Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Many might not be able to afford a house, a vehicle, or a college education if we did not take out loans. Home, vehicle, and other loans may help us grow and achieve significant life objectives. This loan interest calculator will help you find out loan interest very easily.

The value of a loan is determined by the loan type, lender, market conditions, and your credit score and income. Applicants with the best credit profiles often get the lowest interest rates.

Discover your credit rating and check your payment history to ensure it’s correct before looking for a loan. It’s also a good idea to figure out your payment rate. Thus, we have made this post on the loan interest calculator to aid you.

In addition, all debts are protected or unprotected. A secured loan necessitates the borrower pledging an asset as collateral to the lender to secure the credit. A fast loan is something like a car loan. The borrower will confiscate your automobile if you do not make car payments.

Furthermore, there is no need for collateral with an unsecured loan. The vast majority of personal loans are unprotected. It’s good to utilize a loan interest calculator when searching for any loan. This might help limit your property or automobile search by demonstrating how much you can justify paying each month.

It may also assist you in comparing loan prices and determining how interest rate variances affect your payments, particularly with mortgages. Come along as we highlight this below.

How to Use this Loan Interest Calculator

Borrowers make money by charging interests when you take out a loan, whether a school loan, personal loan, vehicle loan, or mortgage. The cost of acquiring a line of credit is called interest. That you will not simply pay back the funds, you received.

You’ll also have to repay an extra amount, the loan’s interest. Interest is charged in a variety of ways by various lenders. Some people use the so-called “simple interest technique.” Others may charge interest depending on a depreciation plan, which applies higher interest early in the loan.

Your payment history, loan size, and loan conditions influence the amount of income you will pay. Here’s how to figure out how much interest you’ll pay on a loan.

Overall, the correct loan calculator will display the overall cost of borrowing as a rate of interest or APR. Our loan calculator can also assist you in making sound financial choices by answering various questions. You may utilize it by following these steps:

Step 1: Enter the loan amount

Step 2: Enter the interest rate

3 Step: Click on “calculate,” Your only interest in payment value will get displayed.

Step 4: If you desire to re-calculate, click “reset,” All your earlier inputs will get cleared.

Loan Interest Calculator

How to Calculate Interest on a Loan

When charging interest, borrowers adopt various ways to maximize their earnings. It might be challenging to calculate loan interest since certain interest forms involve math. These are some of them:

Uncomplicated interest

Computing loan interest is easy if your borrower uses the S.I method and you have the needed details. To determine your total interest charges, you’ll have your principal loan balance, interest value, and the number of weeks or months you will return the debt.

Calculation

You may figure out your accrued interest by following the steps below: The principle loan sum is multiplied over the cost of borrowing compounded by the period to compute interest.

On brief lending, you may be charged vital interest. The method most institutions charge interest, on the other hand, is more complex.

Loan amortization

Many financiers use an amortization plan to compute interest. This includes college loans, foreclosures, and auto loans, to name a few. These loans have a set minimum repayment and are paid back in equal increments over time. However, how the borrower applies your repayments to the lending value varies with time.

The first payments on amortizing loans are usually high in premium. This implies that less of your regular repayment means paying down your principal debt.

Nevertheless, as time goes by and you get closer to your loan’s payback deadline, the tables turn. Most of your monthly payments are devoted to your principal debt as you near the very end of your credit, with less attention paid to interest rates.

Calculation

Here’s how to figure out how much interest you’ll pay on an amortized line of credit:

Calculate your annual interest rate by multiplying it by the number of repayments you’ll make. If your premium rate is six percent and you pay in monthly installments, reduce 0.06 by twelve to obtain 0.005.

To determine how much interest you’ll pay that quarter, multiply that amount by your entire loan sum. If you owe $5,000 on credit, the first month’s charge will cost you $25.

Deduct the premium from your static monthly value to determine how much you’ll have to pay in principle in the preceding quarter. If your static monthly repayment is $429.5, you will get a $404.2 contribution toward the principle for the first month. That amount reduces your remaining value.

Repeat the steps with your current leftover loan amount the following month. Also, repeat the process for each month after that.

