for VAT when your company expands, and your taxable supply rises. As a result, you can recoup the VAT you spend on business purchases and add it to your sales price.

It would help if you calculated the VAT by evaluating the ratio you spent for purchases to the amount you received from sales to get the US VAT. To do it, take the following actions:

- Track and record the VAT they pay on transactions. Under a VAT arrangement, tax jurisdictions get tax revenue throughout the supply chain rather than only at the point of sale to the ultimate customer.

- Take the VAT amount from the most recent stage of manufacturing.

- Subtract the already paid VAT.

- Calculate the VAT utilizing the formula “Output Tax – Input Tax =s VAT.”

If the result is a positive number, you must pay that sum. If the number is negative, you will get a refund for that amount.

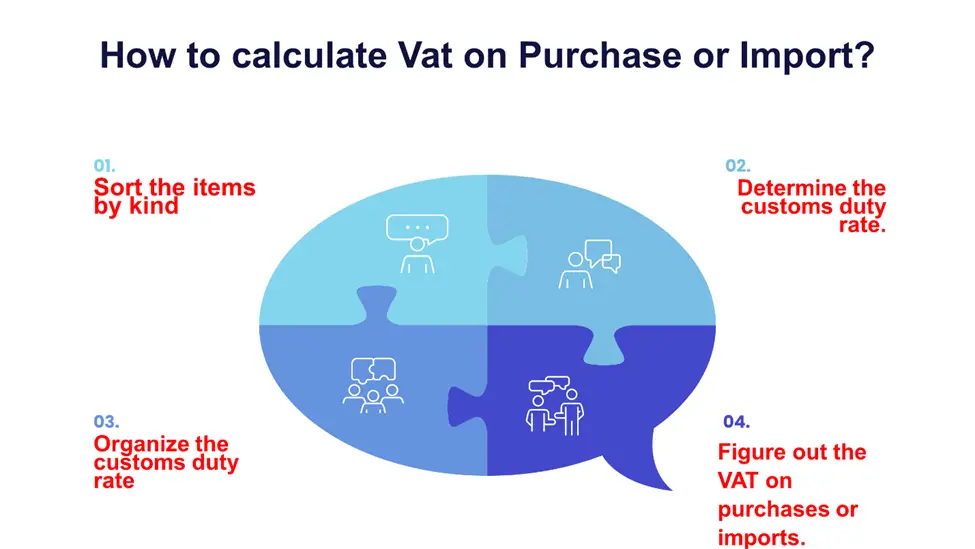

How to Calculate Vat on Purchase or Import?

On January 1, 2018, the area of expertise for value-added tax on imports changed. When the importer is listed on the VAT payers’ registry, the value-added taxation is now the responsibility of the Tax Administration. The modification relates to the entry of commodities into the United States from areas outside the fiscal and customs territories. You can calculate vat on purchases or Import through the following steps:

Sort the items by kind

Sorting out the kind of products is important when calculating Vat on Purchase or Import since the value changes based on the type of goods and is difficult to compute without the right information.

Determine the customs duty code.

The kind of products and the country from which they are imported determine the customs duty rate. You must have a commodity code to search out the proper rate of duty due.

Organize the customs duty rate

You may search for the applicable duty rate and determine this expense after determining the correct commodity code for the items you intend to import.

Figure out the VAT on purchases or imports.

Remember that the VAT on Purchase or Import is calculated as a percentage of the entire amount. This formula will thus be applicable:

Goods + shipping costs + insurance

Frequently Asked Questions

How do you calculate VAT on a price?

It would help if you ascertained the total sum to determine the VAT on a price. To begin, multiply the gross amount by 1 plus the VAT %. After that, take the gross sum away. The result, y, is then multiplied by -1 and rounded to the nearest integer.

How do I work out 20% VAT on a price?

The net amount is multiplied by 1.20 to get the gross amount, which is then subject to 20% VAT. Calculate the gross amount / 1.20 to get the net amount * 0.20 if you want to understand how much VAT is in the amount. The VAT is therefore included.

Do US businesses have to pay VAT?

One of the few nations without a VAT system is the United States. Background information is provided in excessively general words and evaluated on all products and services.

How much is the tax on products in the USA?

There is no basic price since there is no unified sales tax in the US. State-level transactions or use tax rates range from 2.9 to 7.25 percent, depending on the state. In 35 states, local governments levy extra sales or use tax that ranges from 1 to 5 percent on top of the state rate.

Expert Opinion

Most of you have visited a nearby market or supermarket to acquire food and other basics for your daily life. The price you pay when you buy anything from a grocery store is not the amount allocated as the item’s real retail price. Instead, that price consists of all of the differences.

Value-Added, each stage of the sales cycle, was taxed. At each stage of the supply chain—from the producer to the wholesaler to the retailer to the customer—VAT is added to the price. It could be not easy to perform this computation. Thus, it’s best to use the USA vat calculator.