Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

A counter check has a blank space for the account information provided by the customer. The banks typically issue these checks to those clients who have not received pre-printed checks yet and those who have no other ways of withdrawing money from their regular accounts.

The counter checks trust handwritten account information, but many business institutions do not receive these checks as payment due to the risk of fraud. So in this article, we will discuss all that is a counter check. And how does it work in detail?

What is Counter Check?

The counter-check is a type of check that does not have the name of the account holder, address, and account number. People use counter checks when they run out of imprinted checks or before printing a new account.

Some banks can print a small number of counter checks with official account information, allowing the new account holders to get the funds in their regular accounts.

Simply put, it is a blank check type with no check number, account holder name, or address. Most counter checks lack a pre-printed account number but have the bank’s routing number on the bottom of the check.

Why Use Counter Checks

Counter checks, as previously mentioned, are blank checks without the account holder’s name and address imprinted at the top and, sometimes, without the account number. When someone with a checking account runs out of stamped checks, they often utilize counter checks. Additionally, new account holders utilize them before having checks written for their new accounts.

The bank may issue a counter check if the individual does not have the check and requires one right away. The client’s account number is either printed by the bank on the check’s bottom line or must be handwritten by the client.

How to Write a Counter Check?

For writing the counter checks, the following steps are necessary:

- When a customer has to write the counter check, mention his name and address.

- He should also write his phone number, driver’s license number, or social security number.

- The client must choose the handwritten check number for each check at the top corner of the check.

- When the customer opens a new checking account, the bank orders the official bank checks.

- Now customers should use the new official checks and discard the remaining counter checks.

- The official checks are great, as they have the customer’s name and address. Account number, bank routing number, checking account number, and the sequential check number written on them.

Pros & Cons of Counter Checks

The Pros & Cons of counter checks have been highlighted in the table below.

| Pros | Cons |

| You can get the paper checks directly without waiting to receive an order or shipment of checks. | Most merchants and retail places do not receive counter checks, as they are not official checks. |

| You can quickly get the counter-check by visiting the bank. | Many counter-checks users think there is a high risk of accepting counter-checks because the person does not have a regular account yet. |

| The printing fee for the counter-check is minimal. | Banks can charge a printing fee of up to 2 $ per check |

| You can get the counter checks according to your needs |

Information Required for Counter Checks

While opening a new account, personal information is required for the initial batch of checks. The counter checks have less data than regular checks; many retailers do not accept these checks. The form of payment done by the counter checks is legal because it contains all the necessary information.

Function of the Counter Check

The bank issues a counter check to a customer who has opened a new account and needs a check to get the personal statement which is a time taking process. The banks consider the counter checks equivalent to the printed check.

Features of Counter Check

- The customer has a nine-digit router number on the check, with the banking account number or checking account.

- The issuing bank’s name and address are also mentioned in the check.

- You must write the date and amount of numerical check-in value in the check.

Personal information:

- There are lines in the check to fill up the personal information.

- You are liable to give your name, phone number, and driver’s license number in this head.

Misconceptions about counter checks:

- The main misconception about the counter check is that it is not similar to the printed personal checks.

- If the counter check has a bank router number, bank’s name, and the account number of a specific bank, it is equivalent to a printed check.

Typical Uses of Counter Checks

- You can use counter checks to pay bills, rent, and utilities and make car payments.

- The counter checks that do not have the check number will make the process proceed very hard.

- The best way to use the counter check is to order the pre-printed checks having check numbers issued by the check design company or through any bank directly.

How to Recognize when to Use a Counter Check

In the current day, a personal check produced separately by the teller with all of the client’s bank details is often referred to as a “counter check.” If the client forgot his chequebook or ran out of checks, this may be used as a standard check. Since counter checks are not a common service, the holder must pay a modest price in certain situations.

