Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

A life annuity should be considered a retirement income option if you are retired or on the verge of retiring. A lifetime recurring billing on a Single Payment Instant Annuity (SPIA) is what life annuities are. They provide a consistent and safe flow of income payments that are promised to last the remainder of your life. And the lifetime annuity calculator will be of great help to you in navigating through this with ease.

Additionally, you will always get income payments from fixed life annuities. They depend on your premium amount due, gender, age at issue, and the state of the interest rate market at the time of buying. You must pay a one-time premium to obtain a life annuity. Additionally, dividends usually start within a month but may be postponed for up to a year.

One person receives payments from a single-life annuity for the remainder of their lives. A combined life annuity, however, is predicated on the lives of two individuals. Usually married, a joint annuitant receives compensation for as long as they both remain alive. The Lifetime Annuity Calculator can help you make accurate estimates overall. Follow along as we go into more detail about this below.

What is Lifetime Annuity?

Investment vehicles called lifetime annuities are intended to give you money in retirement. You may wish to think about this financial instrument as a reliable, assured source of income if you’re about to retire or have already done so.

Instant lifetime annuities and payout annuities are other names for lifetime annuities. The product is meant to guard against longevity risk or the possibility of outliving your resources for retirees.

Annuitants are those who purchase annuities. And the “modal” refers to how they choose to pay the annuity. Options abound for lifetime annuities. Annuitants have the option of choosing a monthly or quarterly payment schedule. Additionally, inflation-protected insurance is an option for annuitants. Additionally, some annuities are adjustable, which means the payout may change according to the performance of the underlying portfolio.

A lifelong annuity is also a wager between you and the insurer that you won’t survive beyond the period you and they agree upon in your contract. The insurance firms are comfortable establishing the wager’s terms since they have a wealth of mortality data. Additionally, they have a high degree of confidence in their ability to anticipate your life expectancy, the price they should charge you, and the income your annuity will bring in.

How to use this Lifetime Annuity Calculator

You can use this Lifetime Annuity Calculator through the following steps:

- Enter the Monthly Payment Amount

- Enter the Annual Interest Rate (%)

- Put the Number of Payments per Year

- Enter the Number of years of Payments

- The lifetime annuity calculator will process your input and produce the right output.

Lifetime Annuity Calculator

Why You Should Buy a Lifetime Annuity

You should buy a lifetime annuity due to the following reasons:

Annuities may provide dependable, stable income.

People are now living longer lives. A married pair with two 65-year-old members has a 50% probability of having one spouse live to 92. and a 25% probability that one spouse would live to be 97 years old. This implies that your retirement might span anywhere from 20 to 30 years.

As a result, your financial necessities will endure longer. Traditional retirement planning methods may not be sufficient. Therefore, even if you’ve carefully prepared for retirement and are eligible for Social Security payments, you may want to consider a reliable income source like an annuity.

Get to decide when you start getting paid.

You may choose when you want to start receiving income from an annuity, and most don’t even need you to decide in advance. You may choose what’s best for you if you require money now or in the future.

Annuities may provide your whole portfolio with some security.

You may anticipate earning back what you invested and sometimes much more with most fixed annuities. That level of certainty helps balance other investments of yours that could be more susceptible to fluctuations in the market. You will normally earn at least a minimal return from a fixed annuity in your investment, regardless of how the stock and bond marketplaces perform.

Annuities may increase the tax efficiency of your portfolio.

You must pay taxes on your income from several investments each year. As a result, your yearly income isn’t as high as you would believe. On the other hand, delayed annuities only subject you to taxation on the increase when you withdraw money in the future.

By adding another tax-deferred investment to your inventory, you may avoid losing a portion of your annual profits to taxes.

Annuities may be tailored to meet your specific demands and financial objectives.

There is no one size fits with annuities. There are several choices to think about. This includes growth-oriented items and those that promise a reliable stream of future revenue. Find out whether an annuity suits your requirements by consulting a financial expert.

