Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

In the US, a company’s annual sales and the kinds of goods it sells ascertain whether it is required to formally file for VAT. Companies that are not legally compelled to register may decide to do so. Various scenarios and categories of items are subject to different VAT rates. Although there are a few exclusions, many businesses must charge VAT on almost all transactions. Thus, we have made this post on the vat to pay calculator to aid you.

A product is subject to a value-added tax (VAT), a consumption tax, at each point of sale where additional value is added. A tax is imposed when a supplier of raw materials offers something to a facility, and the factory then sells the finished product to a distributor. This is true even if the distributor sells the product to a store and then sells it to the final consumer.

VAT is ultimately charged to the retail customer. At each level of the product’s development, the buyer in the chain after pays back the buyer for the VAT. Additionally, you must decide which items and services should be subject to taxation and how much VAT you may charge before you can accurately calculate your VAT return.

Many items and services have a lesser VAT rate than the typical 20% rate. For instance, the VAT rate on child car seats is just 5%. This can be easily estimated using the Vat to Pay calculator.

How to use this Vat to Pay Calculator

You can use this vat to pay calculator through the following steps:

- Enter the price ($).

- Enter the VAT (%).

- At this point, the VAT to pay calculator will process your input and produce the Payable VAT Amount.

Vat to Pay Calculator

What is the VAT?

VAT is a tax that must be paid on purchases of goods and services. In every situation, the end consumer of the commodity or service is the one who must pay the tax. Every participant in the supply chain serves as a VAT collector. The manufacturer, distributor, and retailer are all included in this.

Typically, they collect VAT from their clients and include it in their revenue returns. They may claim the appropriate amount of VAT charged to them by their suppliers when repaying the VAT collected.

An indirect tax on goods and services is also a VAT. The value added is calculated at each stage of a product’s manufacturing. And a fraction of this value rise is also charged to the tax. The ultimate customer’s place of purchase is where the value-added tax is collected. No one who is a part of the manufacturing process is required to pay the tax.

Some products could not be subject to VAT, reducing customer prices. This often happens for necessities that low-income individuals need. However, since the VAT is based on the consumption volume, lower-income individuals often bear a greater tax burden because they must spend more of their income on necessities.

Since it is impossible for anybody to evade paying the tax, the European Union and many other nations utilize the VAT. Because of this, using the value-added tax often results in larger tax revenues.

Export sales are exempt from taxation, encouraging manufacturers to market their products abroad. Normally, foreign clients can request a refund of any VAT they have already paid.

What is the Vat Percentage of a Product?

A generic, broadly based consumption tax levied on the value added to products and services is known as the VAT Percentage on a Product. Almost all products and services purchased and sold for usage or use are covered by this rule. Therefore, products sold for exporting or services provided to clients in other countries are often exempt from VAT rates.

Imports are taxed in contrast to maintaining a level playing field for producers. This is legitimate for them to engage on an equal playing field with suppliers from outside the Community.

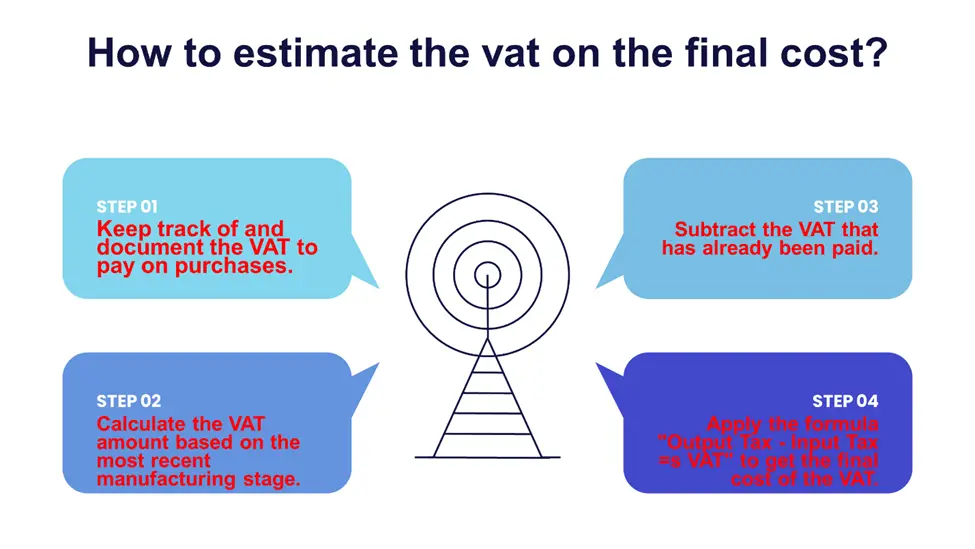

How to estimate the vat on the final cost?

You can estimate the vat on the final cost through the following steps:

- Keep track of and document the VAT to pay on purchases. Instead of merely receiving tax money at the point of sale to the final consumer, tax jurisdictions get it throughout the supply chain under a VAT agreement.

- Calculate the VAT amount based on the most recent manufacturing stage.

- Subtract the VAT that has already been paid.

- Apply the formula “Output Tax – Input Tax =s VAT” to get the final cost of the VAT.

