Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

In the UK, VAT is a tax applied on most products and services but only by companies who have registered for VAT. Additionally, it is levied on certain services and commodities imported into the UK from nations outside the European Union (EU). At this point, the Europe Vat Calculator will aid you immensely.

VAT is levied when a company registered for VAT offers products or services to customers residing in the UK and the EU. Sales to organizations and people situated outside the EU are exempt from VAT. Due to this, non-EU travelers visiting the UK are eligible to get a VAT refund on their purchases made while there. Dedicated desks are available in several department shops to assist overseas clients with VAT refunds.

Businesses registered for VAT often pay or claim VAT when purchasing goods and services. Most of the time, this is calculated using the difference between the VAT they paid on purchases (input tax) and the VAT they earned on sales (output tax).

Businesses pay HMRC their VAT payments, and HMRC reimburses them for VAT paid. This is managed via periodic VAT returns that VAT-registered firms are required to file.

VAT calculations must be precise since mistakes in VAT accounting might result in financial losses or unintended overpayments. Additionally, submitting inaccurate VAT returns to HMRC may result in fines, penalties, or legal action.

The accuracy of this Europe VAT Calculator is guaranteed to be 100%. However, because the user enters the numbers to be computed, it is up to the user to ensure the quantities are accurate.

What is a Europe Vat Calculator?

You may use the Europe VAT calculator, an online tool, to determine how much VAT you will have to pay or claim. This is in addition to the item’s or service’s gross price, which is determined by its net price.

Depending on EU VAT rates, the Europe Vat Calculator also assists in calculating VAT inclusive and exclusive values.

The VAT rates used in this EU VAT calculator are regularly updated. There may be times when the VAT rates for an EU member nation change and this calculator is not updated to reflect the new rates. As a result, this EU VAT calculator won’t be effective during certain times. It is crucial to confirm the EU VAT rates.

The VAT amount payable at the customer’s location is also calculated using the EU VAT calculator. For your convenience, it enables both VAT-inclusive and VAT-exclusive calculations.

Just input the price and choose the category that applies. Additionally, you may use it to compute VAT and make sure that your clients are being charged the appropriate amount of VAT. Each seller is in charge of making sure they are VAT complying.

Europe Vat Calculator

Why use a Europe Vat Calculator

The Europe VAT Calculator is an indispensable tool for easily adding or removing VAT from any sum. A complicated computation requires a few clicks. The formulae for calculating or subtracting VAT are no longer necessary to know. Also, you can forget about using percentages since the calculator will take care of it.

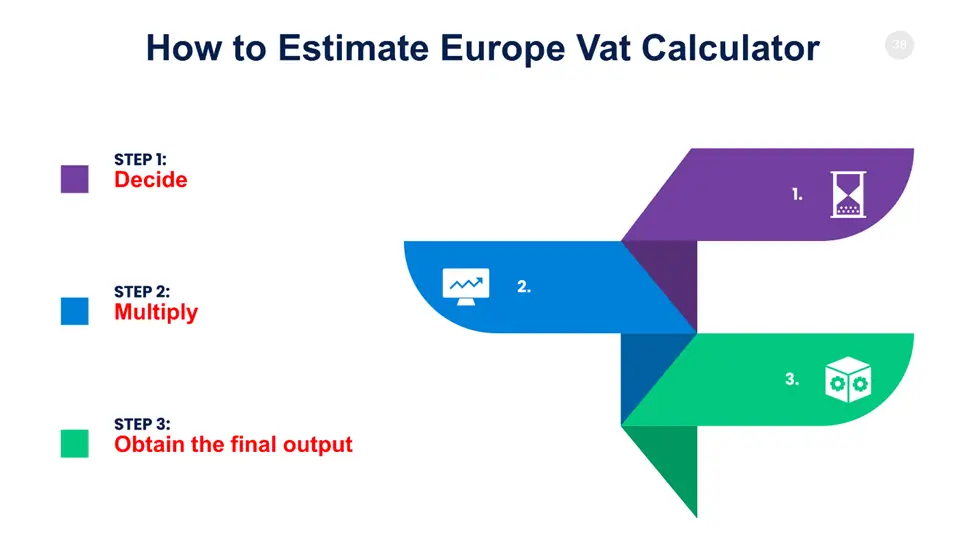

How to Estimate Europe Vat Calculator

You can estimate the Europe Vat Calculator through the following steps:

Step 1: Decide

Choose between the lower 5% rate and the usual 20% VAT rate.

Step 2: Multiply

The price multiplied by 1.2 equals the net price plus VAT for the Standard rate.

Add VAT to the price after multiplying it by 1.05 to get the reduced rate.

Step 3: Obtain the final output

These calculations provide your gross pricing, which includes VAT. A £50.00 item will now cost £60 at the normal rate because of the additional VAT; if you choose the lower VAT rate, that comes to £52.50.

Pros & Cons of using a Europe Vat Calculator

The Pros & Cons of using a Europe Vat Calculator have been highlighted in the table below.

| Pros | Cons |

| Flexibility | Need a working internet connection |

| Confidentiality | Potential for a challenge for first-time users |

| A history-based system | |

| Investor propensity. | |

| 5. Simplifies filing |

Frequently Asked Questions

How much is VAT in Europe?

The estimated standard VAT rate throughout the EU is 21%, six percentage points greater than the minimum allowed by EU law. Consumption taxes are often an economically effective strategy to increase tax collection.

How do I calculate VAT?

Following the previous approach, this involves multiplying the starting price by the amount of VAT, as in: = Initial Price X VAT%.

You must add the original price to the outcome to get the final price with VAT. I.e., Initial Price + Initial Price X VAT%.

How is VAT calculated in Germany?

The formula for calculating the German tax rate goes thus:

VAT=7%X net prices 1.07 = gross price (incl. VAT.)

Which is tax country in Europe free?

Monaco is a country in Europe that does not have any personal income tax.

How much is tax-free in Europe?

Based on the nation, the VAT rate in the European Union typically runs from 5 to 25%. Some of them use several VAT rates depending on the kind of item or service, which are often classed as “normal,” “reduced,” and “super-reduced.”

How much is a VAT refund in Europe?

In Europe, the VAT refund is based on your fees. Although an employee may scarcely benefit from VAT, an entrepreneur can surely benefit from it since he can get the tax back on purchases made for his company. Because of this, he is often asked how high a commodity’s or service’s true net value is. This is true since it’s the only cost he will ultimately incur.

Conclusion

In conclusion, a tax levied progressively is the value-added tax in Europe. Every step of manufacture, transmission, or sale to the final customer is added to the cost of a good or service. Currently, the normal VAT rate in the UK is 20% for most products and services. Thus, the VAT calculator automatically chooses a proper rate. But if you need to, you may choose a different rate.

Expert Opinion

The Europe VAT calculator is a helpful tool that makes it easy to figure out the VAT added to a total amount or the VAT imposed on a net amount. Our Europe VAT calculator is a simple tool that enables you to verify the VAT rate as an EU member because VAT rates might vary over time.

The Europe VAT calculator is a crucial tool to determine which net amount derives from which gross pricing and vice versa. They quickly convert the prices by inputting one of the two numbers and the VAT rate. To compute the necessary outcomes, they also use various formulae.