Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Deals that rely on third-party confirmation may be useful. If you get a check and owe a friend money, you may hand the check over to your friend rather than redeeming it and making a new one. This form of check is a wonderful choice for folks who do not have access to a bank account.

If you’re engaged in a third-party check transaction, you may need to talk with a bank employee about it. Knowing some basic official lingo will come in handy in that situation. First, the remitter is the individual who writes the check. The remitter makes a check payable to a payee or the person who will cash it.

What is a Third Party Check

In the same way, as normal checks must be processed in two stages, third-party checks must also be redeemed in two steps. The bulk of checks contains two parties, which means they are receivable to a single person or corporation from another.

When the originating payee forwards the check to a third party and subsequently cashes it, this is known as a third-party check.

Many companies are cautious to cash or even lodge third-party checks due to the increased possibility of fraud. If a person misplaces a check they’ve approved, an unexpected third party may discover the check and approve it as the other payee. Any money that was lost would be the lender’s responsibility.

Banks and Credit Unions That Don’t Support Third-Party Checks

Several prominent American banks accept and cash third-party cheques for account holders. In some situations, these banks will cash a third-party check for non-customers as long as they wrote the check. Non-account holders may be charged extra costs, and laws differ. You’ll need to provide valid photo identification, and the other signing party may also need to be available.

Several major American banks (Check out Sonoma’s Fees, for example) accept and cash the third-party cheques for account holders. In some situations, these banks will cash a third-party cheque payment for non-customers as long as they wrote the check. Non-account holders may be charged extra costs, and laws differ.

Customer service employees confirmed that the following banks and credit unions do not cash third-party checks:

- Alliant Credit Union

- Ally Bank

- Bank of the West

- Charles Schwab Bank

- Citizens Bank

- Discover Bank

- KeyBank

- PenFed Credit Union

- Regions Bank

- Wells Fargo

Banks That Permit Third-Party Checks: Fees & Requirements Detailed

| Name of the Company | Bank or credit union | Fees (non-account holders) |

| Bank of America | Bank | $8 on checks over $50 |

| BB&T | Bank | $8 on checks over $50 |

| Chase Bank | Bank | $8 on checks over $50 |

| ACE Cash Express | Check to cash store | Vary by location |

| Connexus Credit Union | Credit union | Not available |

| First National Bank | Bank | $10 |

| HSBC | Bank | Individual checks taken on HSBC are free; commercial checks amounting to $100 are $3, then $5. |

| M&T Bank | Bank | 2% of the check amount ($3 minimum) |

| Navy Federal Crediting Union | Credit union | None |

| PNC Bank | Bank | $2 for checks over $25 |

| SunTrust Bank | Bank | $7 for checks above $50 |

| TD Bank | Bank | $7 |

| U.S. Bank | Bank | $7 (only checks drawn on U.S. Bank) |

Risks and Issues: Why Banks Don’t Always Permit Third-Party Checks

The danger of fraud and theft is higher with third-party verification. As a result, banks and credit unions have rigorous guidelines for approving third-party checks, with some refusing to accept them altogether.

Banks ever accepted only the most reliable depositors. They do not know if a valid check with a falsified endorsement was passed over to you. The collecting banker bears the risk linked with earlier endorsements. As a result, several banks are hesitant.

A bank generally refuses to accept a third-party check unless the payee who signs it over to you can be identified. This precautionary strategy is designed to prevent people from redeeming cheques that do not belong to them.

Your state’s Contract Law outlines the hazards of taking any check for a deposit. Specifically, Section 3-417. Allowing a third-party check ensures the drawee bank that all certifications have been double-checked.

Based on the state’s limitation period, the principal payee may have anywhere from 60 days to three years to contact the check’s maker and assert that their signature was forged.

Suspicious Endorsed/Third-Party Checks Negotiated Abroad

Small enterprises, average individuals, and even some huge organizations have valid reasons to employ third-party checks. This works in places where the economic system isn’t as developed as it is in the U.s, and the dollar is in growing demand. For example, you may cash a third-party check in India or the United Kingdom.

At the very same time, there is also the risk of misapplication. Affirmed third-party checks have been used to conduct theft, financial fraud, tax avoidance, and other illicit behaviour in the U.s. And around the world.

For these reasons, as well as the risk of non-payment, many financial institutions across the globe refuse to accept endorsed/third-party checks. It is even discouraged or illegal in other nations.