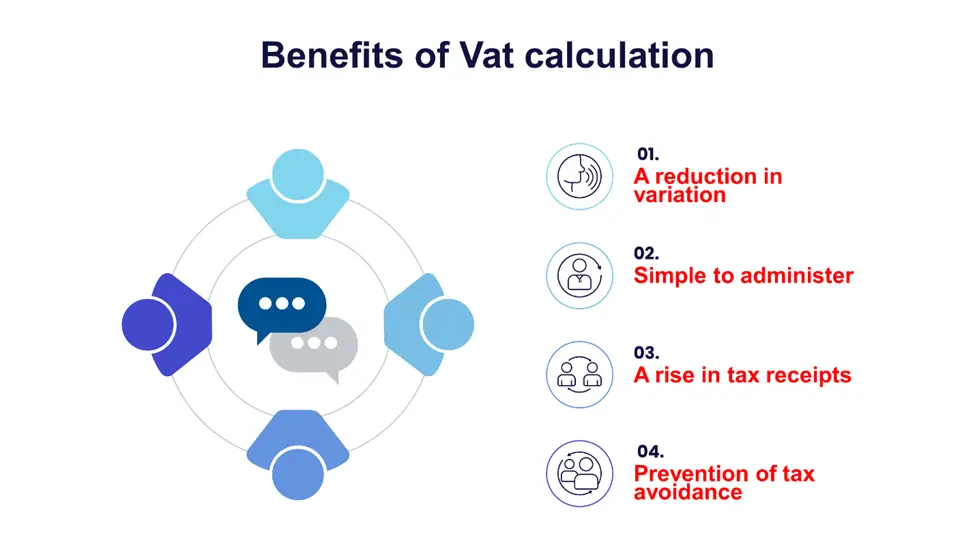

Benefits of Vat Calculation

Some benefits of Vat calculation include:

A reduction in variation

VAT computation offers a steady income stream as a constant tax since it is a tax based on expenditure instead of another variable. Income tax is a different common kind of taxation that changes according to a person’s net profits. A VAT system applies a comparable tax rate to various goods. In comparison to income tax, this lessens diversity from person to person.

Simple to administer

Exports and imports may be made simpler by computing the VAT since a consistent tax rate is applied to a larger population. In addition, it is levied on many firms, creating a system that taxes everyone equally in contrast to other taxes.

A rise in tax receipts

Calculating VAT might bring in a considerable sum of money. The quantity of goods and services subject to VAT determines the amount of tax income it produces. The scope of taxation is wider since the government imposes VAT on a range of goods and services. Authorities may utilize a significant amount of tax income from this to fund public services.

Prevention of tax avoidance

A VAT calculation offers a concrete record of the origin of each good or service. These documents might be digital or printed. They do, however, demonstrate the additional value at each manufacturing step. Because the tangible records show how much tax a company must charge for each item depending on the value gained during manufacture, this may deter tax cheating.

Frequently Asked Questions

How do I work out how much VAT to pay?

Using the VAT calculation formula, you may determine how much VAT you must pay. Reduce the gross amount by 1 plus the VAT rate to start. The value is then multiplied by -1, rounded to the nearest value, and the gross amount is subtracted.

How do I work out 20% VAT on a figure?

The net amount is multiplied by 1.20 to get the gross amount, which is then subject to 20% VAT. Calculate the gross amount / 1.20 to get the net amount * 0.20 if you need to know how much VAT is in the sum. The 20% VAT is a consequence of this.

How do I calculate VAT backward?

Simply split the amount you want backward by 1.2 to calculate VAT. Alternately, you might utilize the VAT Percentage. The VAT is then equaled by subtracting the split number from the initial amount.

How do you subtract VAT from a price?

To subtract VAT from a price, use the following procedure: Multiply the total sum by the VAT rate plus 1. The gross amount should then be subtracted, multiplied by -1, and rounded to the nearest dollar amount.

How do you take 20% off a price?

You can take 20% off a price through the following steps:

- Start with the initial cost.

- Subtract 5 from the original cost.

- Alternatively, multiply the initial cost by 20 and split it by 100.

- Deduct this new figure from the initial figure.

- The amount you computed represents the value with a 20% reduction.

How do I calculate net from gross?

You may use the formula to determine net from gross: Gross Profit – Operating – Other Business – Taxes – Interest on Debt – Other Income = Net Income.

Expert Opinion

Since the 1950s, countries all around the globe have imposed a VAT tax or value-added tax. The idea behind the VAT tax is that a tax is levied on the customer at every stage of a product’s production chain, from the original raw material acquisition to the retail buyer. It also holds while selling services.

The VAT tax, in the words of the Wall Street Journal, is “built into the retail price.” Not only are company transactions subject to the VAT, but a variety of goods and services are also. When renting out facilities and space to other businesses, you must charge VAT on such things. This is in addition to goods supplied at a staff restaurant or things sold at a discount to employees. “Taxable supply” refers to all items for which you must apply VAT.

You must first decide which items and services ought to be taxable and how much VAT you must collect to accurately estimate your VAT Return. Many products and services have a lesser VAT rate than the typical 20% rate. In all, this may be a hassle to calculate. Thus, the Vat to Pay Calculator will aid you immensely here.