Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

It’s something your folks are doing. You’ve read several articles and decided now’s the moment. You even received a letter congratulating you on being an excellent candidate. All of this is valid, but when addressing the topic “Should I refinance?” the response is essentially a personalized one. This refinance loan calculator can take your economic knowledge and support you sort out if it’s proper. But before you accomplish that, you must first ensure that you understand precisely what everybody is speaking over.

A new loan on your property with new conditions is what refinancing a mortgage involves. It’s usually done to reduce the loan’s term or get a more favourable (i.e. cheaper) interest rate. Of course, you might refinance to release some equity from your property.

You may refinance to a near-term loan if you want to create equity in your property faster. Refinancing to an 18-month loan, for example, will result in higher loan repayments.

However, you will be able to pay off your debt sooner. You’ll also own the house outright for a smaller duration of time. Since you would pay less interest, the total cost of the property will be cheaper.

If you wish to save money for other things, you should do the opposite. You may decrease your monthly installments by refinancing to a longer term. However, you will be making these payments for a more extended period and will pay more extra.

Even yet, if other costs in your monthly spending have increased or you have different financing options to pursue, this might be beneficial. Come along as we highlight refinancing a loan calculator below.

How to Put this to Use Refinancing a Loan Calculator

You can use this refinancing loan calculator through the following steps:

- Enter the interest rate for loans 1, 2 and 3

- Enter the loan term for loans 1, 2 and 3

- Put the commission (in %)

- Click “calculate”, and your costs (commission), monthly payments, monthly savings and total cost for loans will be displayed upon calculation. If you desire to re-calculate, click “reset”, and all your earlier inputs will get cleared.

Furthermore, extending your loan term significantly may pay higher interest in the long run. This is true because you’re lending the value over a given time. If you raise your monthly instalments with a shorter-term credit, on either hand, you will pay off your loan sooner.

This will also save you money on interest during the loan’s life. You’ll be able to discover right away whether the second loan will save or cost you money in the end with our calculator.

Refinance Loan Calculator

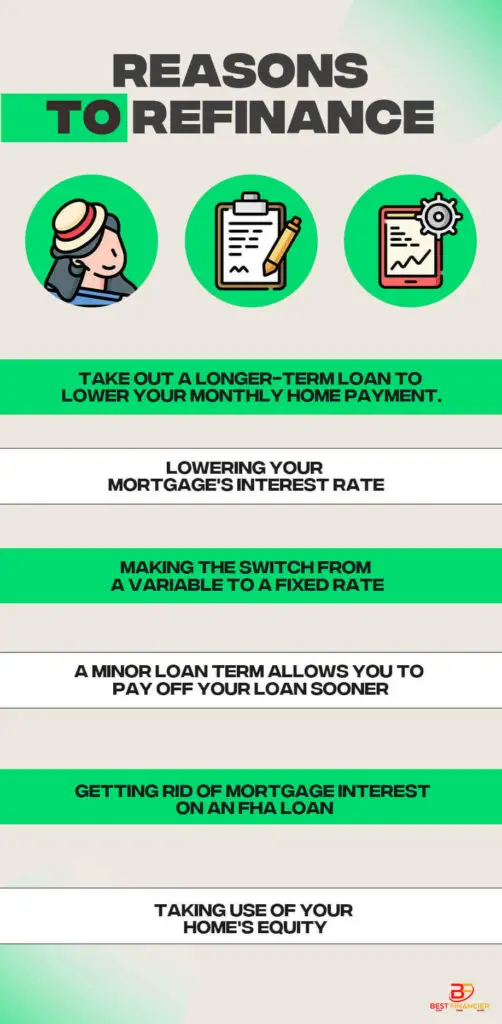

Reasons to Refinance

When it comes to refinancing, knowing when to do so is crucial. There are several causes to refinance your current loan, including the following:

Take out a longer-term loan to lower your monthly home payment.

Your payment method will be reduced if you prolong the payback duration of your loan. The disadvantage is that you’ll not only be adding years to your mortgage, but you’ll also be paying more interest throughout the loan.

Lowering your mortgage’s interest rate

For now, rates are pretty low. Furthermore, if you can lower your lending rate, the savings may surpass the refinancing fees.

Making the switch from a variable to a fixed rate

If you have an extendable loan with a rate rise coming up, you might be able to save up by switching to a home loan.

A minor loan term allows you to repay your loan sooner.

You will save money on interest if you take out a loan with a shorter payback duration. However, you’ll most likely be accountable for a larger monthly payment.

Getting rid of mortgage interest on an FHA loan

FHA loans demand mortgage insurance despite the amount of your down payment. If you have 20% equity in the home, you may refinance to a private loan to get away from it.

Making use of your home’s equity

With today’s low mortgage rates, cash-out refinancing might be a cost-effective way to make improvements to your house. This is on top of debt consolidation with hefty interest rates.

When deciding whether or not to refinance, consider how long you anticipate remaining in your house. It’s unlikely that you’ll be able to repay the initial fees if you relocate out of a property quickly after refinancing your mortgage.

How to Calculate Refinance Payments?

The typical method for calculating refinance repayments is to split the refinance cost by the cash contributions. This straightforward computation may be helpful at times. However, this computation fails to offer a fair evaluation of the current and proposed mortgages in most situations.

How do you determine if refinancing is worth it?

Refinancing a loan is a big step that may save you a lot of money. However, the method has the potential to backfire, placing you in a worse predicament than before. This is because there is less cash in the account. So, how can you know whether refinancing is a good idea?

The quick answer is that refinancing works better if it saves you money in the long run. This also ensures that it won’t give you any new issues. However, there are other factors to consider. This involves risk management and other financial objectives. Examine if your motivations for refinancing are beneficial or detrimental.

