Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

The notion that a Social Security Number may get used to check someone’s assets, such as bank and stock accounts, is a widespread urban individual Taxpayer Id legend. It’s not that it can’t get done in other ways; it isn’t legal in most cases. Let’s learn how to find bank accounts with a social security number.

There are additional options for locating assets, whether or not you have a Social Security number. However, you must use caution in not exceeding your legal authority to view this material. Thus, we have made this post to aid you in finding bank accounts with a social security number.

If you search for “check bank accounts using a social security number” on Google, you’ll discover a slew of private investigation advertising promising to do precisely that. Is it permissible? Like many other life questions, the correct answer is “maybe” or “sometimes.”

There is no miraculous internet source where you can enter your Social Security number and get a list of property and bank accounts. This is not true. Federal agencies get prohibited from disclosing information without authorization under the 1974 Privacy Act unless specific circumstances apply.

On the other hand, asset locations and quantities aren’t challenging to come up with for expert investigators. We create a trail of information breadcrumbs in our daily lives that generate a lot of assets and SS information.

Examples are application forms, credit reports, and legal actions – particularly divorce proceedings –. Among these are public documents and mortgage applications. Even if the investigator doesn’t start with a subject’s Social Security number, it will appear on your credit and employment applications.

As a result, obtaining it is not a difficult task. With all this information, an investigator can typically identify the accounts’ locations and estimated amounts. It is also possible to find the person’s address with the social security number (see this guide for more info).

What is a Social Security Number?

A nine-digit identifier termed a Social Security (SSN) is often given to American citizens, legal immigrants, and certain (productive) non-immigrants. The Social Security System gives out the number to keep track of people’s employment for Social Security payments. The SSN has, however, evolved into a de facto national identification number for taxes and other uses over time. It often appears on the U.S. Citizenship and Immigration Services website (USCIS).

Where to Find a Social Security Number?

You may sometimes be prompted for your Social Security number for security purposes. This holds while requesting services or a job. You may be able to confirm your Social Security number if you don’t have your card and are uncertain about it by looking at specific documentation, such as your:

- Tax filings

- W-2 form

- 1099 form

- Forms already submitted to USCIS

- Bank statements or other financial records

You may ask for a new Social Security card from the Social Security Administration if you don’t already have one (SSA).

What are the Reasons to Find Bank Accounts with a Social Security Number?

If you contact them, you won’t be able to go into a financial institution and pay for information about someone just because you’re interested. It would help if you had a compelling cause for requesting this data.

There are various compelling reasons to be curious. For example, you’re divorced and believe your spouse’s asset statement is false. You may owe child support or have a court judgment against anyone who has declared himself bankrupt.

Most searches for such purposes are based on a court order authorizing them. The investigator cannot lawfully travel too far without a court order.

For example, he can determine whether a bank account exists and where it is currently, but he cannot lawfully access the account to calculate an exact amount. Most experienced investigators, on the other hand, may make astonishingly precise educated estimates.

On the other hand, the investigator has a powerful right to access all known information routes if they obtain a court order. This applies to all federal documents and every bank and brokerage account.

How to Find Bank Accounts with a Social Security Number

Every bank and financial institution must adhere to specific business principles. The most important is their customers’ privacy policies. As a result, no matter how important the cause is, you will not get any information about another person’s bank account from them.

You’ll need legal papers and authorization for this, which the agencies designated for such searches already have. Furthermore, you will need many connections at various levels and an extensive network to make the search process more manageable.