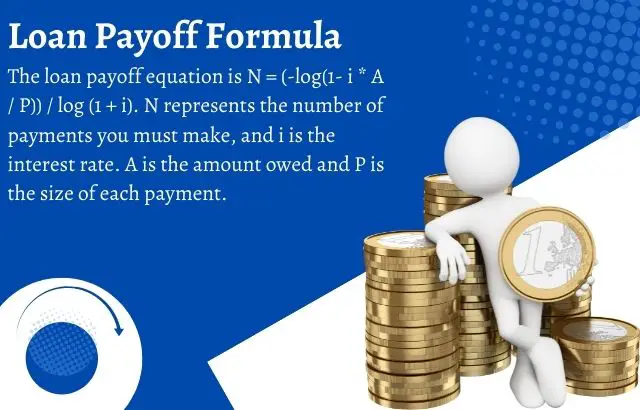

What is my Loan Payoff Amount?

You may be able to plan and enhance your budgeting in the future if you understand how to calculate a loan payback. This might result in financial savings by allowing you to repay your mortgage sooner.

This is on top of what you’ll pay if you ever remortgage your house. Sadly, many consumers have no idea how to figure out how much they owe on their whole debt.

A loan payback is a total sum you will pay until your mortgage is fully paid, including all interest. This isn’t the same as the loan’s principle. The principle refers to the amount you borrowed to purchase your property. However, you will have to repay more than this because of interest.

The figure on your total amount may not be the same as the whole sum you’ll have to pay in the long run. You can better organize your money and take control of your loan if you know how to calculate loan payback.

How to Calculate Loan Payoff Amount

A loan payback amount is calculated by multiplying the loan total by the interest rate and then increasing that number by 365. The loan payback amount is calculated by multiplying this number by the days till payment plus the principal amount.

If you approach your loan provider, they can do these computations for you. Because the data might be somewhat perplexing, this is a more straightforward approach. Your loan payment amount will be confirmed in writing by them.

Furthermore, our online loan payment calculators are also available. They may give you the total loan payback amount or the current debt.

What are the Benefits of Calculating my Loan Payoff Amount?

The following are some of the advantages of calculating your loan payment amount:

Recognize your total loan payment

A startling amount of consumers are unaware of their whole repayment. You may believe that you are paying down the principal debt, but your repayments may simply be addressing interest at first. If you don’t comprehend your full loan payment, you won’t be able to pay it off in the most cost-effective manner.

You can determine how much of your repayment interest is if you compute your loan payback. This is in addition to the payment applied to the principal. Please remember that your refund may contain additional charges such as mortgage interest.

Calculating the length of time it will require paying it off

Knowing when your debt will get paid off makes future financial preparation simpler. You may calculate how long it takes you to be debt-free by calculating the loan payback amount.

You may also evaluate other loan repayment scenarios to determine if you can save funds. Understanding your loan payment amount, for instance, might help you assess whether or not upgrading is a wise idea.

Clearing off your debt more quickly

When you know how much you owe on your debt and how long you have to repay it, you can figure out how to pay it off quicker. Over time, increasing your principal payments might save you a significant sum in interest. Overpaying your credit lowers the cost of purchasing a home significantly.

You may save big bucks over the term of your loan if you pay a little extra monthly. You will also be able to pay off your debt considerably quicker and have more disposable money.

