Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

You’ll often need to disclose your yearly salary to finish the paperwork, whether you’re enrolling for a credit card or submitting your taxes. This might be a difficult question to answer if your employer doesn’t provide you with a yearly wage or if you know that you have income from many other sources. Finding that solution, however, is simpler than you may imagine. Thus, we have made this post on the Yearly salary calculator to aid you.

The sum on your paycheck before taxes and deductions is also included in your yearly wage. This is stated on your invitation letter or contract if you accept a job offer. Your annual pay is the starting point for drafting and completing your income tax return. Knowing this amount will help you determine how much tax you will spend or get back.

Additionally, you need to know your yearly wage to assess if your employer will pay you enough to maintain your standard of living. Start by determining your financial requirements and creating a budget.

Then decide whether your yearly earnings will be sufficient to cover your expenses and enable you to achieve your objectives. Know your annual salary as well as other significant forms of compensation. For instance, be aware of the perks you have access to, such as health insurance, retirement programs, and perks.

Find out whether there is an opportunity for growth and if there is a chance to make more money. The Yearly Salary Calculator may assist you with all of these with ease. Come along as we highlight more on this below.

What is a Yearly Salary?

Annual wage is the sum of money you get from a firm in return for the work you accomplish during the year. Even if you could be paid monthly or biweekly, it’s still crucial to understand your annual compensation for tax reasons. This is also crucial if you decide to apply for a different position.

How to use this Yearly Salary Calculator?

You can use this yearly salary calculator through the following steps:

- Enter the Salary Amount Per Hour ($)

- Enter the Hours Per Weak

- Put the day Per Weak

- Enter the Holidays Per Year

- Enter the Vacations Per Year

- At this point, the yearly salary Calculator will process your input and produce the right output.

Yearly Salary Calculator

What is your Annual Salary?

The sum you make in a fiscal year is your annual wage. Your annual salary is comprised of your base pay and any bonuses, commissions, extra pay, and tips.

Gross and net annual income are two alternative terms that may be used to describe it. Net yearly income is the amount you have left over after expenditures, while gross annual income is your income before taxes. If you’re a wage worker or a company owner, this subject is crucial, especially when submitting your taxes and asking for loans.

Your yearly income before deductions is referred to as your annual pay. Simply splitting the term into its parts—annual meaning year—will help you recall what annual income is. Salary also refers to earnings. Your net yearly wage and family income are necessary to make a budget, request a loan, or establish child support and spousal payments.

How to Calculate Yearly Salary

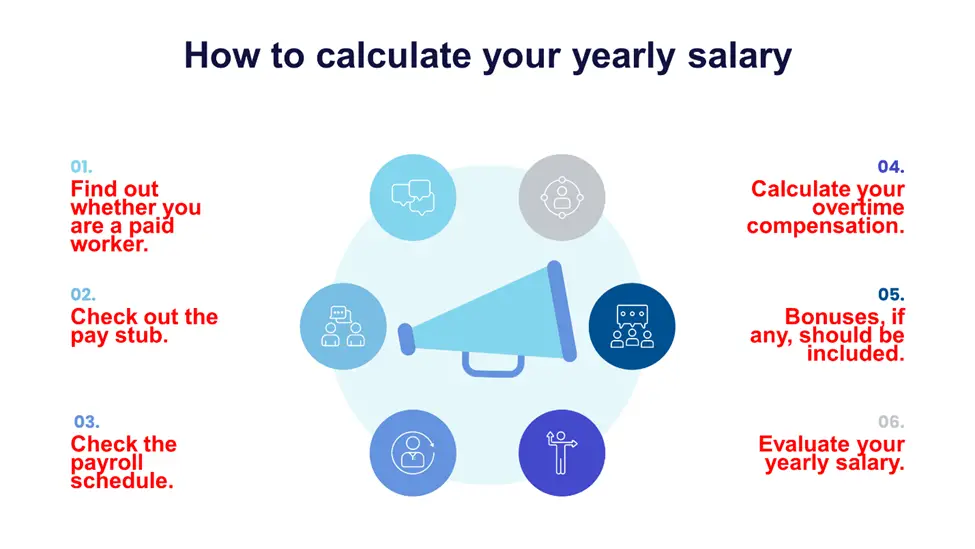

To calculate your yearly salary, you can use the following steps:

Find out whether you are a paid worker.

Salaried workers get a set amount of gross compensation in their paychecks. This sum is unrelated to the number of hours put in. The gross pay amount for each paycheck is determined by dividing their yearly income by the number of monthly payments in a given year. Another name for this is an exempt worker.

Your entire yearly compensation was probably disclosed if you were employed as a salaried employee. However, as time goes on, increases and other compensation adjustments might make it difficult to determine your entire yearly wage.

Check out the pay stub.