To counterbalance the risk of non-payment, money exchange businesses and other financial institutions usually charge a three- to five-percentage-point fee when accepting signed checks. In some cases, third-party checks may be accepted only for collection, causing payment to be delayed by several days.

According to Suspicious Activity Report narratives, U.S.-dollar third-party checks are being submitted to banks located abroad. On the other hand, the payee and payer seem unconnected to the location where the checks appear.

On the other hand, the checks are included in the international cash letter package that is sent to correspondent banks in the United States once they have been negotiated.

Places That Don’t Cash Third-Party Checks

Some institutions, such as Bank of America, Chase, Citibank, M&T, and HSBC, permit third-party checks. Check-cashing stores such as ACE Cash Express, Check ‘N Go, and The Check Cashing Store permit third-party checks.

Expect to produce evidence of identity, and both payees may be required to be available in some circumstances. There may be additional charges. Third-party cheques are rarely cashed in grocery and convenience stores.

In the United States and overseas, endorsed third-party checks have been used to conduct fraud, money laundering, tax evasion, and other criminal activities. For example, such checks are extensively used in the black market peso exchange and other currency black markets in the Middle East, Africa, and the Americas. Such tactics are frequently used in situations involving a variety of illegal activities.

Sign the Back of the Check in the Top Section of the Endorsement Area

In the Endorsement’s Area section, sign the back of the check. On the reverse of every check is a section that says, “Bank of America third party checks here.” This is where you’ll sign your name exactly as it appears on the check’s front.

Because banks are unwilling to cash checks made payable to companies, you’ll almost certainly have to deposit most of your checks. It is feasible to cash checks made payable to a company, but it isn’t easy. This is because cashing a check is the same as withdrawing money.

Businesses may have numerous owners therefore withdrawing or spending money may require the consent of various persons. Regarding company checks, banks are generally hesitant to cash them if they don’t know the individual who wrote them.

Ensure the Person’s/Entity’s Bank Will Accept the Check

To get a check over to someone else, endorse it, and then write “Pay to the order of:” and the person’s name. With the message, your signature indicates that you’re relinquishing your claim to the check and passing it to the individual you named.

If you need money immediately, you might attempt cashing the cheque at the issuing bank. By taking the check to the bank that issued it, you avoid a significant amount of the check transaction procedure. The bank can instantly examine the account against which the check was drawn to ensure sufficient funds to cover the transaction.

Risks of Accepting Third-Party Checks

Third-party checks are often confused with check scams. However, this may not always be the case. There are proper options for a third party to retrieve a cheque not written out to them in the first place.

Many banking firms, however, remain wary of third-party inspections. A banking institution may decline to recognize a third-party check you give in due to this kind of checking risk.

Your check is not legally required to be accepted by financial institutions. A modification of beneficiary is included on third-party checks, along with verification from the original receiver. Banking firms, on the other side, are not obligated to adhere to these orders, and many may opt not to do so due to the possible risks.

Fraud is more likely to occur with third-party checks. Check out the following scenario: You scribble a check and place it on the curb. In contrast, an irresponsible individual discovers the check and removes your name, substituting it with theirs and faking your signature to give the scam the appearance of validity. Because of the possibility of this kind of deception, many institutions are wary of third-party checks.

Before bringing a third-party cheque in, contact your bank. If you’re unsure whether your institution permits third-party checks, call ahead before coming in to redeem your check. If the bank accepts third-party checks, they may have additional instructions.

Third-Party Check Vs. Second Party Check

The distinctions between Third Party Checks and Second Party Check can be seen below:

| Third-Party Checks | Second Party Checks |

| Third-party checks are ones that an account holder issues to a beneficiary so that money may be withdrawn from and paid to the recipient’s account. | These are checks that the check writer writes out to someone else, who then gives it to a third party, generally a company. |

| Walmart does not payout third-party checks. | Two-party cheques may be cashed at Walmart. |

| The person writing the check must first sign his or her endorsement on a third-party check. | The person to whom the check is issued must first sign an endorsement on a second-party check. |

| You must put “Pay to the Order of” and the third party’s name below your signature on a check to approve it to them. | Both parties must sign below the “Pay to the Order of” line on a second-party check to approve it. |

Variety of Third-Party Check

You may draw a third-party cheque from your 401K, brokerage account, or mutual fund, among other accounts. Others include tax rebates, traveller’s checks, or share drafts from credit unions. Another example of a third-party check is a check you are seeking to cash. It was issued to another person or party, but that has been signed over to you.