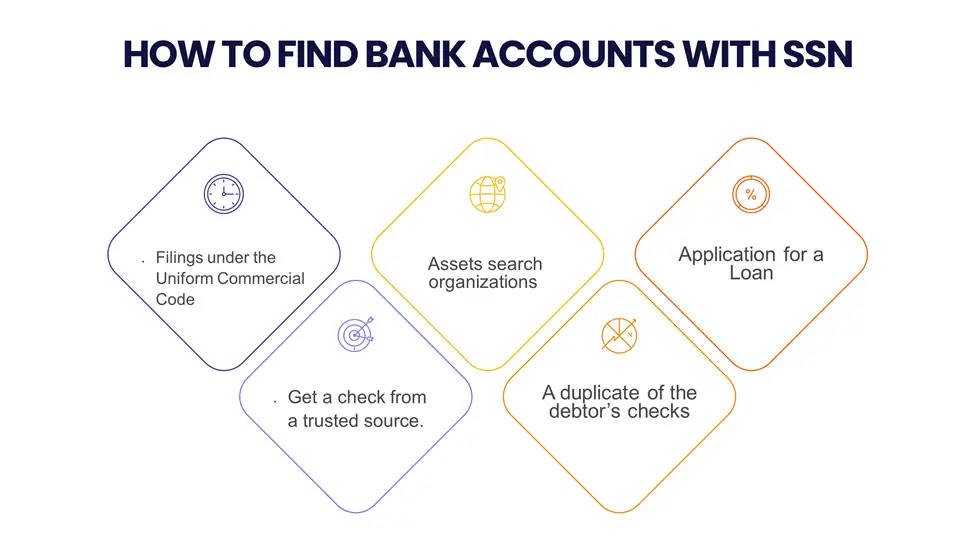

As a result, here’s a rundown on how to locate bank accounts using a social security number:

Filings under the Uniform Commercial Code

Uniform Commercial Code filings (UCC Filings) are authorized methods for a Bank Account Search by Social Security Number. You must submit a copy with the secretary of state for the Uniform Commercial Code filings to get searched.

In such circumstances, the bank that provided the defendant with the loan may be the same bank the accused uses personally. This is a common practice among debtors and a very smart one. The odds of securing a loan are better since you already have a relationship with the bank.

Get a check from a trusted source.

A few checks from the secured party may need provision to the debtor, which will aid in the Bank Account Search by Social Security Number. This is a circumstance where a debtor gets a loan that must be in their bank account.

During deposition, the bank account number is always written on the reverse of the check when it returns to the issuing bank. You may get the paper trail if you subpoena the party for a copy of such a check.

Application for a Loan

It’ll also be necessary to consider the aim of the UCC filing. The defendant may have received a loan application from a secured party. The objective of the UCC filing in this situation is to notify the general public that the secured party has an interest in the debtor’s property.

The loan application form and financial statement are pretty helpful in locating bank accounts in this scenario. The debtor’s bank account details must get included in this information.

A duplicate of the debtor’s checks

When a bank loan gets taken out, the debtor must write monthly checks from their checking account to repay the loan. Such required contributions are never made in cash but rather by check. You may get a copy of such checks if you serve a subpoena on the targeted bank based on the preceding information.

Assets search organizations

Some major asset search organizations can assist you in conducting a bank account search utilizing your Social Security Number by using qualified private detectives.

They may also do asset searches anywhere around the globe for the dead. Or to locate hidden assets that your spouse failed to reveal before or during the divorce.

Asset Search Companies can readily assist you in determining your partner’s financial strength. Asset search businesses may assist if you need to know your partner’s financial status for a commercial or personal reason. They provide a wide range of services, from identifying hidden assets to valuing them, tracking bank accounts, and determining balances.

How to Spot Fake Bank Account Numbers with an SSN?

With an SSN, you can identify bogus bank account numbers in the following ways:

Verify that all the figures are accurate.

Scam artists often neglect to ensure that all the figures on the financial records add up, which is a typical error. If funds are unavailable for automatic verification procedures, you must use your time to determine if the numbers add up.

When matching bank account numbers with SSNs, being cautious is always a good idea. Those who fabricate bank statements often utilize round numbers. Proper round numbers are often a warning sign when determining whether a bank statement is authentic.

Consult a bank employee.

Contact a banking agent if you’re unsure if the bank statement you got is real or fraudulent from a company. Don’t depend on any information on the bank statement; instead, call the bank directly. Validate all the bank account information you wish to confirm with an SSN once you reach a banking agent.

Check Documents for Discrepancies and Errors

The existence of both significant and small irregularities is another possible warning sign for phony bank account numbers. Is the font size and type constant across the same bank’s document types? The bank’s logo: is it accurate and up to par? These discrepancies may aid in combating online fraud since people fabricating bank papers often get lazy.

Does the document’s math add up, and does the final balance make sense? Are there any questionable withdrawals? You may need to do more study if the bank statements show any of these discrepancies.

How to know if you have a Real Bank Account with an SSN?