Benefits & Disadvantages of Buying a Lifetime Annuity

The Benefits & Disadvantages of Buying a Lifetime Annuity have been highlighted in the table below.

| Benefits | Disadvantages |

| Lifetime earnings | You may be confined forever. |

| Regular income | Your funds are limited. |

| Prevention of inflation | Future rate hikes won’t be advantageous to you. |

| Security against a market collapse | Annuity returns may not correspond to investment gains. |

| Money may increase more quickly. | Varying annuities can be expensive. |

| Giving heirs an inheritance | Your investments are made without your influence. |

| You will be paid frequently. | Once payments begin, you cannot alter the revenue you get. |

| Your donations may increase tax-deferred. | Income payments will be modest if the annuity begins at a time of low-interest rates. |

| Fixed annuities provide rates of return that are guaranteed. | |

| Ideal for someone unwilling to take on investment risk. | |

| Usually, death benefits are provided | |

| Your spouse or dependent will get money if you choose a reversionary beneficiary. |

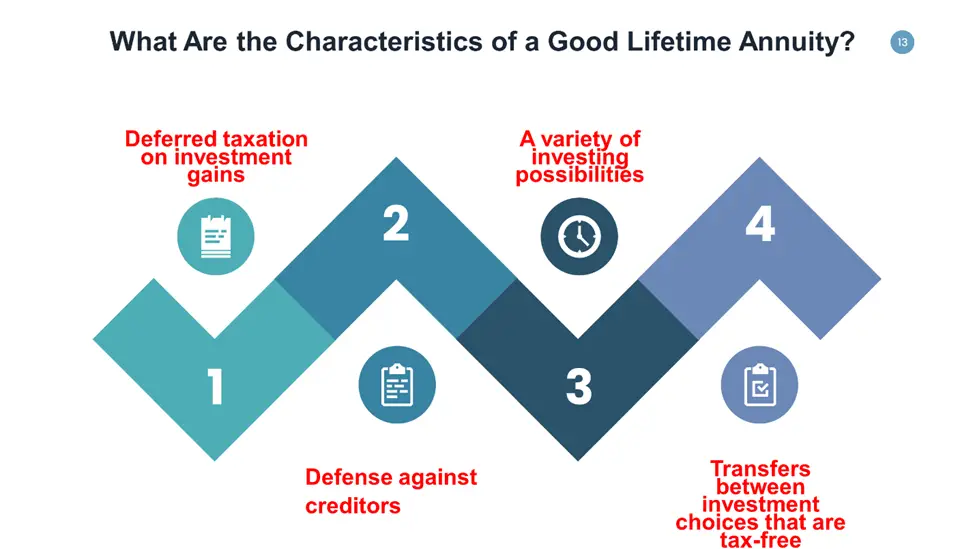

What Are the Characteristics of a Good Lifetime Annuity?

In general, a Good Lifetime Annuity has the following characteristics:

Deferred taxation on investment gains

Many holdings are taxed annually, but annuities’ investment gains and income are not taxable till the investor takes money out of the contract. 401(k)s and IRAs also qualify for this tax deferral. In contrast to these products, an annuity does not have a cap on the amount that may be invested. Additionally, compared to 401(k)s and IRAs, annuities have far more lenient minimum withdrawal limits.

Defense against creditors

An instant annuity owner is given some security from creditors. The payments are often the only thing that creditors may have access to. This is true since the insurer owns the funds the annuity owner handed it. A few states’ legislation and judicial rulings also safeguard the payments from such annuities.

A variety of investing possibilities

Numerous annuity providers provide a range of investing possibilities. For instance, people may invest in a fixed annuity, similar to a bank Deposit Certificate that credits a certain interest rate (CD). They may invest cash in mutual funds, equities, or bonds if they purchase a variable annuity. Annuity businesses have recently developed various ” floors ” that restrict how far investments may fall from a rising reference point.

Transfers between investment choices that are tax-free

With annuities, owners may alter their investments without tax penalties, unlike mutual funds and other assets held with after-tax money. This may be especially helpful if they use the “rebalancing” tactic, which many financial gurus advise. Rebalancing involves occasionally moving assets to restore them to the ratios that best reflect the risk/return trade-off for the investor’s circumstances.

Lifetime earnings

An investment is turned into a continuous stream of payments with a lifetime instant annuity until the annuitant’s death. In theory, the payments are made out of three “pockets”: the initial investment, investment gains, and funds from a collection of investors who do not live as long as predicted by actuarial estimates. The pooling, exclusive to annuities, makes it possible for annuity firms to promise a lifelong income.