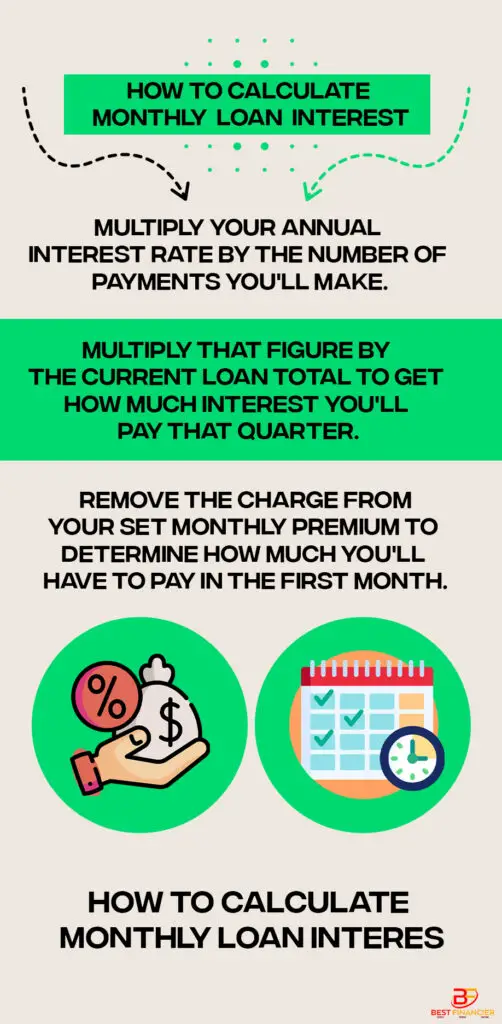

How to Calculate Monthly Loan Interest?

The following methods will help you determine your monthly loan interest:

- Multiply your annual interest rate by the number of payments you’ll make.

- Multiply that figure by the current loan total to get how much interest you’ll pay that quarter.

- Remove the charge from your monthly premium to determine how much you’ll have to pay in the first month.

How to Calculate a Monthly Payment?

Whenever you take out a loan from a borrower, you are given a sum known as the principal, and the borrower is charged interest. The loan is repaid over months or years.

In addition, interest increases the total amount you owe. Typically, your quarterly repayments will be divided into equal installments during the loan’s length.

The method you use to compute your repayments is determined by the kind of loan you have. Here are the three most common forms of monthly loans, each of which is calculated differently:

Repayment Method for Amortized Loans

Compute your monthly premium (P) by multiplying your principal balance (a) by the periodic rate of interest (r). This is your yearly rate calculated by the total of repayment periods, and the overall number of repayment intervals is your maximum number of repayment periods (n)

Methodology for Interest-Only Loan Payments

It’s simpler to calculate repayments for an interest-only loan. To begin, multiply the yearly interest rate (r) by the amount of expenditure made each year (n). Then increase it by the loan amount (a).

Computation for Credit Card Payments

Credit cards, too, rely on basic math. However, since your equilibrium continuously fluctuates, identifying it requires more work. And various lenders have varying interest rates.

Your monthly minimum fee is usually calculated using a formula depending on your total debt. For example, your card issuer may ask you to make a monthly payment of at least $25 or 1% of your existing debt, whichever is larger.

How to Calculate Monthly Principal and Interest

You must return both the principle and interest when you make loans for a car loan, a home loan, or a credit card bill. But what do we mean whenever we say that? Interest is the cost of borrowing money from another person (typically the bank).

After all, it’s how lenders profit from lending and are not in it for the revenue. The payments you make on loan are often divided into two parts. This includes the part that reduces the amount you owe to pay off your loan and the half that covers the interest on that debt.

In general, an interest calculator will assist you in calculating the amount of principal and interest you will pay.

Follow these steps if you wish to do it manually:

- Divide the number of installments you’ll make by your yearly interest rate. This is accurate since interest rates are announced once a year. If you’re paying monthly expenses, for example, divide by 12.

- Add it to your credit total, which will be the first repayment’s total principal amount. This is the rate of money you’ll have to pay back in the first term.

Even if you’ve begun paying down your principal, you’ll need to figure out your new balance before computing the rate you’ll pay over the next several months. So:

- Subtract the amount you expended from the proportion you calculated before. This shows how much of your loan’s principle you’ve paid off.

- To get the new interest rate, subtract this portion from the main amount.

The simplest method for calculating current premium repayments is splitting them into units.

Follow this formula

Since you’re making monthly, rather than annual, payments throughout the year, the 4% interest rate gets divided by 12 and multiplied by the outstanding principal on your loan. In this example, your first monthly payment would include $1,000 of interest ($300,000 x 0.04 annual interest rate ÷ 12 months)

How can you determine how much a loan will cost in total interest?

The actual sum payable with interest is computed by increasing the minimum repayments by the total number of months. Removing the loan balance from the paid sum yields the genuine interest payable.