Information presented on this web page is intended for informational and educational purposes only and is not meant to be taken as legal, financial, investment or tax advice. We do not accept any responsibility for any trading or investment related losses. Please review our disclaimer on before taking action based upon anything you read or see.

Marketers and management invest a lot of time, effort, and money to follow the whole customer journey, enhance the content, and provide the best possible customer experience. However, many marketers emphasize transient outcomes, such as a single sale or upsell. Businesses need to have a long-term perspective if they wish to succeed. It indicates that their approach considers customer lifetime value (CLV). Thus, we have made this post on the customer lifetime value calculator to aid you.

One of the crucial metrics to monitor as part of a program for satisfying customers is the customer lifetime value (CLV). CLV measures a customer’s value to your business throughout the relationship, not simply individual purchases.

Customer lifetime value (CLV) is the sum of a customer’s value to a company throughout their relationship. Increasing the value of your current customers is a wonderful strategy to spur growth since retaining existing customers is less expensive than attracting new ones.

Additionally, understanding CLV enables organizations to create plans for attracting fresh clients and keeping hold of current ones while preserving profit margins. The Customer Lifetime Value Calculator will now be essential. Follow along as we go into more detail about this below.

What is the Customer Life Time Value?

Customer lifetime value (CLV) is a commercial indicator that assesses the typical customer’s potential earnings over the relationship. Calculations of client lifetime value may be complicated by items, prices, purchase frequency, and volume variations. But with the correct tools, you can quickly determine client lifetime value.

Understanding CLV has various advantages, including helping you make more intelligent marketing and sales choices.

Customer lifetime value (CLV) is another metric used to describe how much money a company can anticipate making from a typical customer throughout their relationship.

It’s better to consider both the total average profit and the total average revenue that a client generates when calculating CLV. Each offers crucial information about how clients engage with your company and if your entire marketing strategy is performing as planned.

You could partition your company’s client base into quartiles or another grouping for a more thorough analysis of CLV. As a result, you may attempt to reproduce that performance throughout your client base. This can provide better insight into what is working effectively with high-value consumers.

How to use the Customer Lifetime Value Calculator?

You can use the customer lifetime value calculator through the following steps.

- Enter the Average Sale Value ($)

- Enter the Sale Frequency (annual)

- Put the Retention Period (years)

- At this point, the CCLV calculator will display the Customer’s Lifetime Value.

Customer Lifetime Value Calculator

Benefits of using the CLLV Calculator

The benefits of using the CLLV calculator include:

- It makes computations simpler and faster, and management can understand it more readily. This makes it possible to explain the idea of client lifetime value and how it connects to financial and business goals more effectively. It is often trustworthy in scenarios involving temporary customer loyalty.

- It may be used successfully as a relative metric for monitoring customer lifetime value changes over time since it is typically trustworthy when yearly customer profit contributions are fairly flat.

- It may be used to compare the profitability of various consumer segments.

Tips for Improving Customer Lifetime Value

To increase customer lifetime value, use one of the following strategies:

Improve Onboarding

It’s crucial to create a good first impression since customer turnover rates are at their greatest following only one encounter with the typical firm. Customers often require instruction on the characteristics and advantages of your product to fully comprehend how the product may improve their life.

Effective onboarding in a service industry may be as easy as proving a commitment to customer care and availability to address client issues. During this first engagement, it should be your primary responsibility to pay close attention to the demands of first-time consumers and alleviate any concerns they may have over their buying choice.

Successful Communications

The link between the business and the client is strengthened, and the business seems more human when there is an open contact channel. It’s more crucial than ever in the current atmosphere to reply to criticism, particularly critical remarks and low ratings.

When customers feel heard, it is appreciated. Simply stating that a firm is open to customer criticism and that their issues will be resolved might encourage repeat business.

Increased customer communication efficiency also relates to sales and marketing text. By evaluating attrition and ad conversion rates, you may gauge the effectiveness of customer interaction.

Reward Program

A rewards program is a terrific method to tailor the consumer experience and encourage recurrent purchases. Following a certain number of transactions, certain popular loyalty programs provide reward points, which may be used to access free or reduced goods. Buy nine cups of coffee, for instance, and receive the tenth one free.

Customers take pride in their benefits, and businesses benefit from increased client lifetime value.

Retargeting

Reengaging past brand-experienced consumers is one of the most crucial strategies for increasing client lifetime value. At the very least, retargeting may improve brand awareness by serving as a straightforward reminder of the business. Retargeting campaigns may be quite effective for products with a limited shelf life since they often need to be purchased again.

How to Calculate Customer Lifetime Value?

Customer lifetime value is a monetary prediction; thus, a corporation must base its assumptions on facts. For instance, a company owner must determine the typical sale value, the approximate ratio of engagements, and the length of the business relationship with a certain client to compute CLV. Established companies with past customer data may determine their client lifetime value more accurately.

Here is a method for determining client lifetime value.

- First, multiply the mean sale value, number of transactions, and average client retention term to arrive at the lifetime value.