There is a lot of information on your pay stub. Your gross salaries, or overall earnings, are stated. Additionally, all deductions are listed, including municipal, state, and federal taxes. Along with payments to Medicare and Social Security, this is also required. Additional deductions include health insurance payments, retirement savings programs, and flexible spending accounts.

Your net salary, often known as your take-home pay, is your gross pay minus all deductions. To proceed, you must ascertain your net earnings, or gross pay, to ascertain your annual wage.

You should still obtain a pay stub even if you get a direct deposit. Pay stub data may be stored online by certain businesses. Get in touch with your finance office to request a printed copy of your pay stub or learn how to log in to access that information.

Check the payroll schedule.

Businesses choose a compensation schedule that is appropriate for their business and workforce. The payment schedule establishes when and how often you will be paid. Your payroll plan will let you know how many paychecks you may anticipate receiving year.

You will need the following information to determine your yearly salary from your pay stub. Ask your boss or the payroll office at your organization if you are unsure about your payroll plan.

- Paychecks are issued on the last day of each month. Twelve paychecks are given to employees annually.

- Paychecks for semi-monthly employees are issued on the first, fifteenth, fifteenth, and thirtieth of each month. Each year, employees get 24 paychecks.

- Paychecks for biweekly employees are sent every two weeks on Friday. Each year, employees get 26 paychecks.

- Paychecks are only issued once a week, often on Friday. 52 paychecks are given to employees annually.

Calculate your overtime compensation.

Laws governing overtime pay have recently changed, extending overtime protections to salaried employees. For hours worked beyond 40 per week, salaried employees earning less than $47,476 annually are now eligible for overtime compensation at a rate of 1.5 times their regular pay rate.

You may raise your anticipated pay by the sum of your overtime income if your salary is less than this amount and you perform more than 40 hours per week.

Bonuses, if any, should be included.

You can be eligible for incentives depending on the sort of business you work for and the role you hold. Bonuses are given on top of your yearly fixed income throughout the year. Profit sharing, recognition for performance, sign-on incentives, holiday bonuses, and sales commissions are a few examples of different bonuses.

Based on how your organization distributes incentives, there are differences in their size and frequency, When determining your annual salary total, including bonuses.

Evaluate your yearly salary.

On your pay stub, you may see your pre-deduction total gross income. To get your yearly compensation, multiply this sum by the number of paychecks you receive.

Frequently Asked Questions

How do I calculate my salary for the year?

Find out how many hours you work each week before calculating your annual income. Use the average hours you work each week if your schedule varies. Next, multiply the number of hours you work each week by your hourly wage. To determine your yearly pay, multiply that figure by 52.

How much is $45 000 a year per hour?

A $45,000 yearly income is roughly equivalent to $22.06 per hour, but the hourly pay translation may vary depending on taxes and perks.

How much is a $ 35-a-year salary?

If your hourly rate is $35 and you perform 35 hours a week on average, your annual income will be $63,700. Here’s the arithmetic: 35 hours per week times by 52 weeks in the year = 1,820 hours worked

How much is $70 000 a year per hour?

A pay of $70,000 is equivalent to $5,833 a month, $1,346 per week, and $33.65 per hour.

What does the average 22-year-old make?

Young adults between the ages of 20 and 24 make $667 a week on average or $34,684 annually.

What is a good salary at age 26?

According to information from the Bureau of Labor Statistics (BLS), during the first quarter of 2022, the median pay for full-time employees aged 26 and older was $745 per week or $38,740 annually.

Where should I be financially at 25?

You need to have at least half your yearly costs saved up by the time you are 25. More is always better. In other words, if your annual spending is $50,000, your savings account should be about $25,000. You must have at least $50,000 in savings if your annual spending is $100,000.

What salary is considered rich?

According to the latest statistics from the Census Bureau, the average household income in the US is roughly $65,000. To be labeled “rich,” a family has to earn double that, or a minimum income of $130,545. But to qualify as wealthy, you must also earn more than 20% of the population’s income, and each city has its definition of what that means.

Expert Opinion

Understanding your annual income is a crucial first step in controlling your finances and creating a budget. There are a few different ways to calculate your yearly compensation based on how and how often you get paid. Once you know how much your total yearly pay is, you may compare it to data on what other people in your sector or other professions are making.

Then, you could be able to make an argument for yourself during wage talks using this knowledge. The Yearly Salary Calculator will be of great use to you at this stage. Additionally, employing the annual income calculator can aid in your employment selection.

You can be in a situation where you must compare the pay between two or more jobs. Maybe you’re searching for a job or considering quitting your present position to pursue something new.

Naturally, the whole wage package given is a crucial factor. Benefits, room for advancement, location, and travel time are further aspects that may be important to you.

Sometimes it makes sense to select a job with a better salary because of the potential for advancement, the location, or the work environment. At this point, the Yearly salary calculator will aid you immensely.