Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

The amount of time it will take for the cumulative discounted net cash flows to equal the original investment in a project or asset is known as the discounted payback period. In other words, the DPP determines how long it will take to recoup the original investment. The manual calculation of this might be challenging. To help you, we have created this page on the discounted payback period calculator.

The discounted payback time metric is often used in project management as a component of a cost-benefit analysis. Typically used in conjunction with other profitability-related metrics like internal rate of return or return on investment. However, it may also be used to assess the performance of a project or investment after the fact and pinpoint the time at which an original investment truly paid off.

The discounted payback period still serves as a very useful indication, but since it takes the timing of cash flows into account, it is more accurate than the generic payback period. Your biggest ally at this stage will be the calculator for the discounted payback term. Follow along as we go into more detail about this below.

What is Discount Value?

The present rate or sequence of payments that will be paid in the future is known as the “discount value.” A dollar is worth more now than it would be tomorrow due to the time value of money. The main variable used to price a future cash flow stream is discounted.

For instance, a normal bond’s coupon payments are discounted by a certain interest rate and added to the par value to calculate the bond’s current value.

An asset is worthless from a business standpoint unless it can generate future cash flows. Dividends are paid on the stock. Projects provide investors with additional future cash flows, whereas bonds pay interest to investors.

By adding a discount factor to those future cash flows, the worth of those future cash flows in terms of today’s value is determined.

Discounted Payback Period Calculator

How to Calculate Discounted Payback Period?

The payback time may be calculated in three steps. The following are involved:

- Determine how many years there is still break-even. The project will stay unprofitable to the corporation for thus many years.

- Calculate the unrecovered sum by the recovery year’s cash flow. This is the money generated at the time when the firm first starts to benefit from the project.

- Apply the discounted Payback Period Formula.

Period before Break-Even + (Unrecovered Value / Cash Flow in Recovering Year) = Discounted Repayment Period

It’s also a good idea to remember when working that the discounted variation and the basic payback time have almost similar mathematical formulas. The main difference is that, as hinted by the name, the cash flows in the latter are discounted.

Therefore, the discounted technique should result in a longer suggested payback time. This is true since the original cash flow outflow now has a higher value. This is because the longer the time horizon, the lower the value of the future cash flows will be.

What Is the Discounted Payback Period (DPP)?

The discounted payback period makes an educated guess as to how long it will take for a deal to produce adequate cash flows to reach even and turn a profit. All other things being equal, the project will more likely be approved if the payback time is short.

The discounted payback period in funds budgeting is also the time required for a business to return the cost of an initial investment with the cash flows produced by an investment.

When the payback time is completed, the business has achieved its break-even point, meaning the income a project generates is equivalent to its expenses. Therefore, once the project has reached the “break-even” point, it is no longer a “loss” for the business.

The following variants exist for the Discounted Payback Period:

Shorter repayment Period: The sooner the project’s cash flows can cover its initial costs, the more probable the corporation will accept it.

Longer repayment Period: The less likely a project is to be authorized, the longer it will take for the project’s cash flows to exceed the original investment.

The time worth of money is often criticized as being ignored when using the basic payback period statistic.

A dollar obtained today is larger than the amount received initially due to the option cost of obtaining cash sooner and the potential for earning a return on those funds.

Therefore, while choosing which projects to authorize, it would be best to take the time value of money into the account (or reject). The deferred payback period variance enters the picture at this point.

Limitations of the Discounted Payback Period Calculation

Some Limitations of the discounted payback period calculation include:

- When the payback time is calculated using the discounted payback period approach, it is impossible to tell if the investment will raise the firm’s worth or not.

- Projects that might run longer than the repayment term are not considered. All computations performed beyond the discounted payback period are disregarded.

- The management is not provided with the precise information necessary to make an investment decision by employing this payback time. To calculate the payback time, the company manager must assume the interest rate or the cost of capital.

- If there are several negative cash flows throughout an investment term, the computation for the discounted payback time may get complicated.

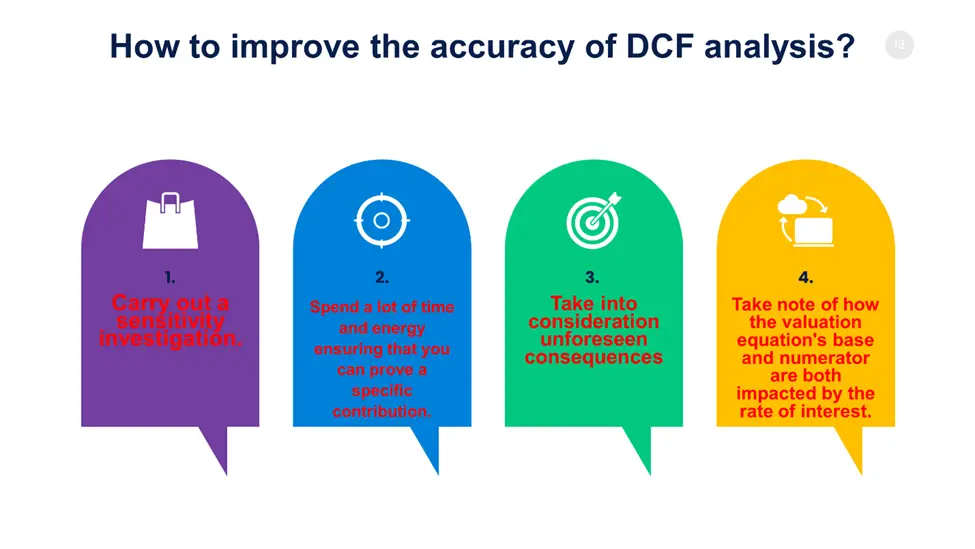

How to Improve the Accuracy of DCF Analysis?

The proprietors of financial planning and asset management businesses may profit from using the discounted cash flow (DCF) valuation model. One of its key features is the DCF valuation model’s ability to provide results that are as near to an underlying stock market value as possible. Valuation professionals may determine the company’s fair market value by valuing it based on the discounted value of future cash flow.

Future sales may be simpler if an unbiased study has established a fair market. Nevertheless, there are various approaches to increasing DCF analysis accuracy. They include:

Why is Calculating the discounted payback period important?

Calculating the discounted payback period is important due to the following reasons:

- Calculating the discounted payback period enables impartial appraisals free from market influences. It is regarded as a more objective valuation tool than other options since it determines value independently of arbitrary market opinion. The DCF is unaffected by transient market distortions because the market often misprices firms.

- The computation of the discounted payback period takes into account the prospective investment’s long-term worth. It evaluates an investment’s prospective long-term returns as well. This is in addition to taking the time value of money into an account and enabling investors to forecast when they will get a certain return.

- Calculating the discounted payback period is a very thorough method of appraisal. It employs precise figures and indicators, like cash flow forecasts and discount rates, that are created based on assumptions about a firm. If these presumptions are correct, they may provide a clear picture of the worth of a business or investment.

Expert Opinion

The discounted payback period shows the project’s profitability, which also takes the time value of money and the timing of cash flows into account. It helps a business in deciding whether to fund a project or not.

The net cash flows of each period are discounted, and the discounted cash flows are added up until the original investment is reached to get the discounted payback time. A discount rate, which may be either the market interest rate or the predicted return, must be used.

Some businesses could also choose to use their weighted average cost of capital or an accounting interest rate. The discounted payback period calculator will be your best ally in the calculation.