- Lifetime Value is calculated as Average Sale Value x Transactions x Retention Period.

- Since the lifetime value of a client is determined in terms of gross income, operational expenditures are not considered.

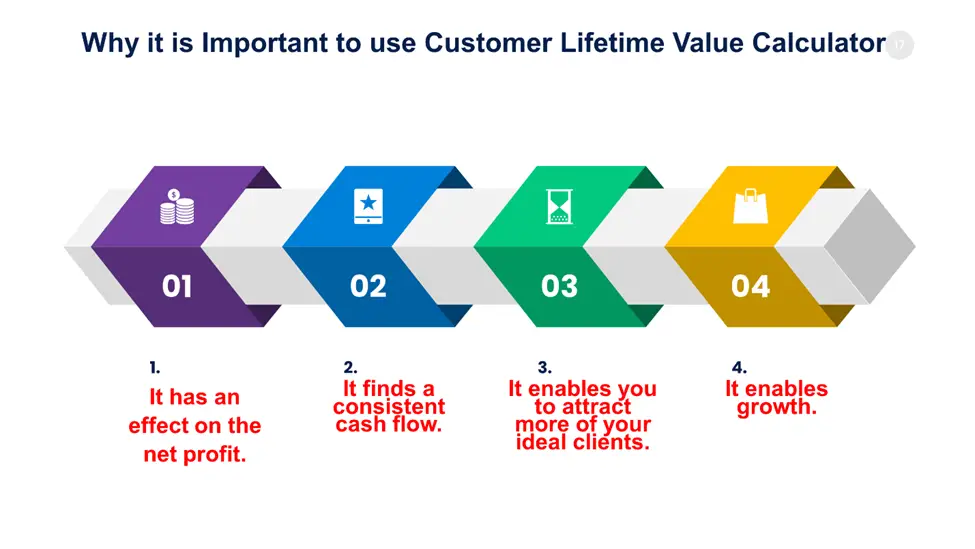

Why it is Important to use the Customer Lifetime Value Calculator

It is important to use the Customer Lifetime Value Calculator due to the following reasons:

It affects the net profit.

The Customer Lifetime Value Calculator affects your revenue. You will get a lower profit from each transaction if you solely focus on conversions, depending on new clients and incurring the expense of acquisition each time.

By maximizing CLV, you may avoid paying to recruit new consumers by receiving orders from existing ones again. In addition, you would get the entire profit margin on any subsequent orders, making up for the CAC you originally paid. Your ROI rises as a result.

It finds a consistent cash flow.

Repeat business from current clients generates a steady stream of healthy cash flow for the company. As a result, you need not worry about all of your expenses. When you are certain that money will come in, it is simple to plan ahead and make all your required payments.

It enables you to attract more of your ideal clients.

You may create a separate acquisition budget if you anticipate that a client would eventually spend $100 with your company rather than just $10. Spend extra to reach the ideal target market. Perhaps a rival used to outbid you on keywords or collaborated with powerful influencers whose services you could not afford.

Quality leads will likely become devoted patrons, enhancing your brand and increasing your client’s lifetime worth.

It enables growth.

With the help of the Customer Lifetime Value Calculator, you can put more money back into expanding your company. With the assurance of recurrent income, it is also easier to expand internationally, create new goods, or hire sales consultants.

Frequently Asked Questions

What is customer lifetime value in simple words?

Customer lifetime value (CLV) is the sum of a customer’s value to a company throughout their relationship. It’s a crucial indicator since retaining current consumers is less expensive than getting new ones. As a result, maximizing the worth of your current clientele is a fantastic strategy to promote expansion.

Why is increasing CLV important?

Increasing CLV teaches marketers to invest less time in gaining consumers with lesser value, which promotes better decision-making. This calls for managing your customer connections effectively, which boosts profitability. The most evident benefit of Customer Lifetime Value could be that.

What is the best way to increase customer lifetime value?

Adding more interaction points is a simple method to increase LTV. Make a list of the online and physical locations where your clients are most likely to be found. Create a presence there via content marketing or advertising. Encourage your clients to interact with your brand on these sites as well.

What are some ways to increase customer lifetime value?

You can increase customer lifetime value through the following ways:

- Enhance the purchasing process.

- Obtain consumer feedback.

- Create a distinctive product.

- Create a satisfying experience.

- Place quality above cost.

- Determine your strong points.

- Change your marketing plan.

Conclusion

In conclusion, brand loyalty, customer happiness, and lifetime value all go hand in hand. It is the monetary benefit of retaining consumers. High CLV retail firms benefit from a consistent cash stream and may expand more independently of advertising expenses. The Customer Lifetime Value Calculator will also aid you immensely at this point.

Expert Opinion

One of the key eCommerce KPIs is customer lifetime value. It gives a long-term and financially viable view of the company. A high CLV signifies a product-market fit, brand image, and ongoing sales from previous clients. If eCommerce companies want to see sustainable development, it is advised that they analyze and maximize client lifetime value. While it naturally varies greatly across sectors, the average CLV for online companies is pretty fair.