What do I Need to Cash a Third-Party Check?

Both participants must provide a valid picture ID, such as a driver’s license or state identity card, to cash a third-party check. After confirming the signatures and IDs, the teller will hand over the cash. If you don’t have an account, some institutions charge a fee for cashing checks; nevertheless, members get the service free.

Pros and Cons of Third-Party Check

The Pros and Cons of Third-Party Check have been highlighted in the table below:

| Pros | Cons |

| If lost, it may be found | Comes with transaction fees. |

| It may be set up quickly and easily. | Froze accounts |

| The ability to halt payments if required | Limited options |

| Flexible structure | If the drawer has no money in its account, it can be worthless. |

| Favourable to small enterprises. | |

| Possibly post-dated |

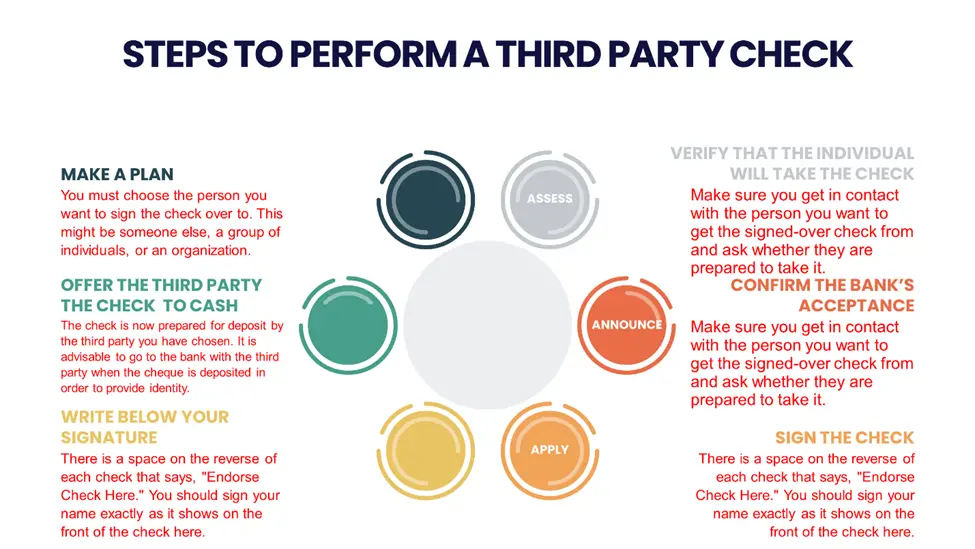

Steps to Perform a Third-Party Check

The procedure for signing over a check to a third party is described in the stages below:

1. Make a plan before signing a check with another person.

You must choose the person you want to sign the check over to. This might be someone, a group of individuals, or an organization. It’s crucial to properly organize the transaction in advance since it might be difficult to cash or deposit a third-party check.

2. Verify the individual or organization will take a signed-over check.

Make sure you contact the person you want to get the signed-over check from and ask whether they are prepared to take it. Moving through the procedure requires both sides to agree, which is crucial.

3. Confirm that the recipient’s bank will accept the check.

A bank is not required to accept a check. Therefore, the person or organization you choose to sign the check over will need to ensure that their bank will. Before the check is approved, this should be verified to prevent misunderstanding from numerous signatures.

4. Place your signature in the endorsement upper portion of the check’s back.

A space on the reverse of each check says, “Endorse Check Here.” You should sign your name exactly as it shows on the front of the check. When handing over a check to someone else, knowing how to endorse it correctly can make the process easier and more pleasant.

5. Write “Pay to the Order” below your signature and the third party’s name.

The identity of the person you are handing the check over to must be written in the endorsement space underneath your signature. This tells the bank that you are approving the check’s ownership transfer.

6. Offer the third party the check to cash.

The check is now prepared for deposit by the third party you have chosen. To provide identity, it is advisable to go to the bank with a third party when the cheque is deposited.

This has also been highlighted in the infographic below:

Why use a Third-Party Check Service?

Using a third-party check service will allow you to skip the need to open your merchant account with a bank. These businesses enable clients like you to handle all of your payments using their merchant accounts. Additionally, most modern customers are time-poor due to their hectic work schedules.