To determine whether to refinance, sum up all the expenses and hazards of getting a new loan and evaluate them to the benefits you’ll get during the life of the new loan.

Conserve funds

Refinancing may save you a lot of money, usually the most compelling incentive. Refinancing, in general, may help you save money on interest throughout the life of your loan.

Additionally, if a borrower arranged a loan with high-interest rates, the borrowing cost may have dropped. It may be feasible to refinance to a new loan with a reduced interest rate, and the borrower saves money on interest charges.

When a lender’s credit score improves, they may be able to refinance, which may entitle them to lower interest rates. If individuals utilize the cash gained to pay off other unpaid debts, their credit score will increase.

Cash crunch

During the repayment procedure, the original loan will reduce. When the debtor has built up enough equity, they may cash out by renewing the loan to a more significant level. Refinancing, on the other hand, usually necessitates disbursement. Cash-out refinancing is usually pricey unless it comes with a cheaper interest rate.

Pay a Lower Amount

Borrowers who have trouble making their monthly repayments may refinance to a new loan with reduced mortgage repayments. This may alleviate some of the financial strain. However, this will lengthen the loan term and raise the overall interest.

Reduce the Loan Length

Borrowers who refinance to lower loan terms may be able to pay off their old debts quicker. Reducing a 30-year loan to a 15-year mortgage is one of the most typical instances. This usually entails a lower interest rate, but it will undoubtedly mean an enormous monthly bill.

Debt Consolidation

It’s far easier to manage one loan with a single settlement date than many with various payment deadlines. This may get accomplished by consolidating many loans into a single loan, particularly true for a loan with a reasonable interest rate than all prior loans.

Change from a dynamic to a fixed rate, or vice versa.

Switching from variable to term deposit is achievable with loan refinances. This is true to seal low rates for the rest of the loan’s term, which protects against increasing interest rates.

Frequently Asked Questions

Does refinancing lower the loan amount?

When you refinance a loan, you may modify some conditions, but two things stay constant: your original loan sum will not be eliminated, and your security must remain in place. Your initial loan debt will not be reduced or eliminated. It’s possible that refinancing may result in you taking on extra debt.

How much loan to value do you need to refinance?

The rule of thumb would be that your LTV proportion should be no more than 80% when refinancing. This indicates that your house has a minimum of 20% equity. However, if you have a decent credit score, you may be able to pay it back with a larger ratio.

What Is Refinancing?

Refinancing a loan entails substituting your existing mortgage with a new one. You must file for refinancing like you would for any other loan. And the procedure entails thoroughly examining your credit, income, job history, and financial situation.

When there is equity in a house, most individuals refinance. The equity is the gap between the apartment’s value and the amount owing to the lender.

The old credit is paid off using funds lent from the home loan when refinancing. Modifying a mortgage usually results in a lower interest rate and a cheaper minimum payment, allowing you to have more cash on hand. You may also refinance into a reasonably short loan to save money on interest and have your house paid off faster.

When restructuring, you have two choices: a rate-and-term buyout or a cash-out refinancing. A rate-and-term refinancing modifies an established mortgage’s interest rate or term without removing equity from the property. With cash-out refinancing, you’ll obtain a new mortgage valued more than what you owe, allowing you to take advantage of whatever equity you’ve built up in your house. You will be compensated in cash for the difference.

Why is my loan amount higher after refinancing?

Refinancing may also get utilized to secure a long-haul loan with lower premiums for debtors struggling to repay the loans. Because interest must get paid over a more extended period in these circumstances, the amount charged will rise.

Does refinancing loans hurt your credit?

You might save big bucks in interest over time by negotiating a lower rate. Remodelling shouldn’t harm your credit score, except for a few points deducted when applying. If borrowing helps you remain current with repayments, it may help boost your credit score.

Do you lose your equity when you refinance?

If you utilize a portion of your loan fee to pay management fees, you may lose value when refinancing. However, when you return the loans and the price of your property rises, you will recover equity.

Do you have to make a down payment when refinancing

Refinancing does not need a down payment. Since you already have equity in the home, you shouldn’t need to secure funding when refinancing. Recall that when you pay back your loan and the value of your property rises, you develop an existing mortgage.

Is it better to refinance or pay extra principal?

Refinancing is unlikely to make practical if you can’t cut your current home loan. Paying more on your home is a better approach to minimize your interest expenses and pay off the credit quicker in this scenario. You want to own your house as soon as possible.

Is it worth refinancing for 1.75 per cent?

Experts frequently argue that refinancing isn’t worthwhile until your interest rate drops by at least 0.5 per cent to 1 per cent. However, this may not be the case for everyone. If you’re converting from an extendable to a home loan, refinancing for a 1.25 per cent cheaper rate could be worthwhile.

Is a 3.5 interest rate good?

Finding a suitable loan interest rate might be difficult since it focuses highly on the person applicant. Yes, 3.5 per cent is a decent interest rate for most consumer loans. On 36-month auto loans, consumers with ordinary to above-average credit ratings should expect interest rates ranging from 3% to 4.5%.

To put things in perspective, a 3.5 per cent interest rate is usually only offered to persons with credit scores of 661 to 780. While higher-score candidates may be granted even cheaper rates, they will not be accessible to those with lower credit scores. Those with credit scores beneath 660, on the other hand, might anticipate lending rates of 6.61 per cent to 14.59 per cent or more.

What is tax-deductible on a refinance?

Closing expenses for a mortgage refinancing may only get deducted if they are deemed interest charges or property taxes. If your closing expenses include surcharges like liens and assessments, they are not refundable.