Contacting the bank that issued your SSN is the only way to determine whether it is a legitimate bank account. A financial agent will often request a postal copy of certain papers. There’s a good chance the bank won’t provide much assistance. Several banks will add a digital signature to the PDF files to thwart document alteration. Nevertheless, this function is often used to safeguard investment accounts.

Frequently Asked Questions

How can I find bank accounts with a social security number?

Is finding a Bank Account with Social Security Number through private firms a good step?

Private research for Bank Account Search by Social Security Number is efficient and safe. Certain private businesses can conduct appropriate legal investigations and gather essential information on secret accounts.

They may also carry out the processes per government regulations. Bank account search businesses, on the whole, have more investigative experience.

Furthermore, learning about a person is difficult, particularly regarding money considerations. However, there may be situations when you need or want to know about a person’s financial situation for specific reasons. Any search firm may assist you here.

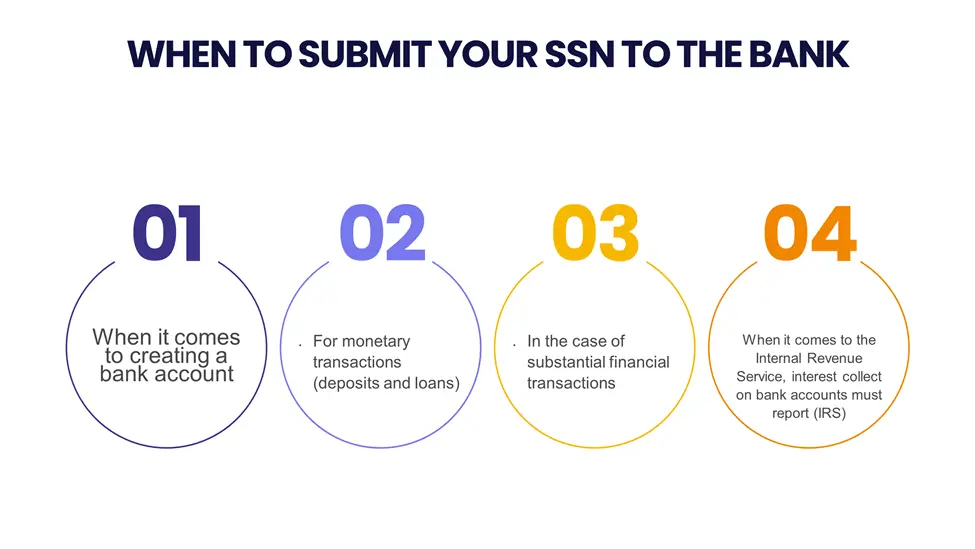

Is it possible for the bank to demand that I submit my Social Security number?

Yes. The bank, in certain instances, may require your Social Security number. For a variety of banking-related tasks, a bank may get the need to get an identity number, including:

The individual’s Social Security number is an identification number for a US citizen. An identification number is the IRS-issued employer identification number for company accounts.

Can I set up a checking account without providing my social security number?

Yes. A social security number is unnecessary to establish a checking or savings account. Before opening a checking or savings account, the bank or financial institution must confirm your name, date of birth, address, and ID number.

You may inquire at various banks and credit unions about the accounts they provide and the types of identification numbers they accept.

Conclusion

In conclusion, social security numbers come with various merits. And if you desire more help finding bank accounts with a social security number, the tips above will aid you immensely.

Author’s Expert Opinion

It’s reassuring that your assets, including bank and trading accounts, may be checked using your Social Security number. On the other hand, you will need to supply certain personal and sensitive details to get started. There are many causes for this. To begin with, the bank requires your contact details to send you crucial documents like your reports. At this point, the above tips on how to find bank accounts with a social security number will be efficient.

References

- https://en.wikipedia.org/wiki/Social_Security_number

- https://www.usatoday.com/story/money/personalfinance/2017/11/15/5-ways-identity-thief-can-use-your-social-security-number/860643001/

- https://money.usnews.com/banking/articles/scams-that-target-your-bank-account

- https://seon.io/resources/how-fraudsters-open-bank-accounts/

- https://www.texasattorneygeneral.gov/consumer-protection/financial-and-insurance-scams/bank-and-check-scams

- https://www.forbes.com/advisor/banking/common-bank-scams-and-how-to-avoid-them/