The demands of customers are satisfied by third-party check services because of their practical and quick qualities. As a result, most young consumers like using third-party payment services.

Frequently Asked Questions

Is it possible to pay a third-party check using the internet?

Most banking firms do not allow third-party checks to be cashed online. Third-party checks must be evaluated more rigorously to protect against fraud. Consequently, cashing a third-party check in person at a financial institution is the best option.

Does anyone cash third-party checks?

Most banks will gladly cash third-party checks if the sum is modest enough. Banks may request picture identification or verification from the main payee to combat fraud. Third-party check cashing is best done at banks and credit unions.

Where can I deposit a third-party check?

Checks written by third parties may be redeemed at your bank, financial institution, or certain check cashing businesses. In rare cases, you may be allowed to transfer a third-party check at an ATM. Checks written by other parties are rarely to be cashed in local supermarket Customer Touch Points or via mobile app payments.

How do you do a third-party check?

- Before you learn how to endorse a check to a third party, make a plan.

- Confirm that the person/entity will accept a check that has been signed over.

- Check with the person’s/bank entities to see if the check will be accepted.

- In the top section of the Endorsement Area, sign the back of the check.

- Below your signature, write “Pay to the Order of” and the third party’s name.

How can I cash a third-party check without an ID?

- Use an ATM at your bank to deposit it into your account.

- If your bank allows it, take advantage of ATM check cashing.

- Someone else should sign the cheque.

Can I deposit a third-party check into my Chase account?

On the other hand, Chase will permit third-party checks for deposit, even though it’s a mobile phone app, but you must have the check-in person of the owner if you plan to cash it. Then you must sign under his or her signature to deposit the money into your bank account.

Can I Mobile deposit a third-party check?

Some banks need payees to approve a check with the words “for mobile depositing third party check the endorsing in its full” to post a check using an online banking app. This recommendation makes a “third-party check” which you may approve, redeem, or deposit for somebody.

How do third-party checks work?

A person can sometimes draft a check for you, and you can sign it over to a third party, leaving it in their possession. When person A writes a check to person B, but person C cashes it, this is referred to as third-party checking.

Person B can write instructions on the check, altering the party to whom the check is written out as person C, allowing for third-party verification.

This form of endorsement results in a “third-party check” that you may give to someone else to endorse, cash, or deposit. To make a third-party check, fill in the endorsement field with “Pay to the order of” and the name of the person who will receive the cash, then sign your name.

Who will cash a third-party stimulus check?

Look no further if you’re looking for a place to redeem a third-party check online. First, you must realize that the partner must sign the check that transfers the liabilities to you. The third-party should sign the reverse to authorise the check and write “Pay to the order of your name.” If crime is suspected, both parties and picture identification may be required to redeem the check at a bank.

Endorsing a third-party check is the first step in paying it. An endorsement transfers the check’s rights to a third party due to the name, third-party check. Third-party checks can be cashed at your bank, credit union, or select check cashing locations.

You may be able to deposit a third-party cheque at an ATM in some instances. Mobile app deposits and grocery store Customer Service Centers are uncommon.

Bottom Line

It’s usually only a question of adequately endorsing a third-party check to cash it. Third-party checks are not the same. One example is a check written to someone else and signed over or endorsed to you. Cashing your paycheck at the bank is a straightforward illustration of this.

Do not endorse a check with simply your signature and no more instructions until you are ready to settle or deposit it. When a check is signed in this manner, it becomes negotiable, which means that anybody who takes it to the bank may cash or deposit it, even if they’re not the payee.

To different people, the term “third party” means different things. A check cashing service may accept a personal check written by you on one of your checks, but not a check is written out to you by a third party, such as friends, family members, or business. A third-party check can also be a money order or a cashier’s check.

Third-party checks include checks written on a 401(k), trading account, fund manager, financial institution advance drafts, tax rebates, or tourist’s checks. A check you’re seeking to cash that was issued to some other party or group but has been switched over to you is an illustration of a third-party check.

But remember, there are more rules about this. The RBI circular on third-party cheque payments is another one you should know about. However, we hope you’ve learned how third-party check works so far.

Personal Opinion

Third-party checks are often equated with check fraud; however, this isn’t always the case. A cheque not written out to you may legally be cashed by a third party. However, many banks and credit unions continue to be wary of third-party checks. A bank could decline to cash a third-party check you provide due to this kind of checking risk. When working with a third-party check, the above tips will aid you immensely.

References