How Much Does a Lifetime Annuity Pay?

A financial instrument you may purchase with a large amount of cash is a lifelong annuity. You will get payment in exchange for the rest of your life. A lifelong annuity ensures payments of a certain sum for the remainder of your life. A period annuity only rewards you for a certain time; this is distinct.

Our investigation indicated that the payments depend on the age at which the annuity contract is purchased, and the interval before the money is taken out.

Is Lifetime Annuities Tax-Free?

You don’t have to pay taxes on your annuity when you take money out or start getting payments since annuities grow tax-deferred. If you bought the annuity with pre-tax cash, the funds would be taxed as earnings when you remove it. You would only be required to pay tax on the profits if you bought the annuity with post-tax money. The ability for annuities to grow tax-deferred throughout the accumulation phase makes them advantageous to purchase.

Frequently Asked Questions

How much does a $50000 annuity pay per month?

If you bought a 50,000-dollar annuity at 65 years and started receiving payments right away, you would get around $239 every month for the remainder of your life. If you buy a $50,000 annuity at age 70 and start receiving payments right away, you would get around $260 per month for the remainder of your life.

How much would a lifetime annuity pay?

You can find out how much a lifetime annuity pays by using our lifetime annuity calculator.

How much does a $1000000 annuity pay?

If you bought a $1,000,000 annuity at age 60 and started receiving payments immediately, you would get around $4,636 monthly for the rest of your life. In case you bought the annuity at age 65 and started receiving payments immediately, it would pay you around $5,157 each month for the rest of your life.

If you bought a $1,000,000 annuity at age 70 and started receiving payments immediately, you would get around $5,678 monthly for the remainder of your life.

Are lifetime annuities a good idea?

Yes, they may be excellent sources of retirement income for the proper individual.

In the United States, annuities are some of the financial service items with the strictest regulations. They are incredible instruments that some of the smartest individuals with degrees in probability and statistics have devised and constructed.

Why should you never buy an annuity?

Some reasons Why you should never buy an annuity include:

- Long-term agreements

- Your investment will be beyond your control.

- The income from annuities may not rise with inflation.

- If you pass away, your beneficiaries won’t get anything.

- Very little to no liquidity

- High prices

Should a 70-year-old buy an annuity?

Yes. According to many financial consultants, starting an income annuity between the ages of 70 and 75 may optimize your payoff. Typically, a deferred income annuity only takes 5 to 10% of your money and starts paying off later in life.

What is better than an annuity for retirement?

Bonds, CDs, income in retirement vehicles, dividend-paying equities, and savings certificates are some of the most popular channels for fixed annuities. These investments are income-focused and generally low-risk, much like fixed annuities.

What is the best annuity for seniors?

Since they start paying out within a year of purchase, instant annuities are sometimes the best annuities for older citizens. Nevertheless, seniors should choose the annuity to achieve their retirement objectives.

At what age should you not buy an annuity?

For fixed index annuities, there are various minimum and maximum age limits. You may acquire a fixed index annuity up to the age of 90. The average upper age limit is 80. Several insurance providers won’t let you buy an annuity with a rider for income until you’re 50 or older.

Expert Opinion

Today, lifetime annuities often provide a variety of benefits. When you bought them, you gave your resources to an insurance provider that assessed little or no costs on them. The stock brokerage business, bank, or investment bank where you held your money is the loser in that transaction.

Even if everything in the universe goes wrong, your annuity’s assets won’t suffer any losses. You won’t lose any money if it all goes wrong for two, three, or ten years. If your annuity increases 20% over five years, the whole gain is safeguarded and cannot be lost. Our lifetime annuity calculator will also aid you immensely at this point.

References

- https://www.scottishwidows.co.uk/retirement/retirement-explained/taking/pension-options/guaranteed-income/lifetime-annuity/

- https://www.iii.org/article/what-lifetime-annuity

- https://www.cnbc.com/2021/10/22/longevity-annuities-can-be-a-good-deal-for-seniors-but-not-many-people-buy-them.html

- https://www.annuity.org/selling-payments/faqs/