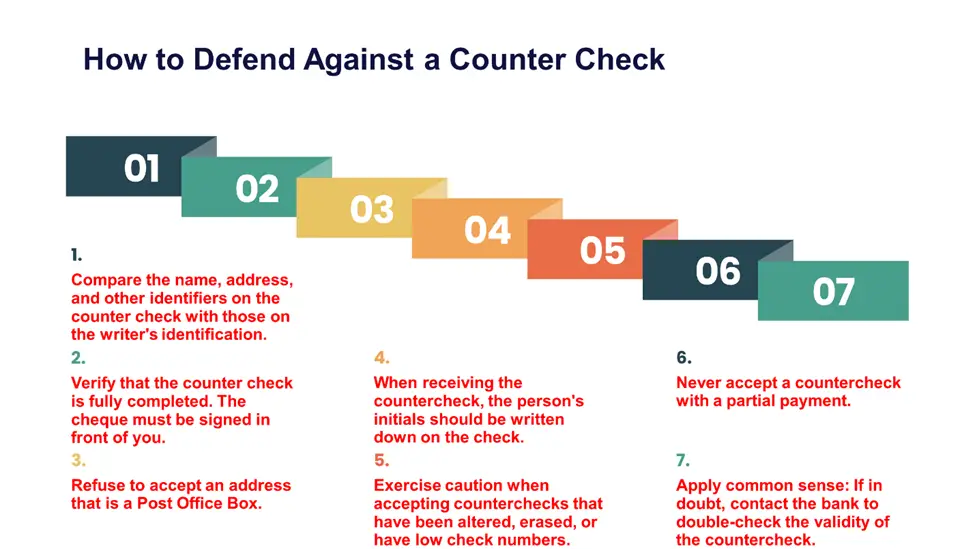

How to Defend Against a Counter Check

You can Defend Against a Counter Check through the following ways:

Counter Check vs Cashier Check vs Personal Check

The distinctions between these checks have been highlighted in the table below.

| Counter check | Cashier Check | Personal Check |

| A blank check that you may get from the bank is a counter check. | A cashier’s check uses the bank’s resources instead of the account holder’s. | Personal checks deduct money from your own bank account. |

| It’s a payment method that ensures sufficient funds to cover the check for the receiver. | The individual seeking the cashier’s check must first furnish the bank with sufficient funds to satisfy the check amount. | The check will be denied as having inadequate funds if you offer someone a personal check and the cash is not in your account is inadequate. |

| The bank can process counterchecks. | Payees can receive prompt and reliable payment while using cashier’s checks. | The bank where it was written is the best place to go if you want to cash a personal cheque. |

| The account holder signs counterchecks. | The bank staff signs the cashier’s checks. | The account owner signs personal checks. |

| Since it lacks your name and address, it is less formal than a cashier’s or personal check. | Given that it includes crucial security information, it is extremely official. | It includes important security information like your name and address, so it is fairly official. |

Tips for Improving your Counter Checking Abilities

You can improve your Counter Checking Abilities through the following ways:

- Post a sign indicating your collaboration with your establishment’s attorney general’s office. This will not only warn dishonest check writers, but it could also make your loyal, honest clients a bit more understanding of your practices.

- A photo ID must be used to verify identity. When the counter check was issued and approved, the writer’s social security number, driver’s license number, and birthdate had to be put on the check’s face. Ensure the check’s author didn’t write their identification on the document. Another method to recognize the check later—necessary for prosecution—is if your handwriting is present on it.

- If the identity on the countercheck differs from the name of the person providing the check, do not acknowledge it.

- For each countercheck, weigh the potential benefit against the potential loss.

- Take extra precautions on the weekends and holidays. Employees may be preoccupied during these hectic periods, an opportunity for skilled poor countercheck writers.

Frequently Asked Questions

How to get counter checks?

To get the counter check visit your bank or credit union’s branch to request the counter check. Before you visit the branch, call and confirm that counter checks are available. Search for the process to get the checks or whether you have to visit any specific department.

How to fill out counter checks?

- Write the date in the top corner at the right.

- Write the payee’s name on the line next to the “pay to the order of.”

- Then write the number of check-in numbers form in the box at the right.

- Write the number of check-in words on the line under the payee line.

What does counter-check mean?

A bank client may use a check to add their bank details and take money from their wallet. A bank client filling out a counter-check while withdrawing cash from their savings account is an example of a counter-check.

What is the distinction between a certified check and a cashier’s check?

The customer signs the certified checks, whereas the bank approves the cashier’s check. Actual bank checks, such as cashier and certified checks, are provided by the bank. A certified check differs from a cashier check-in that a cashier check is written on a checking account, but a certified check is issued on the check writer’s competence.

Conclusion

So it was evident from the above information that if you plan to make a payment with any one of these checks, you should know that the merchants don’t rely on counter checks and do not accept these checks as a method of payment, even if there is printed information about you is mentioned.

The reason is that there is no check number written on the counter check, which is a strong indication for the merchants that the check they got is a counter check. Merchants are afraid that the account opened is new, and you are availing of the facility of counterfeit checks.

Expert Opinion

In this day and age of instant access, checks don’t sit well. When you run out, you’ll need to buy more so they can be printed with your information and sent weeks in advance. You could be in a rush and exhaust your supply of checks before new ones arrive. Typically, your bank can provide many quick counter checks to meet your short-term requirements.

A personal banker or a teller may print counter checks. They will work similarly to regular checks and include information about your account. Certain banks may also include your name and address. Counter checks are generally rather straightforward, and store owners can tell when you’re employing one. The above tips will also aid you here.